Margin of safety formula: how to calculate your buffer

Learn the margin of safety formula to set sales targets, protect profit, and plan smarter.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Friday 13 February 2026

Table of contents

Key takeaways

- Calculate your margin of safety using the formula (Current sales – Break-even sales) ÷ Current sales to determine how far your sales can drop before your business starts losing money.

- Aim for a margin of safety of at least 20-25% for most businesses, with 30% or higher indicating a strong financial buffer that protects against unexpected downturns.

- Use your margin of safety to make key business decisions like setting sales targets, adjusting pricing, controlling costs, and evaluating new products or services.

- Track your margin of safety monthly or weekly if sales fluctuate significantly, as businesses with high fixed costs need higher margins than those with mostly variable costs.

What is the margin of safety?

Margin of safety measures how far your sales can fall before reaching your break-even point, where revenue equals costs and your business breaks even. This financial buffer protects you against drops in demand or cost increases, and a wider margin means lower risk.

What is the margin of safety formula?

The margin of safety formula is:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

Here's what each component means:

- Current sales: your total revenue from selling goods and services over a specific period

- Break-even sales: the exact revenue needed to cover all fixed and variable costs, where your business makes zero profit and zero loss

For example, a business with $50,000 in current sales and a $30,000 break-even point would calculate:

Margin of safety = ($50,000 – $30,000) ÷ $50,000 = 0.4 (40%)

This means sales could drop by 40% before the business starts operating at a loss.

How to calculate margin of safety

Now let's break down the margin of safety calculation.

1. Find your current sales

Current sales is your total revenue over a specific period, whether actual figures or forecasted amounts. Your sales figures should be readily available through your existing sales tools.

If you need to forecast sales, use one of these methods:

- Analyse historical data: review your financial reports for past sales trends and seasonal patterns from your point of sale (POS) system, eCommerce platform, or accounting software like Xero.

- Conduct market research: study your target market, industry trends, and competitor performance.

- Gather qualitative insights: ask your sales team or industry experts for their input.

- Apply quantitative methods: use statistical analysis of historical and market data to predict future sales.

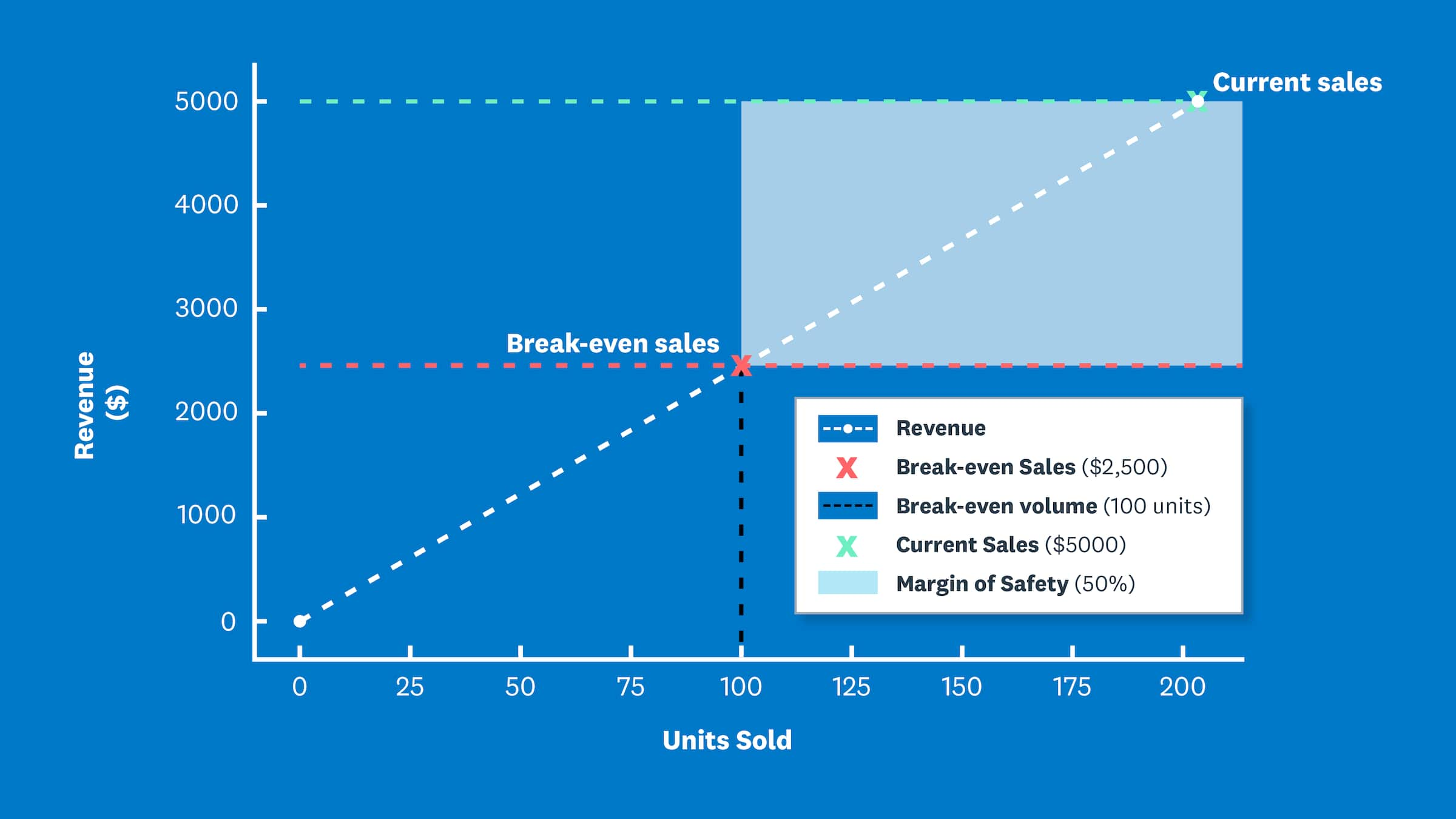

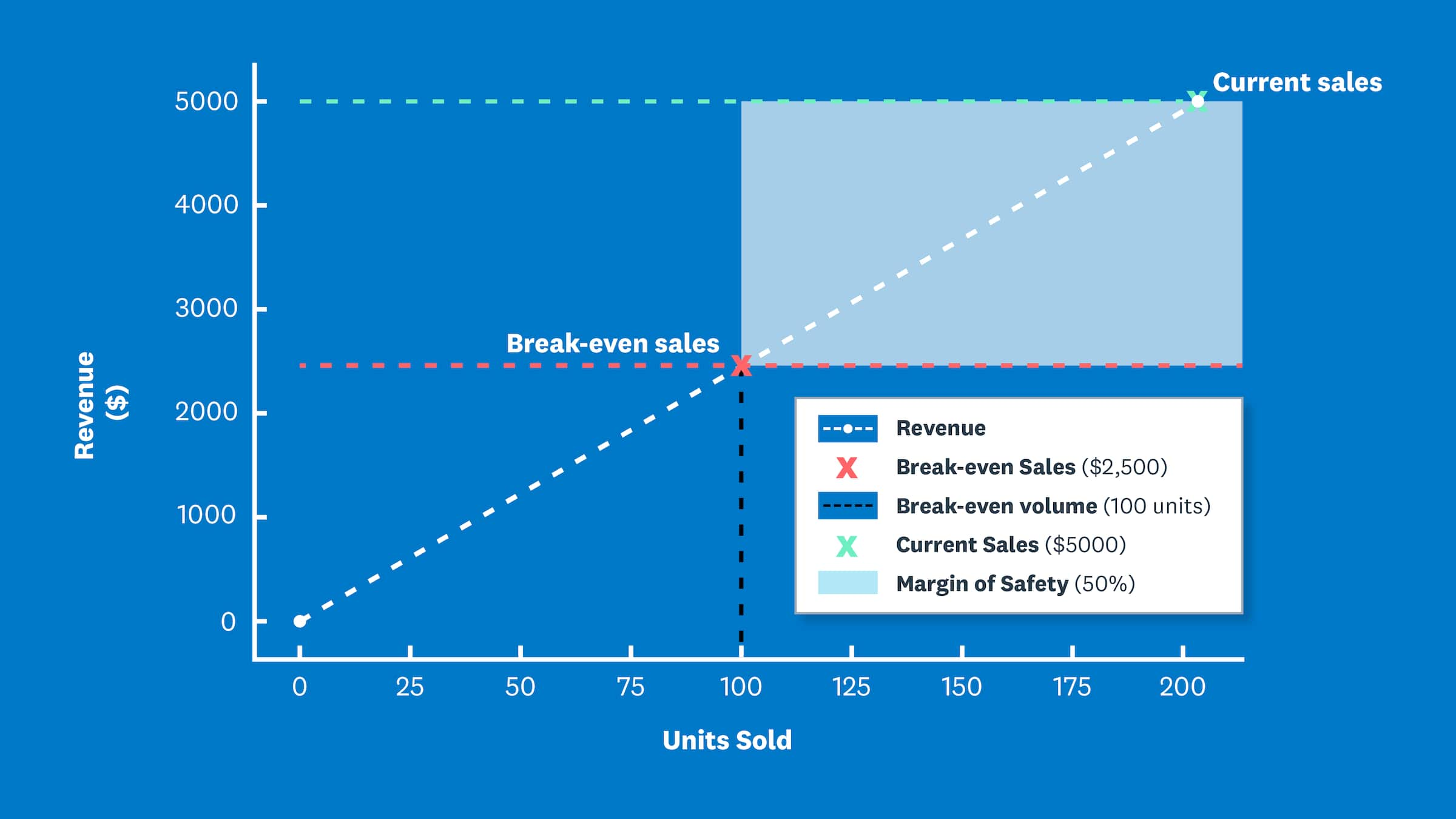

For example, a craft business tracking monthly sales through a POS system recorded $5,000 last month. This figure is used in the margin of safety calculation.

2. Calculate your break-even sales revenue point

For the margin of safety calculation, you need your break-even sales revenue. Here's the formula:

Fixed costs ÷ ((Sales price – Variable cost) ÷ Sales price) = Break-even sales

In this formula:

- Fixed costs are expenses that stay the same regardless of sales volume, such as salaries and rent

- Variable costs are expenses that change with sales volume, such as raw materials and sales commission

Learn more about variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

Continuing with the craft business example:

- Fixed costs: $2,000

- Variable costs: $5 per unit

- Sales price: $25 per unit

The break-even calculation:

$2,000 ÷ ((25 – 5) ÷ 25) = $2,000 ÷ 0.8 = $2,500

With a sales price of $25, the business needs $2,500 in revenue (100 units) to break even.

Learn more about calculating your break-even point.

3. Apply the margin of safety formula

Apply the margin of safety formula:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

The result is your margin of safety ratio, the percentage by which sales can fall before your business starts operating at a loss.

For the craft business with $5,000 in current sales and a $2,500 break-even point:

($5,000 – $2,500) ÷ $5,000 = 0.5 = 50%

This 50% margin of safety means sales could fall by half before the business reaches its break-even point.

What is a good margin of safety percentage?

A good margin of safety percentage depends on your business type, cost structure, and risk tolerance. Here are general guidelines:

- 30% or higher: strong financial buffer with low risk

- 20–25%: reasonable margin, especially for businesses with mostly variable costs

- 10–20%: moderate risk; monitor closely and look for ways to improve

- Under 10%: high risk; you're operating close to break-even with little room for error. For example, one company analysis showed that with a breakeven point of $3.95M on sales of $4.2M, their resulting margin of safety of 5.8% left little room for unexpected downturns.

Variable cost businesses, where most costs change with sales volume, can often operate safely with lower margins because costs drop when sales drop. Fixed cost businesses, with high rent, salaries, or equipment costs, need higher margins because those costs remain even when sales fall.

Your business stage also matters. Established businesses with predictable revenue can accept lower margins, while growing businesses facing market uncertainty may need a larger buffer.

For example, a margin of safety of 40% means your sales could drop by 40% before you start losing money. A margin of 15% leaves much less room for a downturn.

The importance of the margin of safety for your small business

Margin of safety is essential to your risk management strategy because it shows how far sales can fall before your business starts making a loss.

- High margin of safety: indicates low risk, meaning your business can absorb small shifts without much disruption. For instance, one case study of a company with a 32% margin of safety showed that its sales could decrease by $72,000 from their current level before it would be at risk of suffering a loss.

- Low margin of safety: your risk is higher, and you're operating close to your break-even point with less room to manoeuvre.

External shocks, like a jump in supplier prices, increase your variable costs and push up your break-even point. This eats into your margin of safety and leaves your business exposed to further cost increases or falling sales.

How the margin of safety supports your business decisions

Your margin of safety helps you make important decisions across your small business. Research confirms that managers often rely on cost-volume-profit analysis to make quick cost-saving decisions, especially during periods of economic instability.

- Set performance targets: calculate a clear break-even point to establish achievable sales targets that keep you profitable.

- Adjust pricing: review your pricing if your margin of safety is shrinking so each sale contributes enough to cover costs.

- Control costs: treat a low margin of safety as a signal to cut costs and protect your buffer.

- Evaluate new products or services: assess how the costs of a proposed new product affect your margin of safety and ability to turn a profit.

Other metrics that work with margin of safety

Margin of safety works best when combined with other key financial metrics. Using it alongside cost-volume-profit (CVP) analysis gives you a clearer view of your profitability and risk, a practice that international studies have linked to enhanced decision-making efficiency.

Track your margin of safety with Xero

Xero automates margin of safety tracking by giving you instant access to your sales data, break-even calculations, and financial reports.

With Xero, you can calculate your margin of safety faster and track it over time. See your sales performance, break-even point, and financial buffer as they update. Get one month free and see how Xero simplifies margin of safety tracking so you can focus on growing your business.

Learn how Xero's financial reports work.

FAQs on margin of safety

Here are answers to common questions about calculating and using your margin of safety.

What is a good margin of safety percentage?

A margin of safety of 20–25% is reasonable for most businesses, while 30% or higher indicates a strong financial buffer. Businesses with high fixed costs typically need higher margins than those with mostly variable costs.

How often should I calculate my margin of safety?

Calculate your margin of safety monthly for most businesses, or weekly if your sales fluctuate significantly. At minimum, review it quarterly to catch trends before they become problems.

Can my margin of safety be negative, and what does that mean?

Yes, a negative margin of safety means you're operating below your break-even point. This requires immediate action to increase sales, reduce costs, or both.

What's the difference between margin of safety and profit margin?

Margin of safety measures how far your sales can drop before you start losing money. Profit margin measures how much profit you make as a percentage of each sale. They're related but track different aspects of financial health.

How can I improve my margin of safety?

Improve your margin of safety by increasing sales revenue, reducing fixed costs, lowering variable costs per unit, or raising prices. Often a combination of these approaches works best.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.