Assets vs liabilities: What they mean for your business

Understanding assets vs liabilities helps you make smarter financial decisions and grow your business.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Apply the fundamental accounting equation (Assets - Liabilities = Owner's Equity) to determine your business's net worth and financial health, as positive equity indicates your assets exceed your debts.

• Classify your assets and liabilities by timeframe to better manage cash flow, with current assets and liabilities involving 12 months or less, while fixed assets and long-term liabilities extend beyond 12 months.

• Distinguish between liabilities and expenses to improve financial planning, as liabilities are amounts you owe that appear on your balance sheet, while expenses are operational costs that immediately reduce profits on your income statement.

• Review your balance sheet regularly with a professional accountant to identify errors, understand your financial position, and make informed decisions about loans, investments, and business growth.

What's the difference between assets and liabilities?

Assets increase your business’s value, while liabilities reduce it. An asset is any resource your business owns that has future economic value. A liability is something your business owes to another person or company, like a debt or an obligation to provide goods or services in the future.

Understanding this difference is the first step to getting a clear picture of your business's financial health.

What are small business assets?

Business assets are everything your company owns that has monetary value. These fall into several categories:

- Physical assets: Buildings, vehicles, equipment, and inventory

- Financial assets: Cash, bank accounts, and investments

- Intangible assets: Patents, trademarks, and brand value

Having more assets increases your business value and improves your financial health.

Examples of small business assets

Assets can be physical things you can touch or non-physical items that still hold value. Here are some common examples:

- Cash in your bank account or cash register

- Money customers owe you (accounts receivable)

- Inventory or stock for sale

- Business equipment such as computers and machinery

- Company vehicles

- Property and buildings

- Patents, trademarks and copyrights (intangible assets)

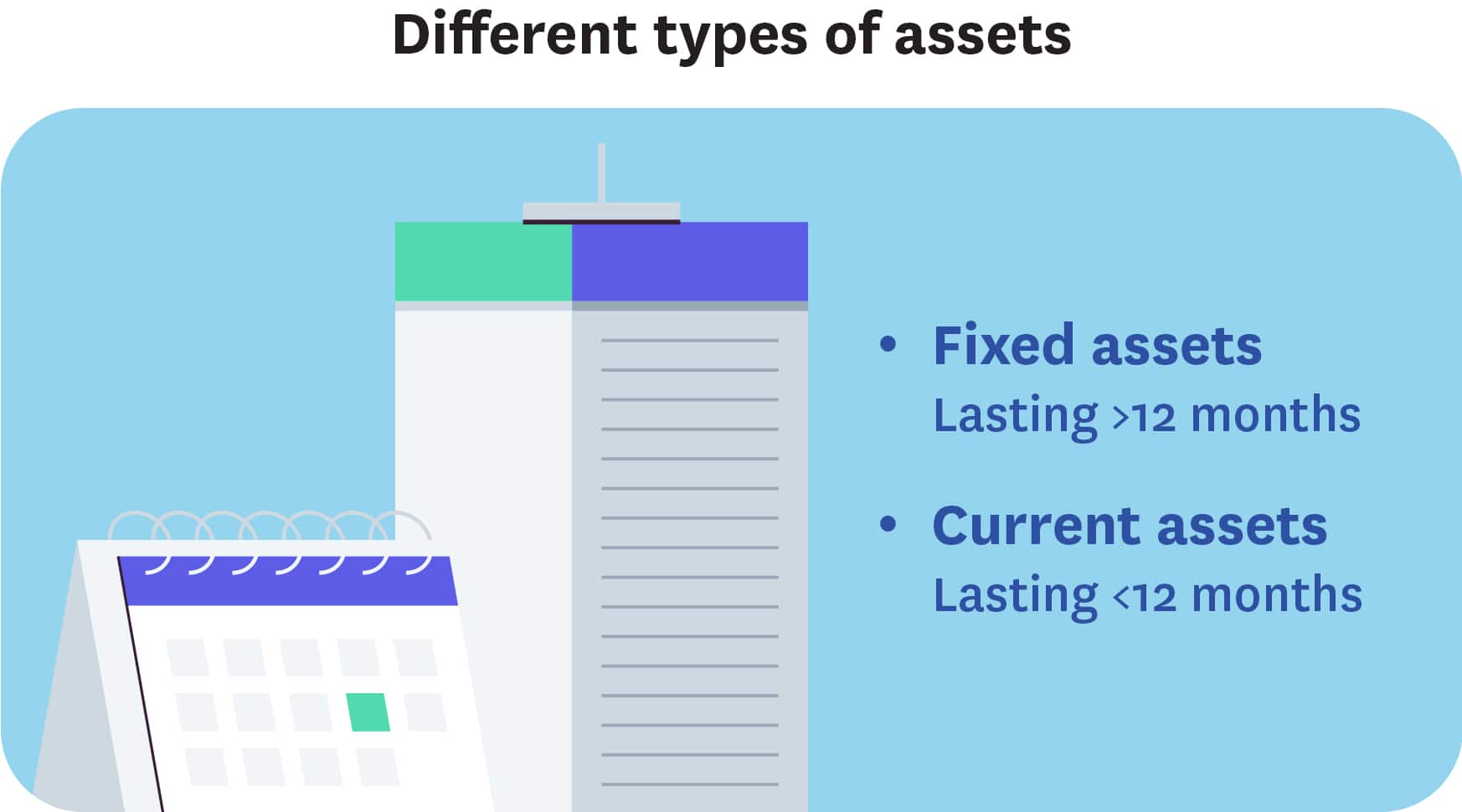

Different types of assets

Asset classification depends on how long you'll own them:

This classification helps you understand your business liquidity and long-term investments.

Fixed assets

Fixed assets are long-term investments your business owns for more than 12 months. They come in two types:

Tangible fixed assets:

- Real estate and buildings

- Vehicles and equipment

- Raw materials and machinery (Add a separate sentence after the list: These assets depreciate over time, which affects your profits.)

- Patents and copyrights

- Trademarks and brand value (Add a separate sentence after the list: You must test goodwill for impairment at least once a year to confirm it has not lost value.)

Current assets

Current assets are short-term assets that can be quickly converted to cash within 12 months. They fund your daily operations and cover immediate expenses.

Common current assets include:

- Cash in bank accounts and petty cash

- Accounts receivable (money customers owe you)

- Inventory ready for sale

- Prepaid expenses such as insurance or rent paid in advance

What are small business liabilities?

Business liabilities are financial obligations your company owes to others. These include debts, unpaid bills, and future payment commitments. Manage your liabilities to meet your financial obligations and maintain strong business relationships.

Examples of small business liabilities

Liabilities represent your financial obligations. Keeping track of them is crucial for managing your cash flow. Common liabilities include:

- Money you owe to suppliers (accounts payable)

- Salaries and wages owed to employees

- Business loans or lines of credit

- Credit card balances

- Taxes owed to the government

- Customer deposits or pre-payments for services not yet delivered (deferred revenue) (Add a separate sentence after the list: If you do not meet loan covenants, a long-term loan can become a current liability and may require immediate repayment.)

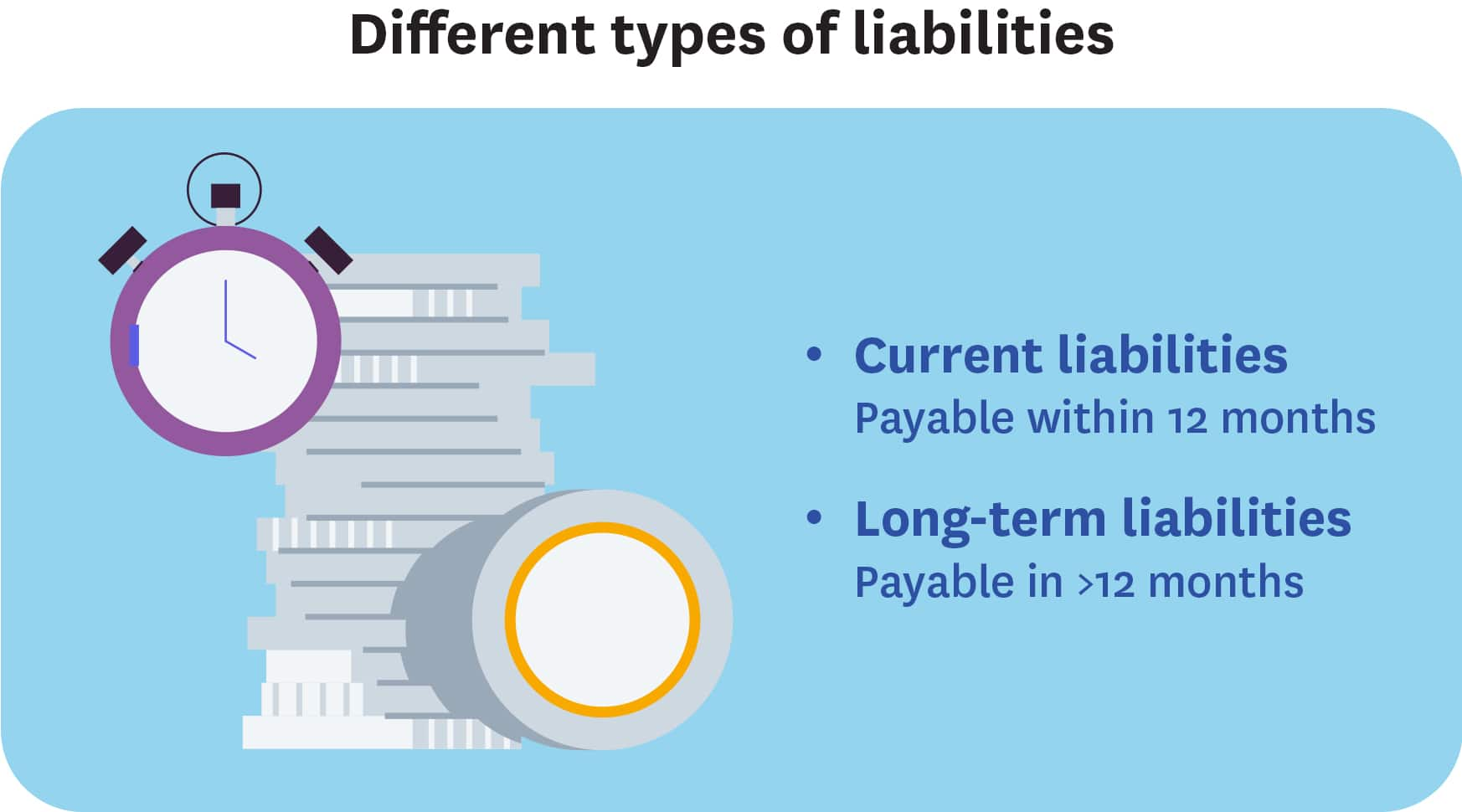

Different types of liabilities

Liability classification depends on when you must pay them:

Keep your total liabilities lower than your total assets to maintain positive equity and financial health.

Current liabilities

Current liabilities are debts you must pay within 12 months, often within just a few months. These cover your daily business operations.

Common current liabilities include:

- Accounts payable (money owed to suppliers)

- Staff salaries and benefits due

- Business credit card balances

- Bank overdraft fees

Long-term liabilities

Long-term liabilities are debts payable beyond 12 months. These typically involve larger amounts and structured payment plans.

Common long-term liabilities include:

- Business loans with multi-year terms

- Mortgages for property financing

- Deferred taxes due in future periods (Add a separate sentence after the list: You can only recognize a deferred tax asset if you expect to have future taxable profit.)

Is a liability the same as an expense?

Liabilities and expenses are not the same.

are costs of running your business:

- Rent, utilities and supplies

- Items recorded on your income statement

- Costs that reduce your profits immediately

Liabilities are amounts you owe to others:

- Loans, unpaid bills and taxes payable

- Items recorded on your balance sheet

- Amounts you must pay in the future

Understanding this difference helps you manage cash flow and financial planning.

Valuing your business – seeing what it's worth

Use this accounting equation to find your business value:

Assets - Liabilities = Owner's Equity

What this means:

- Positive equity – your assets exceed your liabilities

- Negative equity – your liabilities exceed your assets

- Zero equity – your assets and liabilities are equal

This calculation shows your true business worth and financial health.

Owner's equity is the business's net worth. Knowing your net worth can be important if you are applying for a loan or looking for investors. They will want to know how your business is doing and if it's financially viable.

Accounting for your assets and liabilities

Both your assets and liabilities go on your business’s balance sheet. The double-entry bookkeeping system keeps both sides of your balance sheet equal. The balance sheet provides you with a summary of your business.

Your balance sheet has two columns: assets on the left, and liabilities and owner’s equity on the right. Every transaction has a debit and a credit entry. If the two sides don’t match, there’s an error.

Common errors preventing a balance sheet from balancing can include:

- duplicate entries

- incorrect dates

- forgetting a transaction

- putting the wrong inventory numbers or values

These errors appear in your accounting ledger. Your bookkeeper needs to check and correct them to balance your books.

The balance sheet is one of the three main financial statements organizations use to summarize their financial health. For many financial institutions, filing a balance sheet is a statutory requirement under Canadian law. The purpose of the balance sheet is to provide you with a snapshot summary of your business's assets, liabilities, and equity to show you your current financial position.

Reviewing your balance sheets

Review your balance sheet and other financial statements regularly with a professional. An accountant can help you understand your business’s financial health and plan your next steps. Accountants play an important role in your financial planning.

Xero accounting software helps you create your balance sheet, income statement and profit and loss statement quickly and easily. Automation reduces errors, which is helpful if you are audited.

FAQs on assets and liabilities

Find answers to common questions about assets and liabilities below.

What's assets minus liabilities?

When you subtract your total liabilities from your total assets, you get your owner’s equity, or your business’s net worth. This is the value that belongs to you after you pay all debts.

Is cash an asset or liability?

Cash is always an asset. It’s the most liquid asset, so you can use it right away to pay expenses or invest in your business.

How do I know if something is an asset or liability?

Ask yourself: does this item provide future value to your business, or is it something you need to pay? If it provides value, it’s an asset. If it’s an obligation, it’s a liability.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.