Manage Canadian sales tax easily

Automatically calculate applicable taxes on transactions for GST/HST filing online.

Localized sales tax rates

Use the preset standard rates or create your own.

Automated calculations

Sales tax on transactions is recorded for you.

Sales tax return reports

Generate sales tax reports for filing periods.

Prepare federal and provincial sales tax returns without the headache

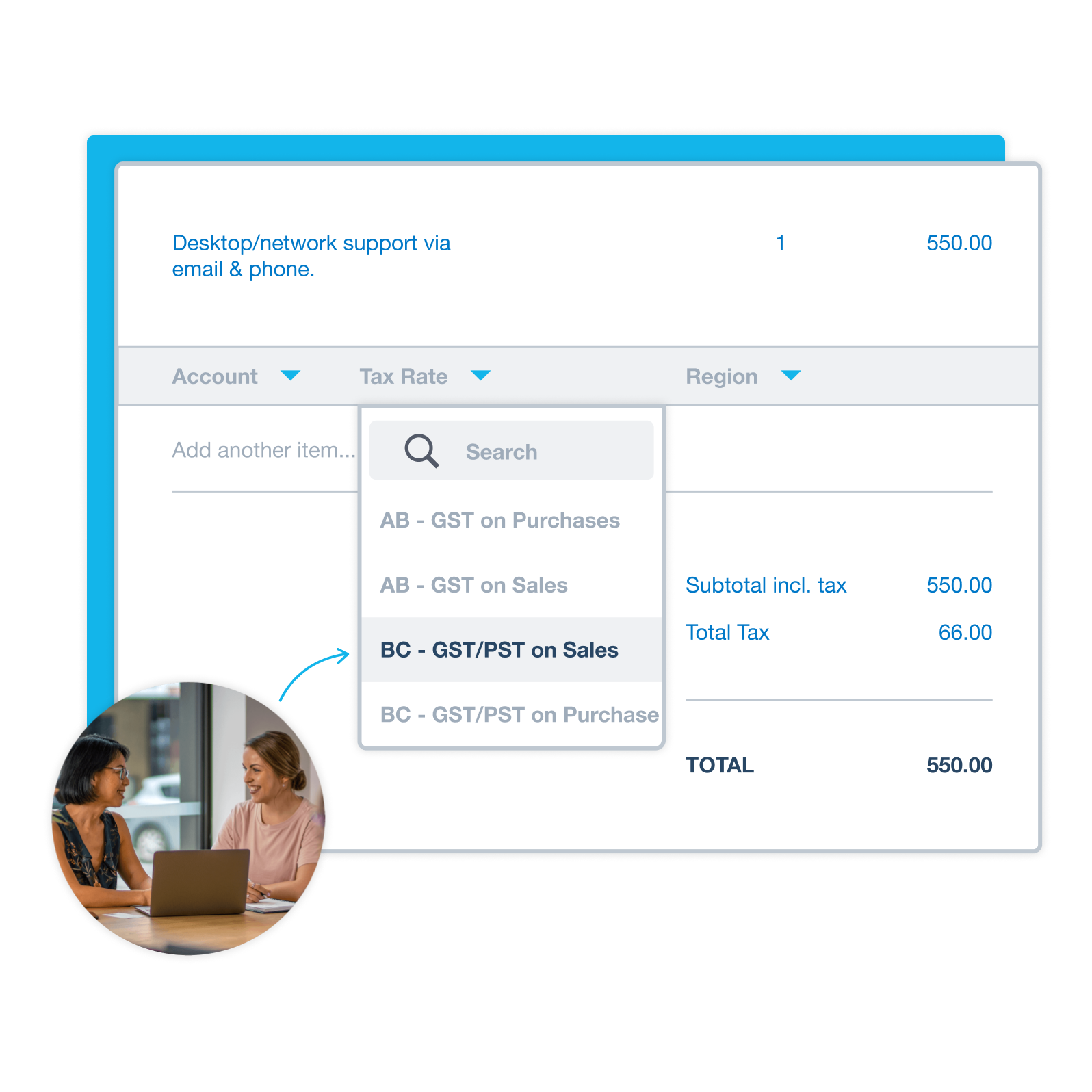

Localized sales tax rates

The relevant tax rates for sales and purchases come set up in Xero and are updated automatically.

- Set a rate as the default for accounts, contacts or items

- Alter the GST/HST or provincial Canadian sales tax on any line item if needed

- Add or customize tax rates

Automated calculations

Calculate GST/HST or provincial sales tax to file GST/HST online.

- The tax rate selected for each item is used to calculate the sales tax

- Taxes for a transaction can be tax inclusive or exclusive, or no tax

- Set up default rates for contacts, inventory items, and accounts

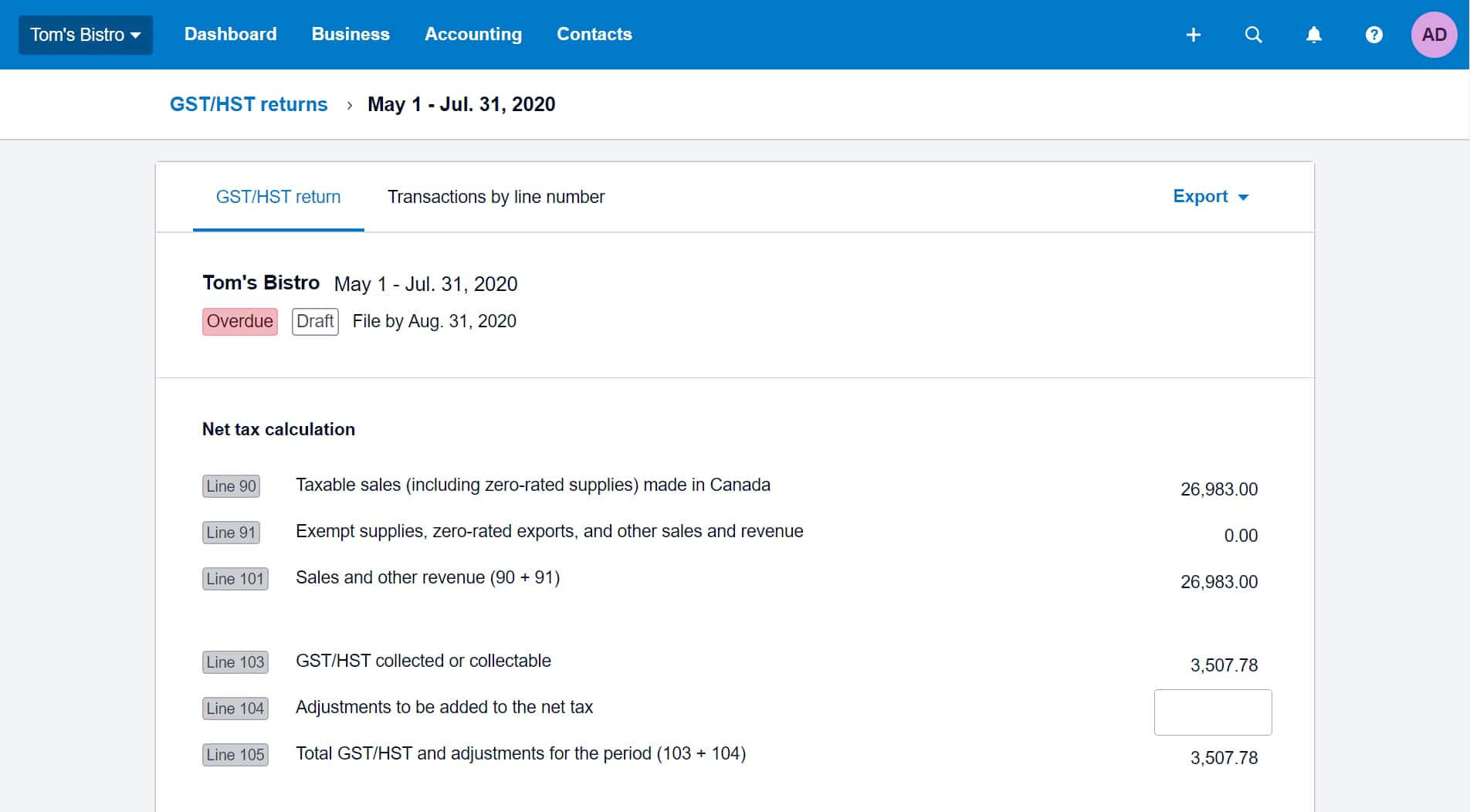

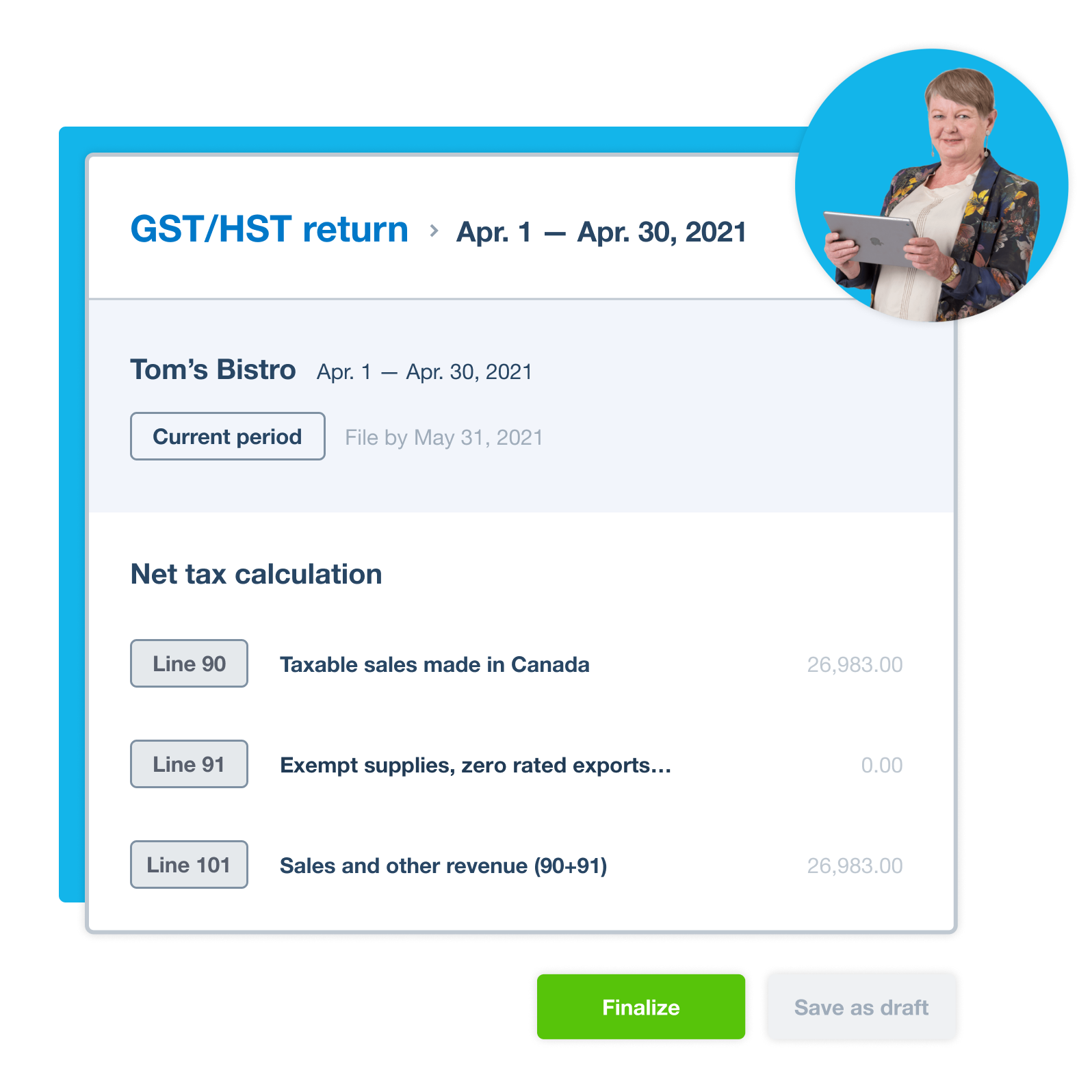

Sales tax return reports

Generate Canadian sales tax reports to file GST/HST or provincial sales tax online. Select tax periods and easily view individual transactions..

- Default tax rates are automatically mapped to corresponding lines or boxes on the return reports

- Easily view individual transactions within each return line or box number

- Track prior period adjustments to account for added, deleted, or edited transactions

- GST/HST, British Columbia PST, Manitoba RST, Saskatchewan PST, and Québec QST return reports are currently available

Accounting software for your small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customize to suit your needs

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

I find Xero’s interface really user friendly

Studio Banaa use Xero to look after their businesses finances