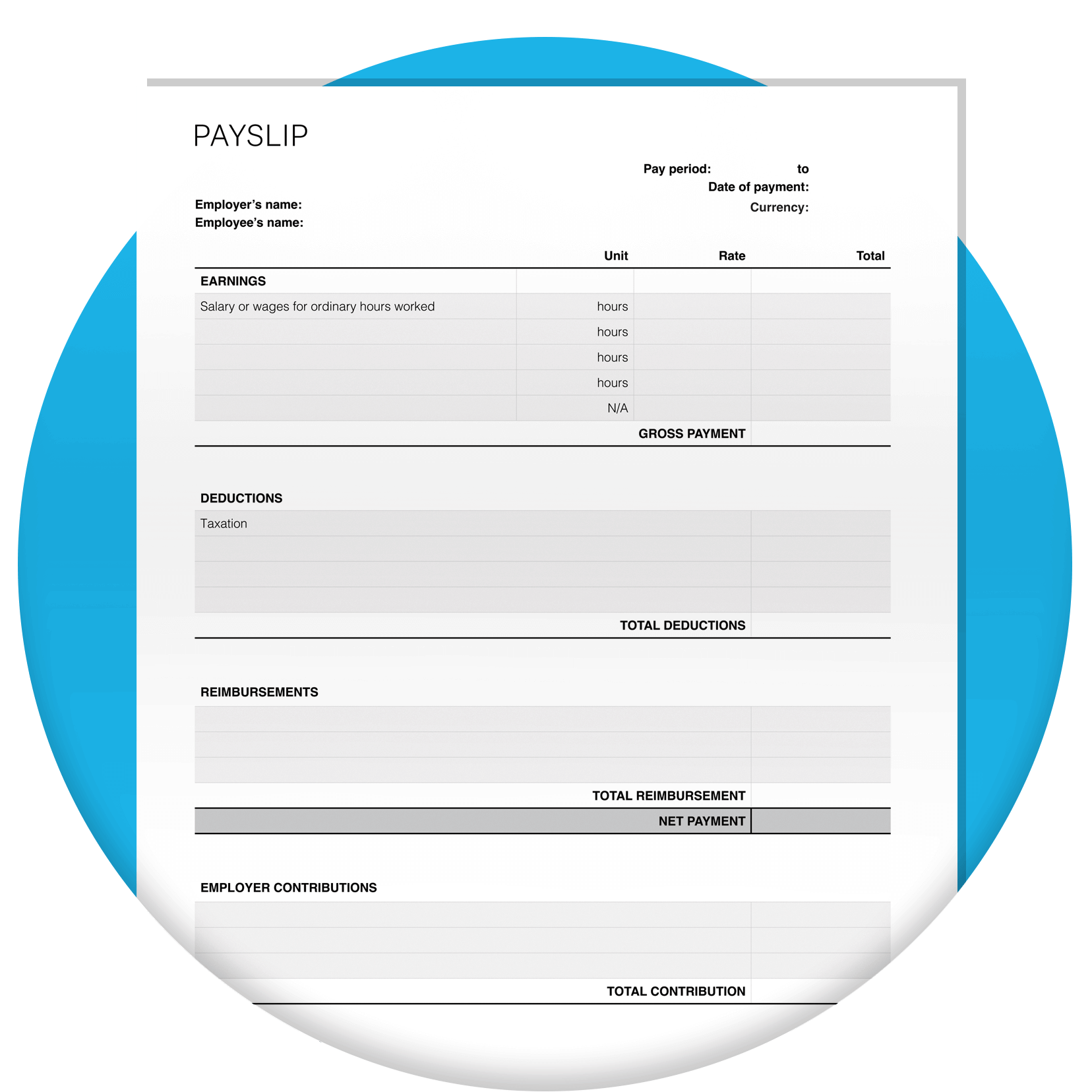

Speed up payroll with Xero’s free payslip generator

Looking for an online payslip maker? Download this free tool once and create payslips again and again for your employees. That’s time saved and mistakes avoided: a definite win!

Create multiple payslips with less hassle

Swap your spreadsheets for this simple tool you save to your desktop and use again and again.

Customise payslips to your business

Choose what to include on your payslips – such as business expenses – and any extra notes.

Reduce human error

Calculate gross and net pay automatically, for more confidence in your numbers.

Download the payslip generator

Fill in the form to get a free payslip generator as an editable PDF. We’ll throw in a guide to help you use it.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

Your payroll just got simpler

Make payroll a breeze with the payslip generator

Download the payslip generator and start using it straight away. Create professional payslips for each employee with minimum fuss.

- Saves you time every payday

- Uses automatic calculations

- Suits small businesses

- Costs you nothing - it’s free!

Free payslip maker vs payroll software

Choosing the right tool for creating payslips makes a big difference. Is this free tool your best choice right now? Or is it worth upgrading to Xero payroll software? Here are the key differences to help you decide which is best for your business.

The free payslip maker is a great short-term option

If you’ve just started your business or need a quick fix, speed up your payroll with this simple tool.

Xero payroll software is a robust long-term solution

If you’re more established, make payslips online with Xero accounting software. It helps with financial admin, including frequent pay runs.

How to use Xero’s payslip creator

Don’t skip this step – it’ll help you keep clear records you can find at a glance.

Don’t skip this step – it’ll help you keep clear records you can find at a glance.

Add their hours – including extras like overtime or paid leave – and their pay rate. The payslip creator calculates their gross pay for you.

Add their hours – including extras like overtime or paid leave – and their pay rate. The payslip creator calculates their gross pay for you.

List anything added to or subtracted from your employee’s pay, like income tax, student loan repayments, or pension contributions.

See ATO advice on deductionsList anything added to or subtracted from your employee’s pay, like income tax, student loan repayments, or pension contributions.

See ATO advice on deductionsDouble-check the info and correct any mistakes. Then save and store the file with the rest of your payroll records. And don’t forget to share the payslip with your employee!

Generate a payslip nowDouble-check the info and correct any mistakes. Then save and store the file with the rest of your payroll records. And don’t forget to share the payslip with your employee!

Generate a payslip now

The benefits of Xero’s payslip generator

Don’t stress your payroll. The Xero team loves helping small business owners with tools like this one.

It saves you time and effort

This handy tool simplifies the process of creating payslips so you can beat the clock.

It creates payslips anywhere at any time

Instead of waiting until you’re back at your desk, get jobs done on the move.

It reduces manual errors

By automatically calculating net pay, you know your numbers are right, every time.

FAQs on payslips

‘YTD’ stands for ‘year to date’ – the period starting on the first day of the calendar or fiscal year, up to the current day. It sometimes appears on payslips as a running total of an employee’s earnings and deductions for that tax year. Employees need to see their total earnings for the year so far. But the person who looks after payroll also needs this figure. Your payroll team also uses it to match year-to-date against payroll budgets to make sure that its fiscal year reporting shows the full picture.

‘YTD’ stands for ‘year to date’ – the period starting on the first day of the calendar or fiscal year, up to the current day. It sometimes appears on payslips as a running total of an employee’s earnings and deductions for that tax year. Employees need to see their total earnings for the year so far. But the person who looks after payroll also needs this figure. Your payroll team also uses it to match year-to-date against payroll budgets to make sure that its fiscal year reporting shows the full picture.

A payroll number – a unique identifier of an employee – is often included at the top of the page next to the employee’s name. Including this on a payslip helps the business keep its records organised, makes sure employees are paid correctly, allows both the business and the employee to track salary or wage payments, and protects personal data.

Here’s government info on wages and payslipsA payroll number – a unique identifier of an employee – is often included at the top of the page next to the employee’s name. Including this on a payslip helps the business keep its records organised, makes sure employees are paid correctly, allows both the business and the employee to track salary or wage payments, and protects personal data.

Here’s government info on wages and payslipsGross pay is your employee’s entire salary before any deductions are made. It works similarly to gross profit: the total amount includes any overtime, bonuses, and other amounts owed to them – before tax is taken out. On the other hand, net pay is their ‘take-home pay’ – what they get in the bank each pay run. Once you understand this difference you can explain to your employees the difference between the gross figure and what they actually see hit their bank balance, and you’ll also be able to manage your cash flow more easily.

Gross pay is your employee’s entire salary before any deductions are made. It works similarly to gross profit: the total amount includes any overtime, bonuses, and other amounts owed to them – before tax is taken out. On the other hand, net pay is their ‘take-home pay’ – what they get in the bank each pay run. Once you understand this difference you can explain to your employees the difference between the gross figure and what they actually see hit their bank balance, and you’ll also be able to manage your cash flow more easily.

More resources for your payroll

Check out these essential resources, written in plain English for busy small business owners.

What you need to understand about payroll

Get the low-down on the easy way to pay yourself and your employees.

Your free timesheet template

Download a free template to create timesheets easily for your employees.

An employee’s first day

Comply with payroll regulations right from your employee’s first day.

Xero: your answer to easier payroll

Xero stops your payroll from slowing down your business. Its clever features are simple to use – no accounting experience needed – so you can easily get up to speed, whether managing your payroll, allowing your employees to self-serve with the Xero Me App, or running payroll reports.

- Securely store employee records in the cloud

- Automate recurring pay runs to save you time each month

- Get comprehensive reports on your payroll whenever you need them

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.