How to prepare and lodge BAS online

Preparing and lodging a BAS online doesn’t need to be a difficult task for a small business owner.

Published Tuesday 18 January 2022

What is BAS?

A business activity statement (BAS) summarises what revenue you take in over a period of time, and reports on a few key expenditures too. GST-registered small businesses submit a BAS to the Australian Tax Office (ATO) to work out:

- their GST bill or refund

- what tax has been withheld from employee pay and must be sent to the ATO

- their income tax instalments if they’re in the pay-as-you-go (PAYG) system

A BAS can also be used to record other taxes and credits, such as fringe benefits tax, luxury car tax, wine equalisation tax, and fuel tax credits.

Who has to lodge a BAS, and when?

If you’re GST registered, then you have to submit business activity statements. Any business can register for GST and certain businesses are required to. You have to register for GST if:

- your income passes a certain amount (check the amount with the ATO)

- you provide taxi, limousine or rideshare services (as an owner driver or if you lease or rent a taxi)

- you want to claim fuel tax credits

Most GST-registered businesses complete a BAS every quarter. After the quarter closes, you get about a month to complete and submit the report. Some types of businesses must submit BAS reports once a month, and others may only have to do it annually. Check the ATO page on lodging and paying to confirm your requirements.

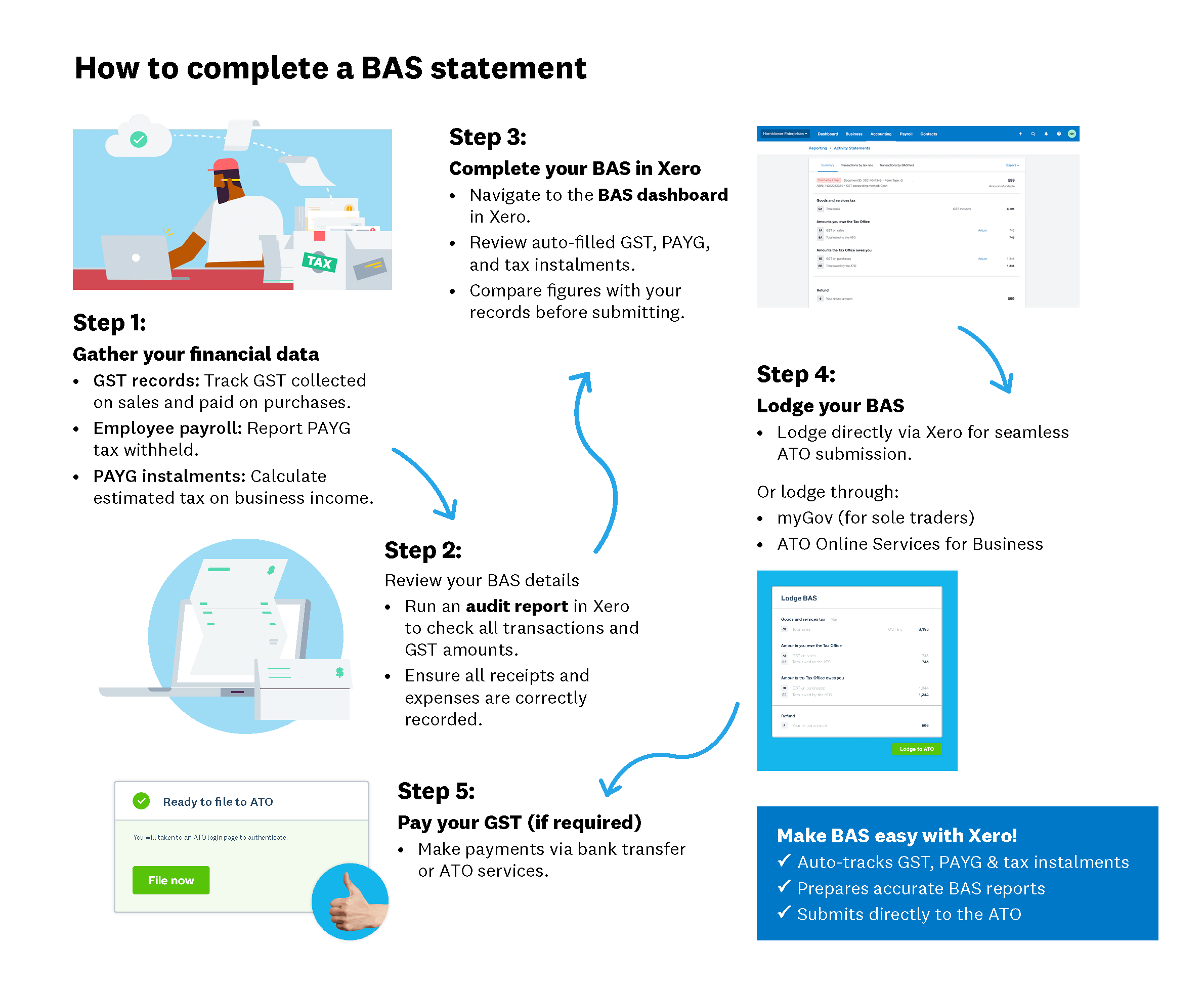

How to complete a BAS statement

Anyone who completes a BAS needs to report how much GST was collected from customers, and how much GST was paid to suppliers. Those numbers should be in your business accounts. If not, you’ll need to look back through your receipts and invoices or bank statements.

If you pay employees, your BAS must report how much PAYG tax you’ve withheld from their pay during the period. That information will be in your payroll system.

And if you’re making PAYG instalments on business income, then your BAS must also include an estimate of the tax you owe. That number is based on your sales for the period, which you can find in your P&L report.

You can set up accounting software so that all these numbers flow automatically through to the BAS when you complete it online.

How to lodge BAS

Before lodging your BAS, check that the accounting data you’re using is correct. Most accounting software will generate an audit report detailing all the transactions included in the BAS. Use this to double-check that all expenses and receipts for the period have the right GST amounts entered.

Once you’re confident the BAS is accurate, you can lodge it:

- via your online accounting software

- through your myGov account if you’re a sole trader

- through ATO Online Services for Business (this also supports sole traders)

- by having a registered tax or BAS agent (generally an accountant or bookkeeper) submit it for you

The beauty of a BAS agent

A lot of Australian businesses have an accountant or bookkeeper who can take care of their BAS and tax obligations. Besides checking that the BAS is accurate, these professionals can give advice on improving business profitability.

You can find accountants or bookkeepers on Xero’s advisor directory.

Keeping BAS hassle free

BAS is another admin job but it doesn’t have to be a big one. It mostly comes down to whether or not your accounts are up to date. If you do daily bank reconciliation and have good bookkeeping habits, it won’t be a problem.

A BAS or tax agent and online accounting software like Xero can help keep you up to date, while minimising the workload.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Plans to suit your business

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.