Real-time payroll reporting with Single Touch Payroll

Report employee earnings, tax, super and other payroll information to the Australian Tax Office (ATO) for each pay run using Single Touch Payroll (STP) software.

Payroll in a tap

Single Touch Payroll explained

Single Touch Payroll (STP) is an Australian government initiative that requires businesses to report pay information to the ATO digitally each pay run. It’s designed to streamline employer reporting.

STP software required

Businesses must use STP software to comply with ATO Single Touch Payroll reporting requirements.

Report every pay run

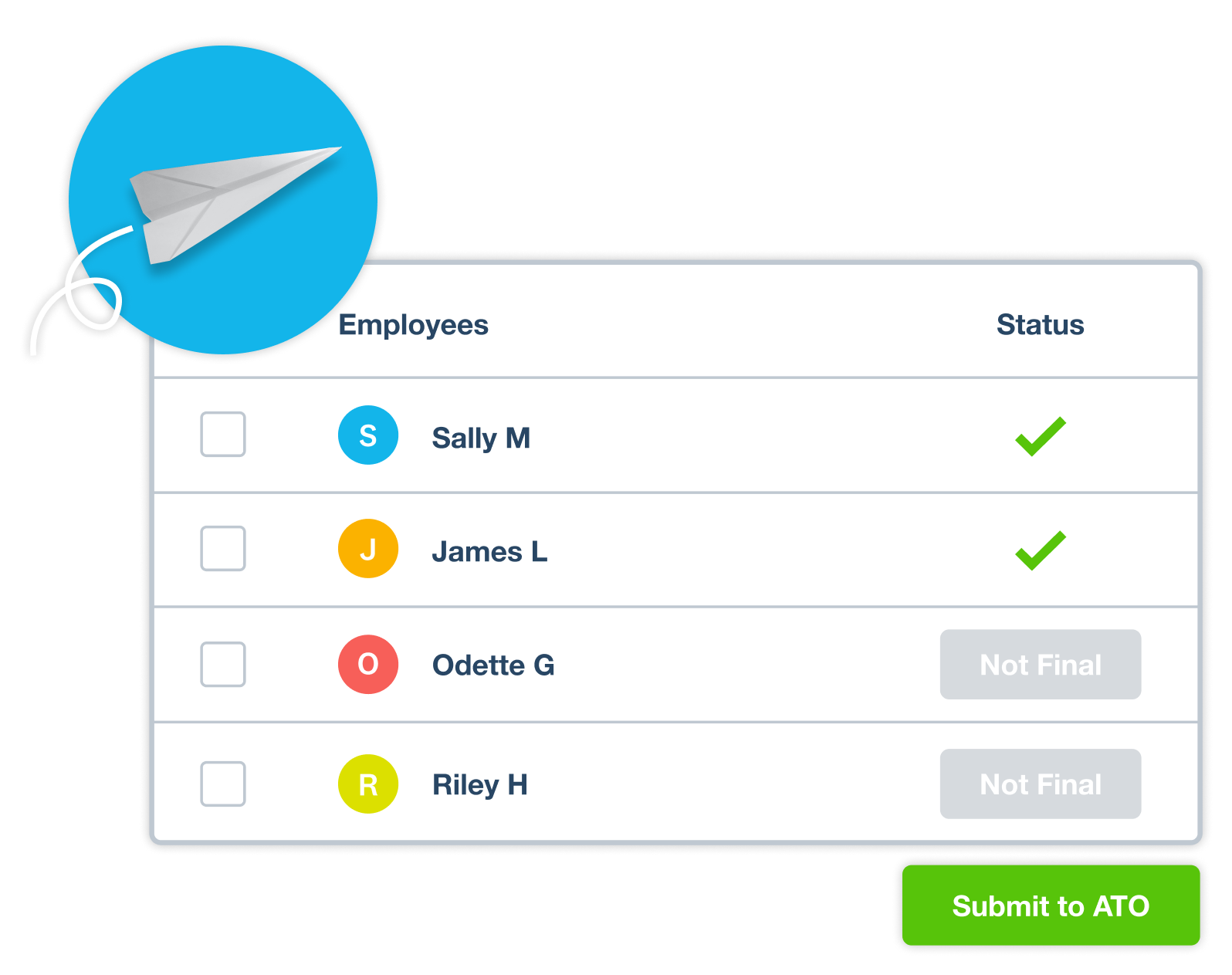

Xero compiles and sends payroll data in an STP-compliant report to the ATO each pay day.

Transition to STP Phase 2

Most employers have transitioned to STP Phase 2 reporting but you may be exempt or able to defer.

About Single Touch Payroll

STP was introduced in 2018 and expanded in 2022 so employers reported additional information to the ATO. This expansion (known as Single Touch Payroll Phase 2) was designed to reduce the work involved for employers who need to report employee information to multiple government agencies.

Learn about Single Touch Payroll at the ATO website

Using Xero to streamline Single Touch Payroll

Xero’s online payroll software for Australia helps simplify STP payroll reporting and lets you send information to the ATO about each pay run.

Learn more payroll in Xero

Sending STP reports direct to the ATO

Once you’re set up for Single Touch Payroll, you can generate and file STP reports showing employee PAYG withholdings and superannuation liabilities every pay run.

Learn more about reporting with STP

More about Single Touch Payroll

During a free trial of Xero, you can use the demo company to test setting up STP, file your pay runs, and finalise STP data without your data actually being sent to the ATO. When you subscribe to Xero, you need to choose a pricing plan according to the number of employees you pay and whether you want auto super included, then prepare to run payroll in Xero. During the setup process, you’ll need to connect your business to the ATO.

See how to set up Single Touch payroll in XeroDuring a free trial of Xero, you can use the demo company to test setting up STP, file your pay runs, and finalise STP data without your data actually being sent to the ATO. When you subscribe to Xero, you need to choose a pricing plan according to the number of employees you pay and whether you want auto super included, then prepare to run payroll in Xero. During the setup process, you’ll need to connect your business to the ATO.

See how to set up Single Touch payroll in XeroCertain employers are eligible for an exemption from STP reporting. As of January 2024, Single Touch Payroll exemptions mainly applied to small employers with low digital capability or in an area with unreliable or no internet service. Employers who need more time to start STP reporting, or to transition to STP phase 2 and start reporting the additional information to the ATO, can seek a deferral.

Read the ATO advice on exemptions and deferralsCertain employers are eligible for an exemption from STP reporting. As of January 2024, Single Touch Payroll exemptions mainly applied to small employers with low digital capability or in an area with unreliable or no internet service. Employers who need more time to start STP reporting, or to transition to STP phase 2 and start reporting the additional information to the ATO, can seek a deferral.

Read the ATO advice on exemptions and deferralsThe expansion of Single Touch Payroll (STP Phase 2) added some extra reporting requirements for employers. The additional information that needs to be reported to the ATO includes income or payment type and the reason for any cessation of employment.

See more about the changes at STP Phase 2The expansion of Single Touch Payroll (STP Phase 2) added some extra reporting requirements for employers. The additional information that needs to be reported to the ATO includes income or payment type and the reason for any cessation of employment.

See more about the changes at STP Phase 2After each pay run, once pay details from Xero have been reported to the ATO, employees can see year-to-date tax and super information in their ATO online services account. An income statement (previously called a payment summary) becomes available there at the end of the financial year.

See more about Single Touch Payroll for employees at the ATO websiteAfter each pay run, once pay details from Xero have been reported to the ATO, employees can see year-to-date tax and super information in their ATO online services account. An income statement (previously called a payment summary) becomes available there at the end of the financial year.

See more about Single Touch Payroll for employees at the ATO websiteRegistered tax and BAS agents need to use Xero or other STP software for reporting if they process payroll or calculate pay-as-you-go (PAYG) withholding and super for clients.

Registered tax and BAS agents need to use Xero or other STP software for reporting if they process payroll or calculate pay-as-you-go (PAYG) withholding and super for clients.

See answers to frequently asked questions about Single Touch Payroll.

See the single touch payroll FAQsSee answers to frequently asked questions about Single Touch Payroll.

See the single touch payroll FAQs

Use Xero for Single Touch Payroll

Access all Xero features free for 30 days, then decide which plan best suits your business.