How to lodge a BAS online: Step-by-step guide for small businesses

Filing your BAS online saves time and reduces errors. Learn the simple steps to prepare and submit yours.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Monday 26 January 2026

Key takeaways

• Utilize online accounting software or ATO digital platforms to lodge your BAS, as this provides an additional 2 weeks for quarterly lodgements and reduces manual data entry errors compared to paper forms.

• Maintain daily bank reconciliation and consistent bookkeeping throughout the quarter to transform BAS preparation from a stressful data-gathering exercise into a quick quarterly review.

• Contact the ATO immediately if you cannot lodge or pay your BAS on time, as early communication can help you avoid or reduce penalties and potentially secure a deferral or payment plan.

• Recognize that BAS lodging frequency depends on your GST turnover, with quarterly lodging required for businesses under $20 million turnover and monthly lodging mandatory for those with $20 million or more.

What is BAS?

is a quarterly report that GST-registered businesses submit to the ATO. It calculates your tax obligations and refunds by summarising your revenue and key business expenses.

The BAS determines:

- their GST bill or refund

- what tax has been withheld from employee pay and must be sent to the ATO

- their income tax instalments if they're in the pay-as-you-go (PAYG) system

You can also use a BAS to record other taxes and credits such as fringe benefits tax, luxury car tax, wine equalisation tax and fuel tax credits.

Benefits of lodging BAS online

Lodging your BAS online has some great advantages. You often get more time to lodge and pay — for example, the ATO states you may be eligible for an extra 2 weeks for quarterly lodgements — which can be a big help for managing cash flow.

Online systems can fill in some information for you, reducing manual data entry and errors. You will also get a faster confirmation that the ATO has received your lodgement. You can also lodge your BAS directly from your accounting software.

Who has to lodge a BAS, and when?

You must lodge a BAS if your business is registered for GST. GST registration becomes mandatory when:

- your business has a GST turnover of $75,000 or more

- you provide taxi, limousine or rideshare services, which requires GST registration regardless of your GST turnover

- you want to claim fuel tax credits

BAS lodging frequency depends on your business type and GST turnover:

- Quarterly: For businesses whose GST turnover is less than $20 million (due 28 days after quarter end)

- Monthly: Businesses with a GST turnover of $20 million or more

- Annually: Businesses that have voluntarily registered for GST and have a turnover under $75,000 may qualify

Check your specific requirements on the ATO lodging and paying page.

BAS due dates and deadlines

Staying on top of your BAS due dates is key to avoiding penalties. For most small businesses that lodge quarterly, your BAS is due on the 28 day of the month after the end of the financial quarter. For example, the quarter ending in March is due on 28 April.

However, if you lodge electronically (either yourself or through a registered agent), you may receive an additional 2 weeks to lodge and pay. Check the ATO website for the latest dates for your situation.

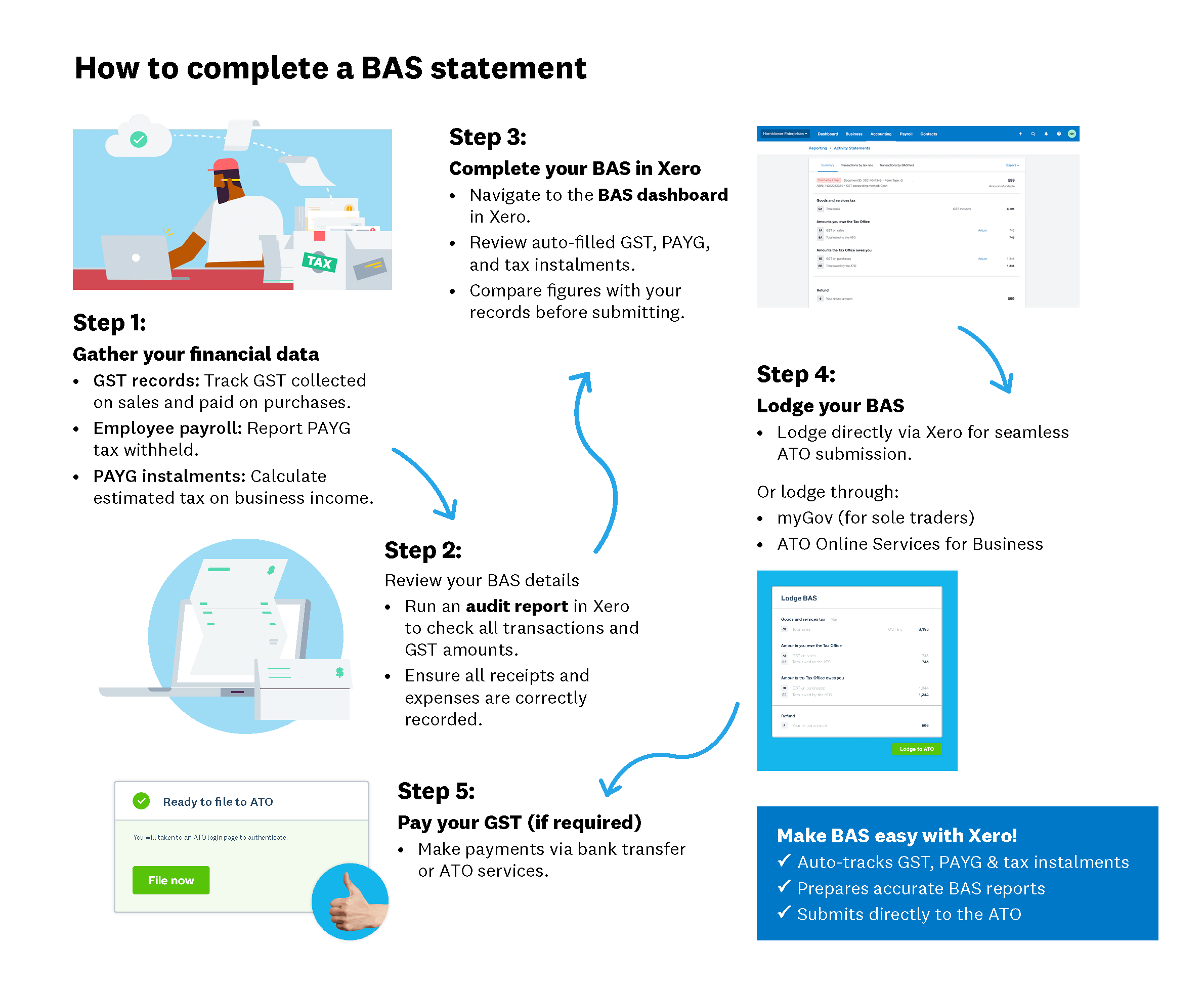

How to complete a BAS statement

BAS preparation involves gathering specific financial data from your business records. You'll need three main types of information:

GST data:

- GST collected from customers (in your sales records)

- GST paid to suppliers (in your purchase records)

PAYG withholding data:

- Tax withheld from employee wages (in your payroll system)

PAYG instalment data:

- Business income estimates (from your profit and loss report)

Your accounting software should automatically track these figures. If not, you will need to review receipts, invoices and bank statements.

You can set up your accounting software to fill in these numbers automatically when you complete your BAS online.

How to lodge BAS

BAS lodging is the process of submitting your completed business activity statement to the ATO. First, check your data using your accounting software’s audit report to confirm all GST amounts are correct.

You can lodge your BAS in one of four ways:

- via your online accounting software

- through your myGov account if you're a sole trader

- through ATO Online Services for Business (this also supports sole traders)

- by having a registered tax or BAS agent (generally an accountant or bookkeeper) submit it for you

How a BAS agent can help you

A BAS agent is a qualified professional (usually an accountant or bookkeeper) who can prepare and lodge your BAS on your behalf. They ensure your BAS is accurate, handle compliance requirements and provide business advice to help you grow.

You can find accountants or bookkeepers on Xero's advisor directory.

What to do if you make BAS mistakes

Mistakes happen. If you find an error on a BAS you have already lodged, you can usually correct it on your next BAS. You can usually correct it on your next BAS. For simple mistakes, you can make an adjustment in your next statement. If it's a more significant error, you may need to revise the original BAS. The ATO provides clear guidelines on how to fix mistakes, and your bookkeeper or accountant can guide you through the best way to correct it.

What if you can't lodge BAS on time

If you cannot lodge or pay your BAS on time, act quickly. Act quickly if you know you will be late. If you know you're going to be late, it's best to contact the ATO or your tax professional as soon as possible. They may be able to grant you a deferral or work out a payment plan. Contacting the ATO early can help you avoid or reduce penalties.

Keeping BAS hassle free

Keeping BAS simple comes down to maintaining up-to-date financial records throughout the quarter. Two key practices make preparing your BAS easier:

- Daily bank reconciliation: Match your bank transactions regularly

When your accounts are current, BAS becomes a quick quarterly review rather than a stressful data-gathering exercise.

A BAS or tax agent and Xero online accounting software can help keep you up to date and minimise your workload.

FAQs on lodging BAS online

Below are answers to common questions about lodging your BAS online.

How much does it cost to lodge BAS?

If you lodge it yourself through myGov or the ATO’s online services, it’s free. If you use a registered tax or BAS agent, their fees will vary. These can range from about $75 for a simple sole trader lodgement to a few hundred dollars for more complex company returns.

Do you need an accountant to lodge BAS?

You do not have to use an accountant or BAS agent – many sole traders and small business owners lodge their own BAS. However, an agent can make sure your BAS is correct and may help you save time and money.

Can I lodge BAS through my accounting software?

Yes, if you use Standard Business Reporting (SBR) enabled software such as Xero online accounting software, you can lodge your BAS directly from the platform. This simplifies the process by using your existing financial data to pre-fill the statement.

What happens if I lodge my BAS late?

If you lodge or pay your BAS late, the ATO may charge you interest and penalties. It's always best to contact the ATO as soon as you know you'll be late to discuss your options.

How long does it take for BAS lodging to be processed?

When you lodge online, you'll get an instant receipt from the ATO. If you're due a refund, it's typically processed within 12 business days.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Plans to suit your business

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.