Gearing ratio: definition, formula, examples and tips

Learn how the gearing ratio guides smarter funding choices and protects cash flow as you grow.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Thursday 19 February 2026

Table of contents

Key takeaways

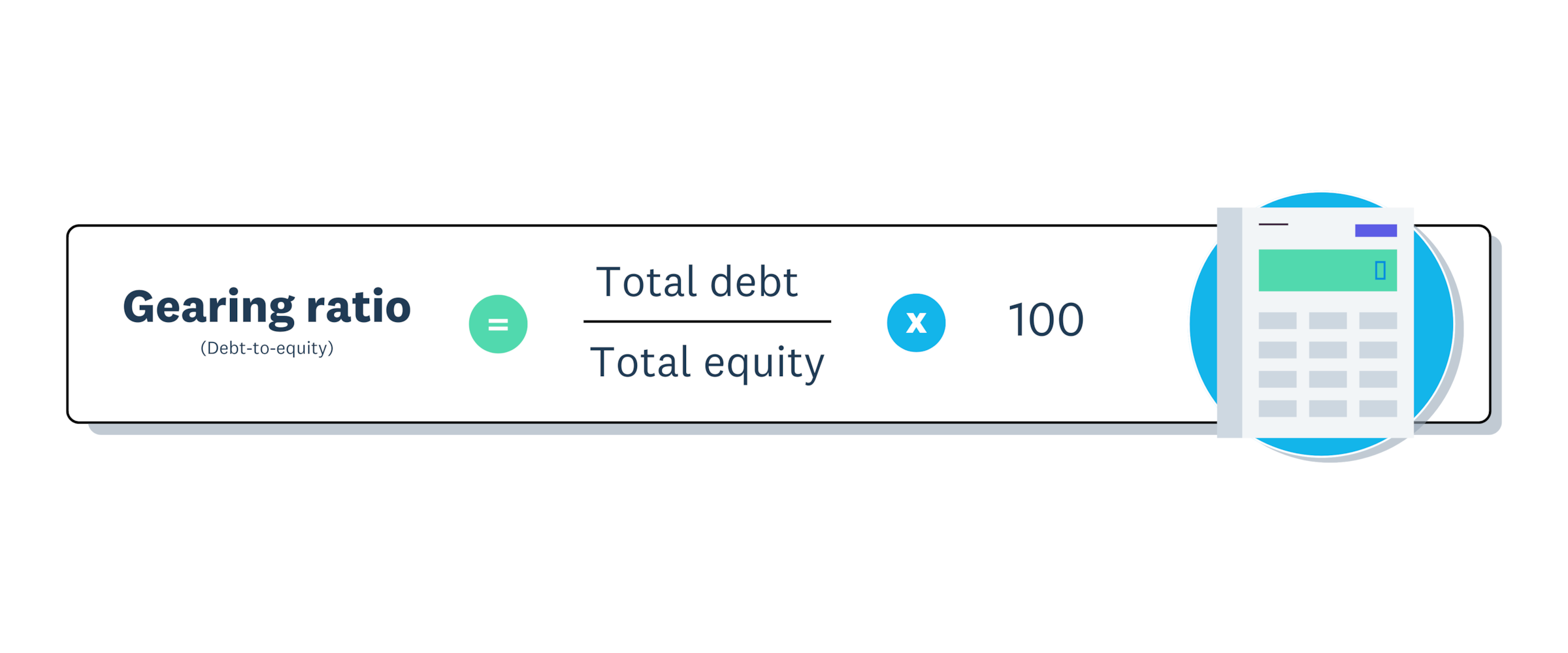

- Calculate your gearing ratio quarterly using the debt-to-equity formula (Total debt ÷ Total equity × 100) to monitor your financial health and make informed borrowing decisions.

- Maintain a gearing ratio between 25% and 50% for most small businesses, as this range balances growth potential with manageable financial risk while remaining attractive to lenders and investors.

- Reduce a high gearing ratio by paying down existing debt (starting with high-interest loans), retaining more earnings in your business, and avoiding new borrowing until your ratio improves.

- Use your gearing ratio to evaluate borrowing capacity before taking on new debt, ensuring you can service additional payments without straining cash flow or increasing financial risk beyond acceptable levels.

Gearing ratio definition

Your gearing ratio compares debt to equity, showing how reliant your company is on borrowed funds versus owner investment. It gives you a clear picture of financial health.

In finance, gearing refers to the balance between debt and equity used to fund operations:

- Debt: Borrowed money, such as loans and lines of credit, that must be repaid with interest.

- Equity: The owner's investment in the business, including retained earnings and share capital.

Lenders, investors, and stakeholders use gearing ratios to assess financial stability. A higher ratio signals greater reliance on debt, which means increased financial risk but also potential for higher returns. For instance, leverage at the largest funds remained elevated at about 15 to 1 in early 2024. A lower ratio suggests a stronger equity position, reducing risk but potentially limiting growth opportunities.

Why does your gearing ratio matter?

Your gearing ratio matters because it reveals how much financial risk your business carries. Tracking it helps you make smarter borrowing decisions and plan for sustainable growth.

Here's how understanding your gearing ratio helps your business:

- Evaluate borrowing capacity: Determine whether you can take on more debt without straining cash flow or increasing financial risk.

- Attract investors and lenders: Signal financial stability with a balanced ratio, making your business more appealing to potential funders.

- Align strategic planning: Match your debt-to-equity structure with your growth goals, whether aiming for rapid expansion or steady, low-risk growth.

- Maintain cash flow stability: Free up more cash for reinvestment with a lower ratio, or plan for higher debt repayments with a higher ratio.

- Manage risk proactively: Spot financial vulnerabilities early by reviewing your ratio regularly and taking corrective action.

Types of gearing ratios

Several types of gearing ratios measure financial leverage and risk. Each examines a different aspect of your business's capital structure.

- Debt-to-equity ratio: Compares total debt to total equity, showing how much of the business is funded by creditors versus owners.

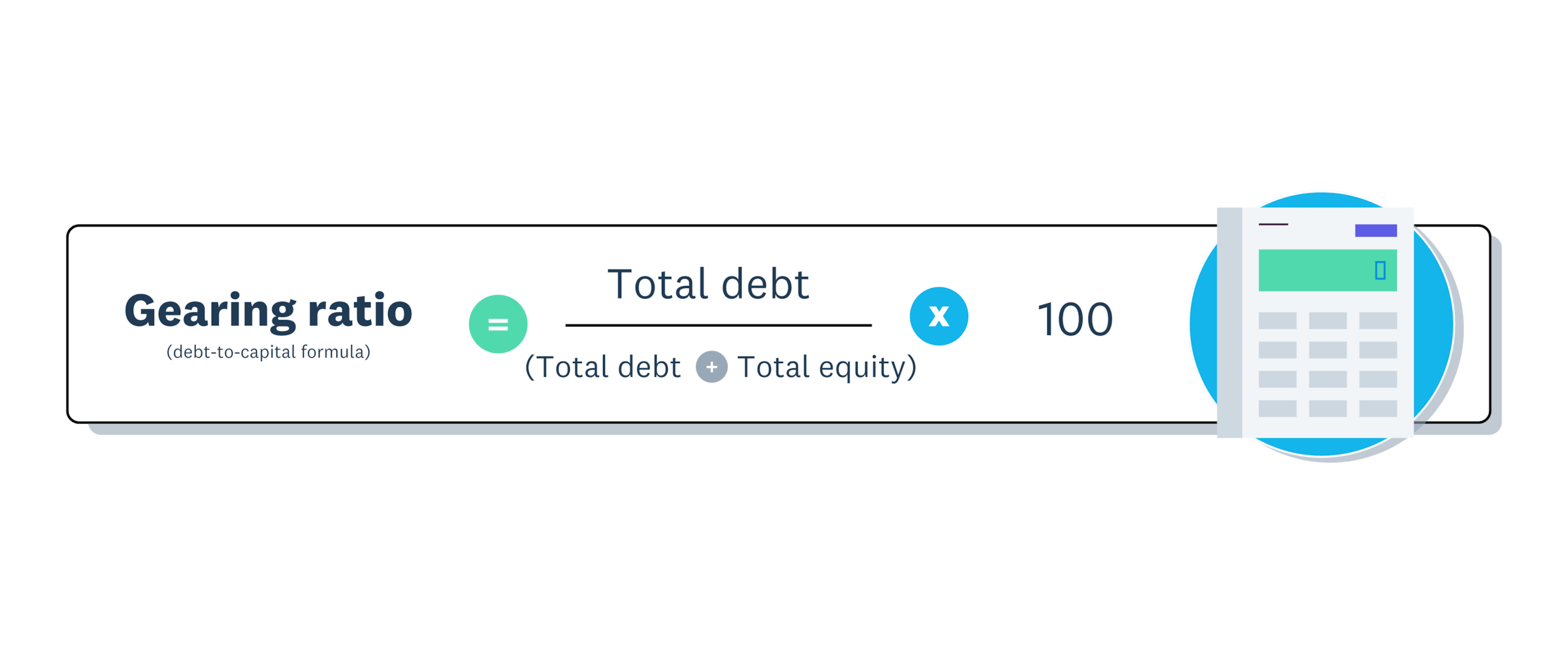

- Debt-to-capital ratio: Measures the proportion of total capital (debt + equity) funded by debt, with higher ratios suggesting greater reliance on borrowing.

- Equity ratio: Represents the share of total assets financed by equity, with higher ratios indicating stronger financial stability.

- Times interest earned (TIE) ratio: Assesses your ability to cover interest payments with pre-tax earnings, reassuring lenders you can meet debt obligations.

How to calculate the gearing ratio

Calculating your gearing ratio takes four steps. You'll need figures from your balance sheet to complete the calculation.

- Calculate total debt: Add all financial liabilities, including loans, bonds, and credit lines.

- Determine total equity: Add retained earnings and share capital to find the owner's total investment in the business.

- Apply a gearing ratio formula: Use the debt-to-equity formula (Gearing ratio = (Total debt / Total equity) × 100) or the debt-to-capital formula (Gearing ratio = (Total debt / (Total debt + Total equity)) × 100).

- Interpret the result: A higher percentage indicates greater reliance on debt, while a lower percentage indicates a stronger equity position.

Example gearing ratio calculations

Here are a couple of practical examples of how to calculate a gearing ratio:

- Total debt: $50,000

- Total equity: $100,000

Using the debt-to-equity formula:

Gearing ratio = (Total debt / Total equity) × 100

Gearing ratio = ($50,000 / $100,000) × 100Gearing ratio = 50%

Using the debt-to-capital formula:

Gearing ratio = (Total debt / (Total debt + Total equity)) × 100

Gearing ratio = ($50,000 / ($50,000 + $100,000)) × 100Gearing ratio = ($50,000 / $150,000) × 100Gearing ratio = 33.3%

Gearing ratio analysis

Analysing your gearing ratio helps you understand your business's financial position and make informed decisions.

A good gearing ratio for most small businesses falls between 25% and 50%. For example, one financial model shows a healthy debt-to-equity is 0.42 (or 42%), which fits within this ideal range. This range balances growth potential with manageable financial risk.

Here's how to interpret your result:

- Low gearing (below 25%): Indicates a strong equity position with lower risk exposure and greater stability.

- Moderate gearing (25% to 50%): Represents a balanced financial approach for most small and medium businesses.

- High gearing (above 50%): Signals heavier reliance on debt and increased financial risk.

Typical ratios vary by industry and growth stage. Capital-intensive industries like manufacturing or construction often carry higher gearing than service-based businesses.

Many small and medium businesses (SMBs) maintain a 30% to 50% debt mix, using borrowed funds to support growth while relying on equity for stability. Finding the right balance is key to managing financial risk and achieving sustainable growth.

High vs low gearing: What's the difference?

High gearing means relying more on debt than equity. Low gearing means using more equity and less debt. The right choice depends on your business goals and risk tolerance.

High gearing example: A retail store taking out a large loan to buy inventory and renovate its premises would have a high gearing ratio. This approach works well if sales thrive, but carries risk if revenues drop or interest rates rise.

High gearing can suit businesses with:

- stable cash flow that can service debt

- high-growth opportunities requiring quick capital access

- confidence in revenue projections

Low gearing example: A family-owned cafe expanding by using saved profits may grow more slowly, but keeps financial risk to a minimum.

Low gearing suits businesses prioritising:

- long-term security over rapid growth

- protection during unstable market conditions

- a strong credit rating

Finding the right balance helps you manage financial risk while staying ready to seize growth opportunities.

Debt to equity ratio vs gearing ratio

The debt-to-equity ratio and gearing ratio both measure financial leverage, but they serve different purposes.

- Debt-to-equity ratio: Compares long-term debt to shareholders' equity, providing a quick snapshot of leverage.

- Gearing ratio: Provides a broader measure using various formulas that consider different types of debt relative to capital structure.

When to use each:

- Use the debt-to-equity ratio for quick financial assessments and standardised comparisons, such as benchmarking against competitors or industry averages.

- Use the gearing ratio for deeper analysis and long-term strategic planning, especially when you want a comprehensive view of leverage across different debt types.

Both ratios help evaluate financial risk. Choose based on whether you need a quick snapshot or a detailed analysis.

How to improve your gearing ratio

If your gearing ratio is higher than you'd like, several strategies can help bring it into a healthier range. The right approach depends on your business circumstances and growth goals.

To reduce your gearing ratio:

- Pay down existing debt: Use surplus cash to reduce loan balances, starting with high-interest debt. One case study shows how a company that paid down debt improved its ratio to 0.5x from 1.0x in a single year.

- Retain more earnings: Reinvest profits into the business rather than distributing them, building your equity base.

- Avoid taking on new debt: Fund growth through revenue or equity investment instead of additional borrowing.

- Convert debt to equity: If you have investors, consider converting loans to ownership stakes.

To increase your gearing ratio (if too low):

- Take on strategic debt: Borrow to fund growth opportunities that will generate returns exceeding the cost of borrowing.

- Distribute retained earnings: If you have excess equity, consider shareholder distributions to optimise your capital structure.

Review your gearing ratio quarterly to track progress and adjust your strategy as your business evolves.

Manage your gearing ratio with Xero

Understanding your gearing ratio helps you make confident borrowing decisions and communicate clearly with lenders and investors. Regular monitoring keeps you aware of your financial position as your business grows.

Xero makes tracking your gearing ratio straightforward:

- Real-time financial reports: Access up-to-date balance sheet data to calculate your ratio whenever you need it.

- Automated calculations: Reduce manual work and minimise errors in your financial reporting.

- Clear stakeholder reporting: Share accurate financial information with lenders, investors, and advisors.

Ready to take control of your business finances? Get one month free and see how Xero simplifies financial management.

FAQs on gearing ratios

Here are answers to common questions about gearing ratios and how they apply to your business.

What is a good gearing ratio for a small business?

A good gearing ratio for most small businesses falls between 25% and 50%. This range balances growth potential with manageable financial risk, though the ideal ratio varies by industry.

How often should I calculate my gearing ratio?

Calculate your gearing ratio at least quarterly, or whenever you're considering taking on new debt or making significant financial decisions. Regular monitoring helps you spot trends and respond to changes early.

Can a gearing ratio be too low?

Yes, a very low gearing ratio (below 25%) may indicate you're not using debt effectively to grow your business. While low gearing reduces risk, it can also mean missing opportunities that strategic borrowing could fund.

How can I improve my gearing ratio if it's too high?

Reduce a high gearing ratio by paying down existing debt, retaining more earnings in the business, or avoiding new borrowing. Focus on high-interest debt first for the greatest impact.

What gearing ratio do lenders look for?

Most lenders prefer a gearing ratio below 50%, as higher leverage can increase the risk of default. In some sectors, the loan delinquency rate has been on the rise. A lower ratio signals you have the capacity to take on new debt and can comfortably meet repayments.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.