Accounting software for your South African small business

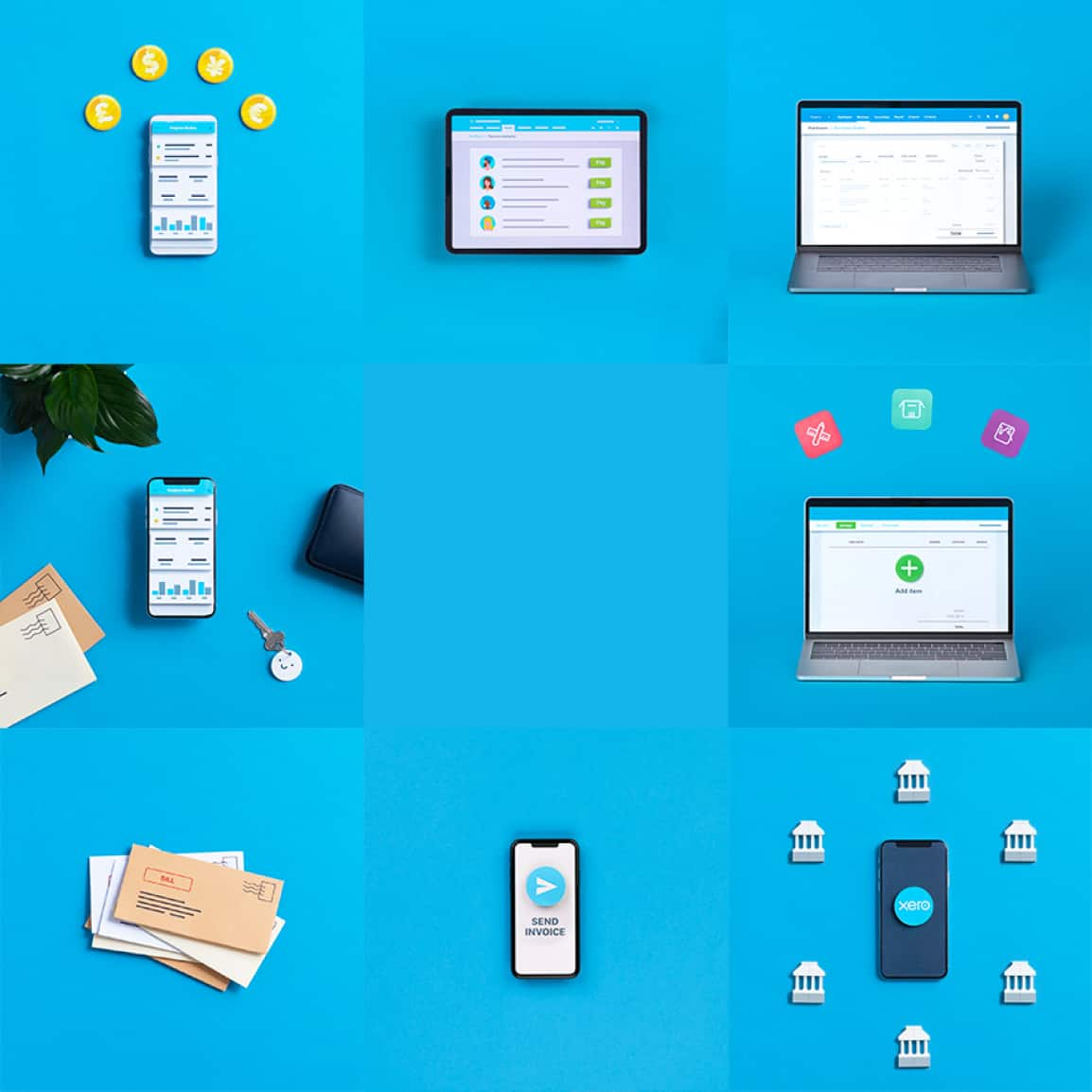

Simplify financial admin with Xero’s cloud-based accounting software. Automate tasks, send invoices, and stay SARS-compliant with smart tools built for South African businesses.

Secure, paperless records

Store your receipts and financial records in the cloud – so you stay organised and your records are updated.

Your latest transactions in Xero

Link your business accounts at most major banks to Xero with bank feeds.

Simplify your VAT

Automate VAT calculations and quickly create -accurate tax returns with Xero’s built-in tools.

Expand your business with apps

Tailor Xero to your business with hundreds of third-party apps in the Xero App Store.

Join over 4.2 million subscribers using Xero

Awards and recognition for our work

Capture receipts in Xero for simple, accurate records

No more manual data entry – just capture and store your receipts in the cloud with Xero for secure, organised, up to date records.

- Capture the data from your bills and receipts, then let Xero’s Hubdoc turn them into transactions in Xero for easy reconciliation

- Snap pictures of your receipts with your phone using the Xero Me up and upload them straight into Xero

- Track your transactions easily – Xero links receipts to transaction lines in Xero and reconciles them automatically

Connect Xero with major South African banks

No more juggling banks and platforms! Xero bank feeds securely import all your transactions each business day so you have all your latest transactions in one place.

- Connect with FNB, ABSA, Standard Bank, Nedbank, and other major South African and international banks

- Reconcile your transactions on the spot for a clear, complete view of your cash flow

- Get up-to-date financial data that helps you spot trends and make confident business decisions

Stay compliant with latest SARS guidelines

Xero’s bookkeeping software simplifies your SARS returns with automated tools for accurate records and smooth filing – that means fewer headaches at tax time.

- Generate SARS-compliant tax invoices in the correct format and with the right numbering and details

- Use built-in VAT tools to prepare accurate returns in line with the latest SARS regulations

- Get auto-reminders for VAT deadlines for stress-free, on-time filing

Customise your Xero with apps that work for you

Tailor Xero to your business with third-party apps from the Xero App Store. Choose from hundreds of apps – including local apps like PayFast, Yoco, and SimplePay – to manage your workflows and data your way.

- Expand Xero’s features with tools that work for your unique business needs

- Find, try and choose apps from all areas of your business – payments, inventory, payroll, eCommerce, and more

- Apps integrate with Xero, so your data flows seamlessly between them

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Invoicing made simple

Learn how Xero invoicing tools can help your business

Manage your inventory the smart way

See how inventory tracking works

Streamline your pay runs

Make your pay runs easier with Xero

Send quotes and estimates like a pro

Send quotes with confidence

Accept payments online to get paid sooner

Get paid sooner with Xero

Track projects easily

Stay on top of every project

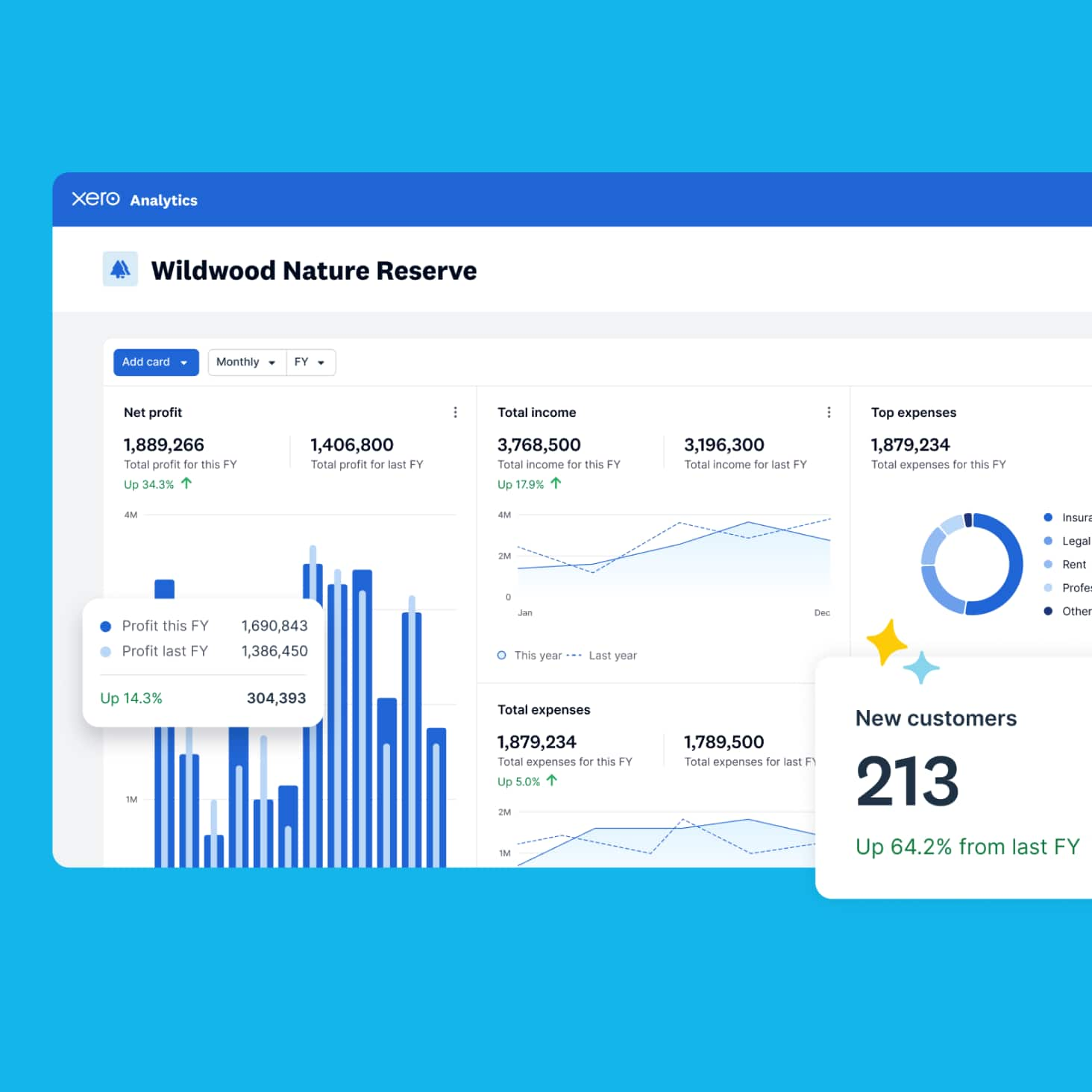

Xero’s business accounting software helps you manage invoicing, reporting, and more – while making compliance a breeze. See how Xero’s features support business

It’s really enabled me to grow as a business owner and given me so much time back to work on my business and be with my family.

Kristen’s Kick-ass Ice Cream use Xero to manage their business

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

FAQs on accounting software

With Xero online accounting software, there’s nothing to install – just log in securely from anywhere with an internet connection. Cloud accounting gives you live access to your finances, lets you automate bank feeds, connect business apps, and collaborate with your accountant in real time. And Xero secures data safely in the cloud, with multi-factor authentication and automatic backups for peace of mind.

See how Xero bookkeeping software for small business can help youWith Xero online accounting software, there’s nothing to install – just log in securely from anywhere with an internet connection. Cloud accounting gives you live access to your finances, lets you automate bank feeds, connect business apps, and collaborate with your accountant in real time. And Xero secures data safely in the cloud, with multi-factor authentication and automatic backups for peace of mind.

See how Xero bookkeeping software for small business can help youNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareThere are three basic steps to setting up an accounting system. The aim is to keep everything simple and accurate. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software, such as Xero, that has the features you need, like the ability to use eInvoicing and send foreign currency payments.

There are three basic steps to setting up an accounting system. The aim is to keep everything simple and accurate. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software, such as Xero, that has the features you need, like the ability to use eInvoicing and send foreign currency payments.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

Yes, you aren’t required to have an accountant in most regions so you can certainly run your business without one. However, it can be beneficial to bring one on and utilise their expertise to help your business perform. Online resources – such as those by Xero – explain topics like managing cash flow, tracking payments, and creating invoices. Read these materials to stay up to date with regulatory and other changes around tax and record keeping. Cloud-based accounting software like Xero is a big help. This keeps all your financial records in one secure place. Its automated calculations prevent data entry mistakes, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Check out Xero’s directory of accountants and bookkeepersYes, you aren’t required to have an accountant in most regions so you can certainly run your business without one. However, it can be beneficial to bring one on and utilise their expertise to help your business perform. Online resources – such as those by Xero – explain topics like managing cash flow, tracking payments, and creating invoices. Read these materials to stay up to date with regulatory and other changes around tax and record keeping. Cloud-based accounting software like Xero is a big help. This keeps all your financial records in one secure place. Its automated calculations prevent data entry mistakes, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Check out Xero’s directory of accountants and bookkeepersTechnically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Technically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Useful features to run your business

Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.