Gross profit margin formula: How to calculate, boost profits

Learn how the gross profit margin formula helps you price smarter, cut costs, and grow profit.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 6 February 2026

Table of contents

Key takeaways

- Calculate your gross profit margin using the formula: (Revenue - Cost of Goods Sold) ÷ Revenue × 100, ensuring you include only direct production costs in COGS and exclude operating expenses like rent or utilities.

- Track your gross profit margin monthly or quarterly to spot trends early, as regular monitoring helps you catch rising costs, measure pricing changes, and identify seasonal patterns before they impact profitability.

- Compare your margin against industry benchmarks rather than universal standards, as what counts as "good" varies significantly between sectors - software and professional services typically achieve 50%+ margins while retail and manufacturing often see 30-50%.

- Improve your margin by strategically raising prices, negotiating better supplier terms, or reducing waste in production, but focus on changes that maintain quality and competitiveness in your market.

What is gross profit margin?

Gross profit margin is the percentage of sales revenue remaining after you subtract the direct costs of producing your goods or services. It measures how efficiently your business turns sales into profit before accounting for operating expenses.

This metric helps you:

- understand how much revenue you keep after covering direct costs

- identify which products or services are most profitable

- spot areas where costs may be eating into your margins

A low gross profit margin makes it harder to cover operating expenses like rent and utilities, reducing your chances of making a net profit.

Gross profit margin vs gross profit

Gross profit is a dollar amount. Gross profit margin is a percentage.

Gross profit shows how many dollars remain after subtracting your cost of goods sold from revenue. Gross profit margin expresses that same figure as a percentage of total revenue, making it easier to compare performance across time periods or against other businesses.

You may also hear "gross margin" used interchangeably with gross profit margin. They mean the same thing.

Components of the gross profit margin formula

Before calculating your margin, understand what numbers you need and where to find them.

What counts as revenue

Revenue is the total income from selling your products or services before any deductions. Include:

- sales of products

- fees for services provided

- any other income directly from your core business activities

Don't include:

- interest income

- investment returns

- one-off asset sales

Use your gross revenue figure, not net revenue (which has deductions already applied).

What goes into COGS

Cost of goods sold (COGS) includes the direct costs of producing what you sell. For a product-based business, this typically includes:

- raw materials and components

- direct labour (wages for staff who make the product)

- manufacturing supplies

- freight and shipping to receive materials

For a service-based business, COGS may include:

- direct labour costs (time spent delivering the service)

- materials used to provide the service

- subcontractor costs

Don't include operating expenses like rent, utilities, marketing, or administrative salaries. These are subtracted later when calculating operating profit.

For detailed guidance, see how to estimate your COGS.

How to calculate gross profit margin

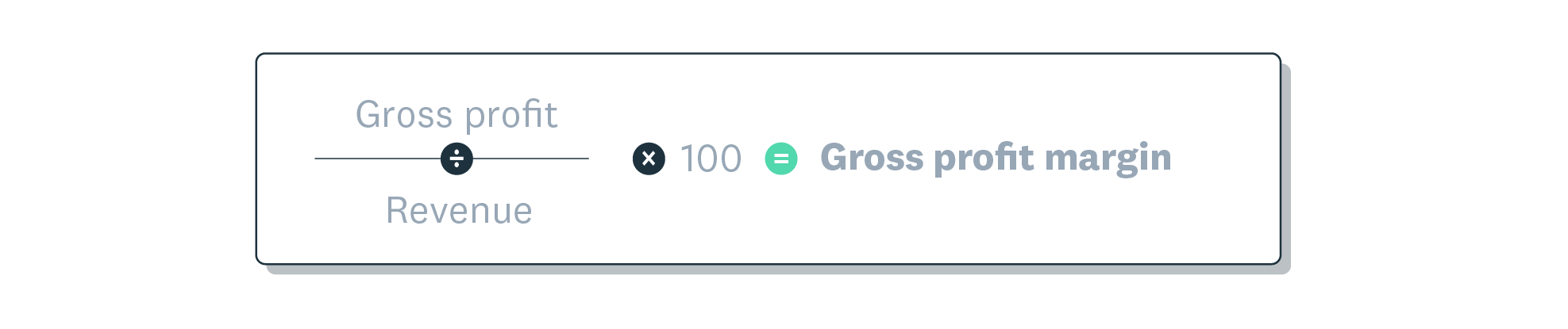

The gross profit margin formula

The gross profit margin formula is:

Gross profit margin = (Gross profit ÷ Revenue) × 100

Or expressed another way:

Gross profit margin = ((Revenue − COGS) ÷ Revenue) × 100

Step-by-step calculation

Follow these steps to calculate your gross profit margin:

- Find your total revenue: Add up all sales from products and services for the period.

- Calculate your COGS: Total the direct costs of producing what you sold.

- Subtract COGS from revenue: This gives you your gross profit in dollars.

- Divide gross profit by revenue: This converts the figure to a decimal.

- Multiply by 100: This gives you your gross profit margin as a percentage.

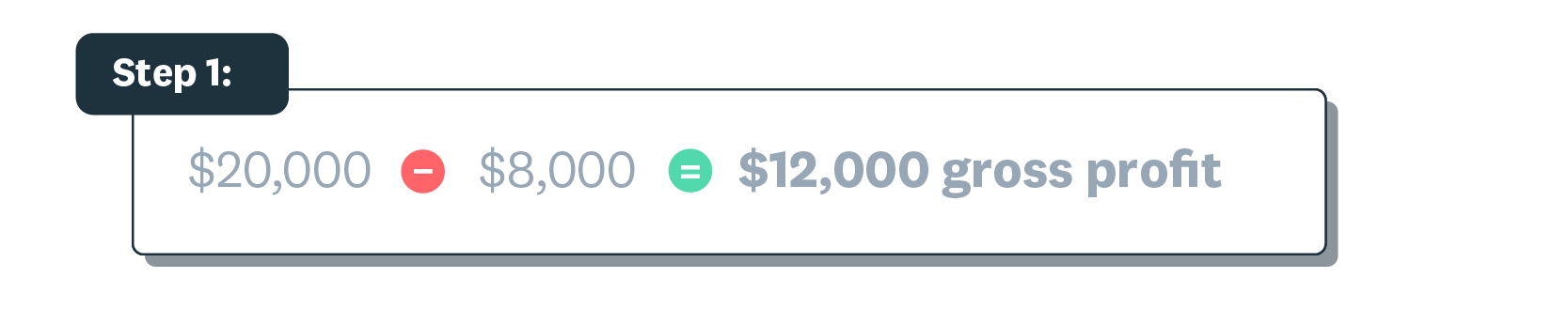

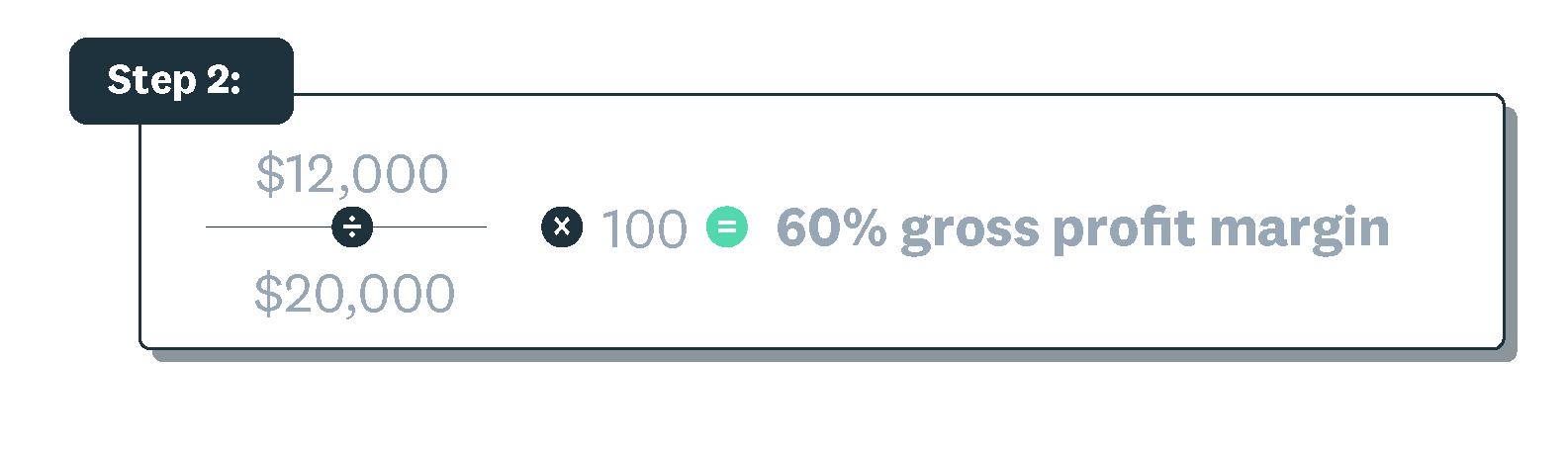

Gross profit margin example

Here's a worked example:

- Revenue: $20,000 (from cleaning offices)

- COGS: $8,000 (cost to provide services)

- Gross profit: $20,000 − $8,000 = $12,000

- Gross profit margin: ($12,000 ÷ $20,000) × 100 = 60%

A 60% gross profit margin means you keep 60 cents of every dollar earned after covering direct costs.

Common calculation mistakes to avoid

Accurate calculations depend on getting your inputs right. Watch out for these common errors:

- Including operating expenses in COGS: Rent, utilities, and office supplies are operating expenses, not COGS. Only include costs directly tied to production.

- Using net revenue instead of gross revenue: Use your total sales figure before any deductions.

- Forgetting labour costs: If employees work directly on producing goods or delivering services, include their wages in COGS.

- Mixing up gross profit and gross profit margin: Gross profit is a dollar amount. Gross profit margin is a percentage.

For detailed guidance on calculating your direct costs, see how to estimate your COGS.

What is a good gross profit margin?

A "good" gross profit margin varies by industry, business size, and market conditions. There's no universal benchmark because different sectors have different cost structures.

Your margin needs to be high enough to cover:

- operating expenses (rent, utilities, salaries)

- taxes and regulatory costs

- debt repayments

- reinvestment in growth

If your margin only covers COGS with little left over, you'll struggle to pay these additional costs and turn a net profit.

Industry benchmarks for gross profit margin

Gross profit margins vary widely across industries:

- Higher margins (50%+): Jewellery, cosmetics, software, professional services

- Moderate margins (30–50%): Retail, food and beverage, manufacturing

- Lower margins (below 30%): Electronics retail, grocery, automotive

These ranges reflect differences in production costs, pricing power, and competition within each sector.

Factors that affect what's considered "good"

What counts as a healthy margin depends on several factors:

- Industry: different sectors have different cost structures. Hospitality typically has high overhead and lower margins, while financial services often achieve higher margins with lower overhead.

- Region: costs, taxes, and market conditions vary by location. A city-centre shop faces different expenses than a rural business.

- Business model: ecommerce businesses often have lower overhead than bricks-and-mortar retailers, allowing for potentially higher margins.

- Competition: in highly competitive markets like electronics retail, price pressure can squeeze margins.

How to benchmark your gross profit margin

Compare your margin against similar businesses to understand how you're performing. For the most accurate comparison:

- Match your industry: compare against businesses selling similar products or services

- Consider business size: a sole trader's margins differ from a company with 50 employees

- Account for region: local cost structures affect what's achievable

Your accountant or bookkeeper can help you find industry benchmarks for small businesses in your sector and clarify what margin you should aim for.

When to reassess your gross profit margin

Review your gross profit margin when:

- costs are rising: supplier price increases or wage growth can erode margins quickly

- you've missed growth targets: a declining margin may explain why profits aren't growing

- you're changing prices: check whether adjustments improve or hurt your margin

- you're launching new products: compare new offerings against your existing margin

- market conditions shift: economic changes or new competitors may affect your pricing power

Accounting software like Xero's financial reports makes it easy to track your margin over time and spot changes early.

Analysing your gross profit margin for business insights

Analysing your gross profit margin reveals how profitable each part of your business is and where you can improve. By tracking this metric, you can make informed decisions about pricing and cost management.

Margin analysis helps you:

- identify your most and least profitable products or services

- spot cost increases before they erode your profits

- set prices that balance competitiveness with profitability

- compare performance across different time periods

What your percentage means

Your gross profit margin percentage tells you how much of each sales dollar remains after direct costs:

- 20% margin: You keep 20 cents per dollar; 80 cents goes to COGS. Common in competitive, low-margin industries like grocery or electronics retail.

- 30% margin: You keep 30 cents per dollar. Typical for many retail and manufacturing businesses.

- 50% margin: You keep 50 cents per dollar. Common in software, professional services, and some retail sectors.

- 60%+ margin: You keep more than 60 cents per dollar. Often seen in luxury goods, software, and high-end services.

A higher margin isn't always better. What matters is whether your margin is healthy for your industry and sufficient to cover your operating expenses and growth goals.

Tracking gross profit margin trends

Monitor your gross profit margin over time to spot patterns in your business performance. Regular tracking helps you:

- identify seasonal fluctuations: margins may dip during slower periods or rise during peak seasons

- catch rising costs early: a declining margin often signals increasing supplier costs

- measure the impact of pricing changes: see whether price adjustments improve or hurt profitability

- compare year-over-year performance: track whether your efficiency is improving

Review your margin monthly or quarterly to catch issues before they become problems.

Factors that can affect your margin

External factors outside your control can impact your gross profit margin:

- Demand shifts: When demand falls, you may need to lower prices to attract customers, reducing your margin

- Rising supplier costs: Increases in material or labour costs narrow your margins if you can't pass them on to customers

- Economic conditions: When customers have less to spend, your sales volume or pricing power may decline

Internal factors you can control also play a role:

- Pricing strategy: Underpricing erodes margins, while overpricing may reduce sales volume

- Operational efficiency: Waste and inefficiency increase your COGS

- Product mix: Selling more low-margin items pulls down your overall margin

Gross profit margin compared with other metrics

Gross profit margin is one of several profitability metrics. Understanding how it relates to operating profit margin and net profit margin helps you get a complete picture of your business's financial health.

Gross profit margin vs operating profit margin

Operating profit margin goes further than gross profit margin by also subtracting operating expenses like rent, utilities, and salaries.

- Gross profit margin: Revenue minus COGS, divided by revenue

- Operating profit margin: Revenue minus COGS and operating expenses, divided by revenue

Use operating profit margin to see how efficiently you're running the entire business, not just production.

Gross profit margin vs net profit margin

Net profit margin is your bottom line. It shows what percentage of revenue remains after all expenses, including operating costs, interest, and taxes.

- Gross profit margin: measures production efficiency

- Net profit margin: measures overall business profitability

You can have a healthy gross profit margin but a low net profit margin if your operating expenses, debt, or taxes are high.

How to use each metric

Each margin serves a different purpose in understanding your business finances:

- Gross profit margin: Use it to evaluate pricing decisions and identify which products or services are most profitable

- Operating profit margin: Use it alongside gross profit margin to assess overall operational efficiency and guide budgeting

- Net profit margin: Use it for long-term financial planning, as you'll be more resilient to economic changes with a consistently high net profit margin

How to improve gross profit margin

If your gross profit margin is lower than you'd like, you can improve it by adjusting prices, reducing costs, or streamlining operations. Here are three approaches to consider.

Review and adjust your pricing

Pricing directly affects your margin. Consider these approaches:

- Raise prices strategically: if your costs have increased, adjust prices to maintain your margin

- Add value to justify higher prices: improve your product or service quality to support premium pricing

- Monitor competitor pricing: stay competitive without racing to the bottom on price

- Test price changes: try small adjustments and measure the impact on sales volume and margin

Reduce your cost of goods sold

Lowering your COGS directly improves your gross profit margin. Try these approaches:

- Negotiate with suppliers: build relationships to secure bulk discounts or better payment terms

- Compare supplier pricing: regularly review alternatives to ensure you're getting competitive rates

- Reduce waste: minimise material waste and spoilage in production

- Optimise inventory: avoid overstocking, which ties up cash and may lead to markdowns

Streamline operations to reduce waste

Operational efficiency reduces costs without affecting quality. Consider these improvements:

- Automate repetitive tasks: use accounting software to reduce manual data entry and errors

- Improve inventory management: minimise excess stock to reduce storage costs and avoid markdowns

- Review your processes: identify bottlenecks or inefficiencies that increase production time or costs

- Train your team: well-trained staff make fewer costly mistakes

For instance, effectively managing your inventory can minimise excess stock, bringing down storage costs.

Track your gross profit margin with Xero

Xero makes it easy to monitor your gross profit margin and other key financial metrics. With Xero's financial reports, you can:

- track your margin over time and spot trends

- compare performance across periods

- identify which products or services drive profitability

- make informed pricing and cost decisions

Get one month free when you sign up.

FAQs on gross profit margin

Here are answers to common questions about gross profit margin.

What does a gross profit margin of 25% mean?

A 25% gross profit margin means that for every dollar of revenue, your business keeps 25 cents after paying for the direct costs of the goods or services sold. The remaining 75 cents is used to cover those direct costs.

Can gross profit margin be negative?

Yes. A negative gross profit margin means your COGS exceeds your revenue, so you're losing money on every sale before even accounting for operating expenses. This signals a serious pricing or cost problem.

How often should I calculate my gross profit margin?

Calculate your gross profit margin monthly or quarterly to catch trends early. More frequent tracking helps you respond quickly to rising costs or declining margins.

What's the difference between gross profit margin and markup?

Gross profit margin is gross profit divided by revenue (selling price). Markup is gross profit divided by cost. A product with a 50% markup has a 33% gross profit margin.

Do I need accounting software to track gross profit margin?

You can calculate gross profit margin manually using a spreadsheet, but accounting software like Xero automates the process, reduces errors, and makes it easier to track trends over time.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.