Online accounting software for your Hong Kong small business

Xero is powerful online accounting software for Hong Kong small businesses that automates invoicing, bank reconciliations, and reporting. Manage your cash flow, smooth your workflows and comply with IRD rules, all in one place!

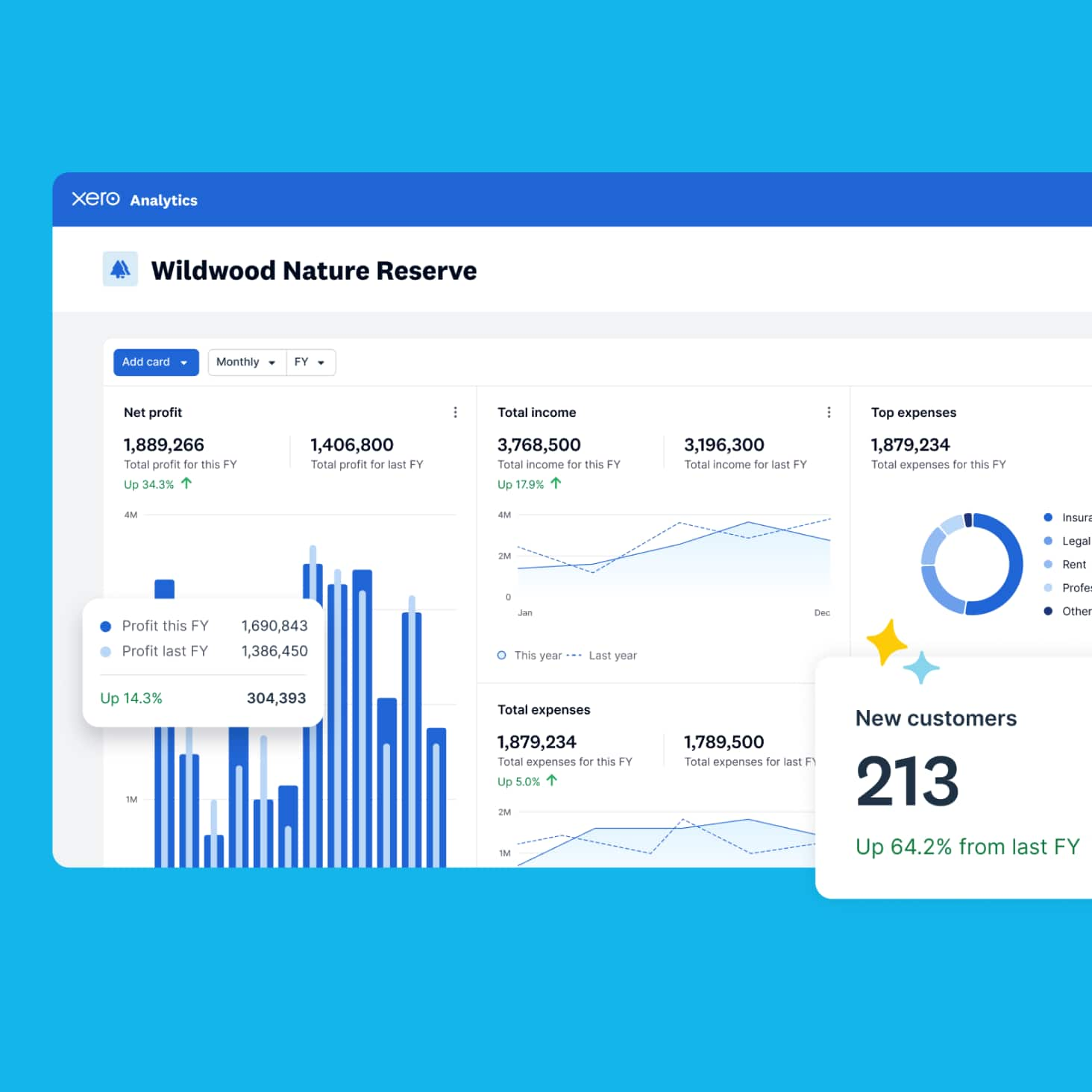

Smart insights for great business decisions

Confidently guide your business with Xero’s clear, detailed insights into your business finances.

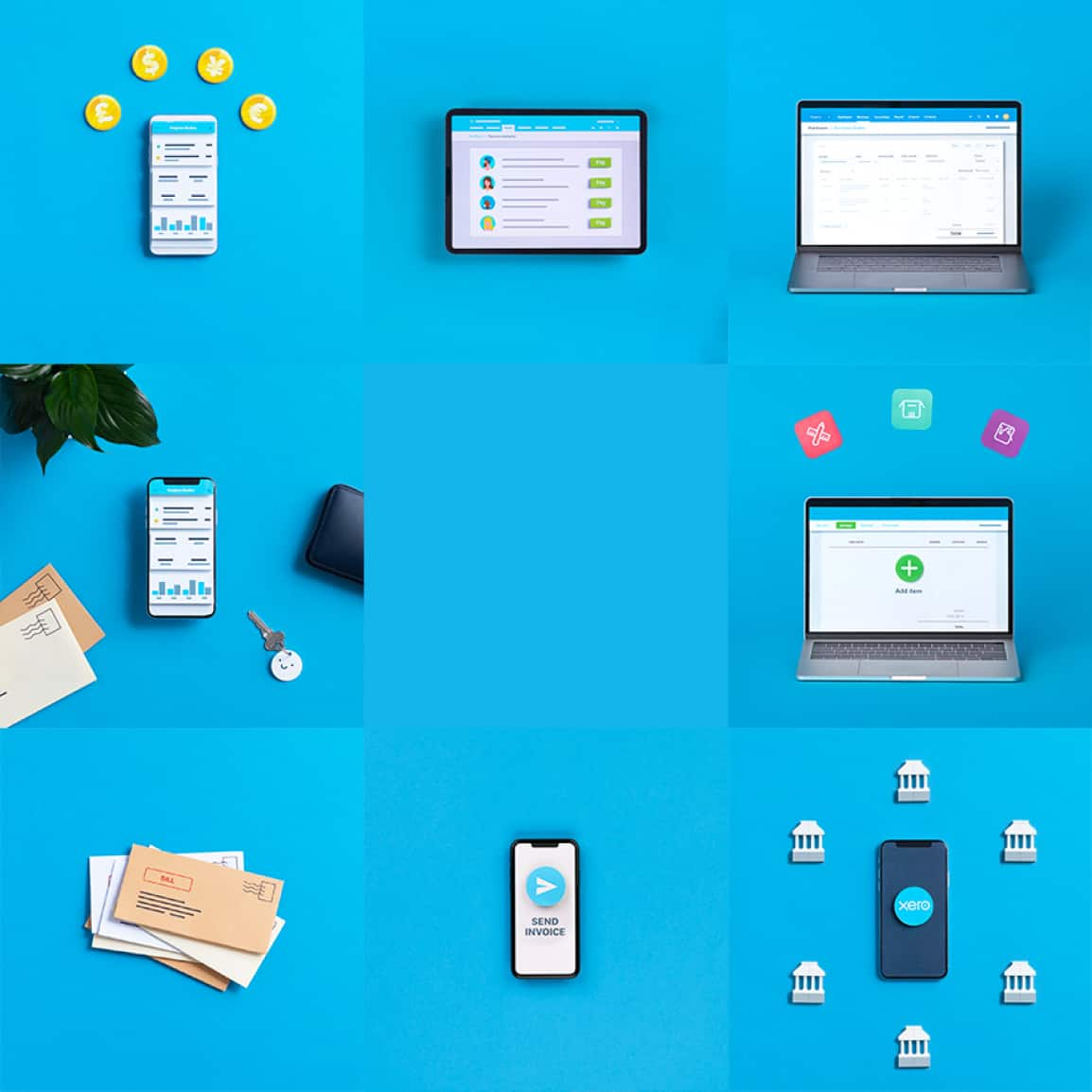

Cash flow clarity: your transactions in Xero

Connect your Xero accounting software to your Hong Kong banks to get your bank transactions in Xero.

Simplified tax filing for a better tax season

Xero cloud accounting software streamlines your tax prep and helps you report to the IRD on time, every time.

Customise Xero to your business with apps

Add the features your business needs with apps for Hong Kong businesses from the Xero App Store.

Join over 4.6 million subscribers using Xero

Awards and recognition for our work

Smart data and insights to boost your business

Xero’s cloud accounting software delivers smart insights from rich data to help you grow with confidence. Xero packs powerful reporting tools into its bookkeeping software so you can track trends today and plan for tomorrow.

- Generate clear financial statements quickly and easily

- Customise reports to get the insights you need

- Get your business’s headline numbers in front of you with the Xero dashboard

Bring your transactions into Xero with bank feeds

Xero’s small business accounting software connects directly with major Hong Kong banks like HSBC and Hang Seng Bank. Xero bank feeds bring your transactions into Xero so you’re up to date, every day.

- Reconcile your bank transactions with your Xero records in a flash

- Stay on top of your cash flow with automatic transaction updates every day

- Make sound business decisions based on your latest cash-flow numbers

Simplify tax filing for an easier tax season

Xero’s online accounting software helps you comply with Hong Kong’s stringent IRD rules by automating your tax reporting, storing all your records where you can access them, and simplifying your tax prep.

See more perks of Xero online accounting

Tailor Xero to your needs with apps

Growing your business? Need more functionality? No problem – Xero’s cloud accounting software integrates beautifully with hundreds of third-party apps in the Xero App Store with the specific tools you need to run and build your business..

- Connect apps that fit your business needs

- Add apps like ignition and fileAI to enhance your processes and workflows

- Easily add or remove apps as your business evolves

Here’s more on Xero’s app integrations for small businesses

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Xero’s really not about the accounting. Rather, it’s about empowering me to do what’s important for the business and being able to trust that everything else is well taken care of.

Habitu uses Xero to take care of their financial needs

Streamline your billing

Send invoices anytime, anywhere, and get paid sooner.

Manage stock levels

Track stock, order more, and scale your inventory to match demand.

Pay staff easily

Pay on time, every time, and make IRD compliance easy.

Send quotes instantly

Take control of your cash flow to know what’s coming.

Accept online payments

Make it easy for customers to pay you.

Keep on top of projects

Manage everything from planning to time tracking and costs to payments

Supercharge your business with Xero’s powerful features, all built into the Xero accounting software for small business. Learn more about what Xero can do

FAQs on accounting software

Xero is based in the cloud, so there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate in real time with your accountant on your numbers, and get automatic backups and world class data protection – all in one platform.

See how Xero’s online accounting software can help your businessXero is based in the cloud, so there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate in real time with your accountant on your numbers, and get automatic backups and world class data protection – all in one platform.

See how Xero’s online accounting software can help your businessNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero that has the features you need, like e-invoicing and the ability to pay in foreign currencies.

Here’s more on cash vs accrual accountingIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero that has the features you need, like e-invoicing and the ability to pay in foreign currencies.

Here’s more on cash vs accrual accountingIt’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

Yes, but you’ll have to do more of the accounting admin yourself.For help, check out Xero’s online resources on how to manage cash flow, track payments, and create invoices. Accounting software like Xero is a big help, too – it keeps all your financial records in one place and its automations help prevent errors, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Find an accountant in Xero’s advisor directoryYes, but you’ll have to do more of the accounting admin yourself.For help, check out Xero’s online resources on how to manage cash flow, track payments, and create invoices. Accounting software like Xero is a big help, too – it keeps all your financial records in one place and its automations help prevent errors, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Find an accountant in Xero’s advisor directoryTechnically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Technically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

See more of what Xero can do

Useful features to run your business

Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.