Single Touch Payroll Phase 1 vs Phase 2

If you're running payroll in Australia, understand the shift to STP Phase 2 so your pay runs are compliant every time.

Table of contents

Key takeaways

- STP Phase 2 expands on Phase 1 by adding more detailed reporting requirements. Phase 2 requires employers to disaggregate gross pay, separate allowances into categories, and include employment conditions and other details for each employee.

- Although STP Phase 2 requires more employee information from you, it also makes compliance simpler in some ways – for example, you no longer need to separately disclose some kinds of information to Services Australia.

- To transition to Phase 2, make sure your accounting software is compliant, double-check payroll categories, confirm employee details, and run a test report.

- Xero complies with STP Phase 2, and has built-in features that make it easier for you to complete your payroll and report it to the ATO each pay day.

What is Single Touch Payroll?

Single Touch Payroll (STP) is the Australian Taxation Office (ATO) initiative that lets employers report their payroll information in digital form each pay day, making it easier for employers to report essential payroll information. STP is designed to reduce errors, improve transparency, and streamline end-of-year reporting.

STP is now mandatory for all Australian businesses. To use it you need STP-compliant payroll software like Xero.

STP was introduced in two phases: the first in 2018, the second in 2022.

Here’s more information from the ATO on Single Touch Payroll.

How Phase 2 builds on Phase 1

Phase 1 required employers to automatically report each employee’s gross pay, tax withheld (PAYG), and superannuation with every pay cycle.

Under STP Phase 2, employers must also report an employee’s income type, employment basis, and (if needed) the reason why their employment ended.

Although STP Phase 2 requires more information from you, it also reduces your paperwork and makes compliance smoother and easier. For example, you no longer have to make certain separate disclosures to other government agencies because the ATO now shares these details with those agencies automatically.

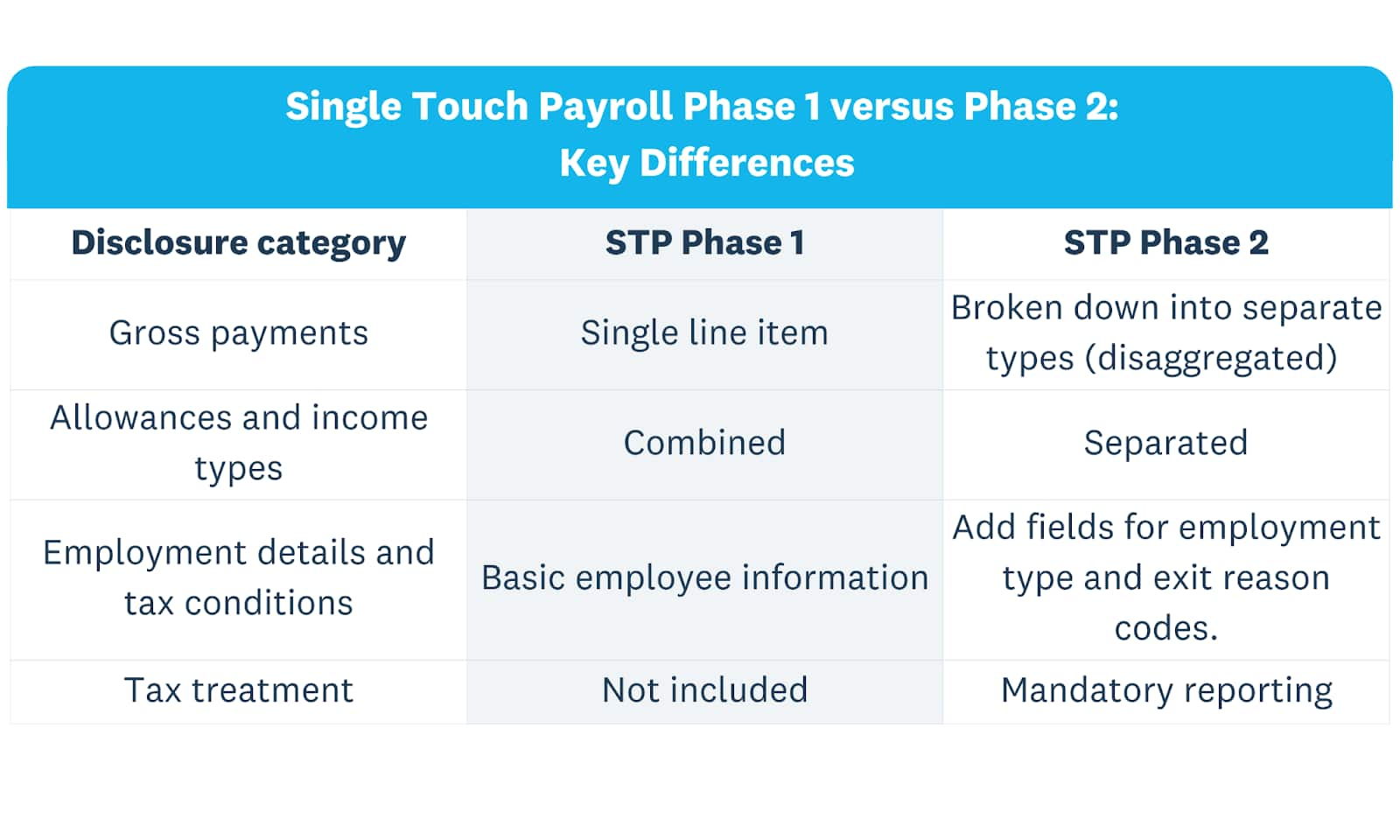

Key differences between Single Touch Payroll Phase 1 vs Phase 2

Here are the main differences between Single Touch Payroll Phase 1 vs Phase 2. The Phase 2 changes help make your ATO payroll reporting more structured, accurate, and transparent for employers and for the ATO.

Gross payments breakdown

STP Phase 2 requires disaggregation of gross pay. This means you now need to break down the components of an employee’s earnings into specific categories, including:

- Regular salary/wages

- Bonuses

- Paid leave

- Overtime

- Directors’ fees

This makes it easier for the ATO to assess an individual’s tax obligations and entitlements.

Here’s the ATO’s full list of earning categories.

Allowances and income types

With STP Phase 2, employers must now select the correct code for each income type. This added detail makes the taxation process clearer.

While most employees fall under the common salary and wage payment categories, make sure you choose the right code as some earnings are taxed differently (such as for non-resident seasonal workers).

STP Phase 2 now also requires employers to separate salary and wages from allowances with specific ATO reporting codes for things like travel (domestic or overseas), meals, and laundry.

Here’s more about reporting allowances under STP Phase 2.

Employment details and tax conditions

STP Phase 2 reporting requires you to provide more employment details and tax conditions. You now need to add:

- Employment basis codes for each employee to indicate whether they work full time, part time, on a casual basis, or otherwise

- Tax treatment codes, which depend on tax tables (weekly, monthly, fortnightly, or daily/casual) and whether the employee has a medicare levy variation

- The reason an employee ceases work, and the date

- Any relevant termination payments as a specific income type

Updated reporting requirements

Employee data fields

STP Phase 1 only required gross pay, tax withheld (PAYG), and superannuation as part of ATO payroll reporting.

STP Phase 2 introduced the following mandatory fields:

- Employment basis type

- Income types

- Tax scale

- Country codes

- Tax treatment

- Cessation reason

STP finalisation tips

By 14 July each year, employers must make a finalisation declaration to the ATO that all the info they’ve supplied through STP is accurate and complete. You need to do this before your staff can complete their tax returns.

Although your process changes between Single Touch Payroll Phase 1 vs Phase 2 should be minor, You should pay close attention to the extra details Phase 2 requires.

Here’s what to do:

- Review your employees’ records (such as name, TFN, employment basis)

- Ensure code categories match the ATO’s codes (like SAW for Salary and Wages income type)

- Lodge the finalisation declaration through your payroll software

- Notify your team so they can complete their tax returns

Things to know about the new process

- Employers no longer need to give employees a year-end payment summary or lodge a payment summary annual report.

- If you can’t make the July 14 deadline for finalisation declarations you can apply to the ATO for a deferral.

- Check your work carefully to avoid making common errors. Make sure you choose the right financial year, remember to submit a declaration for all employees, and use the right ATO codes.

- If you switch payroll software or payroll IDs during the financial year, there are important steps you should take to ensure your data is accurate.

Here’s a guide to your end of financial year (EOFY) payroll.

How to transition to STP Phase 2

Transitioning from STP Phase 1 to Phase 2 is fairly straightforward.

- Check that your payroll reporting software is STP Phase 2 compliant. If it isn’t, consider finding a new software solution or request a deferral from the ATO to extend your deadline.

- Review your payroll categories to make sure they align with the ATO’s requirements. If you need to, re-map codes for allowances, payment type, and.

- Check and update employee info in the system to make sure names, TFNs, and other personal details are correct.

Submit a test report if your payroll software can do this. Some services don’t run test reporting but have alternatives – Xero, for example, has a demo company that lets you run a practice STP Phase 2 payroll.

Xero makes your STP Phase 2 compliance easy

Xero accounting software guides you through every step of the STP Phase 2 process, from adding new employee records to finalising end-of-year reports. Xero:

- Reduces the manual work to categorise your employees with its built-in ATO codes

- Automates your payroll reporting so you can send updates to the ATO directly from within Xero

- Makes managing employee records easier with automatic updates for fields like employment basis, tax codes, and reasons for ending employment

- Has built-in guidance for your EOFY finalisation process and for any ATO deferral you might need

FAQs on STP Phase 1 vs Phase 2

What if my payroll software isn’t ready for STP?

Contact your payroll software provider as soon as you can. If the software doesn’t support Phase 2, you’ll probably have to use a different package, like Xero.. You may also ask the ATO for a deferral.

Here’s more about Xero’s STP-compliant payroll features

What happens if I miss the transition to STP Phase?

You may face some penalties if you miss the transition to STP Phase 2. The ATO may approve a request for a transition deferral, but don’t take this for granted – the ATO makes decisions on a case-by-case basis. So if you think you’ll' will miss the transition for any reason, apply for a deferral.

Do I need to report casuals differently?

Yes – you now need to use a specific employment basis code (C) for casual employees.

You can select employment basis codes in Xero by navigating to an employee’s employment information section and selecting Casual under Employment type.

Do I still need to submit TFN declarations?

No – you no longer need to send a separate TFN submission. While your employees will still complete TFN declarations, STP Phase 2 reporting simplifies the process by removing the need for employers to send a copy of these documents to the ATO.

How does STP Phase 2 affect my EOFY process?

STP Phase 2 includes additional fields to help make your end-of-year financial reporting more accurate. Finalisation still happens through STP software, but there are a couple of extra validation stages – for example, you’ll need to choose the right code categories for each employee.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.