What you need to know about the Federal Budget 2025

Plan confidently for FY25. Discover key ATO updates, tax changes for small business and tools to help stay compliant.

Published on Monday 16 August 2025

Table of Contents

What you need to know about the Federal Budget 2025

Whilst most small businesses are busy wrapping up for the end of financial year 2025, some of the Federal Budget‘s key announcements should give you confidence to start looking ahead.

In a nutshell, budget projections suggest economic growth is set to rise by 1.5%, with inflation down to 3% and wages up by 3.25%. Overall, it’s a generally positive outlook, with relief to both consumers and businesses on the way.

About a million small businesses will benefit from energy relief measures, including a $150 energy bill rebate, and a further 2,400 able to access $25,000 worth of grants for equipment upgrades.

Hospitality businesses will benefit from a frozen tax on tap beer, so it won’t go up with inflation for now, and a range of cyber supports will be built upon to help businesses adopt digital tools and better protect themselves against online fraud. Plus, cuts to personal tax rates are expected to ease the burden for 1.5 million sole traders.

Finally, the Buy Australian Campaign is set to unlock $20 million to put Australian-made products front and centre. More government procurement contracts (up to 35%) will be offered to small businesses, and a $16 million investment in trade pathways (Australia-India Trade and Investment Accelerator Fund) will allow Aussies to tap into global markets with less friction.

Understanding the Federal Budget 2025 to get more cash in your pocket

Under the budget, several tax changes are on the way that may impact how small businesses like yours can access cash flow and plan ahead. These span the instant asset write-off deduction, personal and company tax rate changes, as well as relief measures to the cost of living for everyday Aussies.

When does the financial year end in Australia?

The Australian financial year runs from 1 July to 30 June. This means that any financial strategies, such as asset purchases or claiming deductions, should be planned with this in mind. To assist with your end-of-financial-year planning, check out Xero’s EOFY resource calendar.

What can I claim on tax without receipts?

As always, the ATO allows work-related deductions for $300 without receipts, provided there’s a reasonable basis for the claim. Still, it’s always best practice to keep records.

What are the current company tax rates?

If your business is set up as a company, you’ll continue to pay a tax rate of 25% in FY25 – provided your turnover is under $50 million and most of your income comes from trading, not passive investments (like rent or interest). This ‘base rate entity’ rule hasn’t changed, but it still gives small businesses a leg up compared to the full 30% corporate rate paid by larger companies.

To access the suite of small business tax concessions, your business needs to tick a few boxes:

- Annual turnover under $10 million

- Actively trading – not just holding investments

- Operating as a sole trader, company, trust or partnership

These concessions can help simplify reporting, as well as reduce your tax bill. Some of the most popular include:

- The $20,000 instant asset write-off 2025

- Simplified depreciation for assets

- Deductions for prepaid expenses

- Simplified stocktake if your inventory moves under $5,000 in value

Plus, unlocked opportunities for talent

Under new rules to non-compete clauses, small businesses will be able to hire for certain low‑and middle‑income roles with no limitations. This means you’ll be able to access better talent, more quickly.

How personal tax rates will change in the 2025 financial year

From 1 July 2026, the personal income tax rate for the $18,201–$45,000 bracket will decrease to 15%, followed by 14% in the following year. Savings-wise, this will mean up to $268 in your customers pocket in the 2026–27 year, and up to $536 in the 2027-28 year. While this always depends on consumer confidence, there's potential for increased spending in the retail, hospitality, and service sectors.

For businesses paying themselves a salary

If you operate your business through a company and draw a salary, these tax cuts mean a slight increase in your take-home pay. While the savings might seem modest, remember that every little bit helps when it comes reinvesting into your business.

For sole traders and partnerships

As a sole trader or partner, your business income is your personal income. The tax cuts will directly reduce your personal tax liability, potentially improving your cash flow. This could provide more flexibility for business investments or personal savings.

Changes to superannuation and student loans

From 1 July 2025, the compulsory employer superannuation contribution rate will rise from 11.5% to 12%. And while it’s not quite legislated yet, the government intends to slash all Higher Education Loan Program (HELP) loans by 20%.

ATO compliance requirements to watch out for

From 1 July 2025, the Superannuation Guarantee rate increases to 12%, so now’s the time to review your payroll settings and budgets to make sure you're ready.

Plus, new payday super laws are on the horizon, so getting on top of your super processes now will save you stress (and potential penalties) down the track.

Xero is committed to helping you navigate these changes with Payday Super. Take a look.

A ban on non-compete clauses are coming

The government has announced a plan to ban non-compete clauses from 2027 for employees earning under $175,000 per year. It’s a move that’s expected to apply to a range of industries, including:

- Trades and construction: Electricians, plumbers, builders

- Childcare and education: Early childhood educators, teachers

- Healthcare: Nurses, aged care workers

- Retail and hospitality: Store managers, chefs

- Professional services: Marketing professionals, consultants

To prepare for these employment law changes, it’s a good time to start reviewing existing agreements, seek guidance on how to amend contracts to comply by the deadline, and potentially move to more protective measures, like confidentiality agreements instead.

The removal of non-compete clauses has potential to be a great move for talent and the small businesses who hire them, boosting more positive workplace practices that improve morale.

What is the ATO enforcing in the 2025 financial year?

Each financial year, the ATO sharpens its focus on areas where small business tax compliance might be slipping. For FY25, there are a few hot spots that business owners should be aware of, like:

- Reporting income that doesn’t match ATO data, like from bank feeds

- Unusual changes in income or expenses without explanation

- Large or repeated claims for deductions without clear paperwork

- Not paying the correct amount of super or lodging BAS on time

- Cash-heavy businesses under-reporting takings

To stay on the right side of the rules and reduce your risk of an unexpected audit, be sure to:

Report income accurately Whether it’s cash, card or crypto, make sure everything is declared.

Reconcile regularly Use Xero to match bank transactions to invoices, bills, and receipts so nothing slips through the cracks.

Be prompt with BAS and super Lodging and paying on time helps you avoid penalties and shows the ATO you're on top of your obligations.

Work with a registered tax or BAS agent They’ll help you stay compliant and pick up on things you might miss.

For this financial year – and every year – it’s generally good practice to:

- Store all receipts, invoices, and employee records for at least 5 years

- Digitise everything with Xero, so all data remains searchable and backed up

- Keep clear records of business vs personal expenses

- Track vehicle and home office use accurately if you’re claiming those deductions

For more detail, check out Xero’s guide on ATO compliance for small business. If you’re unsure about your obligations or want to check you’re on track, the ATO website has useful resources.

Talk to your advisor, too – they’ll help you make sense of what applies to your business. The Xero Advisor Directory can help you find the right fit for your small business.

A ban on wage fixing is coming

Big changes are coming to how businesses can handle pay and hiring. From 2027, the government will crack down on secret handshake deals between companies that keep wages low or stop staff from moving between jobs.

Wage-fixing is when two or more businesses agree to pay the same wages, or not offer more than a certain amount.

No-poach is when businesses agree not to hire each other’s employees.

These types of deals are often done quietly, but they’ll soon be illegal, because they stop fair pay and limit job opportunities. It’s worth getting across this now, so you can avoid legal trouble and build a stronger, fairer business in the process.

To stay on top of the new rules:

- Double check contracts you have with other businesses around staff or pay

- Talk to your advisor to make sure your hiring and pay practices are fair and legal

- Update your employment policies to remove anything that could be considered an unlawful agreement under these terms

- Have a chat with your team, especially anyone involved in hiring, so they understand the new rules too.

Is my business eligible for sustainability incentives?

If rising energy bills have been putting pressure on your small business, help is on the way. According to the Federal Budget 2025, energy rebates of $325 may be available to help you ease power costs.

This rebate will be applied directly to electricity bills starting from July 2025, no application needed – just check with your energy provider. Remember, this is in addition to the $25,000 equipment access grants for eligible businesses.

Beyond the rebate, small business support and grants – like those through the Clean Energy Regulator – are designed to support small businesses switching to more efficient lighting and installing better insulation, reducing energy long-term.

Generally, energy-saving upgrades start delivering a return on investment (ROI) within 1 to 3 years. Some measures that may qualify for grants and rebates include:

- Upgrading to LED lighting

- Installing smart meters or energy monitoring systems

- Switching to high-efficiency heating or cooling

- Adding insulation or weatherproofing

- Investing in solar panels or battery storage

Managing cash flow and late payments

With costs rising and the economy still uncertain, keeping a close eye on your cash flow is more important than ever. Even if business is booming, running out of cash can quickly cause headaches when it’s time to pay bills, wages or suppliers.

Here are some quick ways to improve cash flow:

- Invoice faster – Send invoices as soon as work is done.

- Follow up overdue payments – Set up automatic reminders in Xero.

- Trim unnecessary expenses – Review costs and cut what you don’t need.

- Use a cash flow forecast – Spot gaps before they become problems.

Easy ways to improve invoicing in your small business

Invoicing isn’t just admin – it’s how your business gets paid. In an uncertain economy, good invoicing hygiene can free up cashflow when it counts. Luckily, a few small tweaks can make a big difference. Here are four smart invoicing moves to speed things up:

- Send invoices right away – Don’t wait till Friday. Invoice as soon as the job’s done.

- Use clear, friendly language – Spell out what’s included, when it’s due, and how to pay.

- Offer online payment options – Make it easy for customers to pay on the spot.

- Set up automatic reminders – Take the awkwardness out of chasing late payments.

With cloud accounting software like Xero, you can create and send invoices on-the-go, track who’s paid (and who hasn’t), and even get paid faster, online. This helps avoid the common invoicing mistakes, like:

- Forgetting to add payment terms

- Using vague descriptions that cause confusion

- Not following up when invoices go unpaid

- Losing track of what’s been sent or paid

A sure fire guide to clear payment terms

Clear payment terms help your business get paid on time, and avoid awkward follow-ups down the track. With the right wording, you can protect your cash flow, support better client relationships, and make business tax planning in 2025 much easier too.

Whether it’s in a contract or directly on your invoice, be clear and upfront. Include:

- When payment is due (like ‘14 days from invoice date’ or ‘upon receipt’)

- Accepted payment methods

- Late payment fees (if you use them)

- Your ABN and bank details

Need a starting point? Xero’s invoicing features let you save payment terms as default, so every invoice is consistent.

If you need some tips for negotiating terms, try these:

- Be upfront from the beginning – Set expectations before the work starts

- Use plain language – Keep it friendly but firm

- Be flexible when needed – Long-term clients or bigger projects might need tailored terms

- Put it in writing – Always follow up verbal agreements with an email or contract update.

Remember, small perks can go a long way. Some incentives that encourage early payment might be to:

- Offer a 2–5% discount for payments made within 7 days

- Use friendly reminders to keep your invoice top of mind

- Set up online payments so clients can pay with one click

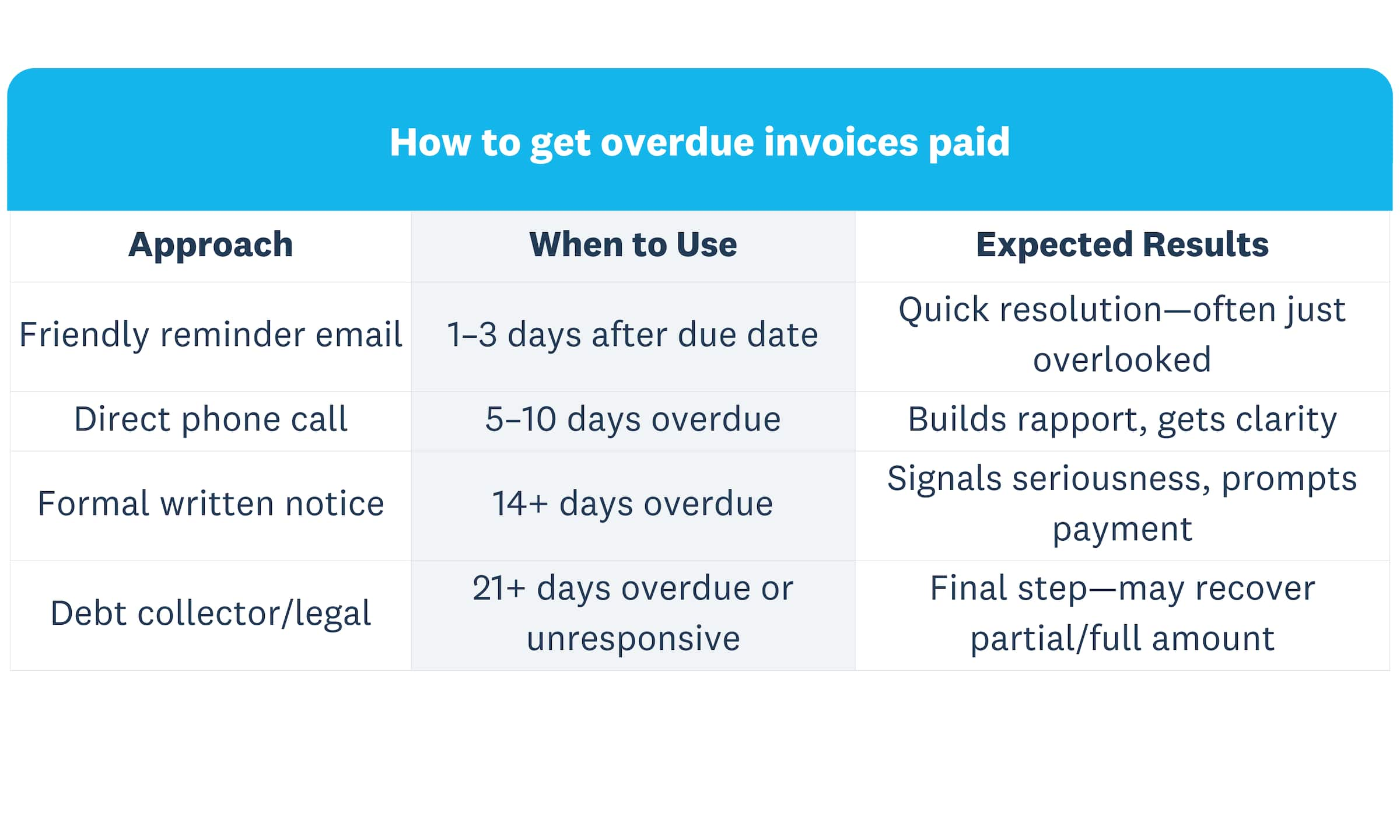

A step-by-step guide to getting overdue invoices paid

Late payments can mess with your cash flow and cause unnecessary stress, but chasing them doesn’t have to be awkward. With the right approach – and a bit of consistency – you can stay on top of overdue invoices while keeping things professional.

Here’s Xero’s step-by-step guide on following up late payments:

- Start with a gentle nudge – A friendly reminder a few days after the due date works wonders. Remember, paying may well have just slipped their mind.

- Send a firmer follow-up – If there’s still no response, send a more direct email or give them a quick call.

- Add a late fee (if you’ve listed it in your terms) – This shows you’re serious about payment, but fair.

- Escalate if needed – If weeks have passed with no word, you might need to escalate to a formal letter or even consider a debt collection agency.

These email templates may be helpful if you need to chase up a late payment but don’t know how:

Gentle reminder template (1–3 days overdue):

Hi [Client],

Just sending a quick note to let you know invoice [#1234] is now due. Let me know if you need me to resend it or if there’s anything holding things up.

Thanks!

[Your name]

Firmer follow-up template (7+ days overdue):

Hi [Client],

We’re still waiting on payment for invoice [#1234], which was due on [date].

Please let us know when we can expect payment. If there are any issues, happy to chat.

Kind regards,

[Your name]

Your rights when it comes to escalating an unpaid invoice

If polite reminders aren’t working after 2–3 follow-ups:

- Send a formal demand letter outlining payment terms and potential next steps

- Consider a mediator or small claims tribunal if the amount is significant

- Talk to your advisor about legal options, or whether to engage a collections agency.

Under Australian consumer law, you have the right to:

- Charge late fees (if stated in your terms)

- Seek debt recovery through tribunals or courts

- Protect your business under contracts that include clear payment terms and timelines

Pro tip: Keeping solid records through cloud accounting software like Xero makes it easier to back up your case, should you need to take legal action.

Employment law changes: What small businesses need to know

There are a few big changes happening in employment law this year, and if you run a small business, it’s worth knowing how they might affect your team. The focus is on fairer work conditions, clearer contracts, and more support for apprentices and trades.

Whether you’ve got casual staff, contractors, or a mix of roles, now’s a good time to make sure everything’s set up properly. Some key highlights according to Fair Work Australia are:

- Casual roles are under review – If someone’s been working regular hours, they might be eligible to switch to permanent.

- More support for apprentices – New funding is available to help you train and support young workers.

- Remote work is here to stay – So with more teams working across locations, it’s smart to set up flexible policies.

Simple ways to get ready

- Double-check your contracts and make sure they’re current

- Chat with any long-term casuals about their options

- Look into government support for hiring apprentices

- Update your policies to support remote or hybrid work

- Use payroll software that stays in step with legal changes.

Navigating tax changes for small businesses can be tricky, but having the right systems in place makes a big difference. Xero can help you keep on top of pay, leave, contracts and compliance, so you can spend more time supporting your team and less time chasing paperwork.

How to leverage technology for growth this financial year

Running a small business means juggling everything from cash flow, to compliance, to staffing, admin, and everything in between. With the right tech, you’ll be able to tackle several of those challenges at once.

Think simple wins: automating your invoices so they go out (and get followed up) without you lifting a finger. Syncing your bank feeds so your books are always up-to-date. Setting up reminders for bills and payroll so you never miss a deadline. That’s where small changes in your tech stack can lead to big improvements across the board.

Stress-free financial admin? Yes please

While financial admin might not be the most glamorous part of running a business, it’s the most essential. That’s where automation can really earn its keep. By setting up a few simple systems, you’ll save hours each week, stay on top of your numbers and avoid the late-night spreadsheet scrambles.

What can you automate for the 2025 financial year?

- Invoicing – Send invoices automatically, add payment reminders, and track what’s been paid.

- Bank feeds – Sync accounts so transactions appear in Xero daily.

- Payroll – Schedule pay runs, automate super and tax reporting.

- Expense tracking – Snap receipts and match them to transactions.

- BAS prep – Pull the data you need without digging through paperwork.

Time vs cost: Is automation worth it?

When you weigh up the hours saved, yes. A few minutes here and there quickly add up to days you could be spending on customers, strategy, or just taking a proper lunch break. Plus, better visibility means fewer nasty surprises at tax time.

Why automation helps with compliance

Mistakes happen, but they’re way less likely when the numbers sync automatically. Automation also means:

- Less manual data entry (and fewer errors)

- Everything’s logged, tracked, and easy to find for tax or audits

- You’re always working with the most up-to-date info.

Remember, you don’t need to overhaul everything at once. Start small, maybe just with invoicing or bank reconciliation. Xero’s here to help you make the most of cloud accounting software that takes care of the heavy lifting.

Embracing digital tools for ATO compliance

Following ATO compliance requirements shouldn’t mean drowning in paperwork. These days, digital tools can take a lot of the stress out of tax time and reporting. Xero tracks GST, PAYG, and super in real-time, so you’re not scrambling to find numbers when deadlines roll around.

Cloud-based systems also make it easier to stay audit-ready, with everything stored securely in one place, so no more digging through filing cabinets or email chains. Plus, modern platforms come with built-in security features like encryption and two-factor authentication, so your business and customer data stays protected.

It’s all about working smarter, not harder – while ticking the compliance boxes along the way. Just take a look at the way Xero’s digital toolkit can make compliance simpler:

1. Xero’s BAS and GST reporting

Automatically calculates GST and generates Business Activity Statements (BAS) using live data. You can even lodge directly with the ATO through Xero.

2. Single Touch Payroll (STP) through Xero Payroll

STP reporting is built into Xero, making it easy to stay compliant with employee pay, tax, and super obligations—without double-handling data.

3. Bank feeds and reconciliation

When your bank accounts are connected, your income and expenses are matched automatically. That means accurate records, fewer errors, and cleaner books at tax time.

4. Expense tracking tools (like Hubdoc or Xero Expenses)

Snap receipts, track spending, and match transactions – no more missing paperwork when you’re claiming deductions.

5. eInvoicing

For businesses working with government or large enterprises, eInvoicing makes it faster and safer to send and receive invoices, and meets new ATO digital standards.

6. Xero Tax (for accountants and BAS agents)

Helps advisors prepare and lodge income tax, BAS, and fringe benefits tax (FBT) returns, all from within one platform.

7. ATO app or myGov account (linked to business software)

Many small business owners also use the ATO app or portal to check due dates, manage debt, or link with cloud software like Xero.

Stay ahead and thrive with Xero

Change can feel overwhelming, especially when there are new rules and reporting deadlines to juggle. If you’re ready to simplify your tax and compliance process, try Xero’s accounting software and see how much easier things could be.

Frequently Asked Questions

As we approach the end of financial year 2025, it’s a great time to get across some of the most common questions small business owners are asking. From industry grants to cloud accounting and regulatory changes, here are some quick answers to help you stay ahead.

How do I find out if my business qualifies for industry grants?

Check out business.gov.au to see what’s available for your industry, and don’t forget to have a quick chat with your accountant – they can help you spot the right opportunities and guide you through the process.

Do I need professional help to manage regulatory changes?

Some regulatory changes can be handled on your own, especially with the right digital tools. But when it comes to trickier areas like employment law or business tax planning, getting advice from a professional can save you time, money, and stress down the track.

What is the fastest way to switch to cloud-based accounting?

Switching to cloud-based accounting is easier than you might think. Most platforms offer migration support and data import tools to guide you through. With a bit of prep, you can usually make the move in under a week.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.