Small business loans and finance

When applying for loans or finance, Xero is your best asset. Share data directly with lenders and get a decision faster.

Watch how it works

Act on that growth opportunity for your business

Why use your Xero data when applying for loans or finance

Speedy application

Apply for a business loan or finance with one of our lending partners in as little as 20 minutes. Just be sure your Xero data is up-to-date first.

Get a decision sooner

Giving the lender access to your Xero business financials means they have the information they need to make a decision faster, so you can act faster.

Forget paperwork, share directly

Simply connect your Xero organisation when you’re making an application to securely share financial reports and data with the lender.

Your Xero data is well protected

Xero protects the privacy of your data using multiple layers of protection. It is securely shared with the lender only with your consent.

Easy ways to apply for loans and finance

Explore types of business finance

Xero works with lenders to streamline the process of getting finance for your small business.

- Invoice finance: Receive invoice payment straight away, without waiting for customers. A short to medium term solution.

- Business loans: Borrow a lump sum that you pay back over an agreed time period. A medium to long-term finance solution.

- Business overdrafts: A line of credit you can access when your account balance drops below zero. A short-term solution.

- Credit cards: Apply for credit up to an approved limit on a business credit card. Generally a short-term solution.

- Vehicle and equipment finance: Borrow to buy vehicles or equipment and take advantage of competitive interest rates.

Moula connected to our Xero accounting software and approved our loan within 2 hours with funds received in less than 12 hours. These guys get it!

Stuart Taylor, Xero customer

Before you apply

1. Get finance ready

Consult your accountant or bookkeeper on the best financing solution for your business and to help you get set up.

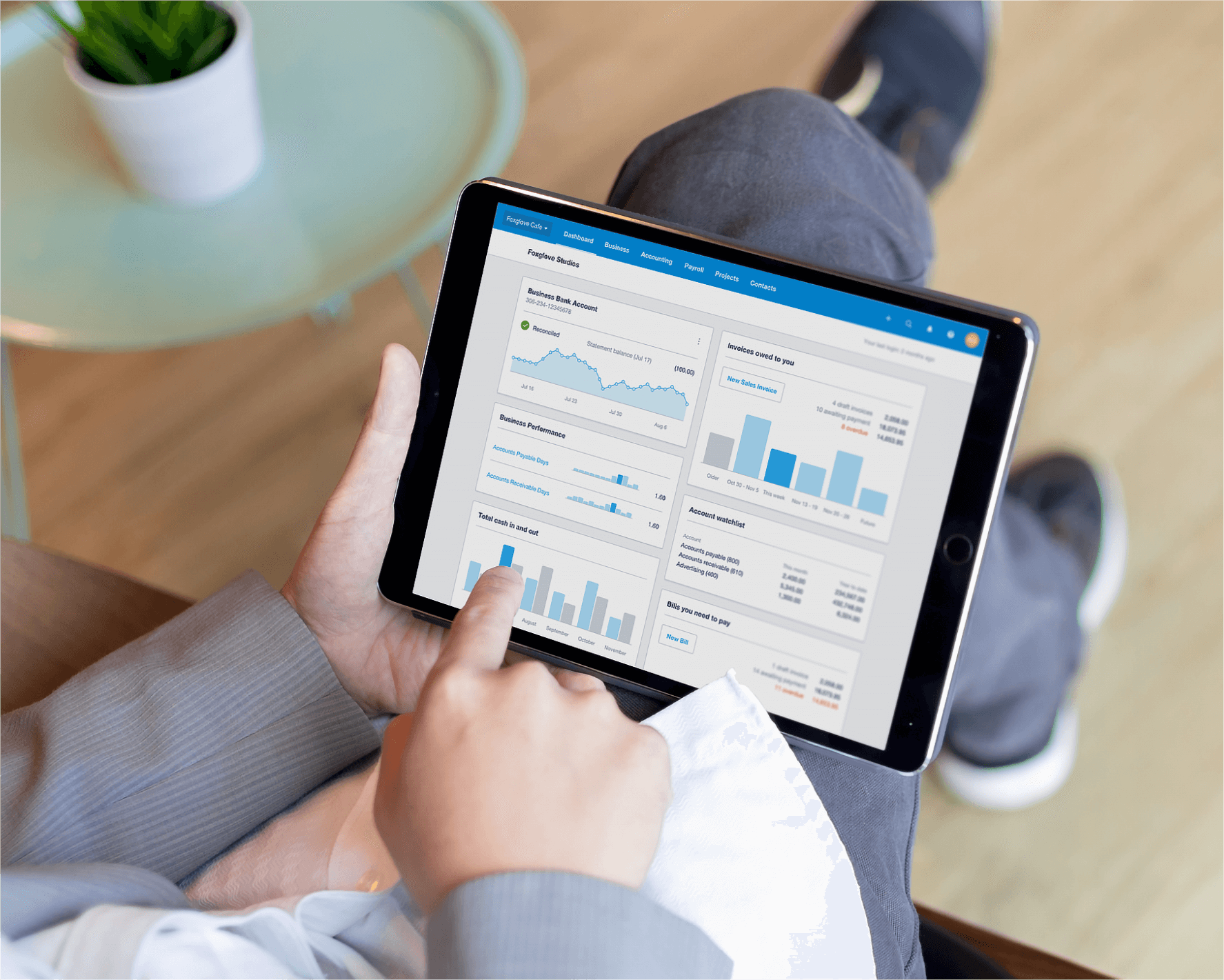

Find an experienced advisor2. Get your financials up to date

Get your transactions into Xero with bank feeds, create bank rules, then reconcile transactions and record income received in Xero.

Learn how to connect your bank accounts3. Be ready to share Xero access

Use email to bills and data capture to get documents and data into Xero. Then use your Xero login to share them with the lender as you apply

Capture and store documents in XeroWant to know more?

Find answers to FAQs about lending

Get answers to frequently asked questions about Xero and business loans and finance.

See the FAQsCash flow app advisory for advisors

See how to advise your clients on getting the most out of Xero and choosing the right integrated apps.

View the playbookA guide to financing your business

Learn about the types of finance available, approaching lenders and investors, and more.

Read the guide

Important notice

General information

This page contains general information only and should not be taken as taxation, financial, investment or legal advice.

- We recommend you always obtain specific, detailed professional advice about any business, lending or credit decisions.

- It’s up to you to assess the suitability of any loan, product or service before going ahead.

- Xero may receive payments or commissions from lenders when Xero customers choose their financial products or services.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.