NOPAT: definition, formula and easy calculation example

Learn how net operating profit after tax (NOPAT) reveals performance, and how to calculate it fast.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Monday 23 February 2026

Table of contents

Key takeaways

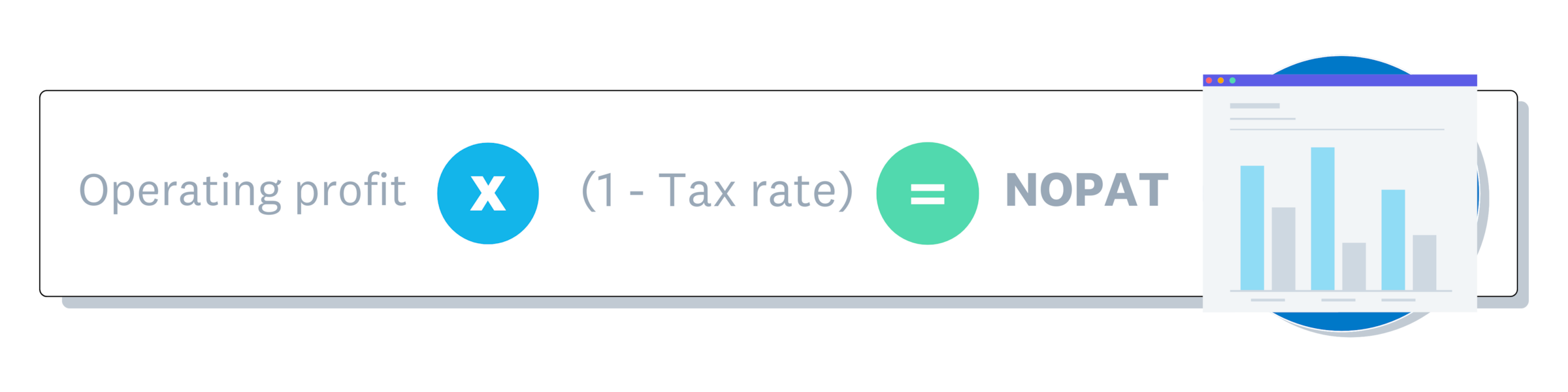

- Calculate NOPAT using the formula: Operating Profit × (1 − Tax Rate) to measure your business's core operational profitability after taxes but before interest expenses.

- Use NOPAT to compare businesses with different debt levels on equal footing, as it removes the distortion of financing decisions and focuses purely on operational performance.

- Apply NOPAT in Economic Value Added calculations to determine whether your invested capital generates returns above its cost, helping you make better investment decisions.

- Distinguish NOPAT from net income by understanding that NOPAT excludes interest expenses and non-operating income, providing a clearer view of how well your core business operations perform.

What is NOPAT?

Net Operating Profit After Tax (NOPAT) measures how much profit your business earns from its core activities, after tax but before interest. It excludes non-operating income (like investment gains) and interest expenses, giving you a clear view of operational performance.

NOPAT helps you understand true operational earnings by filtering out financing decisions. Here's what it includes and excludes:

- Includes: revenue and expenses from core business operations

- Excludes: interest expenses on loans, credit cards, or other debt

- Excludes: non-operating income like stock gains or rental income from side activities

This focus on operations makes NOPAT useful for calculating the return on invested capital in a business.

How to calculate NOPAT

To understand the formula, here's how it relates to a net operating profit after tax example.

The NOPAT formula:

NOPAT = Operating Profit × (1 − Tax Rate)

Formula components:

- Operating profit: revenue minus operating expenses (including depreciation and amortisation), but before taxes and interest

- Tax rate: your effective tax rate as a decimal (for example, 20% = 0.20)

- (1 − Tax Rate): the portion of profit remaining after taxes

Quick example: If operating profit is $100,000 and your tax rate is 20%, then NOPAT = $100,000 × 0.80 = $80,000.

Follow these steps to calculate NOPAT:

- Determine operating profit: Start by calculating your operating profit. This is your earnings from core business activities before taxes and interest. Calculate gross profit (Revenue − Cost of Goods Sold), then subtract operating expenses (Gross Profit − Operating Expenses = Operating Profit). Make sure to exclude any non-operating income (like investment gains) from this calculation.

- Find the tax rate: Find your effective tax rate by dividing income tax paid by your pre-tax income. Effective Tax Rate = Income Tax Paid ÷ Pre-Tax Income. Example: If you paid $20,000 in tax on $100,000 of pre-tax income, your effective tax rate is 20%. If you expect higher earnings this year, recalculate to account for any changes in tax brackets.

- Apply the formula: Apply the formula using your numbers. Sample calculation: Operating profit: $50,000, Tax rate: 25%. Step 1: Calculate the after-tax multiplier: 1 − 0.25 = 0.75. Step 2: Multiply: $50,000 × 0.75 = $37,500. Your business earns $37,500 per year from operations after tax, before interest costs.

Why is NOPAT important?

NOPAT matters because it shows operational profitability without the distortion of financing decisions. This makes it easier to evaluate business performance and compare opportunities.

Key benefits of using NOPAT:

- Compare businesses fairly: evaluate companies with different debt levels on equal footing

- Assess cross-border opportunities: account for varying tax rates across regions, as different debt and tax structures can result in one company realising $35m in tax savings over another

- Measure capital efficiency: calculate how well invested capital generates returns

Reveals true business performance

NOPAT reveals true operational performance by stripping out financing costs while accounting for taxes. This gives you an honest picture of how the core business performs by focusing on profitability, one of the four primary dimensions of overall business performance.

This clarity is especially valuable when:

- evaluating businesses with complex capital structures

- comparing performance across companies with multiple investors

- identifying operational improvements separate from financing decisions

Helps to standardise comparisons

NOPAT standardises comparisons by filtering out the effects of different debt levels and tax situations.

Example: comparing two acquisition targets

Company A:

- Net profit: $100,000

- Interest payments: $0

- NOPAT: $100,000

Company B:

- Net profit: $80,000

- Interest payments: $40,000

- NOPAT: $120,000

Company B looks weaker on net profit, but NOPAT reveals stronger operational performance. If you restructure its debt, the underlying business actually outperforms Company A.

Improved decision-making

NOPAT feeds into Economic Value Added (EVA), a metric derived from adjustments to Generally Accepted Accounting Principles (GAAP) accounting that shows whether your invested capital is generating returns above its cost.

EVA formula:EVA = NOPAT − (Invested Capital × Cost of Capital)

Example calculation:

- NOPAT: $50,000

- Invested capital: $200,000 ($100,000 in loans + $100,000 in equity)

- Weighted average cost of capital: 3%

- Capital charge: $200,000 × 3% = $6,000

- EVA: $50,000 − $6,000 = $44,000

This tells you the business generates $44,000 in value above what it costs to fund it. EVA helps shareholders and potential investors see whether their capital generates sufficient returns.

For more detail, see these EVA calculation examples.

How NOPAT compares to other financial metrics

Several profitability metrics sound similar but measure different things. Here's how NOPAT relates to the most commonly confused alternatives.

NOPAT vs net income

Net income is your bottom line after all income, expenses, and taxes. NOPAT strips out interest and non-operating items to show core operational profit.

NOPAT includes:

- Operating revenue

- Operating expenses

- Taxes

Net income includes:

- Operating revenue

- Operating expenses

- Taxes

- Interest expense

- Non-operating income

Example: A bakery has $100,000 net income, but earns $12,000 from renting parking space and pays $8,000 in loan interest. NOPAT = $100,000 − $12,000 + $8,000 = $96,000.

If a business has no debt and no side income, NOPAT and net income will be the same.

NOPAT vs operating profit

Operating profit measures earnings from core operations before taxes. NOPAT takes that same figure and subtracts taxes, showing what remains after the tax bill.

The relationship:Operating Profit = NOPAT ÷ (1 − Tax Rate)

Example: If NOPAT is $80,000 and the tax rate is 20%, then Operating Profit = $80,000 ÷ 0.80 = $100,000.

Neither metric includes interest expenses or non-operating income.

NOPAT vs EBIT

Earnings Before Interest and Tax (EBIT) can include non-operating income, while NOPAT only includes operating income and accounts for taxes. Use EBIT when you want a broad view of all earnings before financing costs. Use NOPAT when you want to isolate core operational performance after tax.

NOPAT vs EBITDA

Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) adds back non-cash expenses like depreciation and amortisation to show cash-generating potential. NOPAT keeps these expenses in and applies taxes. EBITDA is often used in lending and valuation contexts, while NOPAT gives a more conservative view of sustainable operating profit.

Use Xero to track the numbers that matter

Calculating NOPAT requires accurate operating profit and tax figures. Xero helps you track the numbers you need by automating income and expense tracking, so your data is always ready when you need it.

With Xero, you can:

- pull operating profit directly from your profit and loss report

- track tax payments to calculate your effective rate

- generate financial reports with a few clicks

Get one month free and see how Xero simplifies your financial analysis.

FAQs on NOPAT

Here are answers to common questions about Net Operating Profit After Tax.

Is NOPAT the same as EBIT?

No. EBIT can include non-operating income and does not account for taxes. NOPAT only includes operating income and subtracts taxes, giving a more focused view of core business profitability.

Is NOPAT the same as free cash flow?

No. NOPAT is a profitability measure, while free cash flow (FCF) is a liquidity measure. FCF accounts for capital expenditures and changes in working capital that NOPAT does not include.

Why use NOPAT in business valuations?

NOPAT provides a tax-adjusted view of operating earnings, making it useful for discounted cash flow (DCF) analysis, which is one of several valuation approaches alongside measures such as Tobin's Q. It shows the cash a business generates from operations that is available to all capital providers.

When should I use NOPAT instead of net income?

Use NOPAT when comparing businesses with different debt levels or capital structures. It removes the distortion of financing decisions, letting you focus on operational performance.

Can Xero help me calculate NOPAT?

Yes. Xero tracks your income and expenses, making it easy to pull the operating profit figure you need. Generate a profit and loss report, identify your operating profit, and apply the NOPAT formula using your effective tax rate.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.