What is cash accounting?

Cash accounting (definition)

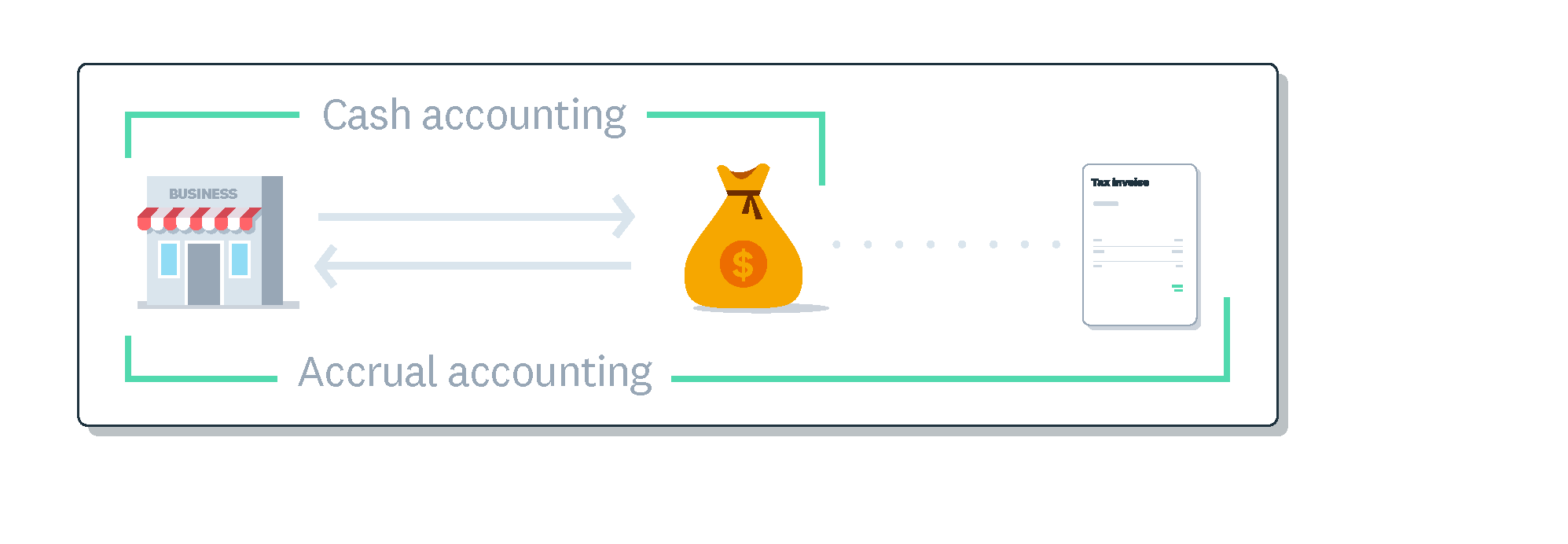

Businesses that count transactions only after money has changed hands are doing cash accounting.

These businesses won’t record income or expenses until payment is received or made. It doesn’t matter if the invoice has been issued, or the goods and services have been shipped. The alternative is accrual accounting, which accounts for amounts owed.

Cash accounting focuses only on money, not bills or invoices.

Cash basis accounting is relatively easy to do. But because it ignores unpaid bills and sales invoices, it leaves business owners with only a short-term view of their financial situation.

For that reason, some lenders and investors prefer to work with businesses that do accrual accounting. Tax offices may not allow certain types of businesses to use cash accounting for their tax returns.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

How to do bookkeeping

Learn about data entry, bank rec, reporting and tax prep in our guide to doing bookkeeping.

Online accounting with Xero

Automate your accounting in the cloud

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.