What is accrual accounting?

Accrual accounting (definition)

Businesses that count how much cash they have – and what invoices are owed – are doing accrual accounting.

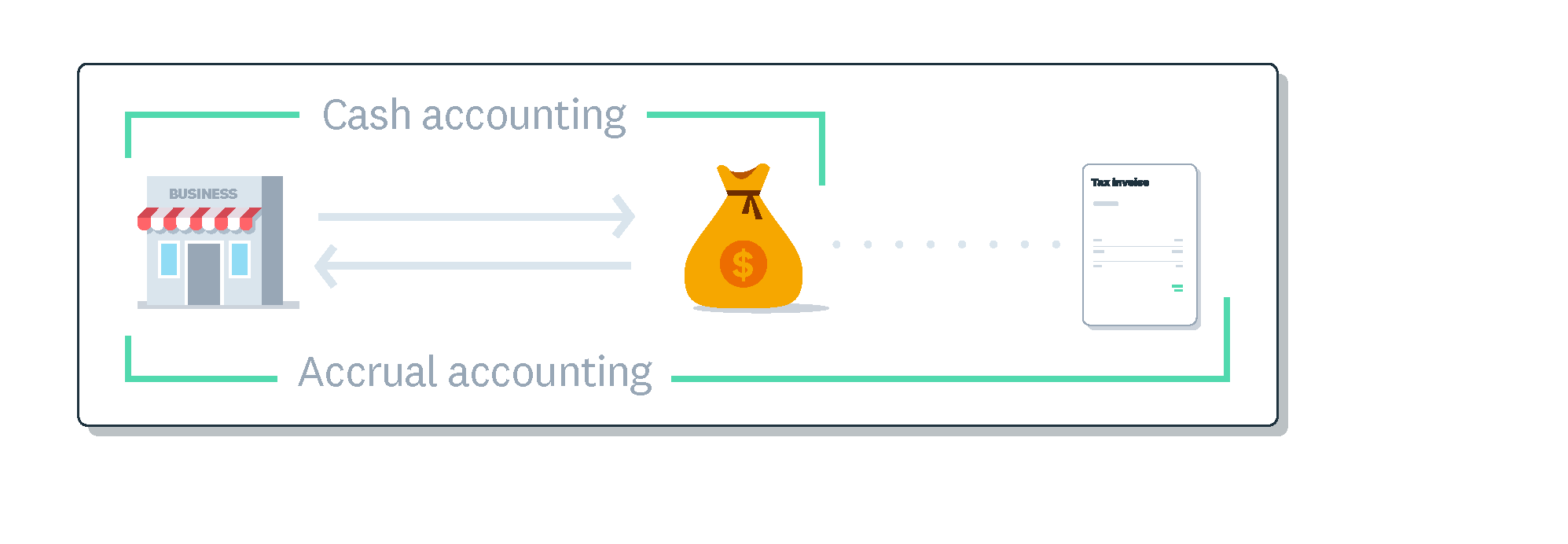

Accrual basis accounting looks beyond your immediate cash situation to acknowledge money that will be coming or going from the business. The alternative is cash accounting, which simply counts cash that has already come or gone.

Accrual accounting keeps tabs on bills and sales invoices that are yet to be paid.

Accrual accounting is harder to do but it provides a more accurate long-term view of finances. Some investors and lenders prefer to deal with businesses that use the accrual basis of accounting. Tax offices may also require certain types and sizes of businesses to use it.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Margin calculator

Calculate your gross profit margin with this simple calculator to check you’re hitting your targets.

Online accounting with Xero

Automate your accounting in the cloud

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.