Profit margin: definition, types and how to calculate

Profit margin shows what you really earn, price smarter, and grow. Learn how to calculate it.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Thursday 12 February 2026

Table of contents

Key takeaways

- Calculate your profit margin by dividing profit by revenue and multiplying by 100, tracking all three types (gross, operating, and net) to get a complete picture of your business's financial health.

- Compare your margins against industry benchmarks regularly, as what constitutes a "good" margin varies significantly by sector, with 5% being low, 10% average, and 20% or higher indicating strong performance.

- Improve your profit margins by focusing on three key areas: controlling costs through supplier negotiations and subscription reviews, increasing operational efficiency through automation and staff training, and adjusting your pricing strategy based on market conditions.

- Track your profit margin trends monthly or more frequently to spot declining performance early and make timely adjustments, as consistent monitoring helps you identify opportunities and address issues before they impact your bottom line.

Key takeaways

- Profit margin is the percentage of revenue left after paying business expenses.

- Three main types exist: gross, operating, and net profit margin.

- Calculate profit margin by dividing profit by revenue, then multiplying by 100.

- A "good" profit margin varies by industry, but higher margins indicate stronger financial health.

- Improve your margins by controlling costs, increasing efficiency, and adjusting pricing.

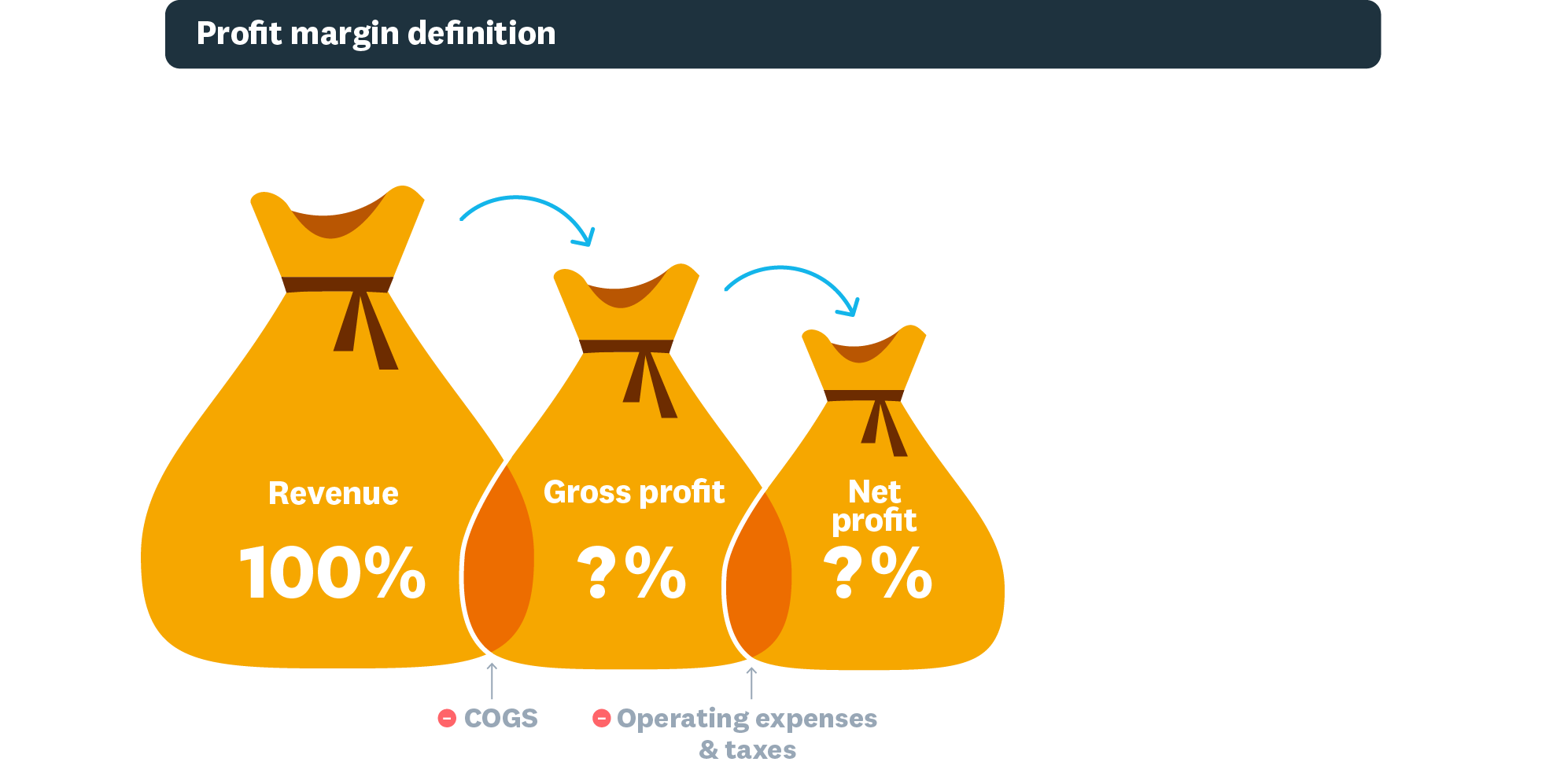

What is a profit margin?

Profit margin is the percentage of revenue left after paying business expenses. The higher the percentage, the more profit you keep from each sale.

Your profit margin reveals your business's financial health at a glance. It shows where you're performing well and helps you identify where to cut costs or adjust pricing.

Types of profit margins

There are three main types of profit margins:

- Gross profit margin: The percentage of revenue remaining after subtracting the cost of goods sold (COGS). Use it to set pricing, spot inefficiencies, and compare performance across periods. Learn more about gross profit margin.

- Operating profit margin: The percentage of revenue remaining after paying variable production costs (wages, materials, operations) but before taxes and interest. It shows how profitable your core operations are. Investors and lenders often review this metric when evaluating your business.

- Net profit margin: The percentage of revenue remaining after paying all costs, including taxes. It's the most comprehensive indicator of financial health because it accounts for every expense. Here's more about net profit margin.

How to calculate profit margins

To calculate profit margin, divide profit by revenue and multiply by 100. This expresses your margin as a percentage, making it easy to compare across periods or against competitors.

Gross profit margin calculation

Formula: (Revenue − Cost of Goods Sold) ÷ Revenue × 100

Example: Your cleaning business earns $20,000 in revenue. It costs $8,000 to deliver those services, leaving $12,000 in gross profit.

$12,000 ÷ $20,000 × 100 = 60% gross profit margin

Try the gross profit margin calculator.

Operating profit margin calculation

Formula: Operating Profit ÷ Revenue × 100

Example: You spend $3,000 on operating expenses (wages, rent, utilities). Your operating profit is $9,000 ($12,000 gross profit − $3,000 operating expenses).

$9,000 ÷ $20,000 × 100 = 45% operating profit margin

Net profit margin calculation

Formula: Net Profit ÷ Revenue × 100

Example: After paying $4,000 in taxes, your net profit is $8,000.

$8,000 ÷ $20,000 × 100 = 40% net profit margin

Try the net profit margin calculator.

What is a good profit margin?

A "good" profit margin varies by industry, but as a general guide:

- 5% or lower: Low margin, common in grocery and retail

- 10%: Average for most industries

- 20% or higher: Strong margin, typical in software, consulting, and luxury goods. Some sectors, like banking, report the highest average profit margins, with net margins reaching over 30%.

Your industry and business model determine what's realistic. Low-end retail often has high sales volume but thin margins (2–5%), while service businesses and luxury brands typically achieve higher margins (15–25%).

Keep in mind that gross margins are always higher than net margins because they don't include all your costs. Your net profit margin gives the clearest picture of overall financial health.

Why do profit margins matter?

Profit margins reveal your business's financial health by showing how much income you keep relative to what you spend. They matter because they directly affect your ability to grow, secure funding, and make smart decisions.

Here's why tracking your margins is essential:

- Pricing decisions: Margins show whether you're charging enough to cover costs and generate profit

- Cost control: Declining margins signal where expenses need attention

- Budgeting: Healthy margins give you room to invest in growth

- Funding access: Banks and investors review your margins before approving loans or investments

Benefits of high profit margins for growth

High profit margins typically mean your business:

- Attracts investment more easily due to demonstrated financial health

- Has room to reinvest profits into growth initiatives

- Can experiment with pricing strategies to find a competitive edge

Compare your margins against industry benchmarks and competitors to see where you stand. Consistent tracking helps you spot trends and act on opportunities early.

Do high profit margins guarantee growth?

No. Healthy margins don't automatically lead to growth. Research from Yale Insights found that profit margins don't necessarily rise as businesses expand.

Rapid growth can reduce margins if short-term costs spike faster than revenue. A broad study of public and private firms found that even as companies grew, researchers consistently fail to find margin improvement over time.

Prioritise sustainable growth and factor your margins into every strategic decision.

Factors affecting profit margins

Several factors influence your profit margins, some within your control and others not:

- Industry type: Retail and hospitality typically have higher overheads and thinner margins than consulting or software businesses

- Economic conditions: Inflation and rising interest rates increase costs, especially if you've borrowed to fund operations

- Location: Rent, local taxes, and regional wages vary significantly and directly impact your bottom line

- Business model: Online businesses often achieve higher net margins than bricks-and-mortar stores due to lower overhead. For example, some dropshipping stores operate around 65–70% gross margin because they don't hold inventory.

Account for these factors when setting prices and evaluating your financial performance.

How to increase your profit margins

To improve your profit margins, focus on three key levers: reducing costs, improving efficiency, and adjusting pricing.

Control your costs

Reducing expenses directly improves your margins. Start with these actions:

- Review subscriptions and cancel tools you no longer use

- Negotiate better rates with suppliers

- Manage labour costs by optimising schedules and reducing overtime

- Switch to more cost-effective vendors without sacrificing quality

Make your operations more efficient

Efficiency gains let you generate more revenue without proportionally increasing costs:

- Automate repetitive tasks like invoicing, scheduling, and data entry

- Invest in staff training to reduce errors and improve productivity

- Streamline workflows to eliminate bottlenecks

- Deliver excellent customer service to boost retention and reduce acquisition costs

Adjust your pricing

A strong pricing strategy helps you capture more value from each sale:

- Use dynamic pricing to adjust for demand, seasonality, or competitor moves

- Create premium packages or bundles that increase average order value

- Review your prices regularly to ensure they reflect your costs and market position

- Test price increases on select products to measure customer response

Learn more about pricing strategies.

Learn from high-profit-margin businesses

Some industries consistently achieve higher margins due to lower overhead, strong pricing power, or high customer loyalty. Understanding what drives their success can help you apply similar principles to your own business.

Industries with high profit margins

These sectors typically achieve above-average margins:

- Software and SaaS: Often 70–90% gross margins due to low variable costs

- Consulting and professional services: 15–25% net margins with minimal overhead

- Luxury goods: Premium pricing supports strong margins despite lower volume

- Online businesses: Lower overhead than physical stores often means higher net margins

Even outside these industries, you can improve margins by adopting efficient business models and clearly communicating your value to customers.

Tips for maintaining high profit margins

Apply these practices used by high-margin businesses:

- Communicate your value clearly: Help customers understand why they should choose you over competitors

- Run efficient operations: Streamline processes, reduce waste, and use resources effectively

- Nurture customer loyalty: Build repeat business through excellent service and loyalty programmes to create steady, predictable revenue

Analyse your profit margins for better business decisions

Use your profit margin data to make smarter decisions:

- Set pricing: Identify which products deliver healthy margins and adjust prices accordingly

- Create budgets: Allocate resources toward higher-margin products and services for better ROI

- Guide investments: Focus growth efforts on the most profitable parts of your business

What profit margin trends reveal

Tracking your profit margins over time shows whether your financial health is improving or declining:

- Rising margins: Indicate better cost control, pricing power, or operational efficiency

- Falling margins: Signal rising costs, pricing pressure, or inefficiencies to address

Compare your trends against industry benchmarks to see how you're performing relative to competitors.

Use Xero for comprehensive profitability insights

Xero helps you track your profit margins in real time, so you always know where your business stands. With automated reporting and clear dashboards, you can spot trends, control costs, and make confident decisions.

Get one month free when you sign up for Xero accounting software.

FAQs on profit margins

Here are answers to common questions about profit margins.

What does a 20% profit margin mean?

A 20% profit margin means you keep $0.20 as profit for every $1 of revenue after covering expenses. It's considered a healthy margin in many industries.

What does a 30% profit margin mean?

A 30% profit margin means you retain $0.30 in profit for every $1 of revenue. This is a strong margin, typically seen in software, consulting, and premium service businesses.

Can my profit margin be negative?

Yes. A negative profit margin means your expenses exceed your revenue, resulting in a loss. This can happen during startup phases, periods of heavy investment, or economic downturns.

How often should I calculate my profit margins?

Review your profit margins monthly at minimum. More frequent tracking is even better, as it helps you catch issues early and make timely adjustments. Research shows that 36% of CFOs report their teams alter their forecasts at least weekly.

What's the difference between profit margin and markup?

Profit margin is profit as a percentage of revenue (selling price). Markup is profit as a percentage of cost. For example, if you buy an item for $50 and sell it for $100, your markup is 100% but your profit margin is 50%.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.