What is the basis of accounting?

Basis of accounting (definition)

Your basis of accounting decides when you formally count a sale as income – or a purchase as an expense.

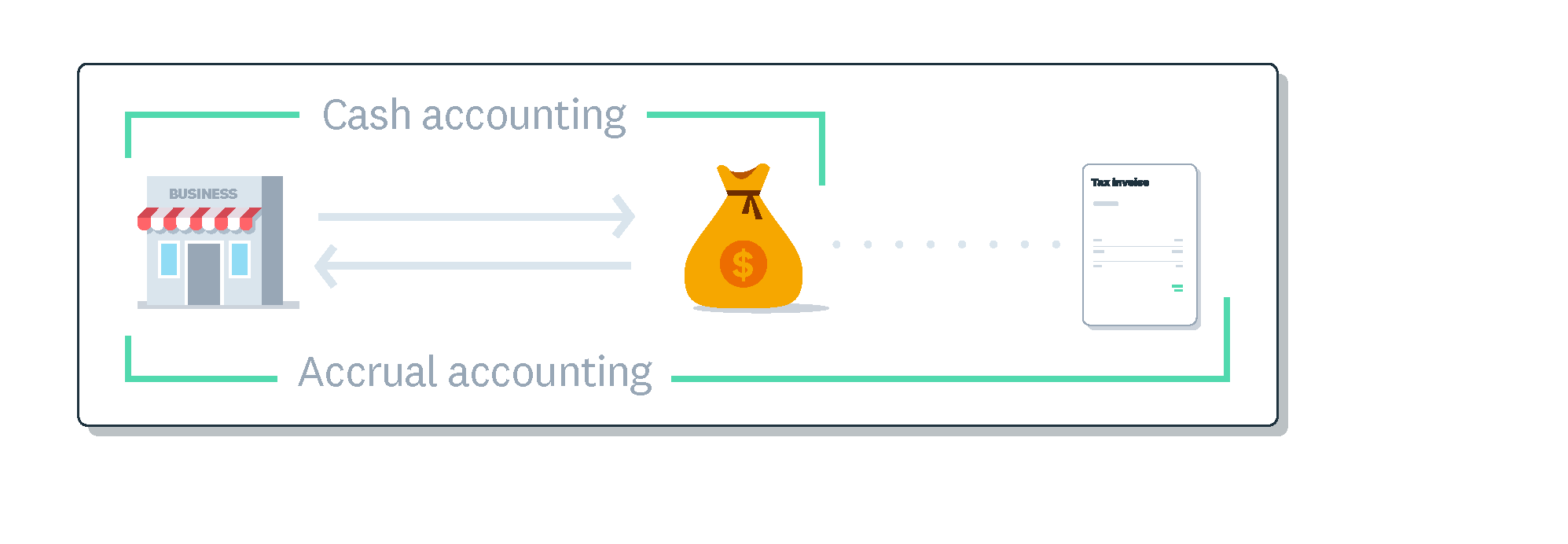

Some businesses count income or expenses as soon as a purchase is made (accrual accounting), while others wait until cash has actually changed hands (cash accounting).

A lot of time can pass between these two events, which makes your basis of accounting really important. This means your basis of accounting can also affect your tax filing.

Basis of accounting determines the point at which you recognise transactions.

Cash accounting generally gives a shorter term view of liquidity (available cash). Accrual accounting gives a longer term picture of profitability.

Tax offices may require particular types and sizes of businesses to use accrual accounting. Also, some lenders and investors prefer to work with businesses that use accrual accounting.

There is a hybrid basis of accounting – in which some types of transactions are counted on a cash basis and others are counted on an accrual basis. This can be legally complex and should only be done with the support of an accountant or tax professional.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

How to do bookkeeping

Learn about data entry, bank rec, reporting and tax prep in our guide to doing bookkeeping.

Online accounting with Xero

Automate your accounting in the cloud

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.