What starting a business looks like

A Xero survey of 1,000 North American startups reveals why and how they started their businesses.

Introduction

Rates of self-employment and business ownership are generally climbing in Canada. This study aimed to understand what it’s really like for those entrepreneurs who are starting a business.

Key findings

- 70% of Canadian startup owners started their business while working a day job (48% were full time employees). Most quit their day job within 6 months.

- 73% say their business earns equal to or more than they projected, with 54% saying they’re better off since starting their business.

- A third started up for less than $3,000. Almost half (45%) got started for less than $7,000. 68% had broken even on their investment within 12 months.

- While most work harder than they did before starting a business, 71% say they’re more fulfilled by their work.

Survey results

Learn what startups said about their journey.

- The start of something new: looking at reasons for starting a business, the planning process, and finance.

- Show me the money: checking income levels, pricing strategies, and startup costs.

- How owners run their business: exploring how businesses get customers, what they spend money on, and how they track finances.

- Is it worth it?: where we ask if the business has delivered financially, and how it’s affected their lifestyle.

1. The start of something new

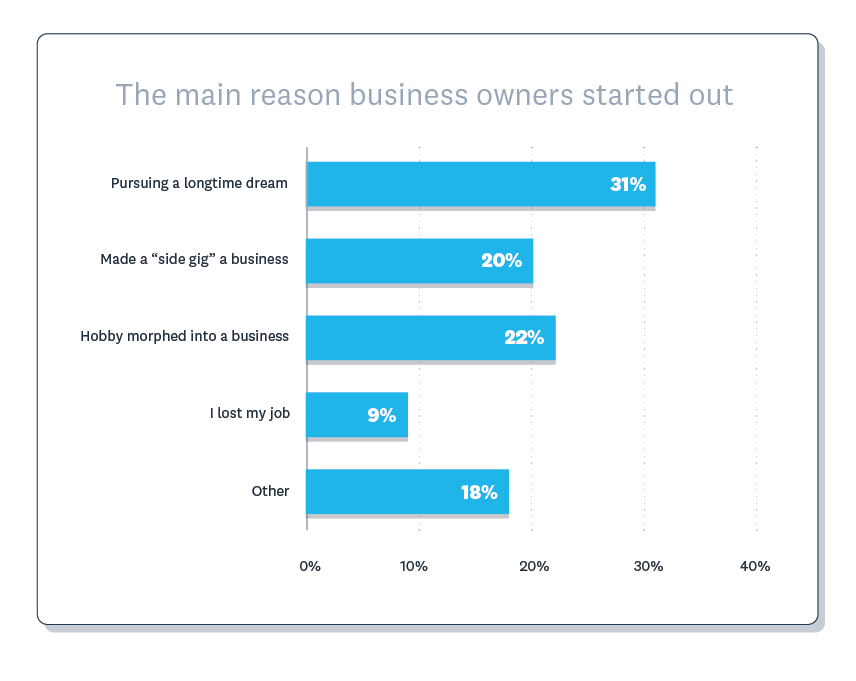

About a third of respondents always dreamt of starting a business, while another 22% found their business grew out of a hobby (something they did for fun). 20% say their business started as a side gig (something like freelancing, which they did to supplement income).

This chart reflects the responses of 500 Canadian business owners.

Business owners have different motivations that helped them take the leap to self employment:

- The top reasons Gen Z business owners started a business was to pursue a dream and by morphing a hobby into a business.

- Millennials were most likely to start a business due to making a side gig an official business.

- Female business owners were more likely than males to start a business due to morphing a hobby into a business.

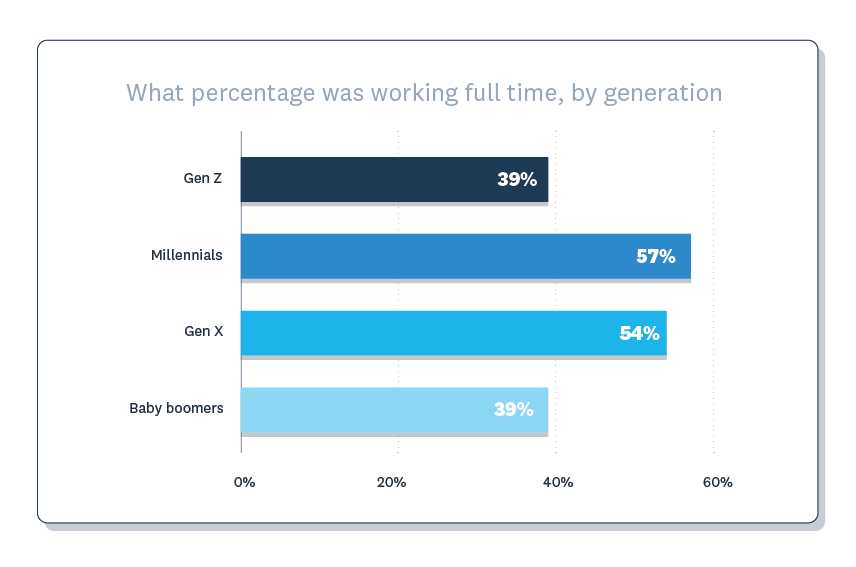

Get ready to work two jobs…for a while

About 70% of startup owners worked a job while launching their business. 48% were employed full time, but almost two-thirds (60%) of that group had quit that day job within 6 months.

This chart reflects the responses of 1,033 business owners in the US and Canada.

Making the leap from full time employee to full time business owner can be tricky, which is why so many business owners report balancing both for a period of time. Though most business owners were fully employed when starting out, they didn’t balance both for very long.

- 30% of business owners balanced a full time job for 4-6 months, while 17% did so for 7-12 months (14% did so for 2-3 months).

- 12% of online business owners report that they are still balancing both a full time job and owning a business to this day.

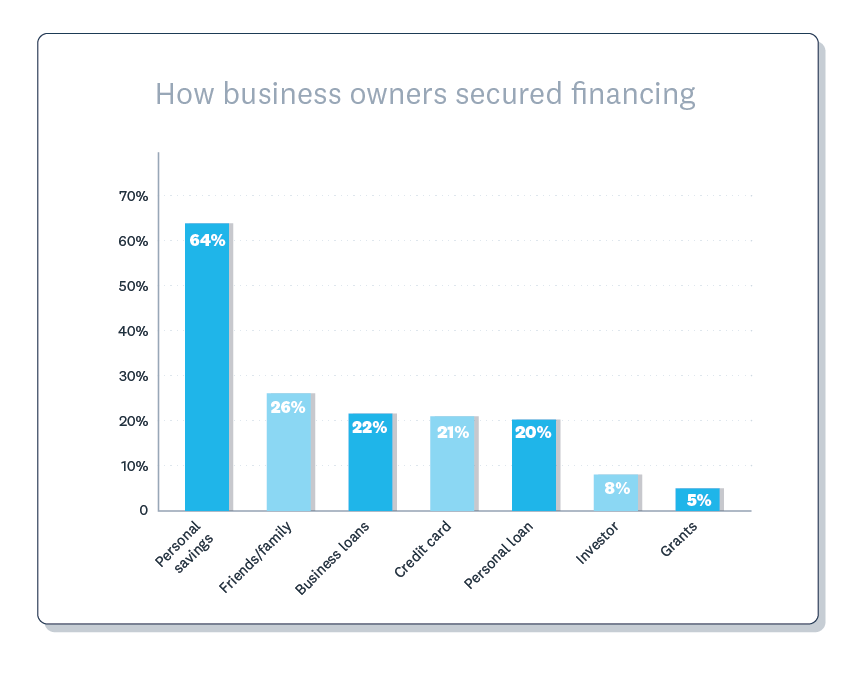

How owners found the money to start a business

Most businesses were started for a modest cost (see Low startup costs keep owners out of the red). That money came from a variety of sources, with many owners using a mix of options.

This chart reflects the responses of 500 Canadian business owners.

Many business owners face the hurdle of securing financing to start their business, especially in tight economic times. While some business owners used assistance to start their business, most used their own personal savings.

- Millennials were the generation most likely to use business loans, while Gen Z was most likely to use friends/family, and baby boomers were most likely to use credit cards.

- Women business owners were more likely than men to use friends/family, while men were more likely to use business or personal loans.

- Business loans are a far less popular (or unattainable) financing option amongst businesses open for less than 1 year (10%) compared to those open 1-3 years (23%) and 3-5 years (34%).

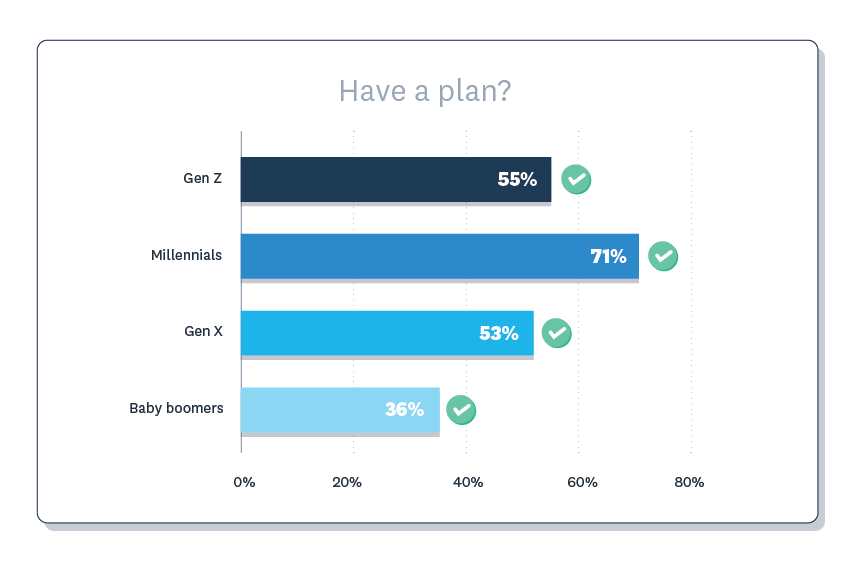

Is planning popular?

More than half of business owners took the time to write a plan, with Millennials leading the way. Those with a plan were more likely to report financial success.

This chart reflects the responses of 1,033 business owners in the US and Canada.

A written business plan gives business owners a blueprint for executing their business idea. Our findings show some business owners had a plan while others opted out.

- Over 2 in 3 millennials business owners in Canada had a written business plan when they started their business.

- On the other hand, 55% of Gen X and 54% of baby boomers did not have a plan when they started out.

- Business owners with a plan were more likely to say their business earned more than expected.

2. Show me the money

Owners are generally happy with the financial performance of their businesses. Modest startup costs are generally reaping expected (or better-than-expected) income.

How does income look?

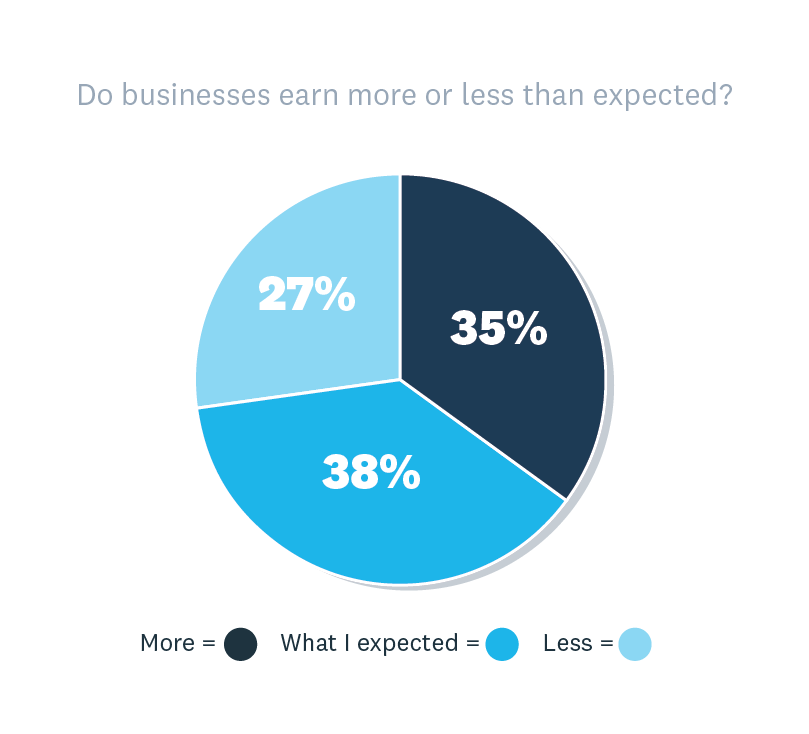

About a quarter of business owners are disappointed by their level of income since starting a business. 38% are hitting their projections while another 35% are doing better than they imagined.

This chart reflects the responses of 500 Canadian business owners.

Many factors can contribute to meeting or exceeding financial expectations and, overall, most business owners were pleasantly surprised with their business’s earnings.

- Hybrid business models are most likely to report earning more than expected, while in-person businesses are most likely to report earning what they expected.

- Businesses using an accountant, bookkeeper and/or accounting software to keep track of their finances were most likely to report earning more than expected.

- Businesses using nothing to track their finances were most likely to report earning less than expected.

How business owners price their products and services

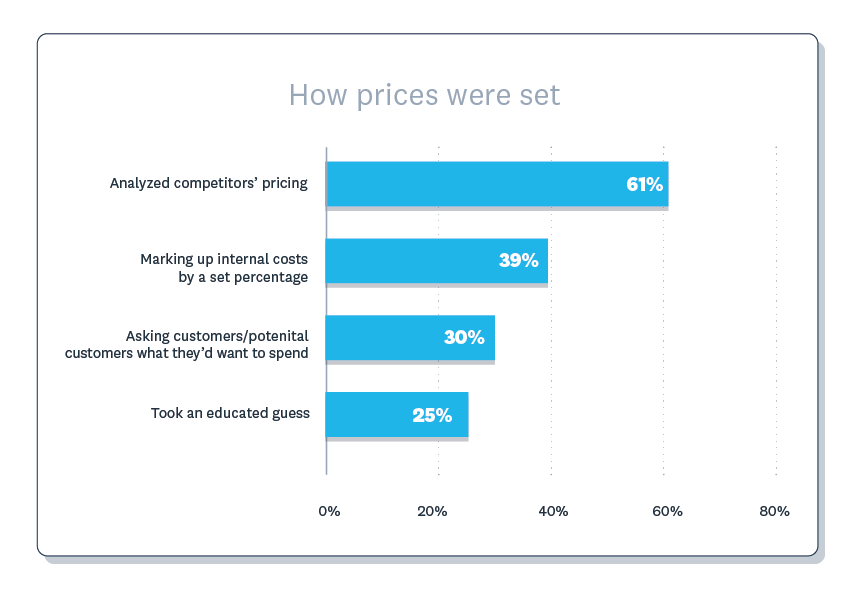

Prices have a big impact on income, so we asked how business owners decide what to charge. They were mostly intentional, although a quarter admitted to some guesswork. Interestingly, those who consulted target customers about pricing reported better business outcomes.

This chart reflects the responses of 1,033 business owners in the US and Canada.

Regardless of age, years in business, and business model, most business owners priced their products by analyzing competitors’ pricing.

- Although only 30% of business owners tested pricing with customers, this group were more likely to say they earned more than expected.

- Those who took an educated guess were most likely to report earning less than expected.

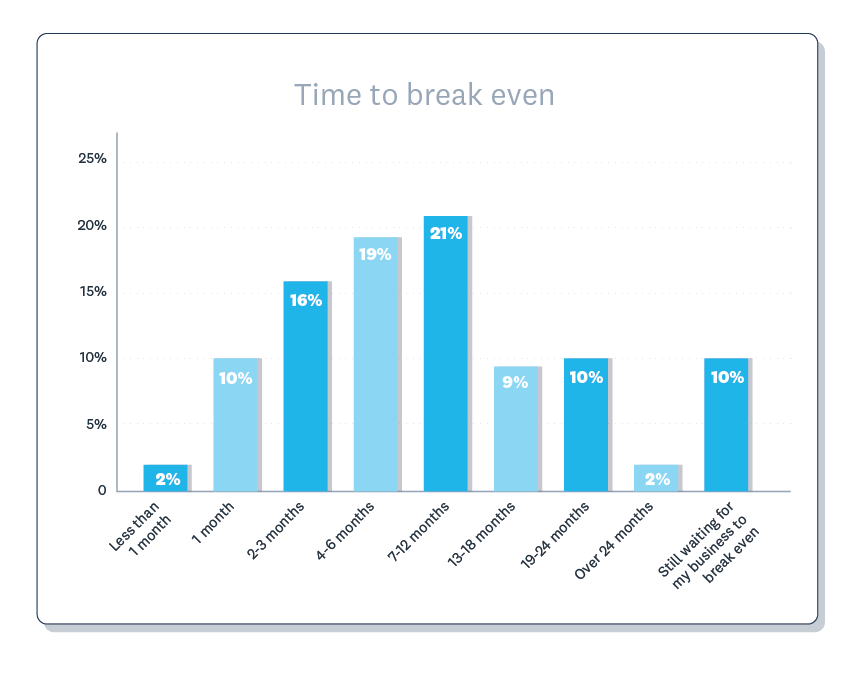

Low startup costs keep owners out of the red

A third of Canadian respondents started their businesses for $3,000 or less, while almost half started for $7,000 or less. As a result of these modest investments, 68% of businesses were able to break even within a year.

This chart reflects the responses of 500 Canadian business owners.

- Male respondents are most likely to report it taking 7-12 months to break even while female respondents are equally likely to say it took 2-3 months or 7-12 months.

- Online businesses were most likely to break even in 4-6 months, while in person or hybrid business models took 7-12.

3. How owners run their businesses

Business owners:

- find new customers through word of mouth and digital channels

- spend most on rent and marketing

- use a variety of methods for tracking finances.

Finding customers

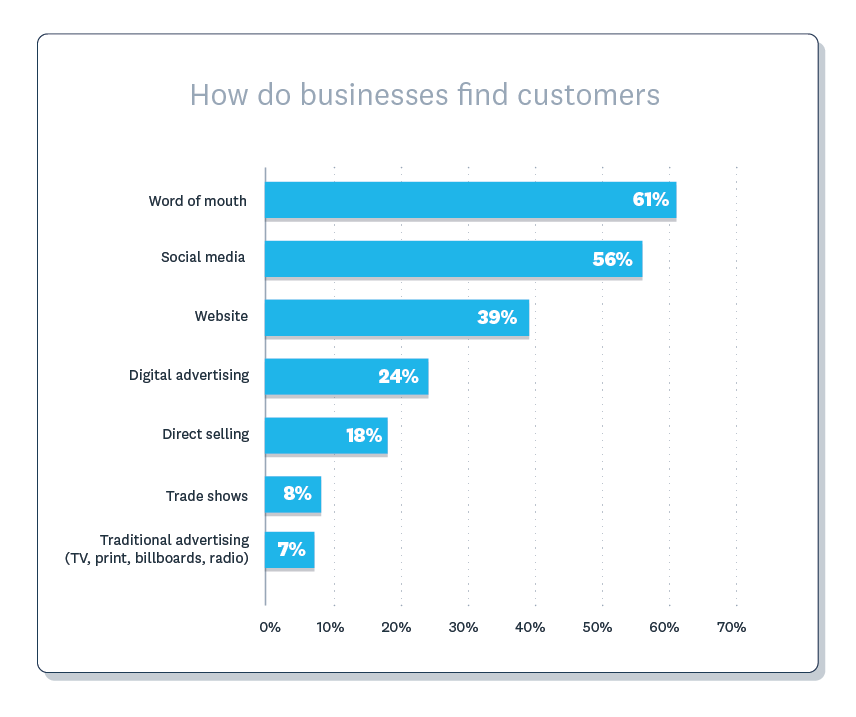

Lots of businesses get new customers through their old customers, via word of mouth. But social media is gaining fast, thanks to high usage among younger business owners.

Methods businesses use to find customers continue to evolve, and business owners attempt to keep up in order to remain profitable.

This chart reflects the responses of 500 Canadian business owners.

- Though word of mouth was the top method total, social media was the top way businesses find customers amongst Gen Z and millennials.

- Women were more likely to use social media while men were more likely to use digital advertising.

- In-person businesses still heavily rely on word of mouth (71%) while online businesses lean much more on social media (61%).

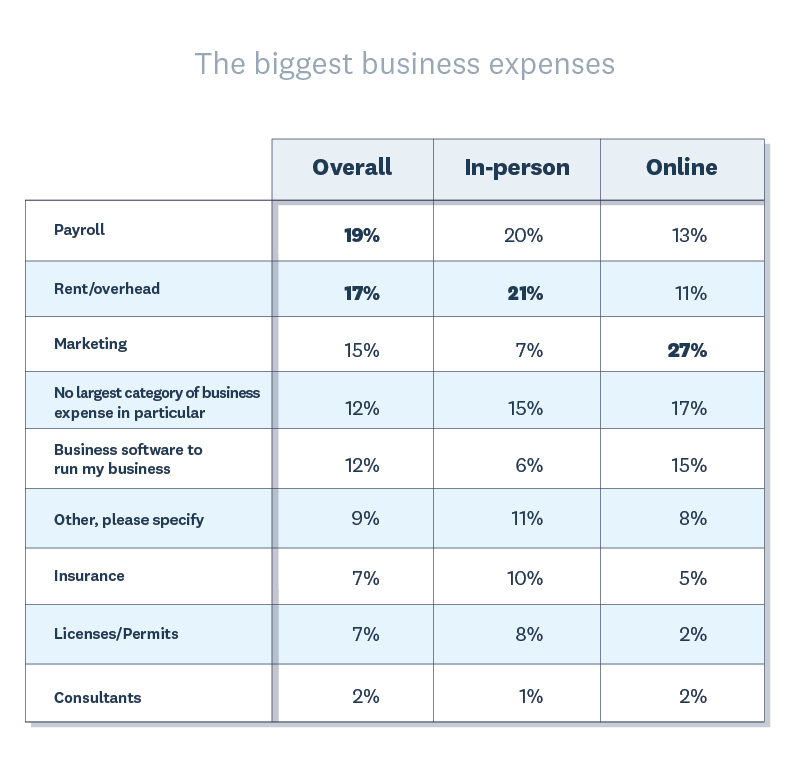

Biggest operating expenses

As you might expect, rent was the biggest expense for physical businesses while marketing was the main cost for online businesses.

Owners face an array of expenses once they start their business. Keeping these expenses in order is key to a business’s success.

This chart reflects the responses of 1,033 business owners in the US and Canada.

- Over 1 in 4 online business owners say marketing is their biggest expense.

- Gen Z business owners were the only generation to report marketing as their biggest expense.

- Millennials were the generation most likely to claim business software as their largest expense.

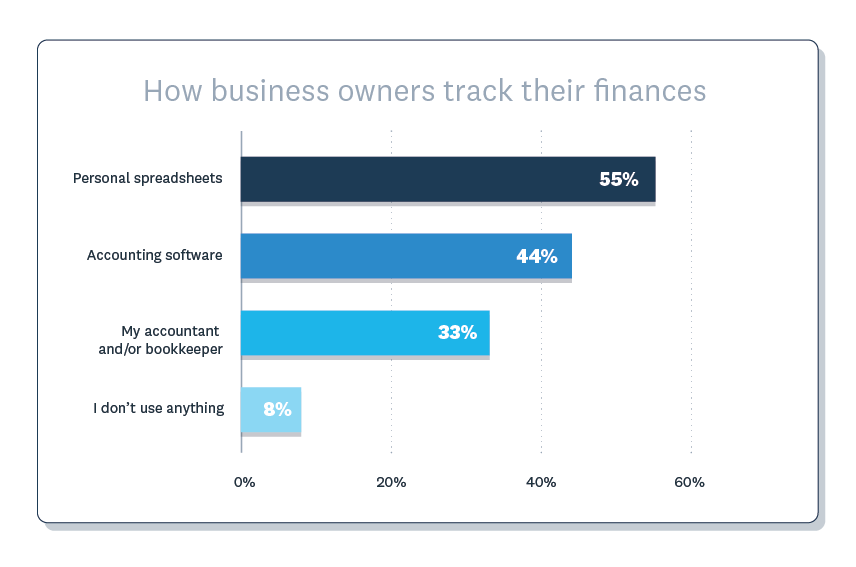

Tracking finances

Businesses use a combo of spreadsheets, accounting software and professional advisors to track their finances. Although 8% don’t actively use anything.

How a business owner chooses to track their finances can also reveal how they deal with other aspects of business.

This chart reflects the responses of 1,033 business owners in the US and Canada.

- The longer someone was in business, the more likely they were to shift to accounting software.

- Millennials are the generation most likely to use accounting software, while baby boomers are least likely.

- Business owners who don’t use anything to track their finances were the only group to report one of their biggest business obstacles being a lack of money/budget.

4. Is it worth it?

Respondents generally felt better off financially and emotionally since starting a business, although they still face plenty of obstacles and work harder than they used to.

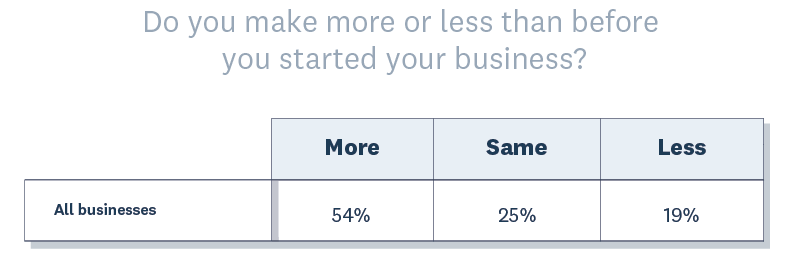

Small business proving a solid financial decision

Just over half (54%) of small business owners earn more by working for themselves than by working for someone else. Another quarter earn just as much as they used to. 19% earn less.

This chart reflects the responses of 500 Canadian business owners.

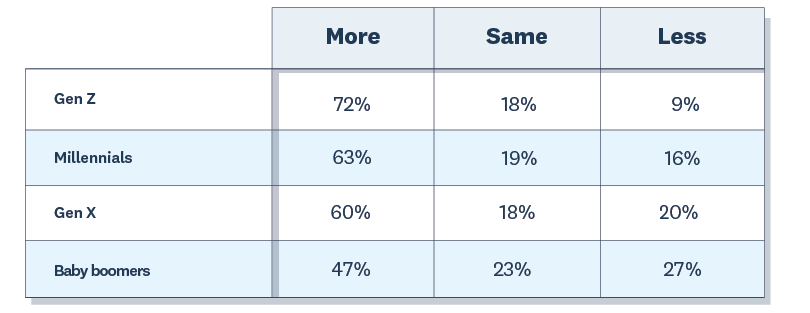

Younger generations were more likely to report an increase in income since starting a business. This may be because they’re less likely to have ascended to higher–paying professional roles.

Most business owners report earning more now than before they started out, but there are a few caveats.

This chart reflects the responses of 1,033 business owners in the US and Canada.

- Over 1 in 4 baby boomers make less than before they started a business.

- Men are more likely than women to report earning more now than before they started a business.

- 2 in 3 business owners using an accountant, bookkeeper or accounting software report earning more now than before they started a business.

- A quarter of business owners using nothing to track their finances report earning less now than before they started a business.

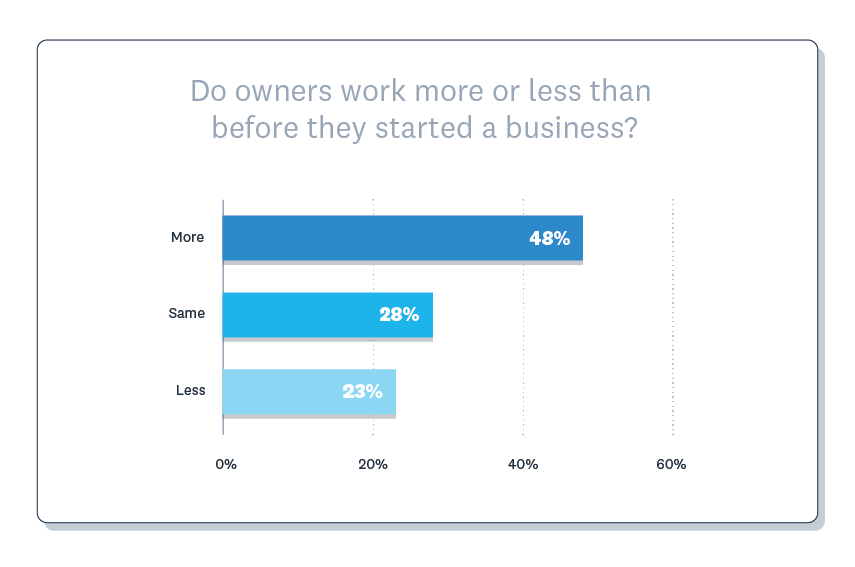

Workload stays high (or goes higher)

Business ownership only rarely lightens the workload. Three-quarters of owners work at least as much as before they started a business – with half working harder.

While most business owners are working more now than before, there are a few exceptions.

This chart reflects the responses of 500 Canadian business owners.

- Gen Z and millennials are the most likely to report working more, while baby boomers are the most likely to report working less.

- Women are more likely than men to report working more, while men are more likely to report working the same or less.

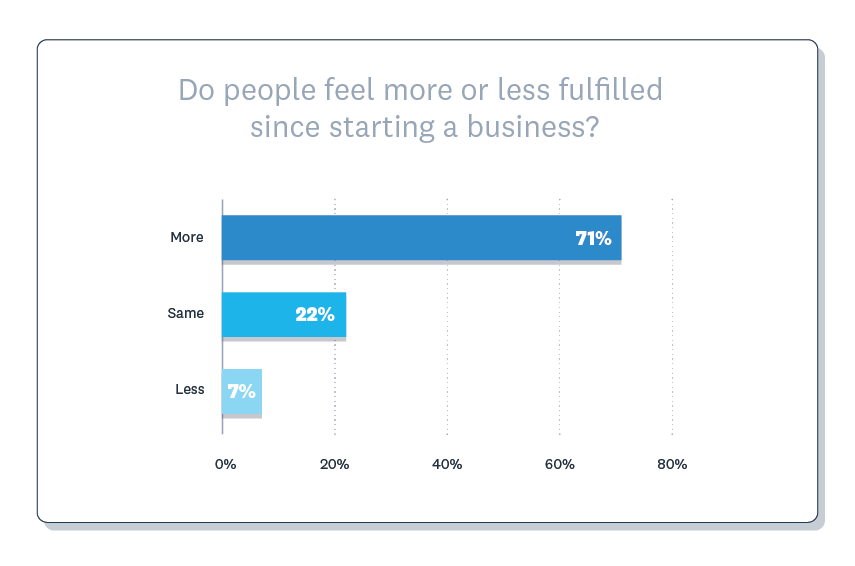

The work is more fulfilling

Despite the extra effort required, a vast majority of business owners feel better about their work. Just 7% say they’re less fulfilled since starting a business.

This chart reflects the responses of 500 Canadian business owners.

Owning a business can be extremely fulfilling and rewarding, especially to business owners who have been at it for a while.

- Gen Z are the most likely to feel more fulfilled, while Gen X and baby boomers are the most likely to feel less fulfilled.

- Men are more likely to report feeling more fulfilled by their business, while women are more likely to feel less fulfilled.

- Those who have been in business less than 1 year are most likely to feel more fulfilled, while owners who have been open 5-10 years are most likely to feel less fulfilled.

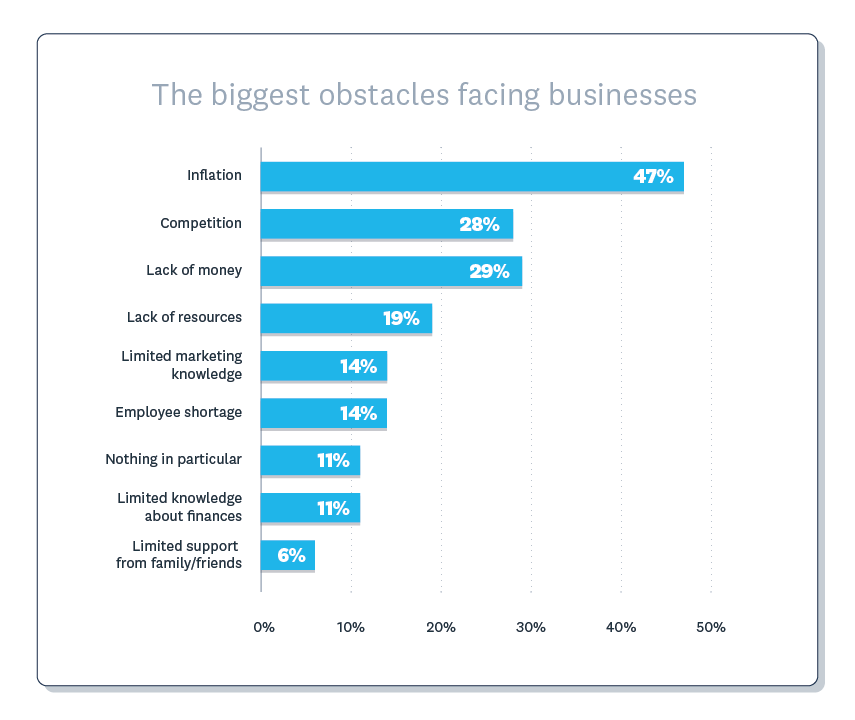

Inside the head of small business owners

Inflation continues to chew up mindshare among business owners. Among day-to-day problems, competitors loom large, while many owners wish they had a bigger operating budget.

This chart reflects the responses of 500 Canadian business owners.

- Inflation aside, Gen Z, millennials, and Gen X reported lack of money/budget as the next biggest obstacle while baby boomers said it’s stiff competition

- Business owners who have been in business less than 1 year say lack of money/budget is their biggest obstacle, while those in business 1 year or more cite inflation.

Conclusion

Starting a business revolves around small steps and managed risks. Newbies tend to make modest investments in their new business and launch while holding down a day job. Of course some will get trapped in that cycle of double-jobbing but a majority have found that their business – while hard work – met or surpassed their earning expectations.

Limitations of the study

This study reports on the experiences of 1,000 business owners. Most respondents were from the Millennial (1986–1999), Gen X (1971–1985) and Baby Boomer (1952–1984) generations. There were comparatively fewer respondents from Gen Z (since 2000), as they are only now emerging into business ownership. We have nevertheless shown Gen Z-specific results in some sections because they will have a growing presence in the startup scene. However, Gen Z results should be viewed as coming from a small sample size.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to start a business

Thousands of new businesses open every day. If all those people can do it, why not you? Here’s what to do, and when.

Download the guide to starting a business

Learn how to start a business, from ideation to launch. Fill out the form to receive this guide as a PDF.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.