Cash flow projection for small businesses

To run a successful business, good cash flow management is crucial. Cash flow projection can help with that.

What is a cash flow projection?

Cash flow projection is a method of predicting cash inflows and outflows to see how much money you’ll have in the future. It gives a good glimpse into your business's financial health and can help plan spending.

A cash flow projection is different from a cash flow statement. A statement focuses on past cash flows, a projection aims to predict the future.

Why is a cash flow projection important?

Staying on top of your business cash flow helps you pay bills on time and it helps ensure you can pay yourself, too. When costs are rising, it becomes even more imperative that businesses get their cash flow management right, and cash flow projection is one way to do it.

Benefits of a cash flow projection

Cash flow projection is a good financial habit to get into. It has multiple operational and financial benefits for your business, including:

- spotting cash shortages and giving you time to work on contingency plans, whether that’s delaying spending, requesting extra credit from suppliers, or securing a business loan

- assessing the affordability of your growth plans – for example, they can show if there’s going to be enough money to buy new tools, or to hire a new employee

- ensuring you will have enough money to pay you, the business owner!

- identifying quickly if expenses are climbing or income is slumping

- highlighting fixable cash flow problems such as slow-paying customers, impractical payment terms, seasonal cycles, or over-reliance on high-cost finance

What are the key components of a cash flow projection?

Your cash flow projection will show a few key aspects of your business' finances. These are:

- starting position (cash in the bank)

- expected cash in (hopefully mostly from sales but may also be from loans or sales of assets)

- expected cash out

- net cash flow, which shows if cash reserves have grown or shrunk

- closing balance

Who is responsible for doing a cash flow forecast projection?

Lots of small business owners do their own cash flow projections. They can use a spreadsheet or accounting software to do it. But plenty of others rely on a bookkeeper or accountant. They’re able to do them quite quickly because they really know their way around small business cash flow.

How to do a cash flow projection

To do a cash flow projection, you estimate the size and timing of upcoming transactions and show what they do to your cash position. You can do this using a spreadsheet or software.

Doing a cash flow projection spreadsheet

- Choose a forecasting period and note how much cash you have at the beginning of that period.

- List and date all your expected cash income for the forecast period, including sales receipts and things like grants, tax refunds, or incoming finance that will hit your bank.

- List and date your outgoings, too. Besides familiar business costs, be sure to capture less regular things like annual fees or taxes that might come due, or repairs that need to be performed during the period.

- Take your starting balance and run through the forecasting period, adding incoming amounts and subtracting outgoing amounts. This will show how much cash you will have at any given point in time.

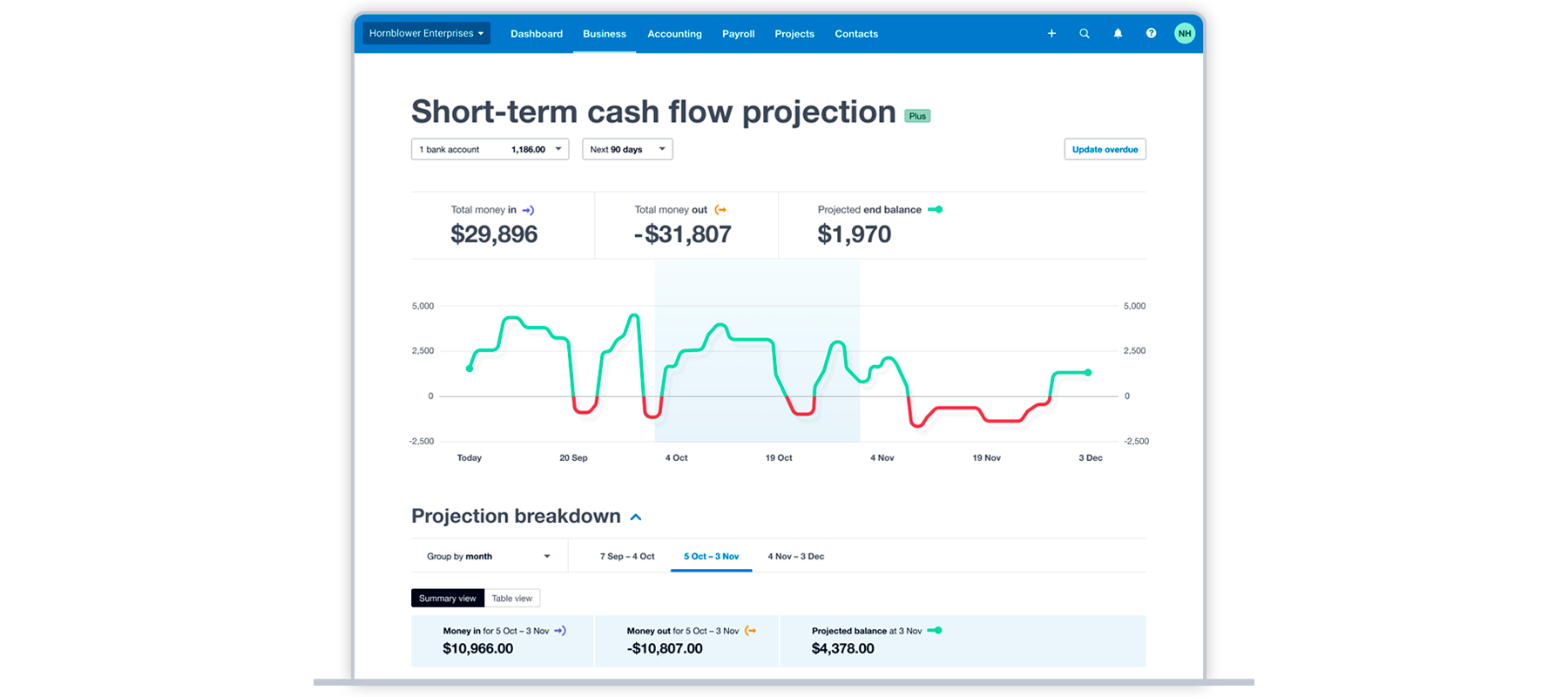

Doing a cash flow projection with software

Businesses can also generate a cash flow projection using accounting software. Xero, for example, is designed to track business incomings and outgoings, which means it can create a projection with a few clicks.

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Alternative methods of cash flow projections

There are other ways to generate cash flow projections from your balance sheet and income statement. These typically provide longer term cash flow guidance rather than day-to-day or week-to-week projections. It also requires accounting knowledge to prepare one of these projections so ask an advisor if you want to know more.

Example of a cash flow projection

The finance manager of Tiny Construction wants to assess whether the business’ cash flow will support the purchase of a new piece of equipment in the next month. The equipment will cost $20,000.

Based on current bank balances and reconciliations, Tiny Construction has a starting balance of $45,000. Outstanding invoices and sales forecasts estimate that incoming payments from sales within the next 30 days will be $90,000. There are no other incoming payments for the month.

So the ‘money in’ part of the cash flow projection will look like this:

The ‘money out’ part of the cash flow projection will look like this:

With incoming sales receipts of $90,000 and outgoings of $65,000, the company would have added $25,000 in net cash flow for the period. Adding that to the $45,000 of existing cash will mean the business has $70,000 left in its bank account at the end of the month. This would become their starting balance the following month.

With incoming sales receipts of $90,000 and outgoings of $65,000, the company would have added $25,000 in net cash flow for the period. Adding that to the $45,000 of existing cash will mean the business has $70,000 left in its bank account at the end of the month. This would become their starting balance the following month.

However, if they purchase the equipment with surplus cash, their starting balance for the next month would reduce to $50,000. This example shows how businesses can use cash flow projections to make investment decisions and estimate whether they would be able to afford it or would have to consider financing it.

How do you analyze a cash flow projection?

Once you have prepared a cash flow projection, spend some time analyzing it by checking:

- the closing balance – the amount of money you expect to have in reserve at the end of each period

- net cash flow – the amount by which your cash reserves went up or down during the period

- accuracy – compare your projection to what actually happens in real life. If the projection was off, find out what you overestimated or underestimated. You may learn something new about your business and this process will help make your next projection more accurate.

How often should cash flow projections be done?

Businesses can do cash flow projections for any timeframe and duration. As you might imagine, it gets harder to accurately predict incomings and outgoings the further into the future you go. But whatever range you choose, it’s a good idea to keep refreshing your projection.

If you run a 12 month projection, for example, with a column for each month, you might refresh it at the end of each month. Drop the last month off, add another month to the end, and check all the projections in between to see if anything needs updating.

Cash flow projections for small businesses

Cash is king. The age-old expression is very true for small businesses, whether you are growing or looking to maintain financial stability. A cash flow projection can help you improve your cash flow planning and take control of your financial health.

To reduce the time spent collecting and updating cash flow data, you can automate the process with accounting software. If you’re not ready for software, you can start by downloading a free cash flow projection template.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.