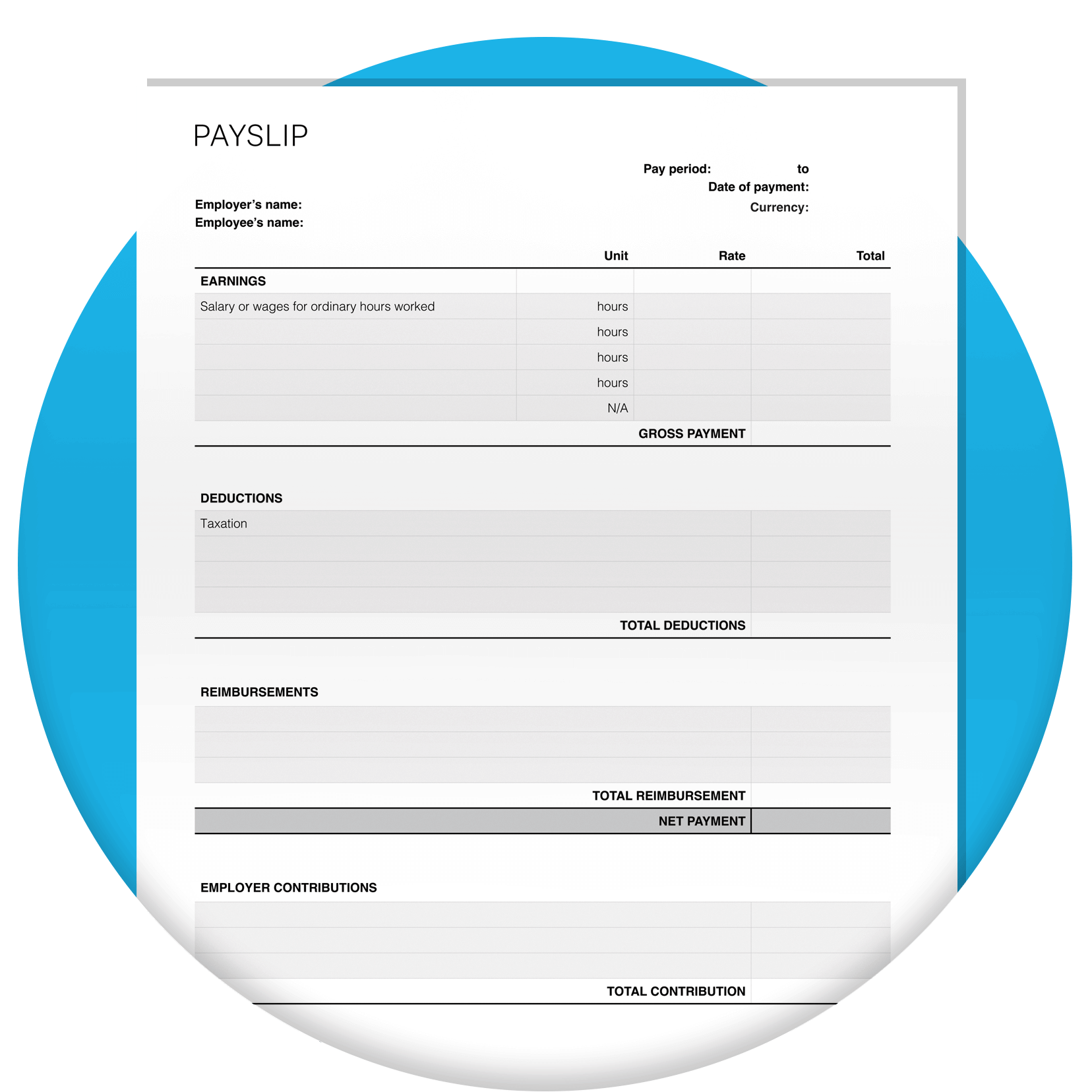

Free payslip template for businesses in South Africa

A free payslip template South African businesses can use for employees. Just download, customise, and send. Or, create payslips in a few clicks with Xero accounting software.

Easy to use and customise

An editable, free payslip template you can download as a PDF

Compliant and accurate

Our South African payslip template meets SARS requirements and supports compliance

Captures pay and deductions

Use this salary payslip template to record data for the monthly payrun

Download the payslip template

Fill in the form to get a free payslip template as an editable PDF. We’ll throw in a guide to help you use it.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

What every South African payslip must include

Mistakes on salary payslips can lead to incorrect tax deductions and payment submissions – which can be tricky and costly to fix further down the line. South African payslip requirements include:

- Employer and employee details

- Pay period

- Earnings, including salary, overtime, and incentive payments

- Deductions made, including tax, pensions, and medical aid

- Net amount paid (this is the employee’s take-home pay)

Making the most of this free payslip template

This free payslip template comes with a how-to guide that includes an example of how to fill one out. In short, you’ll need to enter wages or salary earned, then done down the deductions for things like tax and retirement. There’s also a field on this South African payslip template for reimbursements. This could include repayments made to your employees for things like travel expenses.

This free payslip template comes with a how-to guide that includes an example of how to fill one out. In short, you’ll need to enter wages or salary earned, then done down the deductions for things like tax and retirement. There’s also a field on this South African payslip template for reimbursements. This could include repayments made to your employees for things like travel expenses.

Our payslips download includes a guide to help to fill yours out correctly. In the guide, you get access to the income tax calculator for help with deductions – making it simple to create and send accurate payslips.

Try the income tax calculatorOur payslips download includes a guide to help to fill yours out correctly. In the guide, you get access to the income tax calculator for help with deductions – making it simple to create and send accurate payslips.

Try the income tax calculatorPayslips are vital to employees and employers. A monthly payslip tells your employee how much they earned and where that money went, including pay and deductions. Employers also need these payslips to ensure the right amount of pay, deductions, and tax are paid.

Payslips are vital to employees and employers. A monthly payslip tells your employee how much they earned and where that money went, including pay and deductions. Employers also need these payslips to ensure the right amount of pay, deductions, and tax are paid.

Best practices and legal compliance for South African payslips

If you want to get the most out of this payslip template, South African legal requirements and best practices need to be followed.

Follow SARS requirements

Incorrect PAYE, UIF, and SDL submissions can lead to South African Revenue Service (SARS penalties).

Understand legal obligations

The Basic Conditions of Employment Act and the National Minimum Wage dictate how employees must be paid.

Distribute and save payslips

Payslips must be shared with employees, and kept by employers as proof of compliance with employment laws.

Make payday a better day

Now you know how to make a payslip, it’s time to simplify payroll further. Connect a payroll app to Xero accounting software to streamline payroll administration.

- Payslips are created automatically each payday

- Salary and wages flow straight into your general ledger

- Payday expenses show up in your cash flow forecasts

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.