Australia Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, late payments and time to be paid.

Positive momentum building for small businesses

Published: 26 February 2026

The latest Xero Small Business Insights (XSBI) data for Australia shows small business performance continued to improve in the final months of 2025. In the December quarter sales growth recorded the best result since mid-2023, jobs growth was the strongest in two years and small businesses were paid quicker than in any other quarter in the history of this series. Overall, despite international headwinds, Australian small business performance improved over 2025 - especially during the second half of the year - as the benefits of cuts in the official interest rate start to have a positive impact on customer spending.

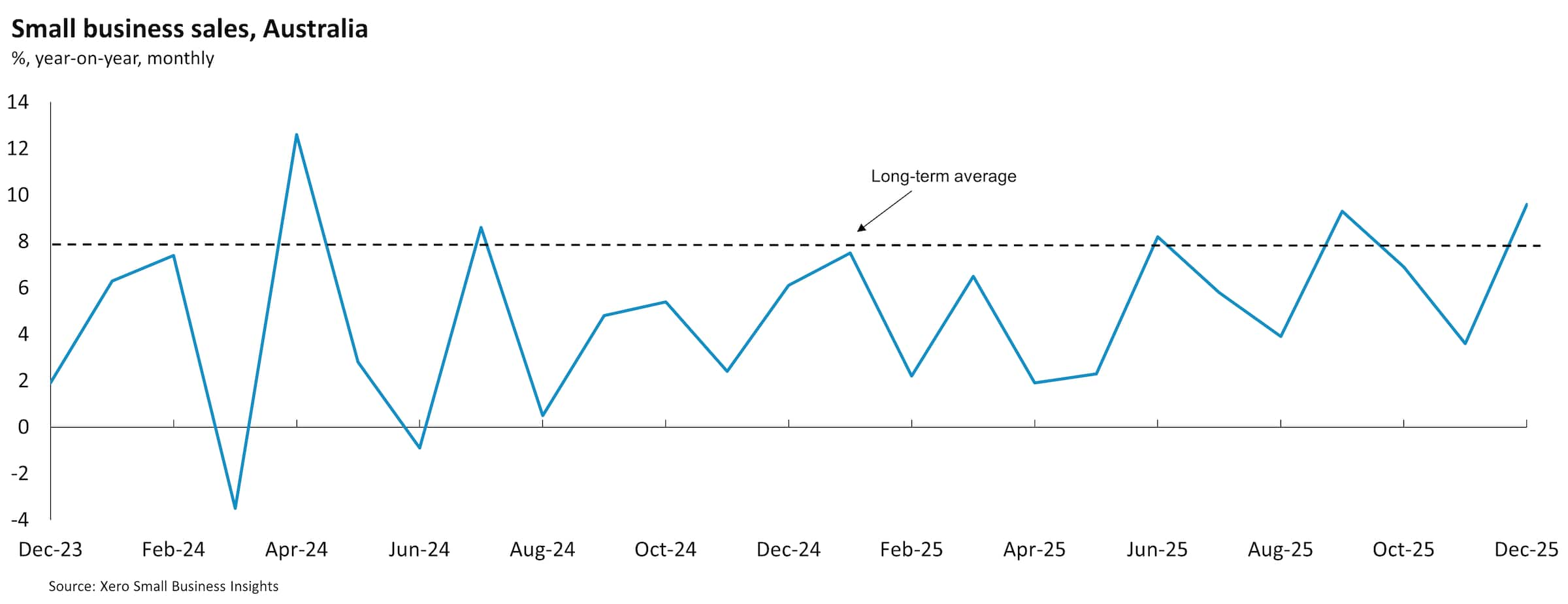

Sales in small businesses grew 6.7% year-on-year (y/y) in the December quarter, building on the 6.3% y/y rise in the September quarter. The latest quarterly performance is the largest rise in sales since the June quarter 2023. Breaking down the monthly movements over the quarter, the best result was a 9.6% y/y rise in December. This was the largest monthly increase since Easter-impacted April 2024. In two of the last four months sales grew above the long-term average.

Small business performance continued to improve in the final months of 2025.

XSBI Australia October 2025 - December 2025 data

The improvement in sales wasn't uniform, with some industries and regions performing better than others. The best performing industry in the quarter was construction (+9.5% y/y), followed by health care (+9.3% y/y) and real estate (+8.6%). Retail trade (+4.7% y/y), hospitality (+3.5% y/y) and arts & recreation (+1.2% y/y) were all softer than in the September quarter suggesting a modest summer period for these three industries where the final few months of the year are often important. Small retailers appear to have missed out on the Black Friday sales period, with November (+3.3% y/y) the smallest monthly rise in the quarter.

In terms of States and Territory performances, perennial top performer Western Australia had to settle for the fourth largest rise in sales (+6.5% y/y) in the December quarter. Queensland (+8.3% y/y), South Australia (+7.8% y/y) and New South Wales (+6.6% y/y) led the sales results.

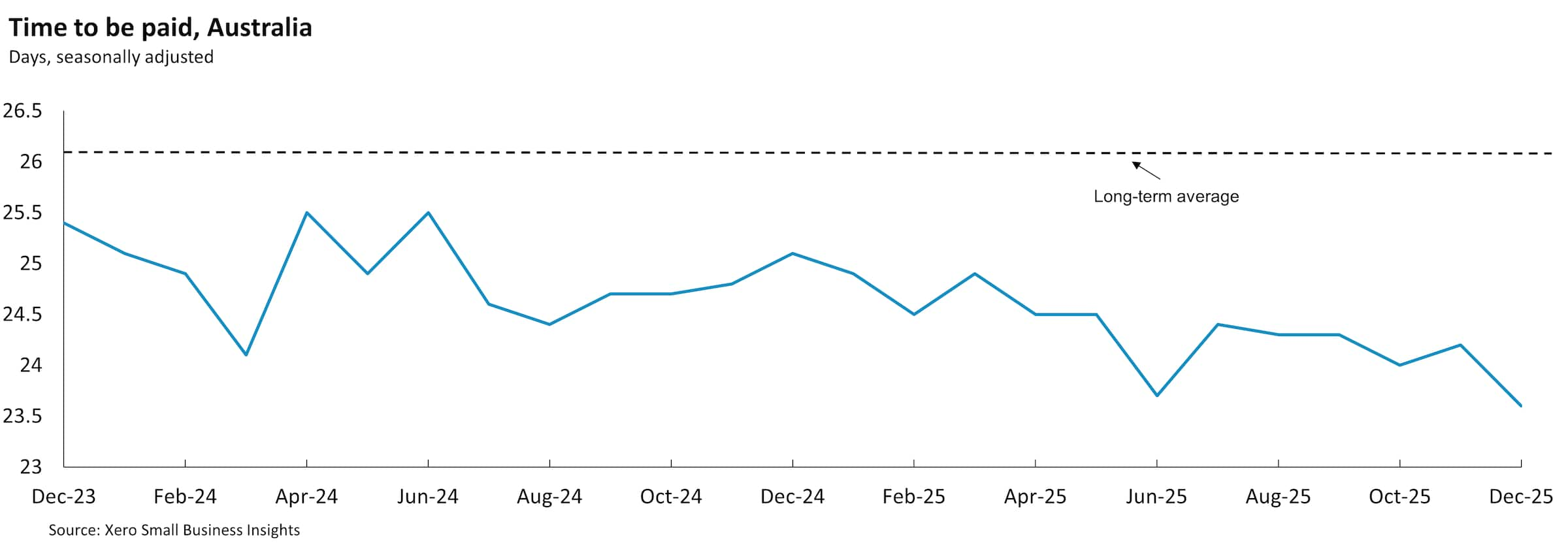

Not only is the sales situation improving, so too is the speed at which small businesses get paid. On average, there were 23.9 days between when a small business issued an invoice and when it was paid. This is the fastest quarterly payment time since this series began in January 2017. Most of this improvement was in the final month of the quarter, with December recording 23.6 days, down from 24.2 in November and 24.0 in October.

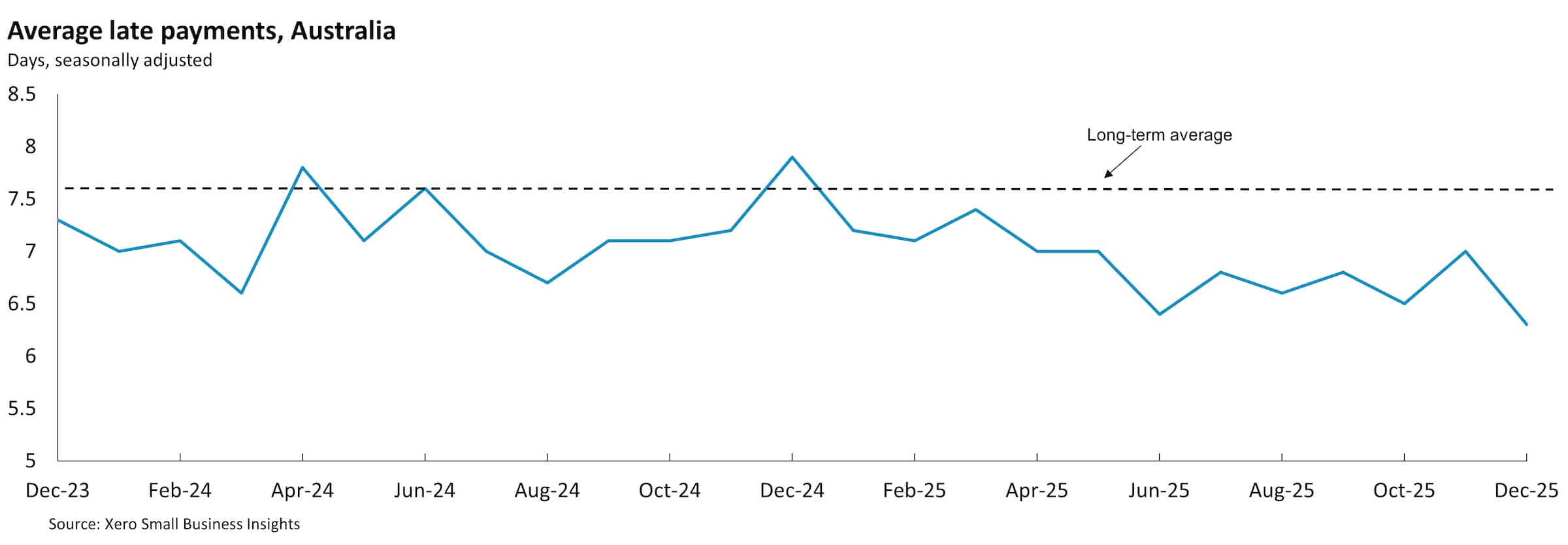

The late payment metric also improved over the December quarter, to 6.6 days from 6.7 days in the September quarter. The late payment metric measures the average time between when the invoice is due and when it was paid. This latest result is the second lowest on record. This trend is worth celebrating but it also means that small businesses are still, on average, being paid late. Payment practices to small businesses still need to improve, ideally getting this measure to 0 (i.e. small businesses get paid on time).

Despite the national improvement, there remains considerable variation in payment practices across industries. Education & training (9.9 days), wholesale trade (8.8 days), manufacturing (8.7 days) and information media & telecommunications (8.7 days) were paid the most late during the December quarter. Hospitality (3.2 days), financial services (3.7 days) and health care (4.1 days) were the industries paid the least late over the quarter.

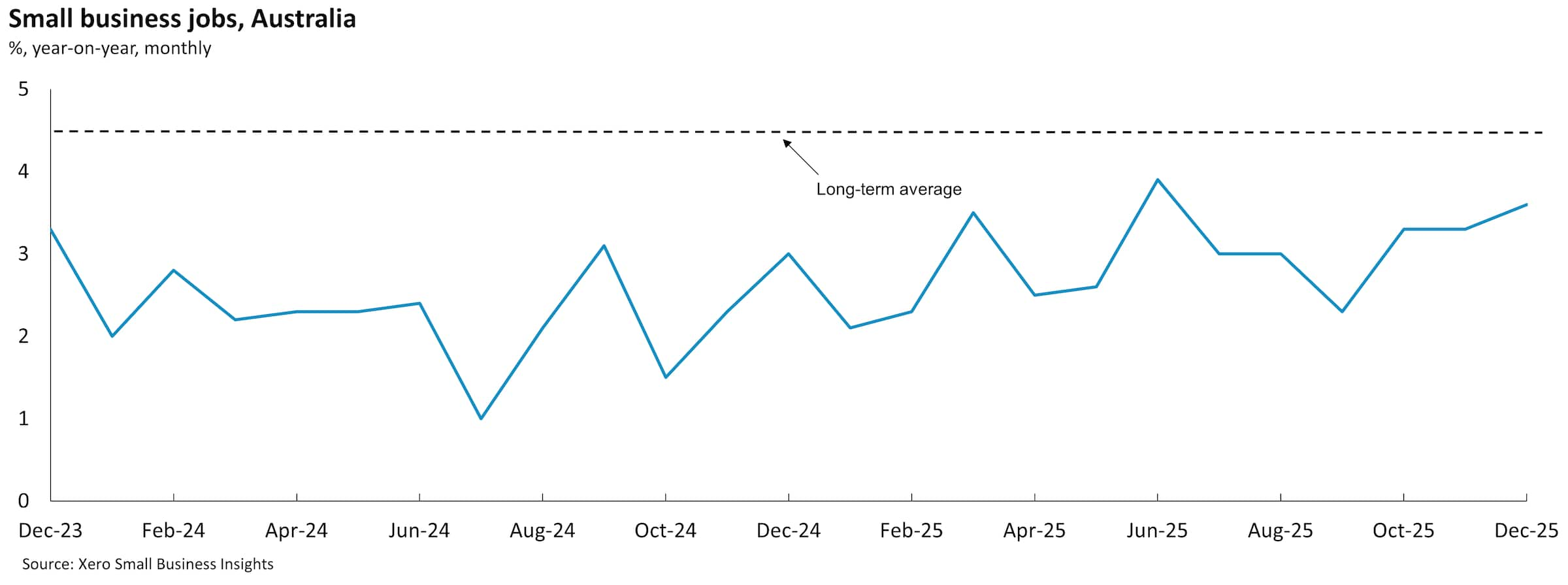

The improved sales performance over the past six months flowed through to jobs, as owners became more confident that the sales pick-up is sustainable. Jobs grew 3.4% y/y in the December quarter, up from 2.8% y/y in the September quarter. This latest result is the biggest increase in jobs in two years.

Similar to the sales breakdowns, construction (+5.3% y/y) and health care (+5.7% y/y) recorded the best jobs outcomes in the December quarter. By far the softest sectors for jobs growth were hospitality (+0.1% y/y) and administrative services (+1.3% y/y).

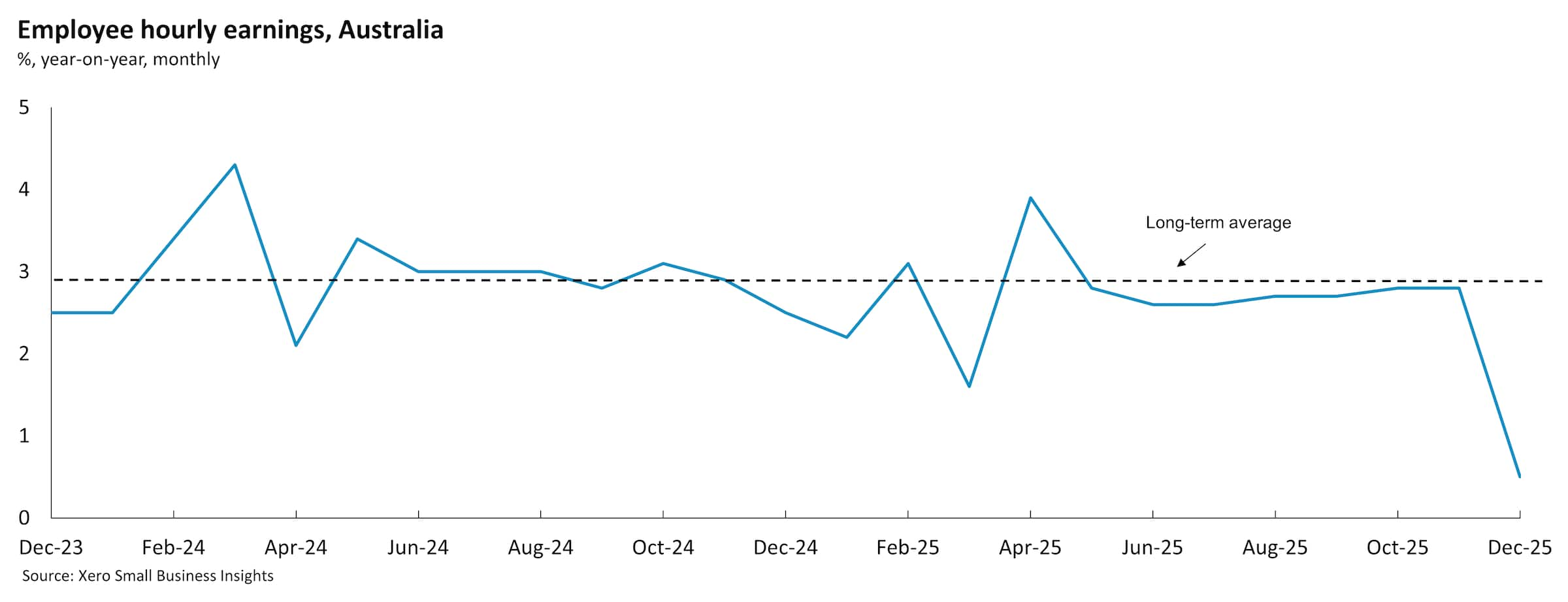

Wages rose only 2.0% in the December quarter. Largely due to a very weak December result (+0.5% y/y). This doesn't mean Australian small business wages were actually this soft, however. Instead it is a regular pattern of XSBI data, due to the holiday period delaying wage reporting in Xero's system. We expect this result to be revised up in the future as more data becomes available. Setting the December month result aside, wages grew an average of 2.8% y/y in October and November - similar to the 2.7% rise in the September quarter and just below the long-run average for this series of 2.9% y/y.

Overall, the latest XSBI data confirms that Australian small business performance continued to improve and is getting closer to 'average' conditions for sales, jobs and wages. The payment time indicators, especially late payments, show that small business owners are getting paid 'less late' but this metric needs to be at 0 to reflect small businesses are being paid on time.

Looking ahead, the increase in the official cash rate in February, by the Reserve Bank of Australia, is likely to be a blow for small business owners, who were finally starting to see signs of a return to sustainable growth in the second half of 2025. Rates were cut as recently as August 2025, and to see such a short 'pause' period is disappointing. The latest forecasts from the Reserve Bank highlight how concerned it has become about the persistence of inflation. A lack of productivity growth means the economy is already experiencing capacity constraints, even in this early stage of the recovery cycle, which risks reigniting price pressures. As household budgets tighten again, small business owners will need to focus on strategies to attract increasingly nervous customers.

For more information on the XSBI metrics, see our methodology page.

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Find out more about XSBI

If you have any questions about Xero Small Business Insights, reach out to us.