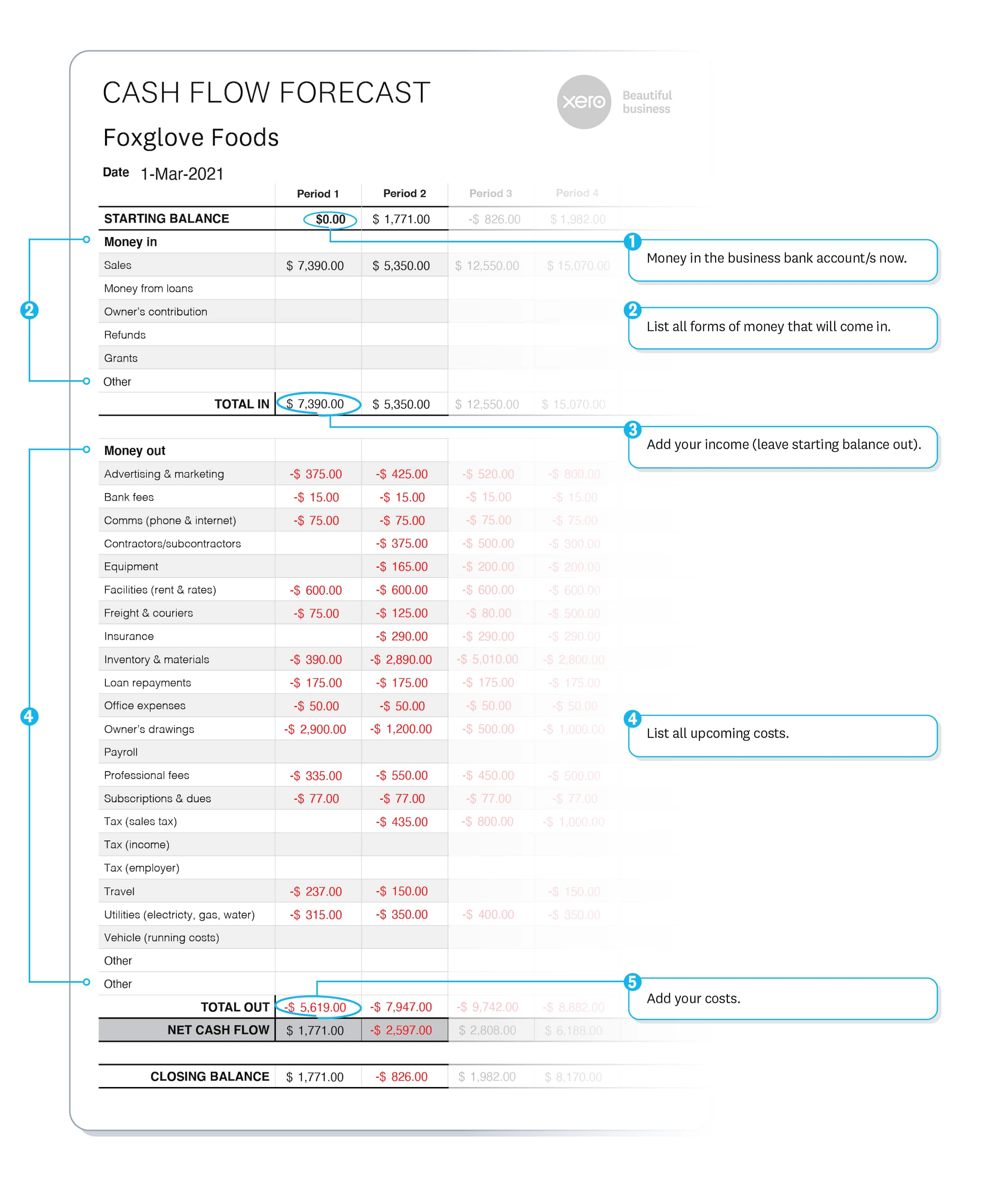

Cash flow forecast example

Follow this example of a cash flow forecast to create your own. A cash flow forecast will help you see when your business will be flush with cash, and when it won’t.

Download the cash flow forecast template

Fill in the form to get a free cash flow forecast template as an editable PDF. We’ll also link you to a guide on how to use it.

Example cash flow forecast

A cash flow forecast allows you to predict incomings and outgoings to estimate how much money you’ll have in the future.

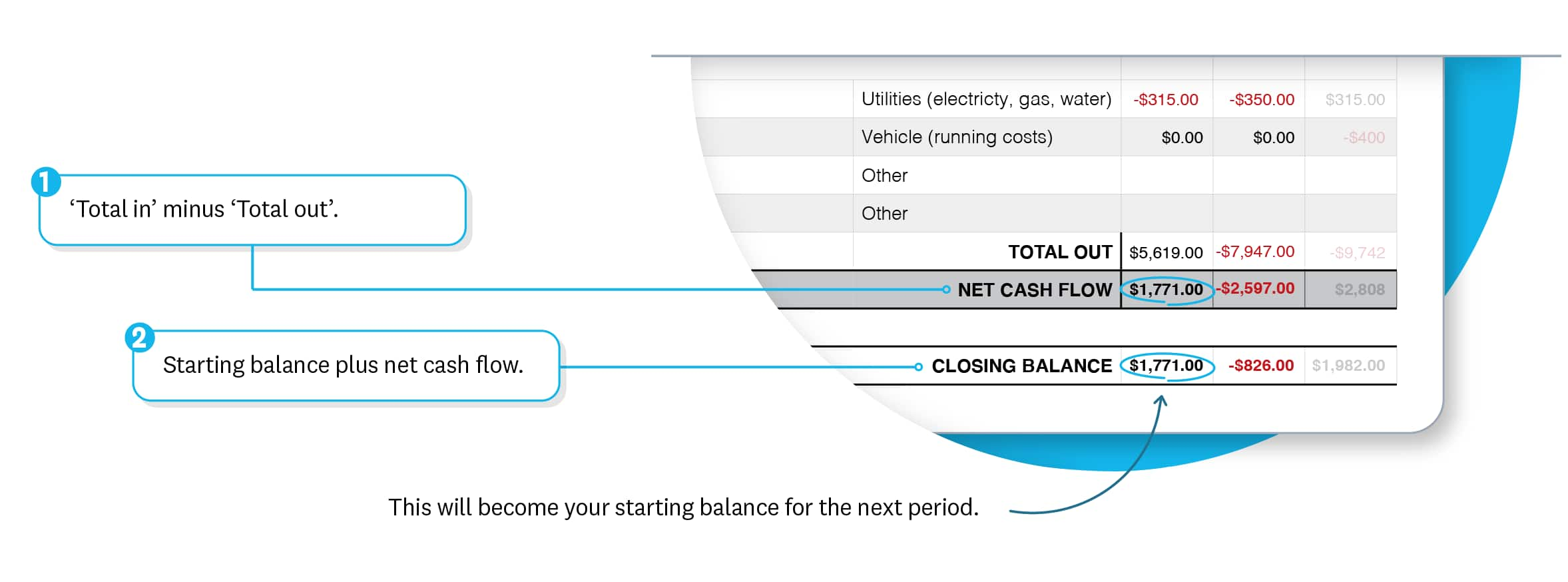

Reading the results

Here's where you subtract costs from your available cash to see how much money you'll have in the bank at the end of each period.

Tips for filling out a cash flow forecast

Owner’s contribution is any personal money you put into the business. Owner’s drawings are any amounts you took out for personal use. Only fill out the ‘Money from loans’ row if newly borrowed money hits your account during the period. Don’t put existing loans in there.

Some costs can go in multiple places. Car insurance could go under insurance or vehicles, for instance. Don’t sweat on the decision too much. Just stay consistent once you’ve made a call.

Want to borrow this template?

If you like the format of the cash flow forecast in this example – we can send it to you as a template.

Track past cash activity

To fully understand your financial position, it’s also helpful to look at a cash flow statement alongside your forecast.

A cash flow forecast helps you predict future cash movements, but to get a full picture of your financial health, it’s useful to also review past cash activity. Use our cash flow statement template to track where your money has been.

Forecast faster

You don’t have to fiddle about with spreadsheets. Online accounting makes forecasting a lot simpler.

How to read a cash flow forecast

The numbers to watch.

- Net cash flow – shows whether you’ll be putting money in the bank, or scrambling to meet costs.

- Closing balance – a negative amount suggests you may need to delay expenditures if you can, or sort out some kind of finance.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.