Xero’s free timesheet calculator

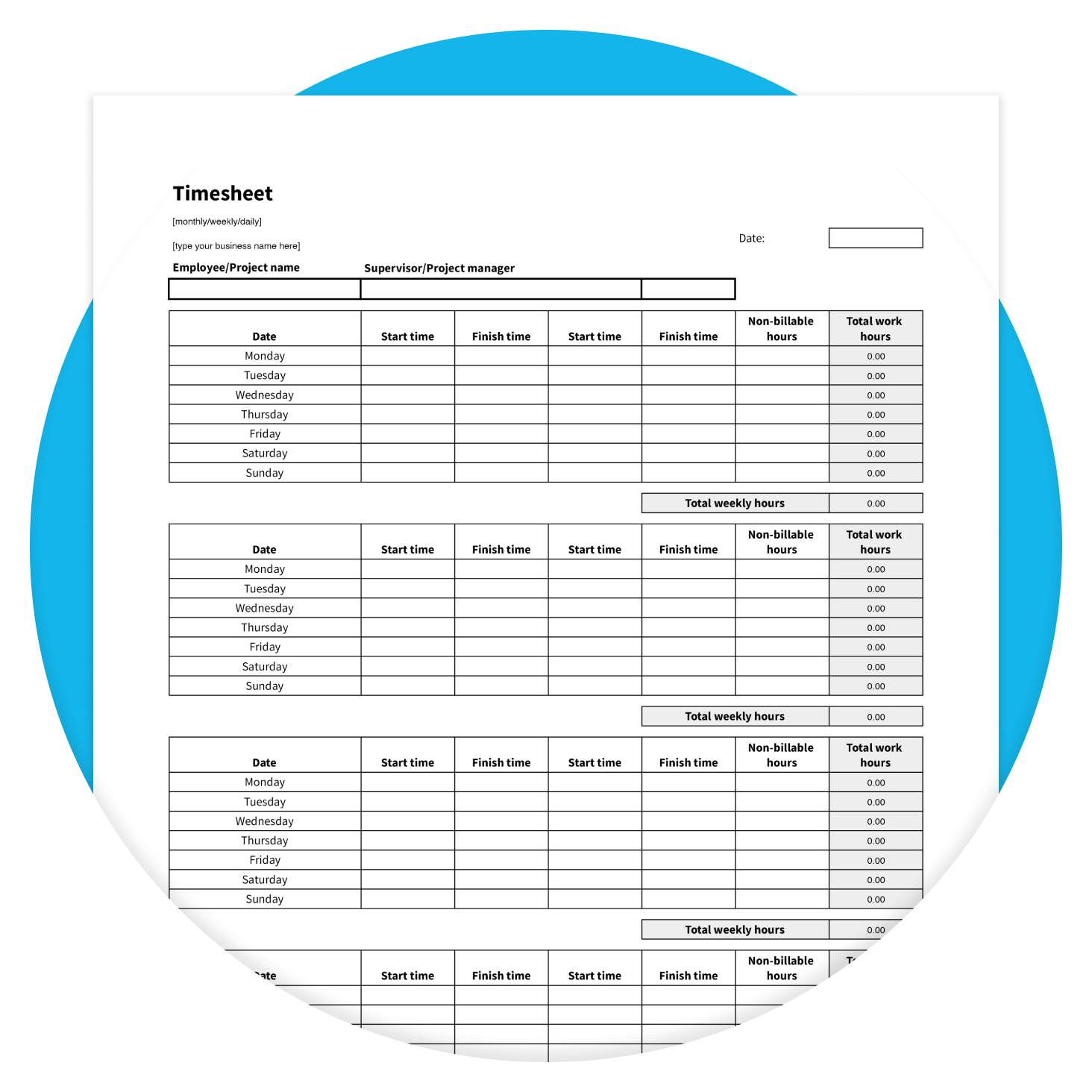

Work out your employees’ total hours with Xero’s time card calculator. Just enter the numbers for fast, accurate calculations, ready for your payroll and to track your productivity. The editable calculator can be used for each employee or project.

- Factor in a daily break and any non-billable hours

- Calculate the total working hours for each week or the whole month

- Save the spreadsheet for your payroll records

Download the free time card calculator

This tool calculates total employee hours to give you accurate records. Fill in the form to get your timesheet as an editable spreadsheet.

Tired of manual calculations?

Let Xero handle the numbers so you can focus on growing your business. Sign up for free!

The benefits of this timesheet calculator

No two days are the same in your business. Your employees work different hours and take different breaks. Calculating their total hours can then be a job in itself – one that’s prone to errors and fiddly admin. This payroll timesheet calculator simplifies the task for you.

Track time accurately

Automatic calculations allow for breaks and non-billable hours.

Ask employees to fill out their timesheet

Save yourself the admin time.

Track billable hours for each project

Show clients who spent time doing what.

Reduce payroll mistakes

Keep a clear account of who worked which hours each week.

Comply with regulations

Keep digital records of your employee hours and breaks.

Features of this time card calculator

This free tool offers one digital place to manage your time tracking, making payroll calculations quick. You’ll enjoy:

A simple design

Use the calculator straight away – no setup needed.

Accurate calculations as part of a timesheet

Streamline the job of logging hours for payroll.

Include breaks and non-billable hours

Flexibility across your team.

A reusable template

Save it to your device or computer.

How to use the timesheet calculator

Download the editable calculator to your computer or mobile device.

Download the editable calculator to your computer or mobile device.

Enter the start and end times for each day, allowing for a break and any non-billable hours. Hours will automatically be calculated.

Enter the start and end times for each day, allowing for a break and any non-billable hours. Hours will automatically be calculated.

See your employee’s total worked hours for each week and for the whole month. Save the spreadsheet and use a new blank version for your next employee or project. It’s a good idea to keep all your timesheets in a secure, central place – it’s an important part of accurate bookkeeping and will make it easier to comply with local labour laws.

See your employee’s total worked hours for each week and for the whole month. Save the spreadsheet and use a new blank version for your next employee or project. It’s a good idea to keep all your timesheets in a secure, central place – it’s an important part of accurate bookkeeping and will make it easier to comply with local labour laws.

FAQs on the timesheet calculator

For a small business, time tracking is an important part of managing your team’s productivity. By keeping track of employee hours and attendance, you’re making sure everyone is doing the work you’ve hired them for, and keeping accurate records too. That way, you comply with labour laws and record information about your project costs. Be sure to name and date each file to be able to generate reports on a weekly or monthly basis.

For a small business, time tracking is an important part of managing your team’s productivity. By keeping track of employee hours and attendance, you’re making sure everyone is doing the work you’ve hired them for, and keeping accurate records too. That way, you comply with labour laws and record information about your project costs. Be sure to name and date each file to be able to generate reports on a weekly or monthly basis.

Yes. Enter the employee’s non-billable hours each day and the timesheet calculator subtracts these from their total worked hours for you. This way, you can record non-billable hours for your own purposes – such as payroll and productivity tracking – but exclude them for working out what to charge your client.

Yes. Enter the employee’s non-billable hours each day and the timesheet calculator subtracts these from their total worked hours for you. This way, you can record non-billable hours for your own purposes – such as payroll and productivity tracking – but exclude them for working out what to charge your client.

Certainly. Xero’s tool lets you enter start and finish times for, say, the morning, and then again for the afternoon. Use the timesheet calculator – with lunch or coffee breaks factored in – to give you accurate calculations for your payroll and client records.

Certainly. Xero’s tool lets you enter start and finish times for, say, the morning, and then again for the afternoon. Use the timesheet calculator – with lunch or coffee breaks factored in – to give you accurate calculations for your payroll and client records.

Consider things like the number of employees you have and how complicated their working hours tend to be. Is Xero’s free tool enough, or do you need something more sophisticated, such as time-tracking software for small businesses? Also think about any industry-specific requirements you need – for example, to record project expenses.

Read more about time tracking softwareConsider things like the number of employees you have and how complicated their working hours tend to be. Is Xero’s free tool enough, or do you need something more sophisticated, such as time-tracking software for small businesses? Also think about any industry-specific requirements you need – for example, to record project expenses.

Read more about time tracking softwareA timesheet calculator is a simple tool to calculate someone’s total worked hours. A payslip is a relatively complex document that shows an employee their pay information, including any tax deductions and workplace benefits. Both are important for small business owners to ensure accurate payroll processing and compliance with local labour laws.

A timesheet calculator is a simple tool to calculate someone’s total worked hours. A payslip is a relatively complex document that shows an employee their pay information, including any tax deductions and workplace benefits. Both are important for small business owners to ensure accurate payroll processing and compliance with local labour laws.

Streamline your pay runs with Xero

While Xero’s handy timesheet makes your working day easier, Xero’s cloud-based software streamlines your entire pay run process. Employees use the app to enter their working hours, request leave, and access their payslips. All information then updates on the software automatically.

- Calculates pay, tax, and deductions

- Lets you store your pay run details online

- Allows you to easily run pay run reports

More templates for your business

Free invoice template

Download the web’s simplest invoice template and use it over and over and over again.

Free cash flow forecast template

Download a free cash flow forecast template. And learn how Xero software makes forecasting easier.

Free expense report template

Download a free expense report template. And learn how Xero simplifies managing and tracking expenses.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This calculator has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.