How DBS and Xero help SMEs get a better view of their money

Do you know how much money is owed to your business, and how much your business owes to suppliers or vendors?

Knowing your money day-to-day is crucial to how you run your business, and impacts the decisions you make. Typically, having access to your up-to-date finances involves lots of manual work, or comparing multiple documents or spreadsheets.

However, online technology that connects your online accounting software to your bank is actually available today - and for free. Here’s how this technology works, and how it can transform the way you run your business.

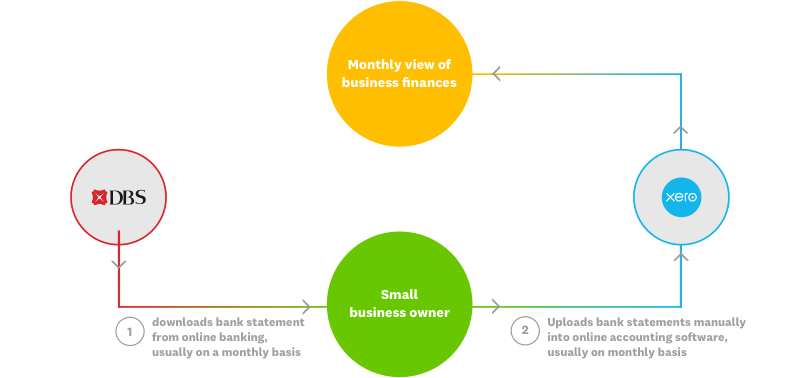

The old way

Do you currently make business decisions on month-old data, or data that's even older? If so, the scenario shown in the chart below may be familiar to your current process.

The better way: Connecting your bank with Xero

What if your bank could connect to your accounting software, so your bank transactions are automatically sent to your accounting software each morning, waiting to be reconciled? This connection is currently available if you have a DBS IDEAL account, and a Xero trial or paid account.

.1656639310450.png)

But how does this connection from DBS to Xero help SMEs?

Admin work

- The old way: Download your bank statement and upload it into your accounting software manually

- The better way: After a one-time setup, the DBS-Xero connection delivers bank transaction records into Xero between Tuesdays and Sundays

Getting data from your bank into accounting software

- The old way: As the process is manual, business owners normally upload their bank statements into their accounting software on a monthly basis, or even longer

- The better way: Bank transactions are sent automatically into Xero by 9AM between Tuesdays and Sundays - this saves time for business owners

Reconciliation

- The old way: As bank statements are only uploaded into the accounting software monthly, this means business owners only match their transactions for the past month

- The better way: Business owners can match their transactions each day, so their cash flow is up to date

Up-to-date financial position

- The old way: Business owners only get a view of their financial position based on the past month’s data, or sometimes even longer

- The better way: Business owners have an up-to-date view of their finances

Informed business decisions

- The old way: Business owners struggle to make business decisions without knowing exactly how much money is available

- The better way: With a daily view of their finances, business owners can make informed business decisions each day

Find out more

Learn more about the DBS-Xero connection, and how you can get this set up within 24 hours.

Try Xero for free

Access all Xero features for 30 days, then decide which plan best suits your business.