Gearing Ratio Explained: How to Calculate for Your Business

Learn how your gearing ratio affects risk, cash flow, and borrowing costs, and how to keep it healthy.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Thursday 5 February 2026

Table of contents

Key takeaways

- Calculate your gearing ratio by dividing total debt by total equity and multiplying by 100, then aim for a ratio between 25% and 50% for most small businesses to balance growth opportunities with financial stability.

- Review your gearing ratio quarterly or before making major financial decisions to spot trends early and ensure you can manage debt obligations without straining cash flow.

- Recognise that industry standards vary significantly when interpreting your ratio, as capital-intensive businesses like manufacturing may acceptably have higher ratios (up to 80%) while service businesses typically maintain lower ratios (20-40%).

- Use your gearing ratio strategically to assess borrowing capacity and attract investors by demonstrating you can take on additional debt responsibly or showing financial stability through balanced debt-to-equity structure.

Gearing ratio definition

Your gearing ratio compares your business's debt to its equity, showing how reliant you are on borrowed funds relative to your intrinsic worth and giving you insight into your financial health.

In finance, gearing refers to the balance between debt and equity a company uses to fund its operations:

- Debt: borrowed money, such as loans and lines of credit, that must be repaid with interest

- Equity: the owner's investment in the business, including retained earnings and share capital

Lenders, investors, and stakeholders use gearing ratios to assess financial stability:

- Higher ratio: signals greater reliance on debt, which means increased financial risk but also potential for higher returns

- Lower ratio: suggests a stronger equity position, reducing risk but potentially limiting growth opportunities

Types of gearing ratios

Several gearing ratios help measure financial leverage and risk. Each examines a different aspect of your business's stability:

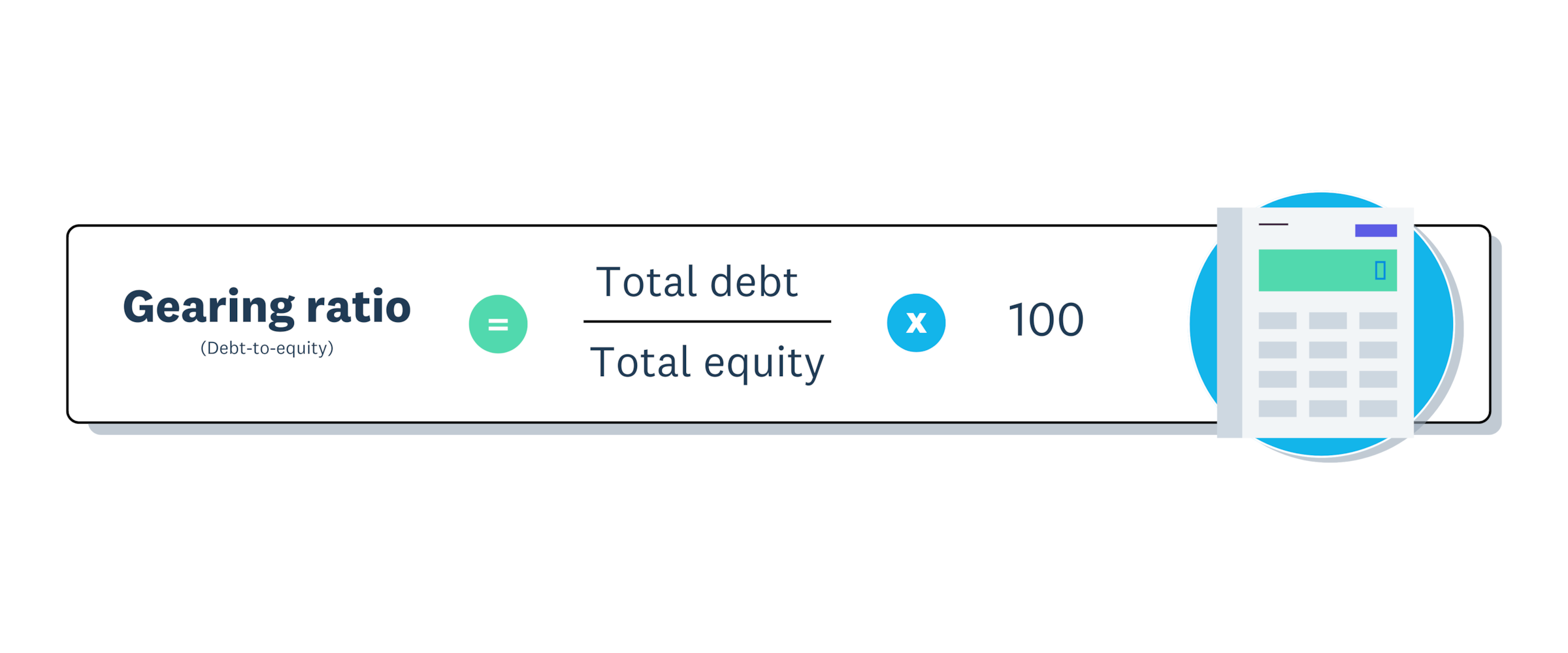

- Debt-to-equity ratio: compares total debt to total equity, showing how much of your business is funded by creditors versus owners

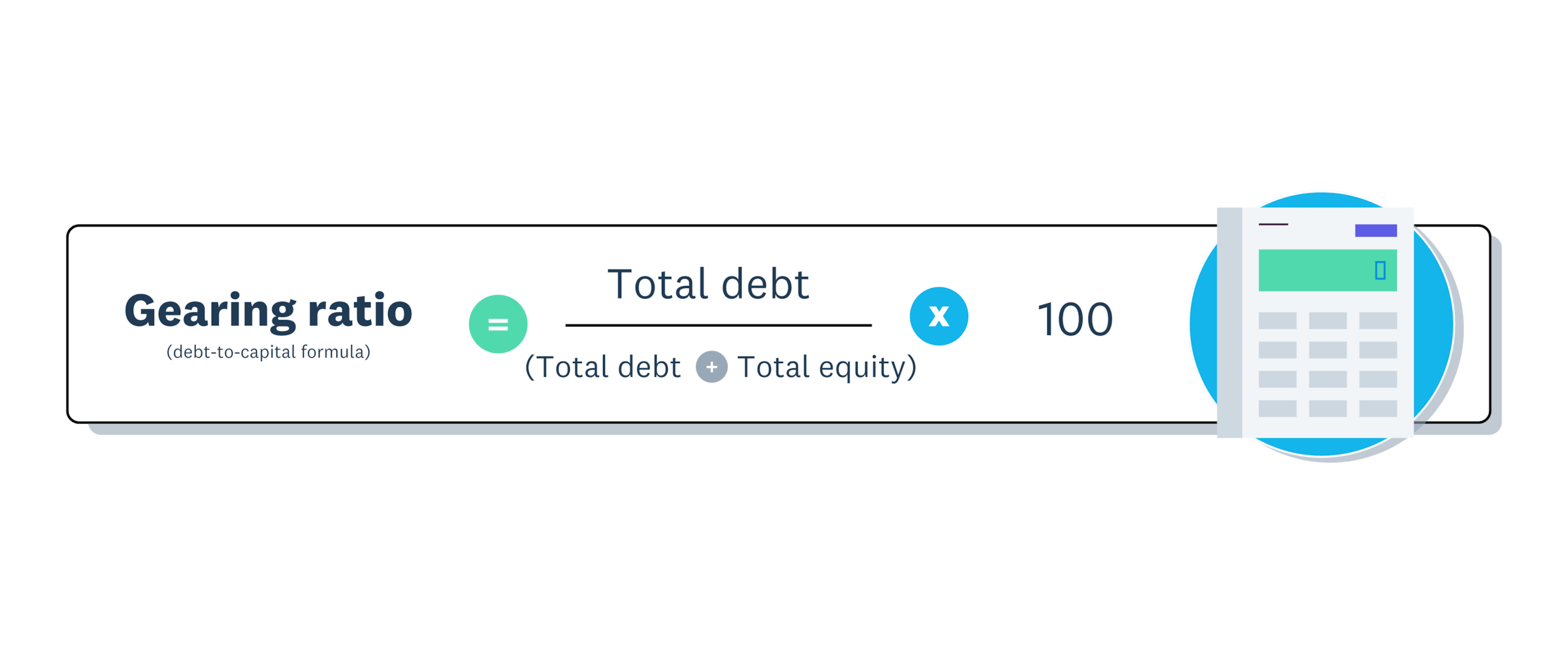

- Debt-to-capital ratio: measures the proportion of total capital (debt + equity) funded by debt, with higher ratios suggesting greater reliance on borrowing

- Equity ratio: represents the share of total assets financed by equity, with higher ratios indicating stronger financial stability

- Times interest earned (TIE) ratio: assesses your ability to cover interest payments with pre-tax earnings, reassuring lenders you can meet debt obligations

Debt to equity ratio versus gearing ratio

The debt-to-equity ratio and gearing ratio both measure financial leverage, but they serve different purposes:

- Debt-to-equity ratio: specifically compares long-term debt to shareholders' equity, useful for quickly assessing finances

- Gearing ratio: a broader measure using various formulas that consider different types of debt relative to capital structure, helping you plan for the long term

Both ratios help you evaluate financial risk.

Why does your gearing ratio matter?

Your gearing ratio indicates your business's financial health. Tracking and managing it helps you make smarter financial decisions and plan for steady, long-term growth.

- Assess borrowing capacity: judge whether you can take on more debt without straining cash flow or increasing financial risk

- Attract investors and lenders: signal financial stability with a balanced ratio, making your business more appealing to potential funders

- Align strategic planning: match your debt-to-equity structure with growth goals, whether aiming for rapid expansion or steady, low-risk growth

- Maintain cash flow stability: free up more cash for reinvestment with a lower ratio, or manage higher debt repayments with a higher ratio

- Manage risk proactively: spot financial vulnerabilities early by reviewing your ratio regularly and taking corrective action

How to calculate the gearing ratio

Calculate your gearing ratio in four steps to understand your business's debt-to-equity balance.

- Calculate total debt: Include all financial liabilities, such as loans, bonds, and credit lines

- Determine total equity: Add retained earnings and share capital to find the owner's total investment in the business

- Apply a gearing ratio formula: Use one of these common formulas. The debt-to-equity formula is: Gearing ratio = (Total Debt / Total Equity) × 100. The debt-to-capital formula is: Gearing ratio = (Total Debt / (Total Debt + Total Equity)) × 100

- Interpret the result: A higher percentage indicates greater reliance on debt, while a lower percentage shows a stronger equity position.

Example gearing ratio calculations

These practical examples show how to calculate a gearing ratio:

- Total debt: $50,000

- Total equity: $100,000

Using the debt-to-equity formula:

Gearing ratio = (Total debt / Total equity) × 100

Gearing ratio = ($50,000 / $100,000) × 100 Gearing ratio = 50%

Using the debt-to-capital formula:

Gearing Ratio = (Total Debt / (Total Debt + Total Equity)) × 100

Gearing Ratio = ($50,000 / ($50,000 + $100,000)) × 100 Gearing Ratio = ($50,000 / $150,000) × 100 Gearing Ratio = 33.3%

Gearing ratio analysis

A good gearing ratio typically falls between 25% and 50% for most small businesses. Anything in this range is generally considered a low gearing ratio, though this varies by industry and growth stage. Interpret your results as follows:

- Low gearing (below 30%): suggests a strong equity position, offering lower risk exposure and greater stability

- Moderate gearing (25–50%): generally represents a balanced financial approach for most small and medium-sized businesses (SMBs)

- High gearing (above 50%): indicates heavier reliance on debt and increased financial risk

Typical gearing ratios vary significantly by industry, growth stage, and risk tolerance. Many SMBs maintain a 30% to 50% debt mix, using borrowed funds to support growth while relying on equity for stability.

High versus low gearing: What's the difference?

The difference between high and low gearing comes down to how you balance debt and equity to fund your business.

High gearing means relying more on debt than equity. If you take out a large loan to buy inventory and renovate, you'd have a high gearing ratio. This approach works well when:

- your business has stable cash flow that can service debt

- you're in a high-growth industry where revenues are increasing

- you need to borrow to grow quickly

The risk? If revenues drop or interest rates jump, high debt becomes a burden.

Low gearing means using more equity and less debt. If you expand by using saved profits, you may grow more slowly but keep financial risk to a minimum. Low gearing is the 'safety first' choice when:

- market conditions are unstable

- you're prioritising long-term security

- you want to protect your credit rating

Finding the right balance helps you manage financial risk so your business is ready to seize growth opportunities.

Manage your gearing ratio with Xero

Manage your business's finances simply and efficiently with Xero. Track your gearing ratio and other important metrics with automated calculations and real-time financial reports. Streamline accounting tasks, stay compliant, and share clear, up-to-date information with investors and lenders.

Get one month free and make confident financial decisions.

FAQs on gearing ratios

Answers to common questions about gearing ratios for small businesses.

How often should I review my gearing ratio?

Review your gearing ratio quarterly, or whenever you're considering taking on new debt or making significant financial decisions. Monitoring regularly helps you spot trends and address issues early.

Can my gearing ratio be too low?

Yes. A very low gearing ratio may indicate you're not using debt wisely to grow your business. For instance, some analysis suggests a ratio below 25% means you may not be able to take advantage of expansion opportunities when interest rates are low. Some debt can help fund expansion and improve returns on equity.

How does my gearing ratio affect my ability to get a loan?

Lenders use your gearing ratio to assess risk. A ratio above 50% may make borrowing more difficult or expensive, while a balanced ratio (25–50%) signals you can manage additional debt responsibly.

What should I do if my gearing ratio is too high?

Reduce your gearing ratio by paying down existing debt. You can also increase equity through retained earnings or new investment, or avoid new borrowing until your ratio improves. One way to increase equity is to authorise the sale of company shares, which can sometimes pay off up to 30% of debt.

Does my industry affect what's considered a good gearing ratio?

Yes. Capital-intensive industries like manufacturing or property often have higher acceptable ratios. Debt-to-equity ratios sometimes exceed 80% due to financing expensive equipment. In contrast, service businesses typically maintain lower ratios (20–40%). Compare your ratio to industry standards for context.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.