Difference between quick ratio and current ratio

February 2024 | Published by Xero

Quick vs current ratio (comparison)

The quick ratio measures a business’s ability to meet costs in the next 3 months, while the current ratio looks at costs for the next 12 months.

Current ratio meaning

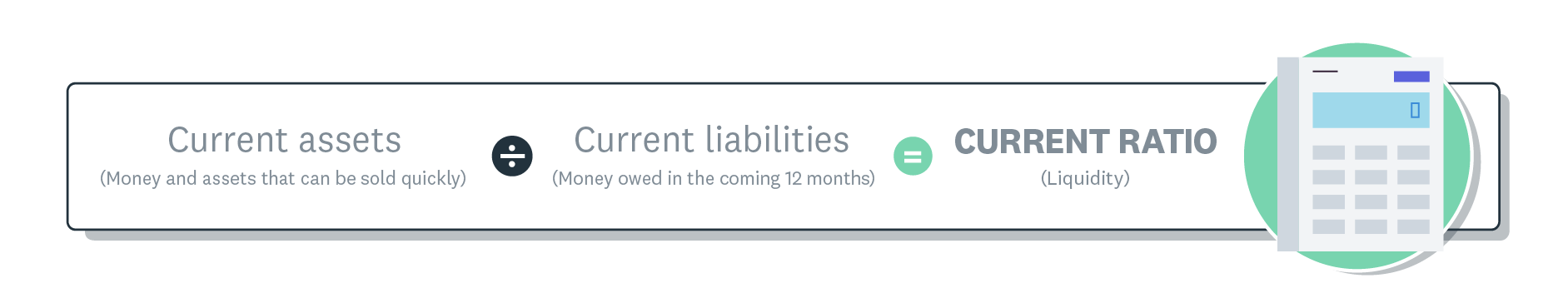

The current ratio (also called working capital ratio) shows a business how easily it can cover upcoming costs in the next 12 months. It counts assets the business will convert to cash within 12 months, and liabilities that will come due in that period.

The formula for calculating the current ratio is:

Current ratio liquidity formula.

Quick ratio meaning

The quick ratio (also called the acid test ratio) shows a business how easily it can cover its costs in the next three months. The calculation includes liquid assets (those that can be converted to cash within three months) and liabilities that will come due in the same period.

There are two formulas for calculating the quick ratio.

Version 1:

-calculation-1.1708626946524.png)

Quick ratio formula Version 1.

Version 2:

-calculation-2.1708626946541.png)

Quick ratio formula Version 2.

The biggest difference between the two formulas is what qualifies as a liquid asset and how they’re calculated. In the first formula, liquid assets include cash, cash equivalents like certificates of deposit, and investments and receivables. In the second formula, you begin with your current assets and subtract your inventory, which can’t be converted into cash quickly, and prepaid expenses.

Similarities between the quick ratio and current ratio

Both ratios measure the ability of a business to pay its bills and repay its loans within a set time period. Each ratio should be measured at the same time each month, as the ratio can change depending on where the business is in its billing cycle.

Differences between the quick ratio and current ratio

The biggest difference between the ratios is the periods of time they cover. The quick ratio looks at the next 3 months, while the current ratio looks at the next 12 months.

Another difference is what goes into the calculation:

- The quick ratio uses a more conservative definition of liquid assets like cash, and short-term investments and receivables that can be converted to cash within three months

- The current ratio uses current assets that extend beyond a three-month period, such as prepaid expenses and inventory

While both ratios are valuable, businesses may prefer one over the other. For example, businesses that rely less on inventory and retail businesses that have seasonal inventory may prefer the quick ratio, as the inclusion of inventory would cause the current ratio to fluctuate. Retail businesses with consistent inventory may prefer to use the current ratio.

Decisions about the liquidity of a business should ultimately be based on trends in several metrics. An accountant can help with this analysis.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory.

Balance sheet template

See where and how assets and liabilities are reported.

Push-button liquidity reporting

Check your current ratio whenever you like with Xero’s accounting dashboard.

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.