Small business sales and jobs growth slowed in March as Omicron peaked

March growth slowed compared to February but remained positive year-on-year

Wellington — 28 April, 2022 — Xero, the global small business platform, today released its Xero Small Business Index for March 2022, with sales and jobs growth slowing compared to February but remaining ahead of March 2021.

Small business sales slowed to 3.7 percent year-on-year (y/y) growth in March, after four months of double digit growth. Jobs growth also slowed to 2.7 percent y/y, from 4.1 percent y/y in February.

Xero’s Managing Director for New Zealand & Pacific Islands, Craig Hudson, says the resilience of the small business community in the face of rising Omicron cases is remarkable.

“With the high number of Omicron cases across the country forcing many small business employees to isolate themselves, the slowdown in sales and jobs growth is not unexpected. But, it is encouraging to see annual growth has remained positive despite the challenging conditions,” says Hudson.

In March, all sectors except hospitality and agriculture had positive sales year-on-year. Construction (+6.2% y/y) and professional services (+4.7% y/y) remain two of the strongest industries in terms of sales, followed by manufacturing (+4.4% y/y) and retail (+4.3% y/y).

.1651090339700.png)

“Even with the solid overall results in March, we need to remember not all small businesses are doing well. It’s important to continue supporting your local community, especially if they’ve experienced Omicron-related staff shortages,” says Hudson.

“As the Omicron surge plays out, we’ve consistently seen hospitality bear the brunt of COVID-19 challenges, with sales down 6.6 percent y/y.

“Sales in the agriculture sector were also down 1.0 percent y/y. Interestingly, the Waikato region saw a major slowdown in sales - down 0.7 percent y/y in March after growing 19 percent y/y in February.”

Wages climb with inflation

Looking at wage growth, all regions across Aotearoa recorded above 4 percent wage growth, with Waikato the strongest at 4.9 percent.

“As we reach record high levels of inflation, it’s important we see employee earnings stay on par with the rising costs of living,” says Hudson.

“The challenge will be for small business owners when it comes to managing these increasing costs, and how to stay afloat in already difficult times.”

Jobs growth recorded in March

For the fourth month in a row, the strongest region for jobs growth was Otago (+5.7% y/y). Canterbury (+5.0% y/y) and Wellington (+3.7% y/y) also both recorded solid results while Bay of Plenty was the weakest region but still heading in the right direction at +0.3 percent y/y.

The strongest sectors for job gains were professional services (+7.0% y/y), manufacturing (+6.5% y/y) and construction (+5.4% y/y).

“Although less than the 4.1 percent rise in February, we still saw jobs increase 2.7 percent y/y, despite the high level of COVID-19 cases impacting the small business workforce,” says Hudson.

“Hospitality jobs (-11.0% y/y) were hardest hit by disruption from COVID-19 illness and self-isolation. This was the seventh month in a row of negative growth for that sector.

“With the borders opening over the next few months, the hope is the hospitality and tourism sector will begin to see some rejuvenation in the latter half of 2022.”

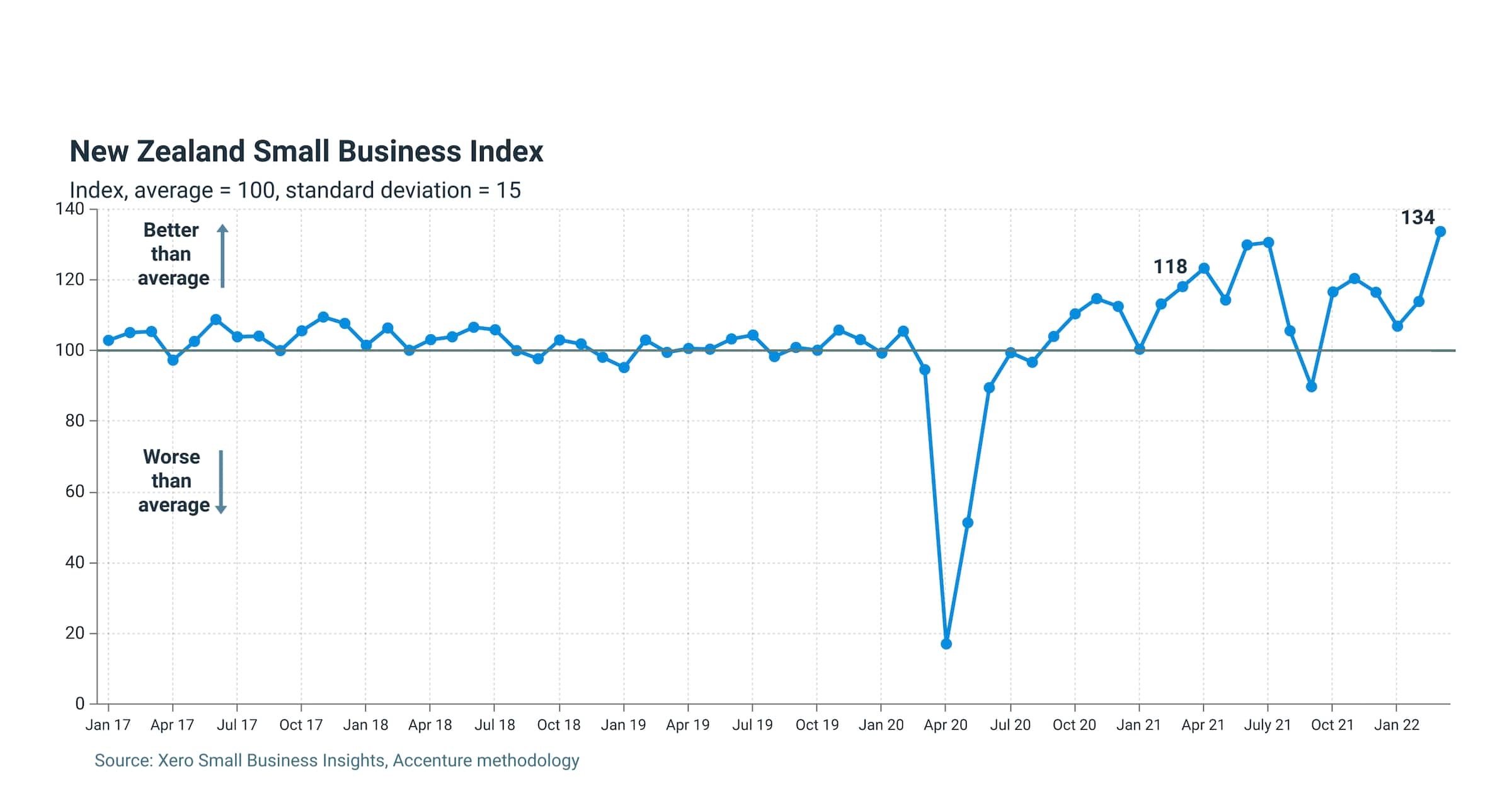

Record high Small Business Index score

Despite the impacts of Omicron on the small business economy, the New Zealand Small Business Index rose 20 points to 134 points in March, the highest level since the series began in January 2017.

“The very strong Index result was driven by a significant 2.4 day improvement in the time small businesses waited to be paid to 21.3 days - the lowest result since the series began,” says Hudson.

“While this is a very good sign, we’re conscious it aligns with the end of Aotearoa’s financial year, the busiest time for accounting.

“This impacts how small businesses file their results and caution should be used in interpreting the time to be paid measurement. We saw a similar result at the end of the previous financial year which was subsequently revised the following month.”

ENDS

Media Contact

Amelia Lewis | Xero Communications | amelia.lewis@xero.com

About Xero

Xero is a cloud-based accounting software platform for small businesses with over 3 million subscribers globally. Through Xero, small business owners and their advisors have access to real-time financial data any time, anywhere and on any device. Xero offers an ecosystem of over 1,000 third-party apps and 300 plus connections to banks and other financial partners. For three consecutive years (2020-2022), Xero has been included in the Bloomberg Gender-Equality Index. In 2021, Xero was included in the Dow Jones Sustainability Index (DJSI), powered by the S&P Global Corporate Sustainability Assessment and in 2020, Xero was recognised by IDC MarketScape as a leader in its worldwide SaaS and cloud-enabled small business finance and accounting applications vendor assessment.

About Accenture

Accenture worked in collaboration with Xero on the design and methodology of the Index prior to February 2022. Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialised skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders.

Related media and enquiries

For all media enquiries, please contact the Xero media team.

- Media release

New data shows slow job growth is stalling small business recovery

Small businesses across the UK are struggling to fill job vacancies, according to Xero

- Media release

Xero appoints Chris O’Neill as Chief Growth Officer

New executive role to lead growth of Xero’s small business platform and strategic development of Xero in the Americas

- Media release

Xero named as FIFA Women’s Football Partner

Xero named as latest FIFA Women’s Football Partner under new commercial partnership structure

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.