Bank reconciliation in South Africa made easy

Keep your financial records up to date with fast and simple reconciliation. Easily match your bank data with bills, invoices, and receipts using Xero’s bank reconciliation accounting software.

Spend less time on bank reconciliation

Focus on running your business with bank account reconciliation software that saves you time and helps you keep accurate accounting records.

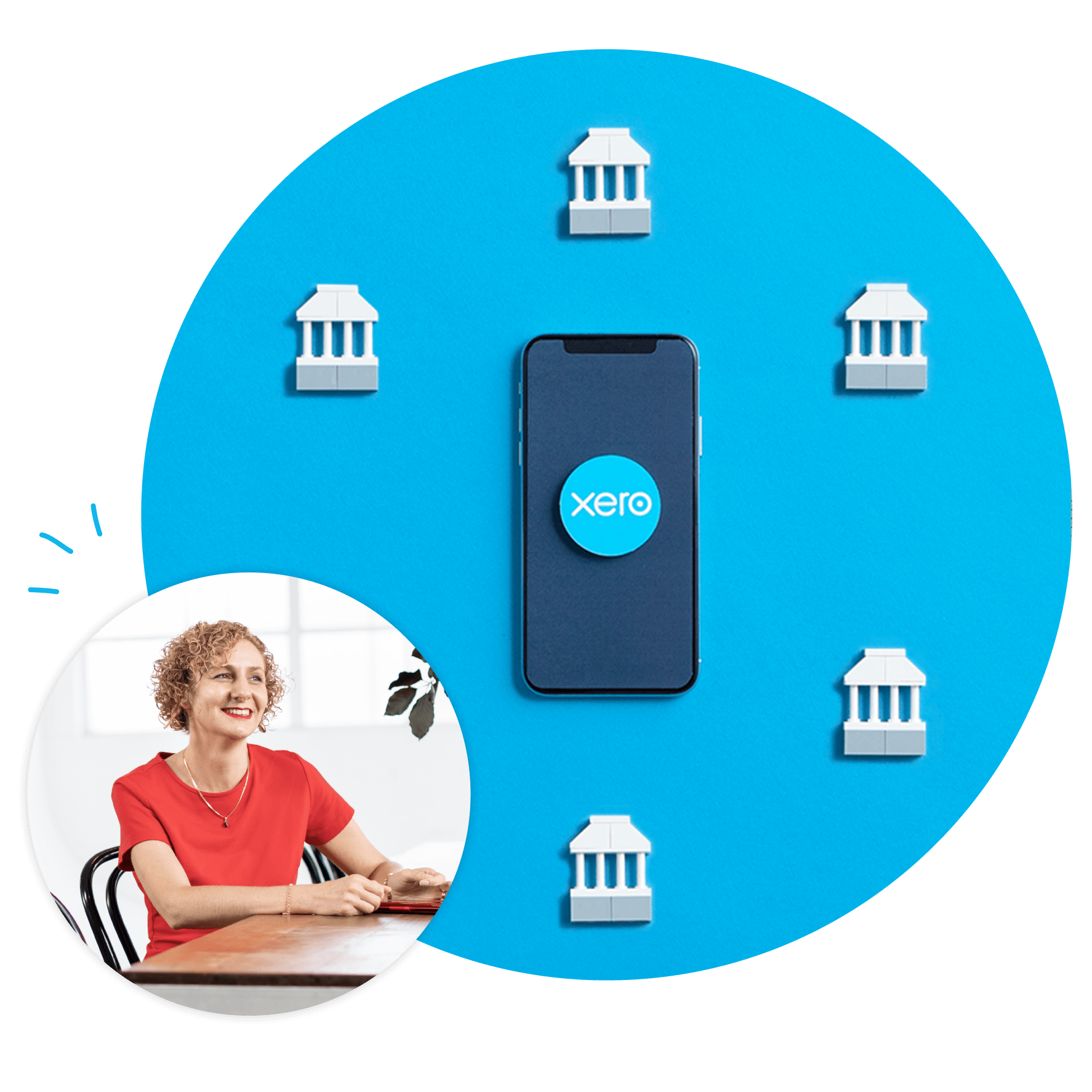

Import data from your bank

Xero connects to your bank and pulls in data regularly, ready to reconcile at a time that suits you.

Reconcile accounts easily

See suggested matches for your transactions, so you can reconcile bank data in a few clicks.

Bank reconciliation on the go

Do bank reconciliation at any time, on multiple devices. Reconcile transactions from your desk or on the train.

It’s something I’m going to be able to teach my future employees

Xero gives John a better idea of his cash flow at Horsetooth Hotsauce

A better way to do your bank reconciliation

Bank reconciliation is part of running your South African business. Xero’s bank reconciliation software helps eliminate manual effort and clarify your cash flow.

- Import your bank transactions directly into Xero for a clear view of cash balances every day

- Spot errors (and fraud) quickly them with automated transaction matching

- No more manual data entry – transactions appear in Xero automatically, ready for you to match

Complete your account reconciliation in minutes

Live bank data flows into Xero, so you get daily reconciliation accounting updates on bank transactions, including cash account balances – from any device, at any time.

- Use your downtime to do your bank reconciliation in just moments with the Xero Accounting app

- Automate bank statement balance record matching so your data stays clean and tax compliant

- Do it on mobile – the Xero Accounting app lets you reconcile transactions wherever and whenever you like

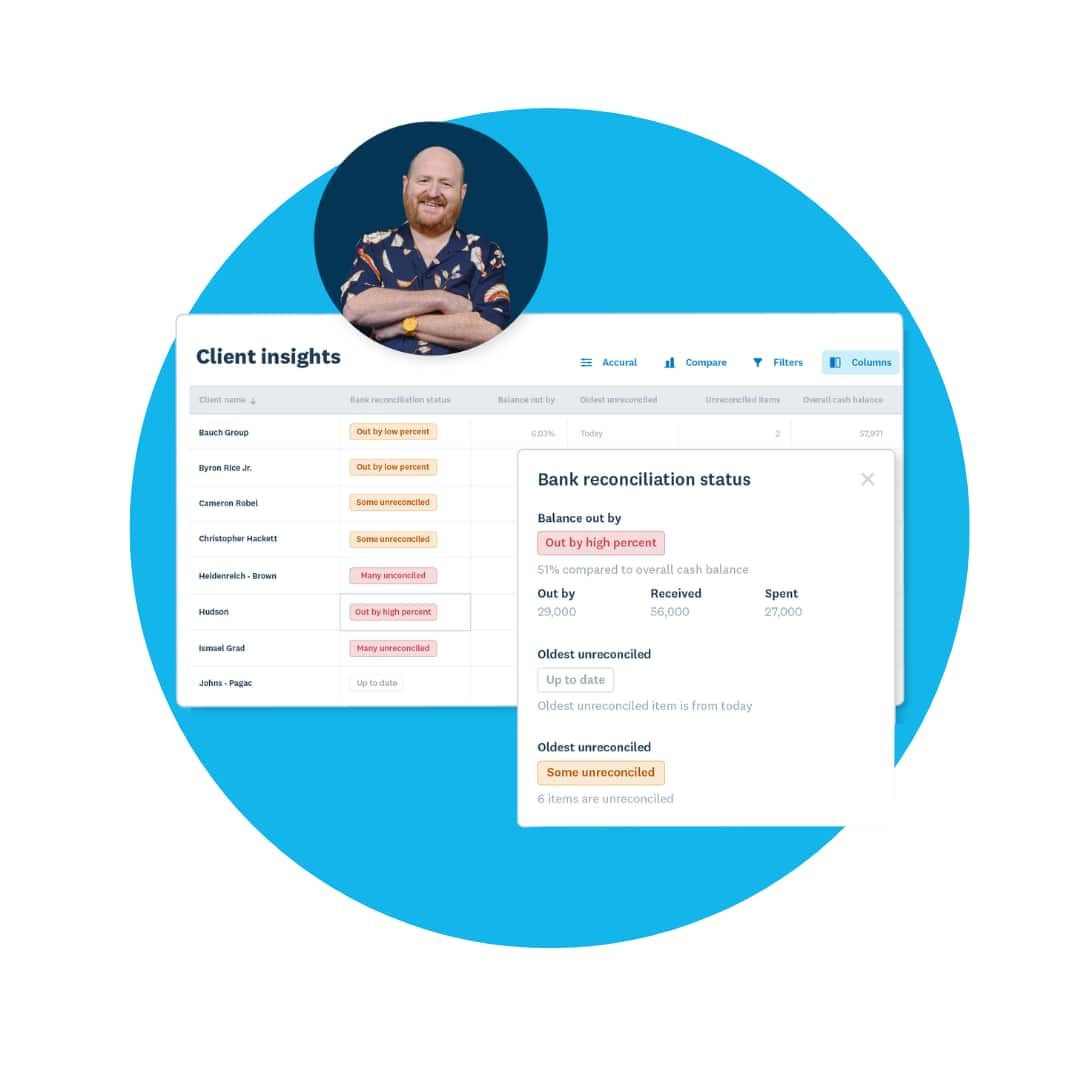

Faster, smarter bank reconciliation with suggested matches

Xero’s account reconciliation software matches your transactions, categorises them, and applies bank rules you create. Xero does the account reconciliation work for you – All you have to do is review, amend if needed, and approve! Job done.

- Quickly match data from your bank statements to invoice or bill payments

- No match? No problem. Create a new transaction in Xero to match against a bank statement line in Xero. Simple.

- Reconcile your way – set up bank rules to match and manage the same types of transactions the same way. Perfect reconciliation every time.

Reconcile multiple transactions at once

Save time dealing with bulk transactions. Xero’s account reconciliation handles transactions in bulk if you’re on the Standard or Premium plan.

- Let Xero sort and group transactions automatically, then reconcile them in one go

- Set up alerts suggest matches to regular invoices or bills, saving you time

- Create bank rules to automatically manage groups transactions the same way every time

Bank reconciliation software to support your South African small business

With Xero, completing your account reconciliation is fast and painless. And with smart match suggestions and Xero’s bank rules feature, it’s never been easier to make sense of your numbers. That means less mundane data entry and more time for your business!

See how Xero can take the burden off of your small business

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Bank reconciliation FAQs

Getting bank data into Xero for reconciliation is simple. Most banks can connect to Xero so data flows in automatically. Then you can set your opening balance.

Getting bank data into Xero for reconciliation is simple. Most banks can connect to Xero so data flows in automatically. Then you can set your opening balance.

If you set up a bank feed in Xero, Xero pulls in data from your bank statements automatically, so you can reconcile transactions with your business accounting records. To make things easier, Xero also automatically suggests matches for transactions with your invoices, bills, and payments. You can check these matches are correct and accept them to reconcile.

If you set up a bank feed in Xero, Xero pulls in data from your bank statements automatically, so you can reconcile transactions with your business accounting records. To make things easier, Xero also automatically suggests matches for transactions with your invoices, bills, and payments. You can check these matches are correct and accept them to reconcile.

Absolutely. Review and match bank data over your morning coffee or in any free moment using the Xero accounting app.

Absolutely. Review and match bank data over your morning coffee or in any free moment using the Xero accounting app.

If done with Xero, yes. Bank reconciliation is the process of confirming that the transactions in your bank accounts are recorded in your business accounting records. When done manually it can be tedious and time-consuming, but in Xero, it’s simple to do. When Xero is connected to your bank, your bank data flows in automatically. Xero automatically suggests matches (which you can accept to reconcile) or you can create your own rules for reconciling certain kinds of transactions.

If done with Xero, yes. Bank reconciliation is the process of confirming that the transactions in your bank accounts are recorded in your business accounting records. When done manually it can be tedious and time-consuming, but in Xero, it’s simple to do. When Xero is connected to your bank, your bank data flows in automatically. Xero automatically suggests matches (which you can accept to reconcile) or you can create your own rules for reconciling certain kinds of transactions.

Yes – keep your bank reconciliation up-to-date and you can view your bank account balances, cash flow, unpaid invoices, monthly profit and other insights. See reconciled bank data and receive alerts about unreconciled transactions on the Xero dashboard.

Yes – keep your bank reconciliation up-to-date and you can view your bank account balances, cash flow, unpaid invoices, monthly profit and other insights. See reconciled bank data and receive alerts about unreconciled transactions on the Xero dashboard.

Yes, you can edit all fields on reconciled and unreconciled transactions in the Account Transactions tab of your bank accounts in Xero. If you’re editing a reconciled transaction, any edited line amounts must add up to the same amount as the original reconciled item. If the changes you make will affect the total, you should delete the transaction and start over instead, using the ‘Remove & Redo’ function.

Yes, you can edit all fields on reconciled and unreconciled transactions in the Account Transactions tab of your bank accounts in Xero. If you’re editing a reconciled transaction, any edited line amounts must add up to the same amount as the original reconciled item. If the changes you make will affect the total, you should delete the transaction and start over instead, using the ‘Remove & Redo’ function.

Yes, you can bulk-reconcile multiple statement lines related to cash transactions in Xero using cash coding. It creates new receive or spend money transactions for cash payments. This process is fast and efficient, displaying statement lines in a spreadsheet format, making it easy to sort and code similar transactions. You can view up to 200 lines at once and can choose to work through them individually or select multiple lines for reconciliation simultaneously. Cash coding is available on the Grow, Comprehensive and Ultimate plans. To access it, go to 'Bank accounts' in the Accounting menu, choose the bank account you want to reconcile, and select the 'Cash coding' tab.

Learn more on how to reconcile transactions in bulkYes, you can bulk-reconcile multiple statement lines related to cash transactions in Xero using cash coding. It creates new receive or spend money transactions for cash payments. This process is fast and efficient, displaying statement lines in a spreadsheet format, making it easy to sort and code similar transactions. You can view up to 200 lines at once and can choose to work through them individually or select multiple lines for reconciliation simultaneously. Cash coding is available on the Grow, Comprehensive and Ultimate plans. To access it, go to 'Bank accounts' in the Accounting menu, choose the bank account you want to reconcile, and select the 'Cash coding' tab.

Learn more on how to reconcile transactions in bulk

Run your entire business with Xero

Bank reconciliation is just the start: Xero helps you run your entire business more efficiently. Automate day-to-day tasks, get paid sooner with online invoicing, and get tailor financial reports for business insights so you can plan with confidence.

Accept online payments

Let customers pay your invoices online – to get invoices paid fast boost your cash flow can bring income to your business more flexibly.

Learn more about accepting payments with XeroTrack project time

Record the time spent on work accurately and with ease, know if you’re going over, and when ready, turn the data straight into an invoice.

Learn more about time tracking with XeroGet instant financial statements

Get a financial health update with Xero’s customisable reports to make informed, confident decisions about the future.

Get instant financial statements

Check out our small business guides

Bank reconciliation is just one piece of the puzzle. Here are some guides on key topics for business owners.

What is bank reconciliation?

Let’s take it back to basics. Once you understand bank reconciliation, you can get it right every time.

How to do bank reconciliation

Making sure every transaction is accounted for isn’t just about compliance – it’s about financial confidence.

Growing your business

Ready to scale up? Here are some ways you can achieve healthy business growth.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

FAQs about Xero in South Africa

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App Store.

See how bank transactions flow securely into Xero

This video will make you hungry.

Xero’s bank reconciliation experts are here to help

Our team is here to make bank reconciliation easy for you.

Bank reconciliation in Xero

See how bank reconciliation works, including how to tell the difference between statement lines and transactio

Learn how to reconcile transactions

Reconcile payments between Xero and your bank account, including creating bank rules.

Reconcile your accounts step by step

Review imported bank statement lines and match them to transactions in Xero.