Mandatory E-Invoicing in Malaysia: what you need to do

As a small business owner, you must follow new rules for how to invoice your customers. The Inland Revenue Board of Malaysia (IRBM) is rolling out a national initiative requiring businesses to adopt electronic invoicing and report transactions. Your deadline depends on your turnover.

Instant invoicing.

What is E-Invoicing?

E-Invoicing is a structured way to send invoices in a digital format – streamlining the process and encouraging faster payments. The Malaysian government is phasing in a mandatory E-Invoicing initiative, which asks businesses to report their financial transactions to IRBM.

All small businesses must comply by set dates

Check out this timeline for your deadline to implement E-Invoicing, and requirements you’ll need to follow.

E-Invoicing uses the Peppol network

Send your invoices between accounting systems via Peppol’s secure global public network rather than by email.

Xero helps you follow E-Invoicing guidelines

Register for electronic invoicing in Xero and let the clever automations handle the data entry for you.

Xero has strong E-Invoicing experience

Trust Xero as one of the largest international E-Invoicing providers, supporting 450,000 global customers.

Download the E-Invoicing guide

Get prepared for E-Invoicing with our comprehensive guide. Learn what E-Invoicing means for you, including key dates and how to prepare.

Who needs to follow the E-Invoicing rules?

The government’s rules apply to all businesses across Malaysia. E-Invoicing and monthly reporting to IRBM will soon be your new normal – a faster, more secure way to handle your billing. Make sure to familiarise yourself with what E-Invoicing means for your small business.

Here are LHDN’s full E-Invoicing in Malaysia guidelines (PDF)

Your timeline to introduce E-Invoicing

The government is rolling out E-Invoicing in phases based on your business turnover. If your annual turnover is between RM500,000 and RM25 million, you have until 1 July 2025 to switch to electronic invoices, for example. You’ll then have a 6-month ‘relaxation period’ with slightly different rules:

- You won’t need to issue individual E-Invoices during this initial 6 months

- Instead, you can issue consolidated E-Invoices for all your business transactions and activities

- This gives you time to prepare for your full E-Invoicing implementation

Benefits of E-Invoicing for Malaysian businesses

Why the change in process? The old system of sending invoices by email – or in the post – is replaced with electronic invoices, giving you more accuracy and security when it comes to billing. E-Invoicing:

- Saves time filing with IRBM

- Makes it easy to stay compliant

- Digitises your tax and financial reporting

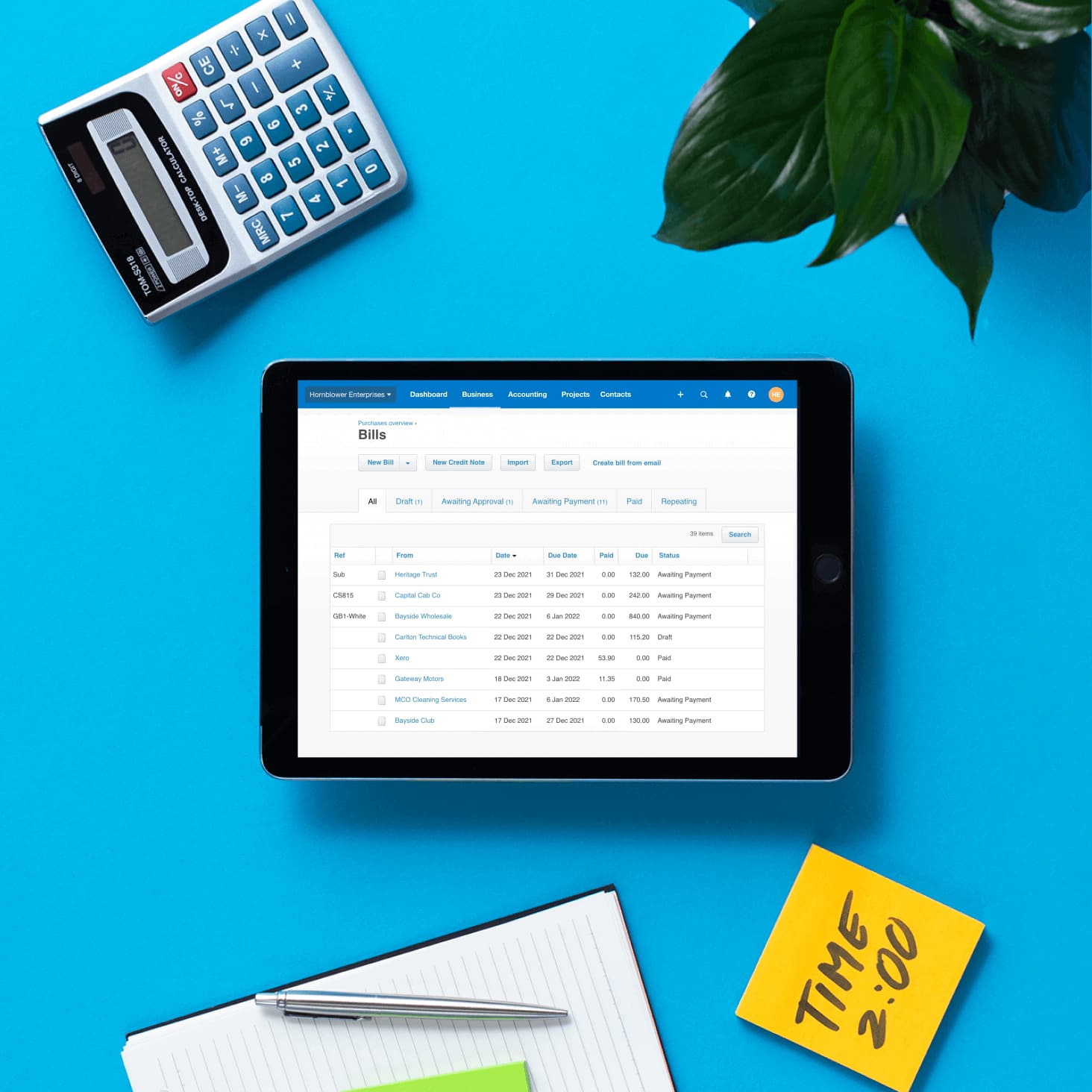

Master your electronic invoicing with Xero

It’s easy to follow government rules with Xero software. Instead of using the MyInvois portal each time, let Xero automate the data entry and save yourself precious hours on your admin. Xero is a certified Peppol service provider that’s accredited by MDEC. And it’s simple to get started!

Here’s how to set up E-Invoicing with Xero (PDF)

Keep growing with Xero’s accounting software

Introduce E-Invoicing and grow your business with confidence. Xero’s accounting software supports your goals, whether it’s strengthening your billing process, streamlining your payroll admin, or understanding your financials with in-depth customised reporting.

Discover more about E-Invoicing in Malaysia with Xero

Simplify e-Invoicing Compliance in Malaysia with Xero

Discover how Xero can help you navigate Malaysia's e-invoicing changes with ease in our dedicated free webinar. You will learn about:

- What e-invoicing is and the Malaysian government mandates

- What Xero is doing to help support businesses with these mandates

Frequently asked questions about e-Invoicing

Along with more than 20 countries worldwide, Malaysia uses Peppol as the network provider for e-Invoicing due to its maturity, interoperability, and well-governed standards. MDEC (Malaysia Digital Economy Corporation) is Malaysia’s Peppol authority. It accredits Malaysia's Peppol service providers and Peppol-ready solution providers, specifying local requirements and technical standards, governing the overall Peppol framework compliance, and promoting the business adoption of e-Invoicing in Malaysia.

Learn more about MDECAlong with more than 20 countries worldwide, Malaysia uses Peppol as the network provider for e-Invoicing due to its maturity, interoperability, and well-governed standards. MDEC (Malaysia Digital Economy Corporation) is Malaysia’s Peppol authority. It accredits Malaysia's Peppol service providers and Peppol-ready solution providers, specifying local requirements and technical standards, governing the overall Peppol framework compliance, and promoting the business adoption of e-Invoicing in Malaysia.

Learn more about MDECYou can look up which businesses are registered for e-Invoicing in the Peppol directory for Malaysia.

Search for registered businesses in the Malaysia Peppol directoryYou can look up which businesses are registered for e-Invoicing in the Peppol directory for Malaysia.

Search for registered businesses in the Malaysia Peppol directorye-Invoicing is included in Xero Starter, Standard and Premium plans; you don’t need to purchase any additional add-on or external service, and accountants and bookkeepers can register on behalf of their business clients. Businesses will still receive bills by email and other methods.

Learn how e-Invoicing workse-Invoicing is included in Xero Starter, Standard and Premium plans; you don’t need to purchase any additional add-on or external service, and accountants and bookkeepers can register on behalf of their business clients. Businesses will still receive bills by email and other methods.

Learn how e-Invoicing works

Prepare for your switch to E-Invoicing

Here’s more info on electronic invoicing. You can use Xero’s E-Invoicing system if you’re on a Xero Starter, Standard, or Premium plan.

Malaysia’s national E-Invoicing initiative

Learn how E-Invoicing helps small businesses and why the government supports it.

What you need to know about E-Invoicing

Discover how E-Invoicing is the easier way to invoice in this Xero blog post.

Register at the MyInvois portal

Connect Xero to E-Invoicing using your TIN (tax identification number).

Try Xero free for 30 days

Access Xero features for 30 days, then decide which plan best suits your business.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.