What is the working capital ratio?

February 2024 | Published by Xero

Working capital ratio (definition)

The working capital ratio is a calculation of a business’s ability to pay its bills and loan repayments in the coming 12 months.

It’s also called the current ratio, and is a longer-term measure of liquidity than the quick ratio.

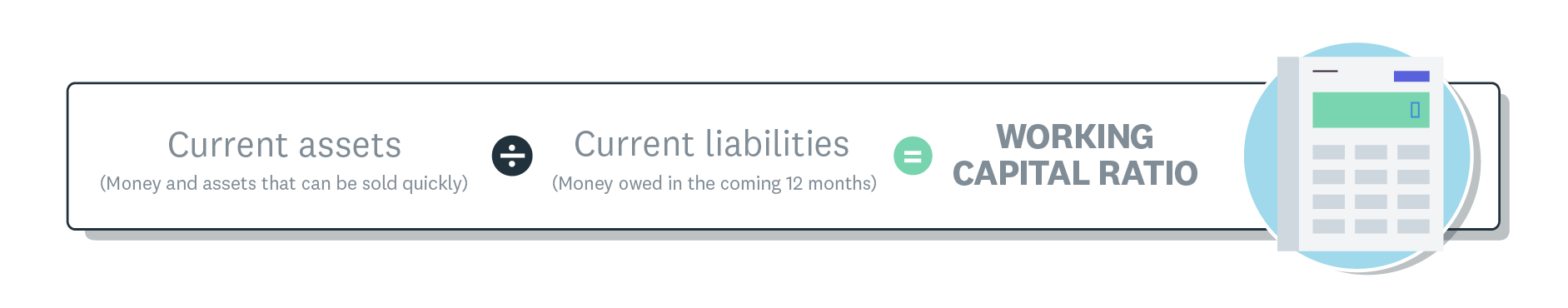

The working capital ratio formula compares current liabilities – amounts owed in the next 12 months – against current assets, which include cash, payments due, and any assets that could be sold within the next 12 months.

Working capital ratio liquidity formula.

What the working capital ratio means for a small business

- A ratio of 1.0 or more shows the business can cover its costs and is doing OK

- A ratio of less than 1.0 isn’t ideal but isn’t necessarily a bad thing – a business in a growth phase can expect to have bigger bills and may find their working capital ratio drops below 1.0 for a time

- But a ratio that is stuck below 1.0 is something a business should try to avoid

The working capital ratio should be measured at the same time every month as the result of the calculation changes depending on where a business is in its billing cycle. The business can then be sure it’s accurately measuring the trend in its liquidity.

Other liquidity ratios

Although the working capital ratio is the most common way for small businesses to measure liquidity, there two other ratios:

- Quick ratio (or acid test ratio): It only uses assets that can be changed into cash within three months

- Cash ratio: Cash and cash equivalents divided by current liabilities

Learn more in our guide on liquidity ratios.

How working capital ratio differs from working capital, free cash flow, and cash flow

The working capital ratio measures a business’s spending power, similar to cash flow, free cash flow, and working capital. But where the working capital ratio shows how easily a business can cover upcoming costs:

- cash flow refers to the general availability of cash

- free cash flow is the amount of cash left after making capital investments

- working capital shows how much money will be left after covering the upcoming costs

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory.

Balance sheet template

See where and how assets and liabilities are reported.

Push-button liquidity reporting

Check your current ratio whenever you like with Xero’s accounting dashboard.

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.