Small business trends 2023

A look at what businesses did in 2022, and what they’ll do more of in 2023.

Top 10 business trends and where they came from

It’s been another year of experimentation and improvisation by small businesses, who’ve battled inflation and a cooling economy. These small business trends are based on research across the USA, Canada, the UK, Singapore, Australia and New Zealand, with commentary from experts in many of those same regions.

Published October 2022

Business trends 2023

Business trend 1

Dealing with a budget-shredding cost hike (that’s strangely not all bad)

Business expenses leapt massively in 2021 alone, when inflation was just getting started. By way of example, figures out of the UK show an 18% cost hike for small businesses. So why are costs climbing so steeply?

Xero Economist, Louise Southall compared YoY expenses and sales across Xero’s accounting software users to find out.

“Sales rebounded, which meant businesses had to spend more on supplies and labour, and then inflation started pushing up costs as well. Official national statistics, such as the consumer price index, suggests that trend is continuing into 2022.”

That has made budgeting incredibly tricky. After two years of disruption, not many businesses have an extra 14-18% sitting around to cover surging costs.

“Lots of businesses carry just enough cash for a month’s expenses so there isn’t a big war chest to call on,” says accountant Paul Bulpitt of The Wow Company.

“Higher interest rates are making finance expensive so some businesses are running out of options. It’s a time to focus on the activities that still make money and to make some hard decisions about the things that don’t.“

As a result, one of the top business trends for 2023 will be to prioritise profitability and really focus on the highest-performing products and services. Accountants and bookkeepers can help identify the profit drivers in your business. Find one in the Xero advisor directory.

Business trend 2

Pick up the inflation tab, or pick up prices – a tough call for some

As costs climb across the economy, small businesses are picking up a lot of the inflation burden because they’re slow to raise prices.

“A small business might see their costs go up 30% and they feel that pain immediately,” says Marc Cowling, Professor of Economics and Productivity at Oxford Brookes University (UK). “But they know they can’t pass the whole lot on to customers or sales will tank. So they put prices up 10% and take two-thirds of the hit.”

Accountant, Paul Bulpitt of The Wow Company agrees they end up absorbing costs, and he says this is compounded by how slowly they raise prices.

“Businesses are often slow to act because they worry it will upset loyal customers,” he says. “In reality, most of those customers are much less sensitive to price than businesses imagine. Pricing is only one of the factors they consider and, frankly, customers expect prices to go up at the moment. Businesses need to be more comfortable experimenting with their pricing.”

Xero economist Louise Southall suggests business owners keep track of their margins to see when price increases are needed.

“Owners often check sales or revenue, but that breaks down when costs and volumes are changing so much. They really need to keep an eye on margins at times like these.”

So a renewed focus on margins and a pragmatic approach to pricing are likely to be major business trends for owners who are being squeezed by inflation.

Business trend 3

Businesses getting paid days faster despite economic hardships

Yes, the past two years may have read like an economics emergency manual – with pandemics, war, inflation and economic slowdown – but invoices keep getting paid faster and faster.

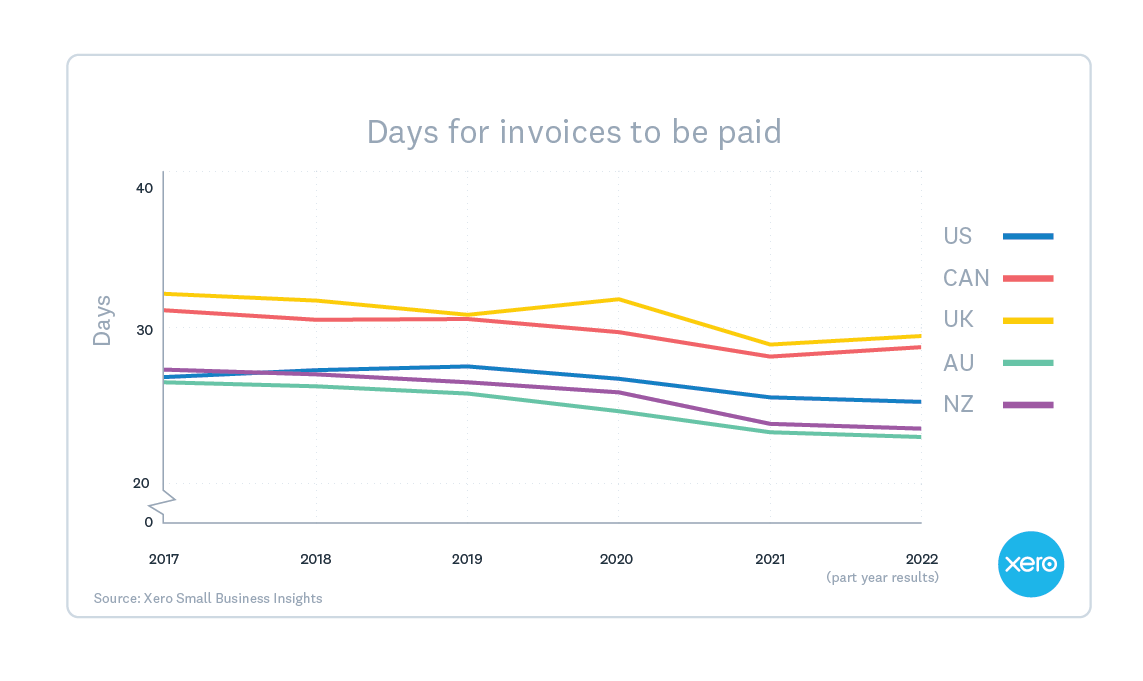

Invoice payments are coming in sooner across the US, Canada, the UK, Australia and New Zealand.

Note that 2022 wait times are based on part-year results. Chart includes data from the first 9 months of 2022 in the UK, Australia and New Zealand, and the first 6 months of 2022 in the US and Canada.

Xero’s invoicing software measures the time between when invoices are issued and when they’re paid. Payments Manager, Vinita Persaud says she’s encouraged to see the wait is shrinking.

“We’ve been measuring this since 2017 and the wait times generally drop each year. On-time payment is so important to small business cash flow so it’s great to see the trend continue, even through hard times.

Persaud attributes the faster turnarounds to the growing popularity of instant online payment.

"We’ve found that digital invoices which offer instant payment via cards, direct debit, or ACH can get paid up to twice as fast. We also see that more businesses are meeting the demands of their customers who want to pay online by connecting payment services such as Stripe and GoCardless. This shift in customer choice may explain the improvements."

Faster payments are a business trend anyone can get behind. Learn about online invoice payments.

Business trend 4

Small businesses in red a third of the year

Xero data shows that UK, Australian and New Zealand small businesses experience negative cash flow for about four months of the year. So in case you were wondering, no – your cash flow struggles aren’t unusual.

The finding comes from an analysis of aggregated accounting data, which shows just how often small business spending exceeds revenues in a given month.

Accountant Steve Thomas of Your Finance Department says lots of businesses experience cash flow problems because expenses can tend to fall due at around the same time.

“Cash shortages tend to cluster around the same types of events. For example, businesses commonly have seasonally quiet Decembers and Januaries, which leaves them short of cash when February and March bills come in. Tax payments also catch out lots of businesses when they come due.”

He says that so long as a business is broadly profitable, cash flow problems can be fixed.

“90% of the cash flow issues we see can be fixed, so long as those businesses are pragmatic about managing costs.

“It certainly helps to understand the business’s revenue cycles and to have a good view of upcoming expenses. Not a lot of businesses have that long-term view so it’s something for them to work on.”

Business trend 4, therefore, is a continuing tight cash budget for many businesses, but hopefully with a more strategic approach to cash flow management.

Business trend 5

Mad geniuses congregating online

Got an out-of-the-ordinary business idea? Try giving it a spin online. A Xero survey has found that entrepreneurs are more likely to try novel concepts in the ecommerce environment – probably because it de-risks the startup journey.

A survey of accountants and bookkeepers, who ride shotgun on thousands of startup journeys, found that businesses which launch online generally experienced:

- lower running costs

- wider net profit margins

- a faster route to break even

As a result, advisors in the study said their online clients were 4X more likely to be based on a novel idea.

“Ecommerce is creating new, lower risk pathways to business ownership,” the report says. “Lower startup and operating costs mean owners face fewer personal financial losses in the event of a business failure. This de-risks the ‘worst case scenario’ and gives entrepreneurs more freedom to try something different.”

Learn more about this business trend in online vs brick-and-mortar businesses.

Business trend 6

When quiet quitters become stealthy startups

A cooling economy coupled with an inflation hangover could spur a fresh round of stay-at-home startups, according to entrepreneurship experts.

R. Duncan Pelly, Associate Professor of Entrepreneurship at McMurry University (USA) says many professionals will consider a side hustle as their salary shrinks, in real terms.

“Their raise this year won’t match inflation so their spending power will go backwards and some will decide it’s time to finally try that business idea they’ve been sitting on,” he says.

Marc Cowling, Professor of Economics and Productivity at Oxford Brookes University (UK) adds that economic slowdowns often accelerate big lifestyle decisions.

“It changes behaviours. Employers start getting a bit tighter with what they pay and that can be the tipping point that leads some employees to go for it.”

Pelly says that this next wave of entrepreneurs won’t necessarily resign their current job to start up. “We’ll see people starting something on the side to help supplement their income.”

This business trend could be further enabled by ecommerce, with a recent Xero study showing it’s a popular business model for side-hustlers.

Professor Cowling says businesses that start as side hustles more-often succeed. “People who soft launch while holding down a day job tend to do better. They get feedback on their product and change it for the better before going all in.”

Business trend 7

It’s poaching season for smaller businesses

Small businesses that have struggled to find employees may be able to attract talent from bigger shops as the economy cools, according to experts.

“In a boom, your job offer will be matched or bettered by another business,” says Marc Cowling, Professor of Economics and Productivity at Oxford Brookes University (UK). “But that might not be the case as the economy slows.”

Mark Koziel, President of Allinial Global (an accounting association) predicts this may lead to a redistribution of workers from larger businesses to smaller ones.

“Medium and larger sized businesses may lay people off or cut hours. It’s a fast way to reduce costs. That will give smaller players a chance to find much-needed help.”

Neither Cowling nor Koziel felt the market would suddenly be flooded with workers, as most businesses would try to avoid redundancies. But they predicted slowing wage growth would allow small businesses to compete better.

To take advantage of this trend, businesses need to be organised; understanding the roles they’d like to fill and being ready to offer the right candidate at short notice.

Business trend 8

Why the right decision can be so hard to make

Small businesses that use apps to automate key tasks have more time and energy to pursue growth, a Xero study has found.

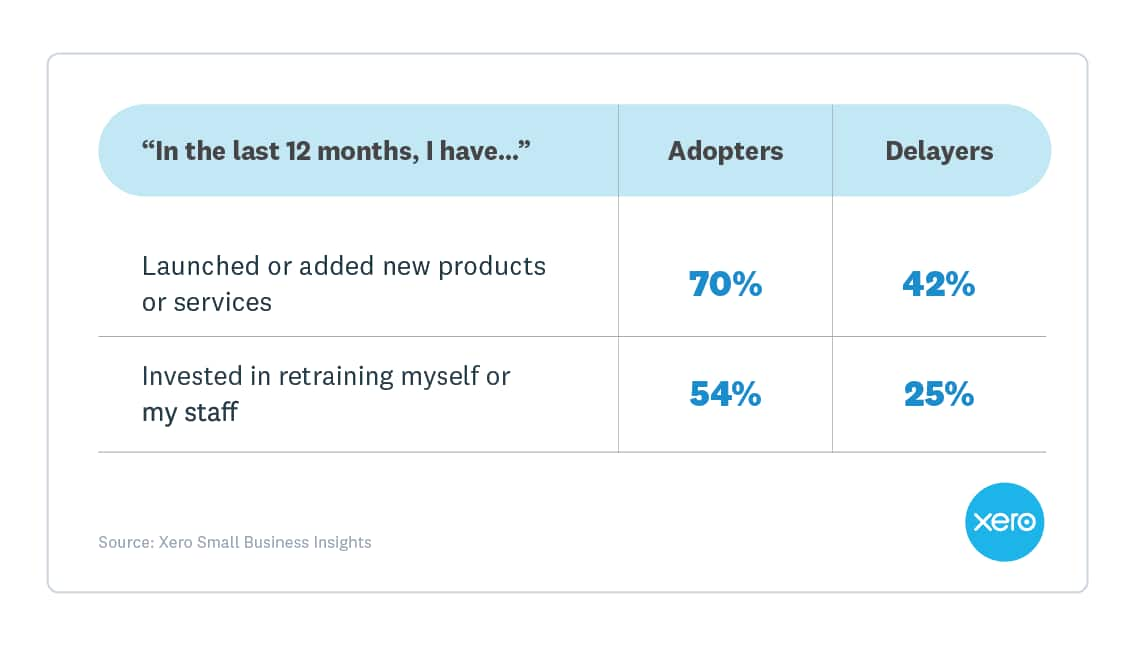

In a survey of 4,000 small business owners across the USA, Canada, the UK, Singapore, Australia and New Zealand, tech adopters were much more likely to expand their offering and their skills.

Adopters (people who frequently invest in technology) were engaged in more growth-related activities.

However, less than a quarter of small business owners fell into the ‘tech adopters’ category. The rest attributed their reluctance to adopt new technology to a range of barriers.

The study says it’s up to tech makers and advisors to remove hurdles by:

- introducing small and incremental change

- helping business owners learn from peers

- encouraging a more long-term perspective of tech adoption

- presenting the benefits of tech adoption in a more relatable way

- better controlling the tsunami of information around technology products.

Tech-focused accountants and bookkeepers can be a good first port of call for business owners who want to be more efficient but struggle with technology decisions. You can find one in Xero’s advisor directory.

Business trend 9

Hold your breath come Jan and Feb

It’s confirmed – small businesses go through a tricky revenue dip every year, as sales typically slow in January and February.

When mapping real-life small business revenue data on a calendar, Xero found that boom months in October, November and December typically gave way to a flat new year.

Revenue tends to peak late in the year, then drop off a cliff come January and February.

Small business cash inflows are inherently seasonal

Average percentage of total annual revenue earned within the month, pre-COVID 19 (2017-19)

Most business owners will be familiar with the decline in customer activity through the holiday period. However, the study illustrates just how much juggling businesses have to do.

“They don’t just navigate long-term financial cycles of boom and slowdown, but also annual cycles that present really difficult cash flow challenges,” says Xero economist, Louise Southall.

“The average business has cash shortages in up to four months of the year, and 90% of businesses have at least one month in the red.”

Predicting when shortages will occur and how long they’ll last can help businesses manage them. But Southall recommends using data from your own individual business.

“While we see patterns like this at a national level, each business has its own seasonal variations so it’s worth doing an analysis for your specific business,” she says.

You can spot cash flow trends in your business by looking at what happened last year. Or you can use predictive tools like a forecasting template or forecasting software.

Business trend 10

Productivity’s super power confirmed

After a bumpy couple of years, everyone’s learned a lot about business resilience, including academics at the OECD (Organisation for Economic Cooperation and Development).

When the pandemic hit and sales tanked by 26% in the UK, 12% in Australia and 44% in New Zealand, the OECD’s economists got the perfect opportunity to see what happens to small businesses during challenging times.

Using Xero small business insights data, they dug into the factors that boosted resilience and found that productivity was a major livelihood saver.

“The most productive businesses had smaller job losses during the crisis and a faster recovery coming out of the crisis,” the authors noted in their report.

In case you’re wondering, productivity is a measure of revenue generated per employee. Productive businesses are able to do more with less, which makes them economic cacti – able to battle on when times are tough. But Xero economist Louise Southall notes they do more than just survive.

“Productive businesses switched back into growth mode sooner, which means they helped lead the recovery for the wider economy.”

Productive businesses typically have systems and processes to drive them on. Technology can also play a role. The study found that productive firms were 60% more likely to use multiple apps to help run the business.

As businesses gear themselves up to be more resilient, expect a trend toward leaner operations and more automation.

How do we know this stuff?

Xero is used by 3.3 million small businesses in 180 countries. We based this small business trends 2023 report on their experiences.

Specifically, data came from these surveys and reports:

- Xero 2022 – Online vs brick-and-mortar businesses

- Xero, Accenture 2022 – Crunch: Cash flow challenges facing small businesses

- Xero, Accenture 2022 – XSBI payment data

- Xero 2022 – One step – small business digitsation

- OECD, Accenture, Xero 2021 – Small business as usual

Insights and comments on these small business trends came from accountants and economists in the USA, the UK, and Australia.

Written by Eammon Conaghan

Who’s been interviewing, analysing and writing about small businesses since 2014.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.