Profit Margin: Types, Formulas, How to Improve Yours

See how profit margin helps you price with confidence and grow. Learn how to calculate it.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Thursday 5 February 2026

Table of contents

Key takeaways

- Calculate all three profit margin types regularly to get a complete picture of your business health: gross profit margin shows production efficiency, operating profit margin reveals core business performance, and net profit margin measures overall financial success after all expenses.

- Focus on three key strategies to improve your profit margins: reduce costs by reviewing subscriptions and negotiating better supplier rates, increase efficiency through automation and streamlined workflows, and adjust pricing using value-based or dynamic pricing approaches.

- Track your profit margin trends monthly or quarterly and compare them against industry benchmarks to spot problems early and make informed decisions about pricing, budgeting, and resource allocation.

- Use profit margin data to guide critical business decisions by identifying which products or services deliver the highest returns, allocating resources toward profitable areas, and demonstrating financial health to potential investors or lenders.

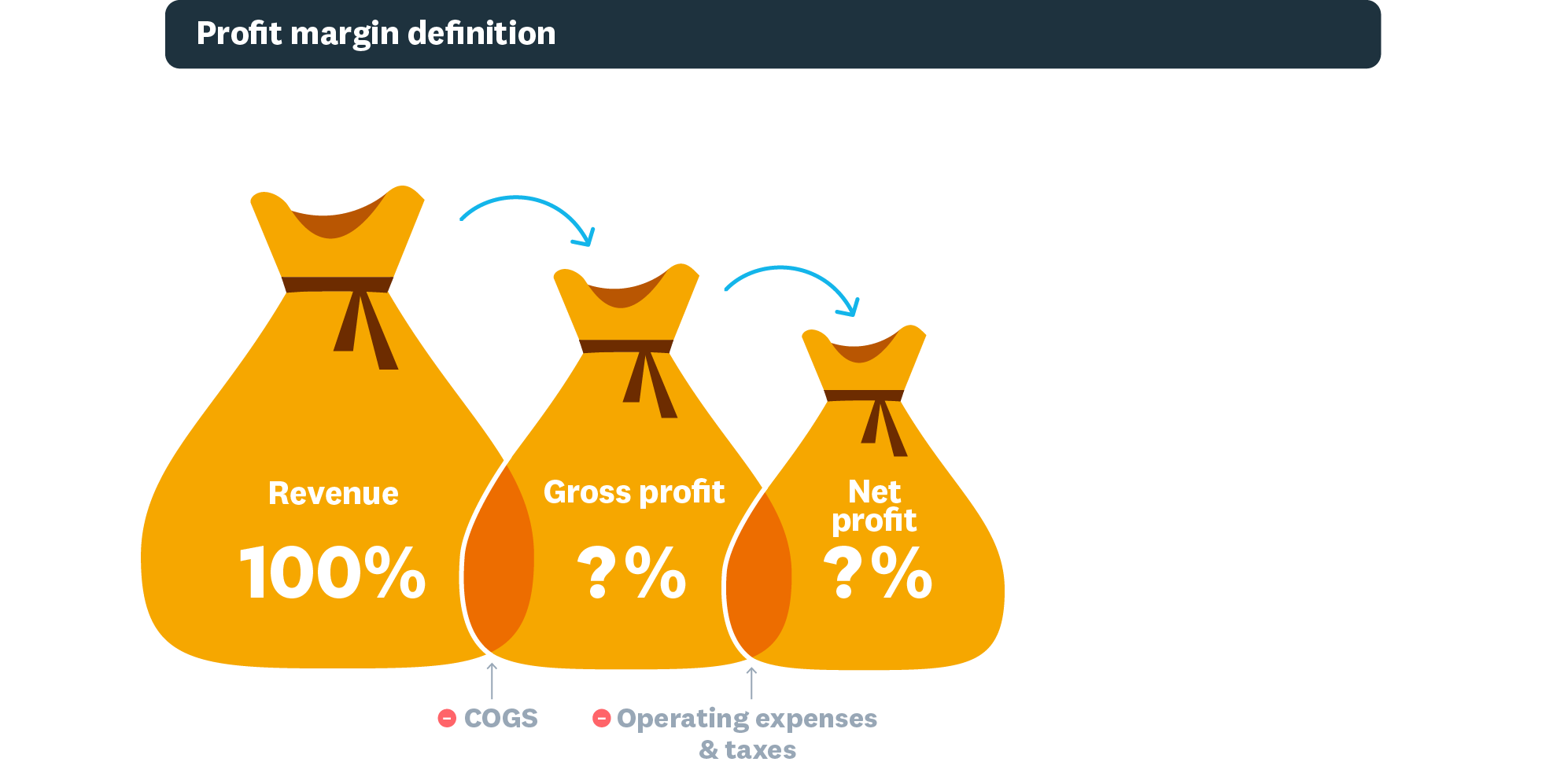

What is a profit margin?

A profit margin is the percentage of revenue left after paying business expenses. The higher the percentage, the more profit you keep.

A strong profit margin signals your business earns enough to cover costs and reinvest in growth. It also reveals which areas perform well and where you may need to cut expenses.

Profit margins vs net profit

Net profit is the dollar amount left after deducting all expenses from revenue. Profit margin expresses that profit as a percentage of revenue.

Net profit tells you how much money you made. Profit margin tells you how efficiently you made it.

Types of profit margins

There are three main types of profit margins. Each measures profitability at a different stage of your business operations.

Gross profit margin

Gross profit margin is the percentage of revenue remaining after subtracting the cost of goods sold (COGS). It shows how efficiently you produce or source what you sell.

Use gross profit margin to set pricing, spot production inefficiencies, and compare performance across periods.

Operating profit margin

Operating profit margin is your profit after paying variable costs like wages, materials, and operational expenses, but before taxes and interest. While it measures how well your core business operations generate profit, the exact calculation can vary. An International Accounting Standards Board (IASB) study found that companies use at least nine different ways to calculate operating profit.

Investors and lenders often review operating margins to assess whether a business is financially sound.

Net profit margin

Net profit margin is the percentage of revenue left after paying all costs, including taxes and interest. It's the most comprehensive measure of your business's financial health because it accounts for every expense.

Learn more about net profit margin and how to calculate it.

How to calculate profit margins

Profit margin formula: Divide profit by revenue, then multiply by 100 to get a percentage.

Expressing profit margin as a percentage makes it easier to compare performance across different time periods or against other businesses.

Gross profit margin calculation

Example: Your cleaning business earns $20,000 in revenue. It costs $8,000 to deliver those services, leaving $12,000 in gross profit.

Calculation: $12,000 ÷ $20,000 × 100 = 60% gross profit margin

A 60% gross profit margin means you keep 60 cents of every dollar earned after covering direct costs.

Try our gross profit margin calculator.

Net profit margin calculation

Example: After paying $4,000 in taxes and other expenses, your net profit is $8,000.

Calculation: $8,000 ÷ $20,000 × 100 = 40% net profit margin

A 40% net profit margin means you keep 40 cents of every dollar earned after all expenses.

Try our net profit margin calculator.

Operating profit margin calculation

Example: From your $12,000 gross profit, you spend $3,000 on operating expenses like rent and utilities. Your operating profit is $9,000.

Calculation: $9,000 ÷ $20,000 × 100 = 45%operating profit margin

An operating profit margin shows how much you earn from core operations before taxes and interest.

What is a good profit margin?

A good profit margin varies by industry and business type. There's no universal benchmark, but understanding typical ranges helps you evaluate your performance.

General benchmarks by industry:

- Retail: 2%–5% net profit margin

- Professional services: 15%–25% net profit margin

- Software and technology: 20%–40% net profit margin

- Restaurants and hospitality: 3%–9% net profit margin

Your gross profit margin will naturally be higher than your net profit margin because it doesn't account for all expenses. Focus on operating and net profit margins to assess your overall financial health.

Why do profit margins matter?

Profit margins reveal your business's financial health by showing how much income you keep relative to expenses. In fact, the Institute of Chartered Accountants in England and Wales (ICAEW) lists profitability among its top five practice key performance indicators (KPIs), which helps businesses make smarter decisions and attract funding.

Here's why profit margins matter:

- Pricing decisions: Identify which products or services deliver healthy returns

- Cost control: Spot areas where expenses eat into profits

- Budgeting: Allocate resources toward higher-margin activities

- Funding access: Banks and investors review margins before approving loans or investments

Benefits of high profit margins for growth

High profit margins give your business more flexibility and opportunity. Here's what healthy margins enable:

- Easier access to funding: Investors and lenders favour financially healthy businesses

- Room to reinvest: Extra profit can fund new equipment, staff, or marketing

- Space to innovate: Test new pricing strategies or products without risking cash flow

Compare your margins against industry benchmarks and competitors to identify where you stand and where you can improve. Focus on sustainable growth. Rapid expansion can temporarily reduce margins if costs rise faster than revenue.

Factors affecting profit margins

Several factors influence your profit margins, some within your control and others not:

- Industry type: Retail and hospitality typically have tighter margins than professional services due to higher overheads

- Economic conditions: Inflation and rising interest rates increase costs and squeeze margins

- Location: Rent, taxes, and local wages vary by region and directly affect expenses

- Business strategy: Pricing decisions, supplier negotiations, and operational choices all impact margins

Account for these factors when setting prices and planning for growth.

How to increase your profit margins

To improve profit margins, focus on three areas: reducing costs, improving efficiency, and adjusting pricing. Most businesses can make gains in all three.

Control your costs

Reducing expenses directly increases your profit margin. Start with these tactics:

- Review subscriptions and cancel services you no longer use

- Negotiate better rates with suppliers

- Manage labour costs by optimising schedules and reducing overtime

- Switch to energy-efficient equipment to lower utility bills

Small savings across multiple areas add up to meaningful margin improvements.

Make your operations more efficient

Efficiency improvements let you generate more revenue without increasing costs:

- Automate repetitive tasks like invoicing, payroll, and inventory tracking

- Streamline workflows to reduce time spent on admin

- Train staff to handle tasks faster and with fewer errors

- Use accounting software to spot inefficiencies in real-time

Adjust your pricing

A smart pricing strategy suited to your industry and customers helps maximise revenue and boost margins. Consider these approaches:

- Dynamic pricing: Adjust prices based on demand, seasonality, or competitor activity

- Premium packages: Bundle products or services to increase average order value

- Value-based pricing: Set prices based on the value you deliver, not just your costs

- Regular reviews: Revisit prices annually to account for inflation and rising expenses

Test different approaches to find what works for your customers and market.

To maintain healthy margins over time, focus on three fundamentals: communicate a clear value proposition, run efficient operations that minimise waste, and nurture customer loyalty through excellent service and retention programs. You can measure this last point by tracking key metrics like client retention rate and cost of client acquisition.

Analyse your profit margins for better business decisions

Profit margin data helps you make informed decisions across your business. Here's how to use it:

- Set pricing: Identify which products deliver healthy margins and adjust prices for underperformers

- Create budgets: Allocate resources toward higher-margin products or services for better returns

- Guide investments: Focus growth efforts on the most profitable areas of your business

- Spot problems early: Declining margins signal issues before they affect cash flow

What profit margin trends reveal

Profit margin trends show how your margins change over time, revealing patterns in financial health and operational efficiency.

Here's what different trends indicate:

- Rising margins: Your business is becoming more efficient or commanding better prices

- Falling margins: Costs may be increasing faster than revenue, or pricing power is weakening

- Stable margins: Operations are consistent, but look for opportunities to improve

- Seasonal fluctuations: Normal for many industries; plan cash flow accordingly

Track margins monthly or quarterly and compare against your own history and industry benchmarks.

Use Xero for comprehensive profitability insights

Xero accounting software helps you track profit margins in real-time, so you can spot trends and make faster decisions. With automated reporting and clear dashboards, you'll spend less time on spreadsheets and more time growing your business.

Get started with Xero accounting software or try Xero free for one month.

FAQs on profit margin

Here are answers to common questions about profit margins.

What does a 20% profit margin mean?

A 20% profit margin means you keep 20 cents of every dollar in revenue after expenses. If your business earns $100,000, a 20% margin leaves $20,000 in profit.

What does a 30% profit margin mean?

A 30% profit margin means you keep 30 cents of every dollar earned. Many industries consider this healthy, though benchmarks vary by sector.

What's the difference between profit margin and markup?

Profit margin is profit as a percentage of revenue (selling price). Markup is profit as a percentage of cost. A product costing $60 and selling for $100 has a 40% profit margin but a 67% markup.

How often should I calculate my profit margins?

Calculate profit margins monthly or quarterly to spot trends early. This aligns with common business practice, as an IASB analysis found companies also disclosed most alternative performance measures for interim periods. Review them whenever you change prices, add products, or notice shifts in costs.

Can profit margins be negative?

Yes. A negative profit margin means expenses exceed revenue, resulting in a loss. This can happen during start-up phases, economic downturns, or when costs rise unexpectedly.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.