Australia Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, and time to be paid.

Small business continues to adapt and grow

Published: 31 October 2024

The September quarter Xero Small Business Insights (XSBI) data for Australia shows sales growth has slowed, but is still positive. Meanwhile jobs growth has picked up further and wages growth remained largely the same as the previous quarter. Both payment time measures lengthened slightly, but this is mainly due to a return to 'normal' after the end-of-financial year impacted the June results.

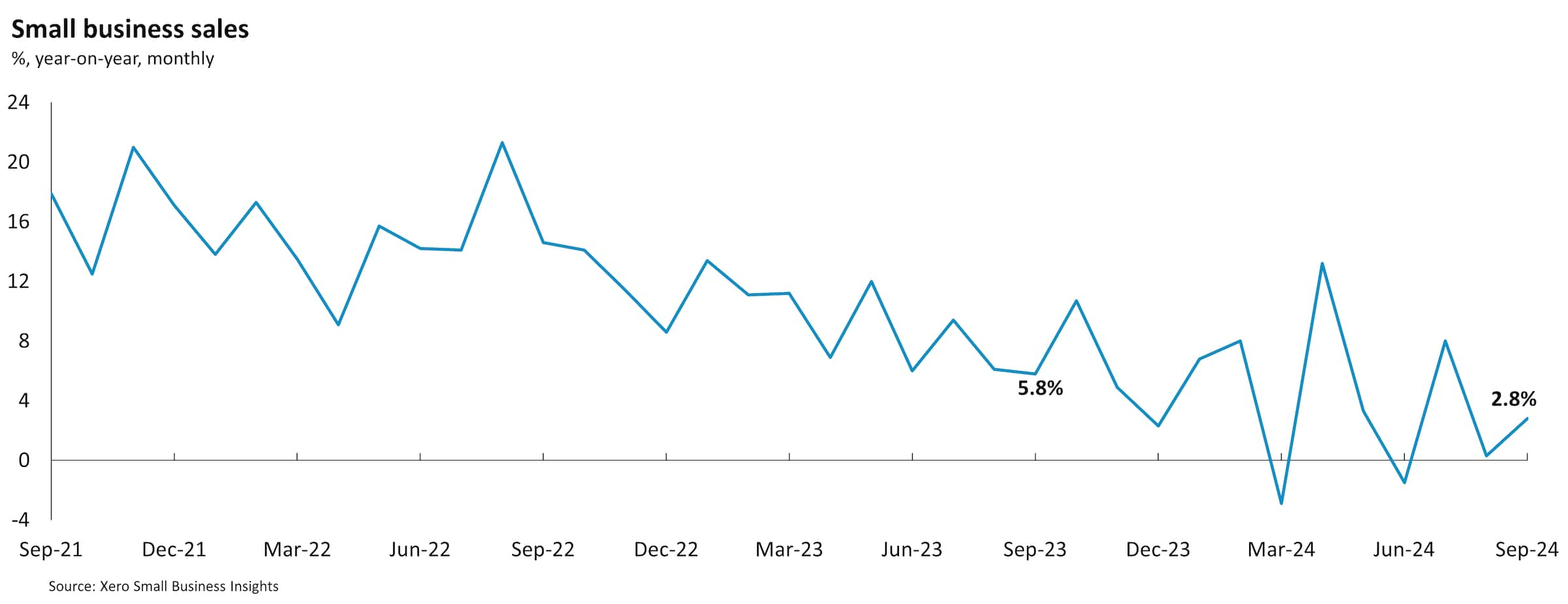

Sales in small businesses grew 3.7% year-on-year (y/y) in the September quarter, slower than the 5.0% y/y rise in the June quarter and similar to the 4.0% y/y increase in the March quarter. During the quarter July sales were solid, up 8.0% y/y, rebounding after 1.5% decline in sales in June. This was possibly an immediate response to the income tax cuts that started on 1 July. Unfortunately, this was only a temporary spending spree, with sales rising a smaller 0.3% y/y in August and 2.8% y/y in September.

The industry results highlight there is considerable variation below this national sales outcome. Two industries recorded double-digit sales growth in the quarter - public administration (+12.0% y/y) and healthcare (+10.2% y/y). At the other end of the scale, hospitality (+0.3% y/y) and agriculture (+1.1% y/y) had very little sales growth compared to a year ago.

The differences between the regions was smaller than between industries. Sales growth in the September quarter was led by Queensland (+5.8% y/y), Western Australia (+5.5% y/y) and South Australia (+5.2% y/y). The two largest States of New South Wales (+3.1% y/y) and Victoria (+2.4% y/y) were slightly below the national average. By far the weakest sales result was in Tasmania, where sales were 0.6% lower than a year ago in the quarter.

Despite significant macroeconomic headwinds they are still, collectively, growing sales and employing more people.

XSBI Australia July - September 2024 data

Jobs growth accelerated and wage growth was little changed

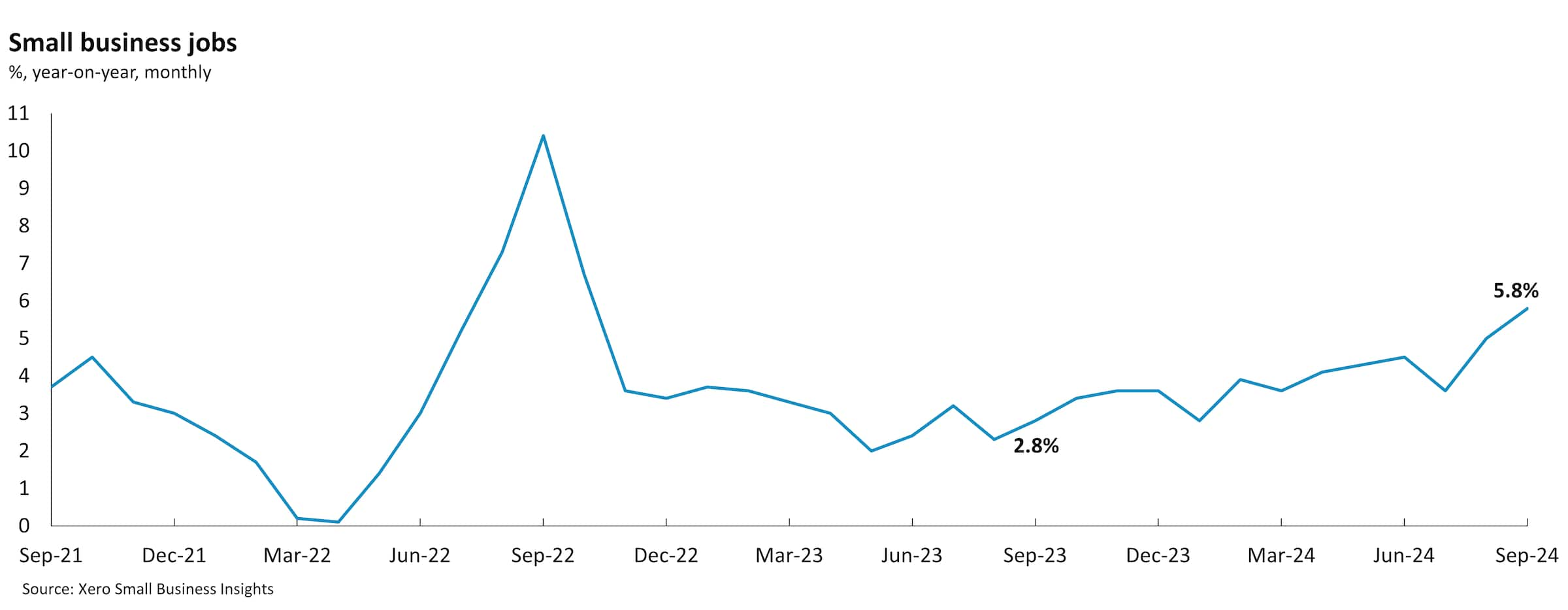

While sales growth slowed, jobs growth ticked up a little. Jobs grew 4.8% y/y in the September quarter, after a 4.3% y/y rise in the June quarter. The final two months of the quarter - August (+5.0% y/y) and September (+5.8% y/y) - were the strongest two monthly results in two years.

The industry and regional jobs results had a similar pattern to the sales outcomes. Jobs gains were led by public administration (+9.0% y/y) and healthcare (+8.6% y/y). Hospitality (-0.2% y/y) was the only industry employing fewer staff than a year ago - the fifth consecutive quarter where this has been the case. Western Australia (+6.7% y/y), Queensland (+6.0% y/y) and South Australia (+ 5.1% y/y) were the regions with the largest job rises and Tasmania (+2.3% y/y) had the smallest.

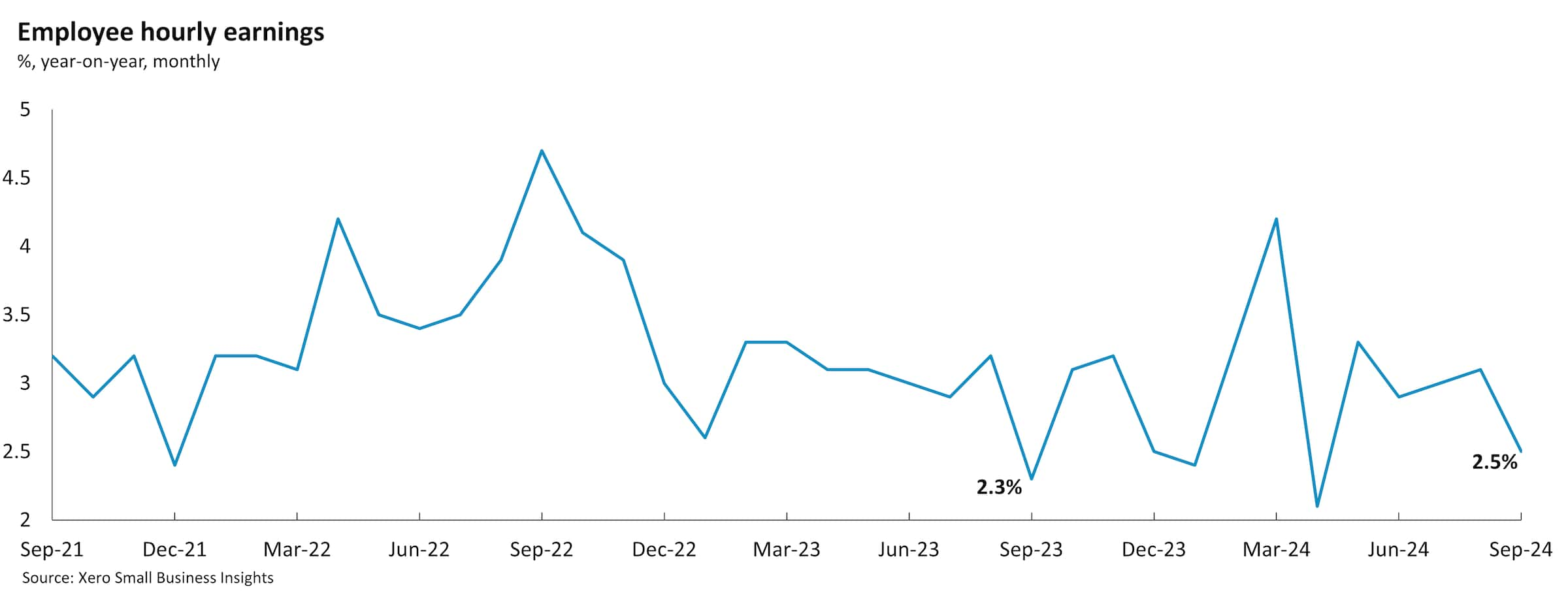

Wages rose an average of 2.9% y/y in the September quarter, similar to the 2.8% y/y rise in the June quarter. This suggests small businesses continue to pay smaller wage increases than the national average (as measured by the Australian Bureau of Statistics' Wage Price Index), which for the year to June was 4.1%.

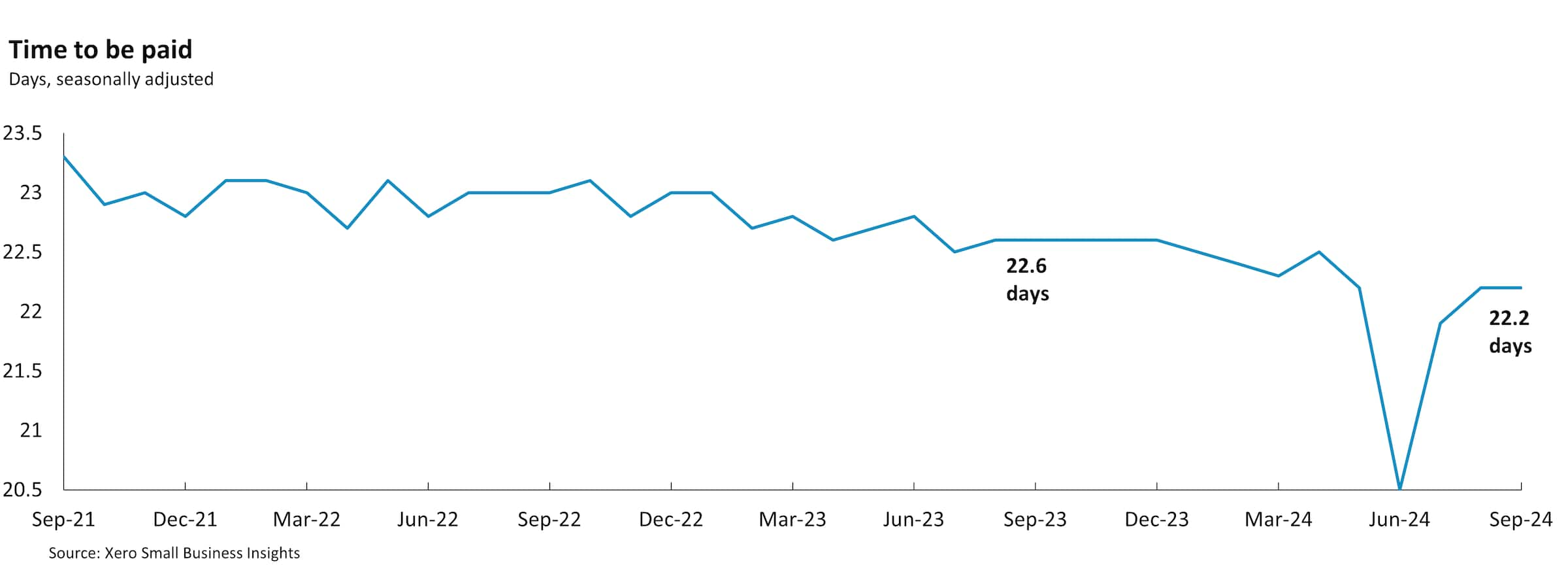

Payment times lengthen slightly

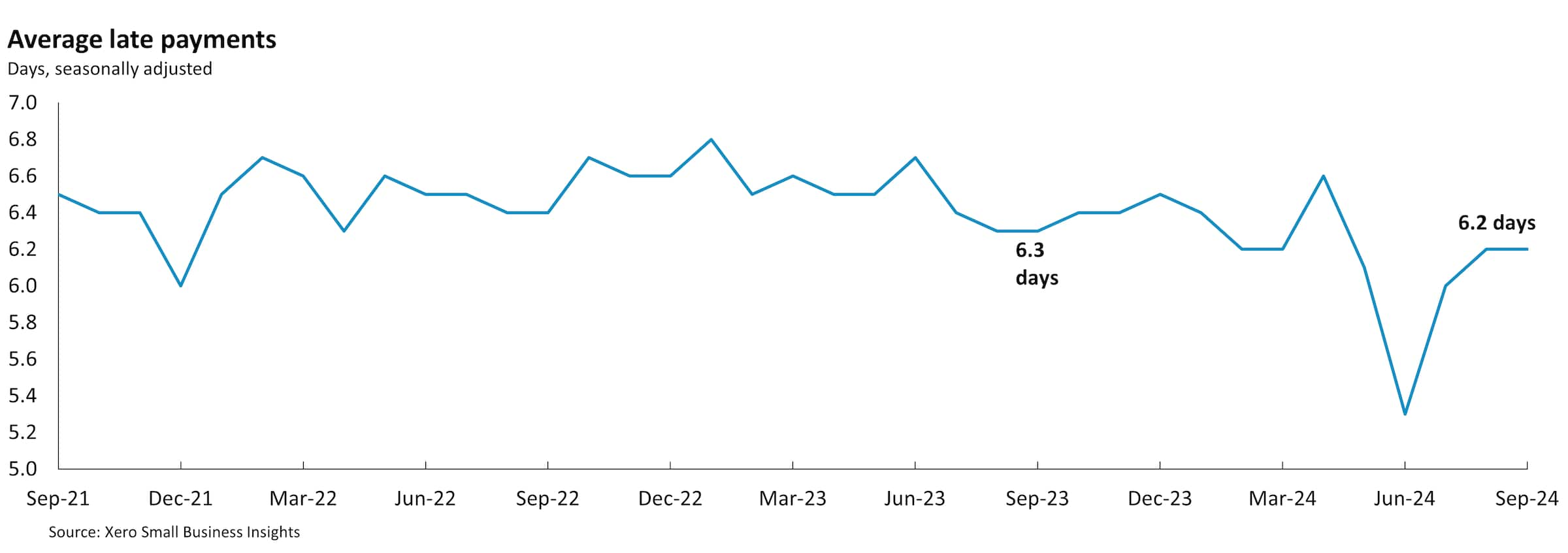

Both measures of payment times rose slightly in the September quarter. However, this was largely due to the June quarter result being abnormally low (this trend is observed in all the XSBI countries at the end of their financial years). Payments to small businesses were made, on average, 6.1 days late in the September quarter compared to 6.0 days in the June quarter. The average time small businesses waited between issuing an invoice and getting paid was 22.1 days in the September quarter, up slightly on the 21.7 day wait in the June quarter.

Australia performing better than other countries

Resilience feels like an overused word, but it succinctly describes how Australian small businesses are performing currently. Despite significant macroeconomic headwinds they are still, collectively, growing sales and employing more people. The industry and regional data highlights that there are even some sectors where small businesses could be described as thriving, still recording above average sales and job gains.

One of the benefits of the XSBI program is that it allows us to compare Australian small businesses with those in New Zealand, Canada, the US and the UK. Taking this global perspective highlights that Australian small businesses, on almost all metrics, are leading the way. They have the strongest sales performance, the shortest payment times, the highest proportion of small businesses still creating jobs and have been one of the most effective at managing wage cost pressures.

Looking ahead

That said, even though sales are still growing they are only just doing so, which raises questions about how long small businesses will be able to sustain staffing levels and stay on top of ongoing cost and cash flow pressures. The central banks of all the other countries tracked by XSBI have cut interest rates at least once in recent months. But in the minutes from its September meeting the Reserve Bank of Australia noted that: "it was not necessary for the cash rate target to evolve in line with policy rates in other economies since Australian inflation was higher, the labour market stronger and monetary policy less restrictive than in many other advanced economies." The RBA Governor has also repeatedly made it clear that interest rates are unlikely to be cut in the near term. This means small businesses will need to continue showing the adaptability and resilience that they have for a little longer.

For more information on the XSBI metrics, see our methodology page.

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Contact us about Xero Small Business Insights

Arming small business owners with simple but powerful insights. If you have any questions, reach out to us.