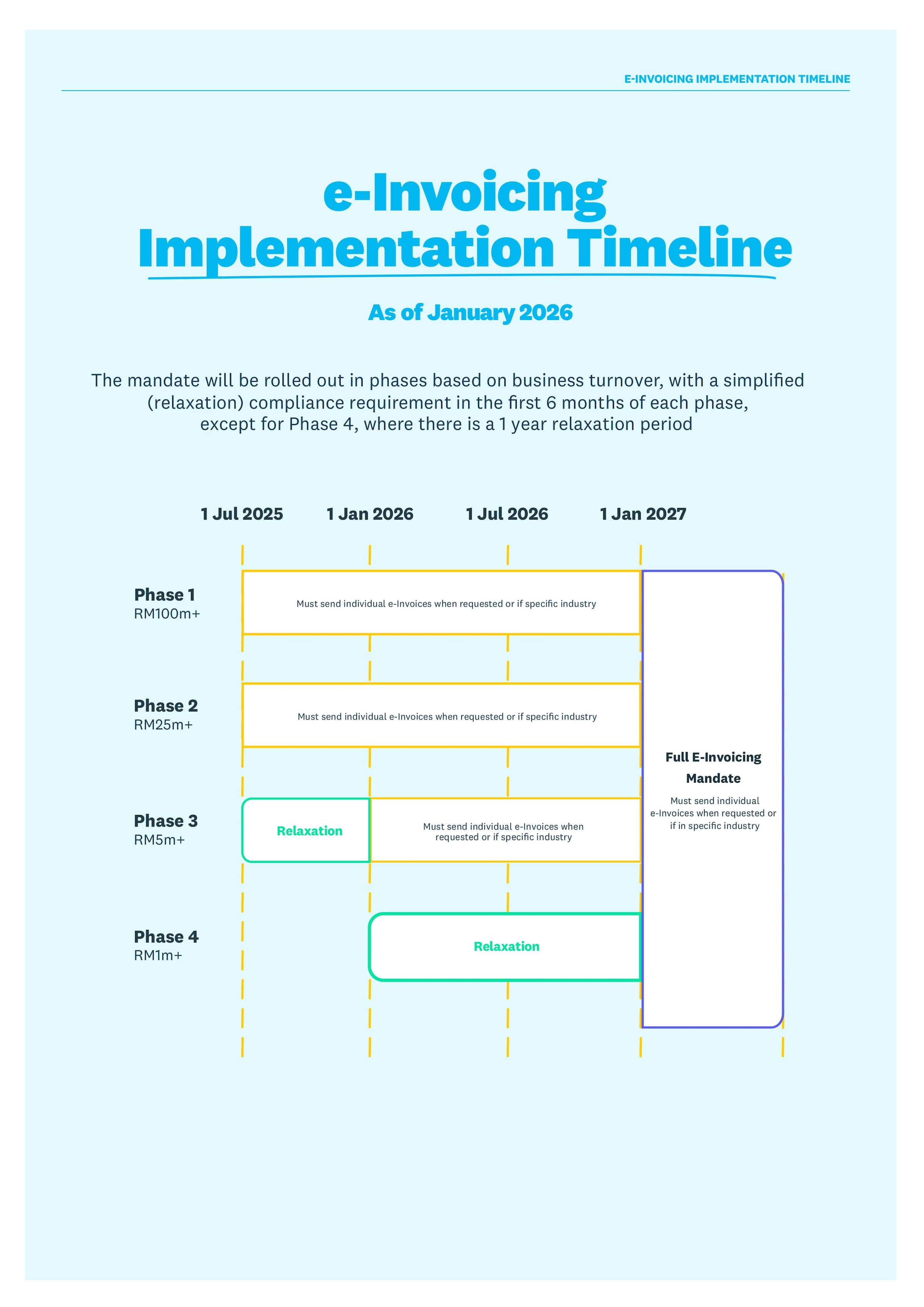

E-Invoicing start dates: what to do and when

You must start using electronic invoicing in your business by a set timeline. This is part of a government initiative that also requires you to report your business transactions to IRBM. Your E-Invoicing implementation dates depend on your yearly turnover and, helpfully, begin with a relaxed period.

What the relaxation period requires of you

Because E-Invoice implementation requires a shift in your billing admin, the Malaysian tax authority (IRBM) allows an initial 6 month relaxation period. Ease yourself into the new process by sending consolidated monthly E-Invoices for B2B and B2C transactions. And prepare for the full mandate:

- Review your existing invoicing system and see if you need to adapt or upgrade to new software

- Decide how to connect to the global network Peppol

- Train your team so everybody understands the new E-Invoicing guidelines and what they need to do

- Check the timeline above to see when your relaxation period starts and ends, depending on your annual turnover

What happens after the relaxation period

By the end of this period, you must understand the ins and outs of individual E-Invoicing. This means you can follow the official rules on how you send and receive electronic invoices, and report your business transactions and activities to IRBM each month. Make sure you can:

- Send individual invoices when requested by the buyer or if you’re in an industry like aviation or construction

- Send invoices, credit notes, debit notes, and refunds electronically

- Keep a record of your E-Invoices for at least 7 years

- Meet your official E-Invoice start date to avoid fines and delays in invoice processing