Gross margin formula: How to calculate and improve yours

Learn the gross margin formula to price right, control costs, and grow your profit.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 6 February 2026

Table of contents

Key takeaways

- Calculate your gross profit margin using the formula (gross profit ÷ revenue) × 100, ensuring you only include direct costs like materials, labour, and production expenses in your cost of goods sold calculation.

- Benchmark your margin against industry standards to assess performance, aiming for 50% or higher for most small businesses, with service businesses typically achieving higher margins than retail operations.

- Monitor your gross profit margin monthly to spot trends and identify when rising costs, pricing changes, or market conditions affect your profitability.

- Improve your margins by regularly reviewing and adjusting prices, negotiating better supplier terms, reducing waste, and focusing on higher-margin products or services in your business mix.

What is gross profit margin?

Gross profit margin is the percentage of sales revenue remaining after you subtract the direct costs of products sold or services provided. This metric reveals how efficiently your business turns sales into profit before accounting for overhead.

Here's what your gross profit margin tells you:

- Pricing effectiveness: shows whether your prices cover direct costs and leave room for profit

- Operational efficiency: reveals how well you manage production or service delivery costs

- Financial health: indicates your ability to cover operating expenses like rent and utilities

A low gross profit margin makes it harder to pay essential expenses and reduces your chances of earning a net profit.

Gross profit margin vs gross profit

Gross profit is a currency amount. Gross profit margin is a percentage.

- Gross profit: the actual pounds or dollars left after subtracting direct costs from revenue

- Gross profit margin: gross profit expressed as a percentage of total revenue

The term gross margin means the same thing as gross profit margin. You'll often see these terms used interchangeably.

How to calculate gross profit margin

Use this formula to work out your gross profit margin percentage and understand your business's pricing effectiveness.

Gross profit margin formula

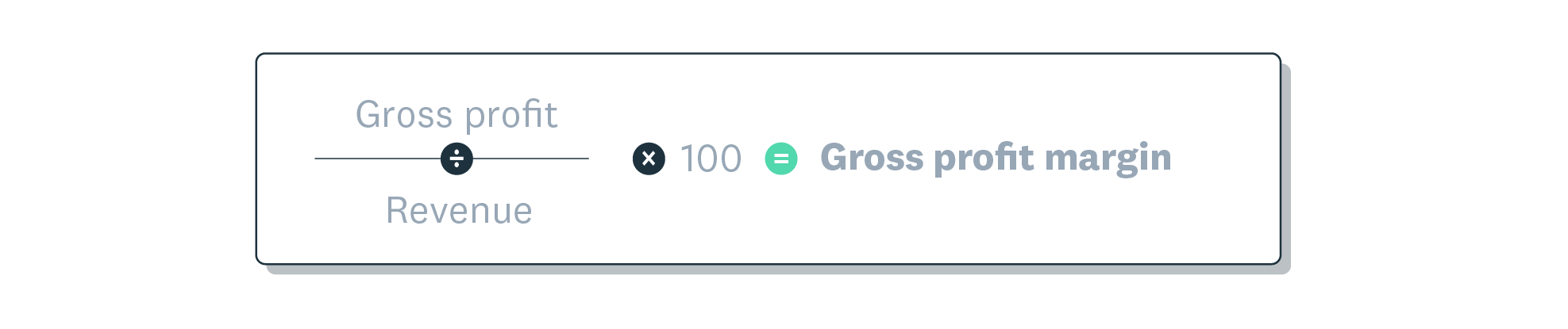

The gross profit margin formula:

Gross profit margin = (gross profit ÷ revenue) × 100

Or expressed another way:

Gross profit margin = ((revenue − cost of goods sold) ÷ revenue) × 100

Gross profit margin formula explained

Follow these steps to calculate your gross profit margin:

- Find your total revenue: add up all sales income for the period

- Calculate your cost of goods sold (COGS): include direct costs like materials, labour, and production expenses

- Subtract COGS from revenue: this gives you your gross profit in pounds or dollars

- Divide gross profit by revenue: then multiply by 100 to get your percentage

Gross profit margin example calculation

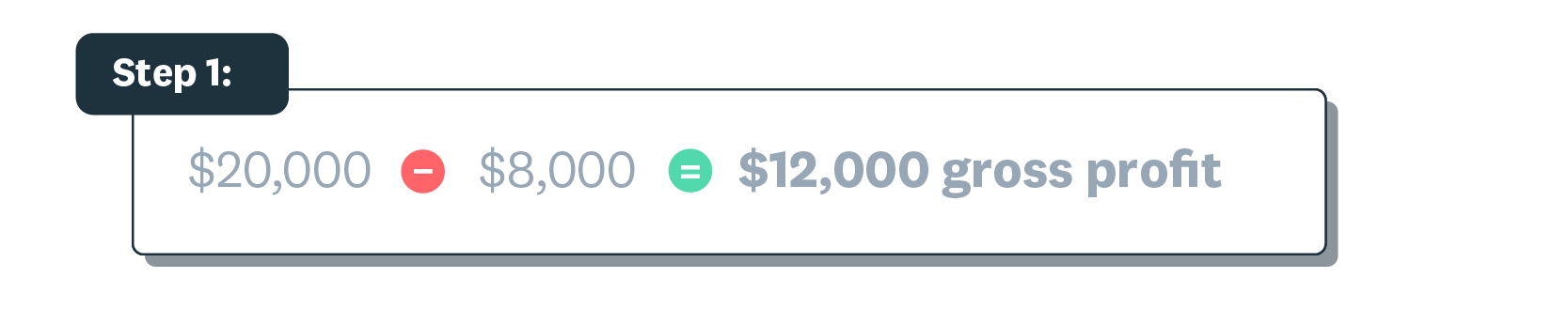

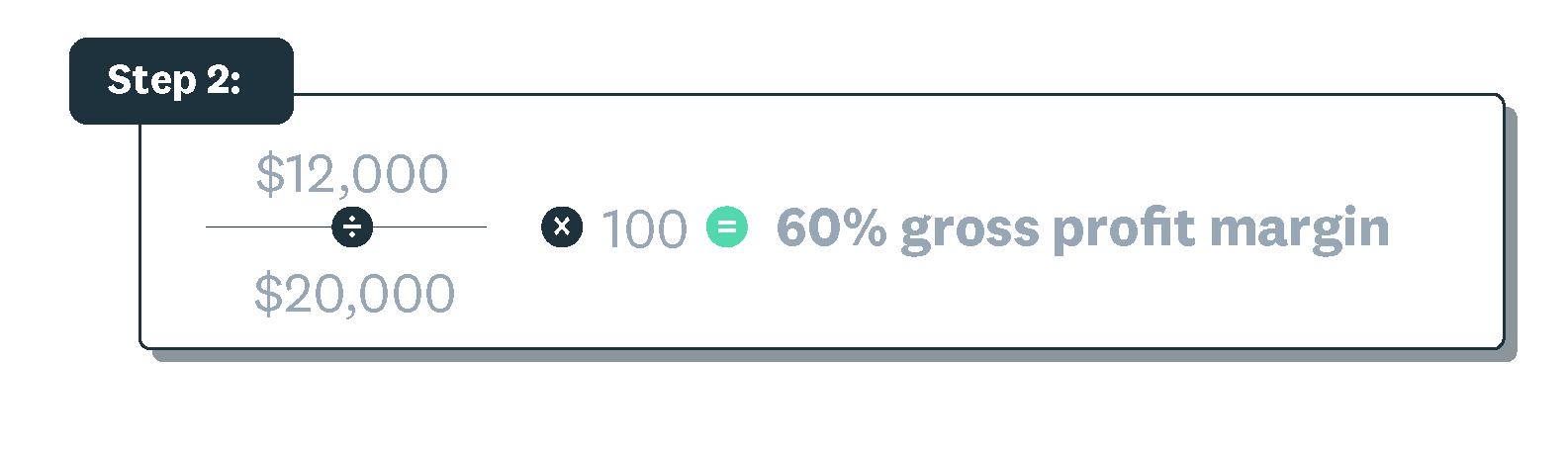

Here's a practical example:

- Revenue: £20,000 (from cleaning services)

- Cost of goods sold: £8,000 (labour, supplies, equipment)

- Gross profit: £20,000 − £8,000 = £12,000

Gross profit margin: (£12,000 ÷ £20,000) × 100 = 60%

This means 60p of every pound earned stays in the business after covering direct costs.

Getting your COGS calculation right is essential for accurate results.

Avoid common calculation mistakes

Accurate COGS calculation is essential for a meaningful gross profit margin. Here are common mistakes to avoid:

- Including operating expenses: rent, utilities, and office supplies are not part of COGS

- Forgetting direct labour: wages for staff who produce goods or deliver services should be included

- Missing materials costs: raw materials, packaging, and shipping to customers count as COGS

- Excluding subcontractor fees: if you outsource production or service delivery, include those costs

Your COGS should only include costs directly tied to producing what you sell.

What is a good gross profit margin?

A good gross profit margin varies by industry, but most profitable small businesses aim for 50% or higher. For example, an analysis of over 5,000 ecommerce stores suggests that a margin between 60-70% is what makes profitable scaling possible, according to ecommerce margin research. Your target margin must be high enough to cover operating expenses, taxes, and leave room for net profit.

What counts as "good" depends on:

- Your industry: consider that service businesses often have higher margins than retail

- Business size: note that larger operations may accept lower margins due to volume

- Market conditions: recognise that competitive markets may compress margins across the board

Understanding the factors that determine what qualifies as a good margin helps you set realistic targets for your business.

Factors affecting your margins

Several factors determine what qualifies as a good margin for your business:

- Industry: consider that hospitality businesses often operate on thin margins due to high food and labour costs, while professional services typically achieve higher margins. This reflects a wide disparity across sectors, as shown in gross profit margin research, with margins ranging from over 99% for regional banks to just 9% for automotive businesses.

- Region: note that local costs, tax rates, and customer spending power vary significantly between locations

- Business model: recognise that ecommerce businesses often have lower overhead than bricks-and-mortar shops, enabling higher margins, with the average online store today operating around 60–65% gross margin.

- Competition: understand that highly competitive markets like electronics retail tend to compress margins across all players

Comparing your margin to similar businesses helps you understand whether you're performing well or need to make adjustments.

Benchmarking your gross profit margin

Benchmark your margin against similar businesses to understand your competitive position. For the most accurate comparison, look at businesses that match your:

- Industry and sector: compare like with like

- Size and revenue: note that margins often differ between small and large operations

- Region or market: recognise that local cost structures affect what's achievable

Your accountant or bookkeeper can help you find relevant industry benchmarks for small businesses in your sector.

Industry benchmarks for gross profit margin

Here are typical gross profit margin ranges by industry:

- High margins (55%+): include jewellery, cosmetics, software, and professional services. For instance, the system and application software industry has an average gross profit margin of 71.52%.

- Medium margins (45–55%): include food service, retail clothing, manufacturing

- Lower margins (below 45%): include electronics retail, grocery, alcoholic beverages

These ranges reflect typical industry cost structures. Your specific margin will depend on your business model, pricing strategy, and operational efficiency.

Check your margin regularly to spot when changes in costs, prices or market conditions affect your profitability.

When to reassess your gross profit margin

Reassess your gross profit margin when:

- Costs change: supplier price increases or rising labour costs affect your margins

- Sales decline: falling revenue may indicate pricing or demand issues

- Growth targets are missed: margin analysis can reveal why profits aren't meeting expectations

- Market conditions shift: economic changes, new competitors, or industry disruption warrant review. Financial teams must be so agile that 36% of CFOs report their teams alter their forecasts at least weekly, according to industry profit margin research, making regular margin reviews critical.

Use accounting software with financial reports to monitor your margins and spot trends early.

Analyzing gross profit margin for business insights

Gross profit margin analysis helps you identify which products, services, or business areas generate the most profit. Use this insight to make informed decisions about pricing, costs, and resource allocation.

Two main levers affect your margin:

- Pricing: competitive prices can increase sales volume, but prices that are too low squeeze margins

- Cost management: reducing direct costs improves your margin without changing prices

Tracking your margins over time reveals patterns that help you understand business performance.

Interpreting gross profit margin trends

Track your gross profit margin over time to spot patterns in business performance. Regular monitoring reveals:

- Seasonal variations: identify which months or quarters show stronger or weaker margins

- Product performance: discover which items or services generate the highest margins

- Cost changes: spot when supplier prices or labour costs are rising

- Pricing effectiveness: assess whether recent price changes improved or hurt profitability

External factors can also impact your margins, even when your operations remain consistent.

Factors affecting gross profit margin

External factors can affect your gross profit margin, even when your operations stay the same:

- Demand shifts: recognise that falling demand may force price reductions to attract customers

- Rising supplier costs: note that increases in materials or labour costs narrow your margins

- Economic conditions: understand that when customers have less disposable income, sales volume and pricing power may decline

- Competition: watch for new competitors or aggressive pricing from rivals that can pressure your prices downward

Gross profit margin compared with other metrics

Gross profit margin is just one of several profitability metrics. Understanding how it differs from operating and net profit margins helps you get a complete picture of your business's financial health.

Gross profit margin vs operating profit margin

Operating profit margin measures profitability after both direct costs and operating expenses.

- What it includes: covers COGS plus operating expenses like rent, utilities, salaries, and marketing

- What it shows: reveals how efficiently you run day-to-day operations

- Formula: (operating profit ÷ revenue) × 100

Operating margin gives a fuller picture of operational efficiency than gross margin alone.

Net profit margin takes the analysis further by including all business expenses.

Gross profit margin vs net profit margin

Net profit margin shows your true bottom-line profitability after all expenses.

- What it includes: covers COGS, operating expenses, interest, and taxes

- What it shows: reveals overall financial health and true profitability

- Formula: (net profit ÷ revenue) × 100

This is your "bottom line": what's left after every expense is paid.

Each metric serves a different purpose in understanding your business's financial performance.

How to use each metric

Use each metric for different decisions:

- Gross profit margin: evaluate pricing strategy and direct cost management

- Operating profit margin: assess operational efficiency and overhead control

- Net profit margin: guide long-term financial planning and measure overall business health

How to improve gross profit margin

Improving your gross profit margin directly increases the money available for growth, debt repayment, and owner compensation. Here are practical strategies to boost your margins.

Adjust your prices

Review your pricing regularly to protect and improve margins:

- Monitor competitor pricing: adjust when market conditions change to stay competitive

- Add value to justify higher prices: improve quality, service, or features

- Test price increases: small increases on high-demand items often go unnoticed

- Segment your pricing: charge premium prices where customers value convenience or speed

Cost reduction is another effective way to improve your margins without changing prices.

Reduce your cost of goods sold

Reducing direct costs improves your margin without changing prices. Try these approaches:

- Negotiate with suppliers: request bulk discounts, longer payment terms, or price matching

- Compare suppliers regularly: don't assume your current supplier offers the best rates

- Reduce waste: track materials usage and minimise spoilage or excess

- Optimise labour: schedule staff efficiently and reduce overtime where possible

- Review product mix: focus on higher-margin items and consider discontinuing low-margin products, especially as research on ecommerce profit margins shows that when margins fall below 55%, growth becomes fragile.

Improving operational efficiency also helps protect your margins.

Streamline your operations

Operational efficiency directly impacts your margins. Consider these improvements:

- Automate repetitive tasks: use accounting software to reduce admin time and errors

- Improve inventory management: minimise excess stock and storage costs

- Streamline production: identify bottlenecks that slow output or increase costs

- Track time accurately: understand where labour hours go and eliminate inefficiencies

- Review processes regularly: small improvements compound over time

Track your gross profit margin with real-time financial reports and dashboards. Monitor margins, spot trends, and make informed pricing decisions, all in one place.

Track your gross profit margin with Xero

Track your gross profit margin simply with real-time financial reports and dashboards. With real-time financial reports and dashboards, you can monitor margins, spot trends, and make informed pricing decisions, all in one place.

Get one month free and see how Xero helps you stay on top of your business finances.

FAQs on gross profit margin

Still have questions about calculating and using gross profit margin? Here are answers to common questions.

What does 30% gross margin mean?

A 30% gross margin means you keep 30p of every pound earned after paying direct costs. The remaining 70p covers your cost of goods sold.

Are gross profit and gross margin the same?

No. Gross profit is a pound amount (revenue minus COGS). Gross margin is that same figure expressed as a percentage of revenue.

What's the difference between gross margin and markup?

Gross margin is profit as a percentage of the selling price. Markup is profit as a percentage of the cost. A 50% markup results in a 33% gross margin.

Can I calculate gross margin in Excel or accounting software?

Yes. In Excel, use the formula: =(Revenue-COGS)/Revenue*100. Accounting software like Xero calculates this automatically from your financial data.

How often should I calculate my gross margin?

Review your gross profit margin monthly at minimum. Check it more frequently during periods of price changes, cost fluctuations, or rapid growth.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.