Make pay runs easy with online software for Irish businesses

Do simple, automated pay runs, file them online, and keep accurate payroll records using Xero accounting software. Or if your small business needs advanced features, integrate a payroll app with Xero.

Streamline your online pay runs

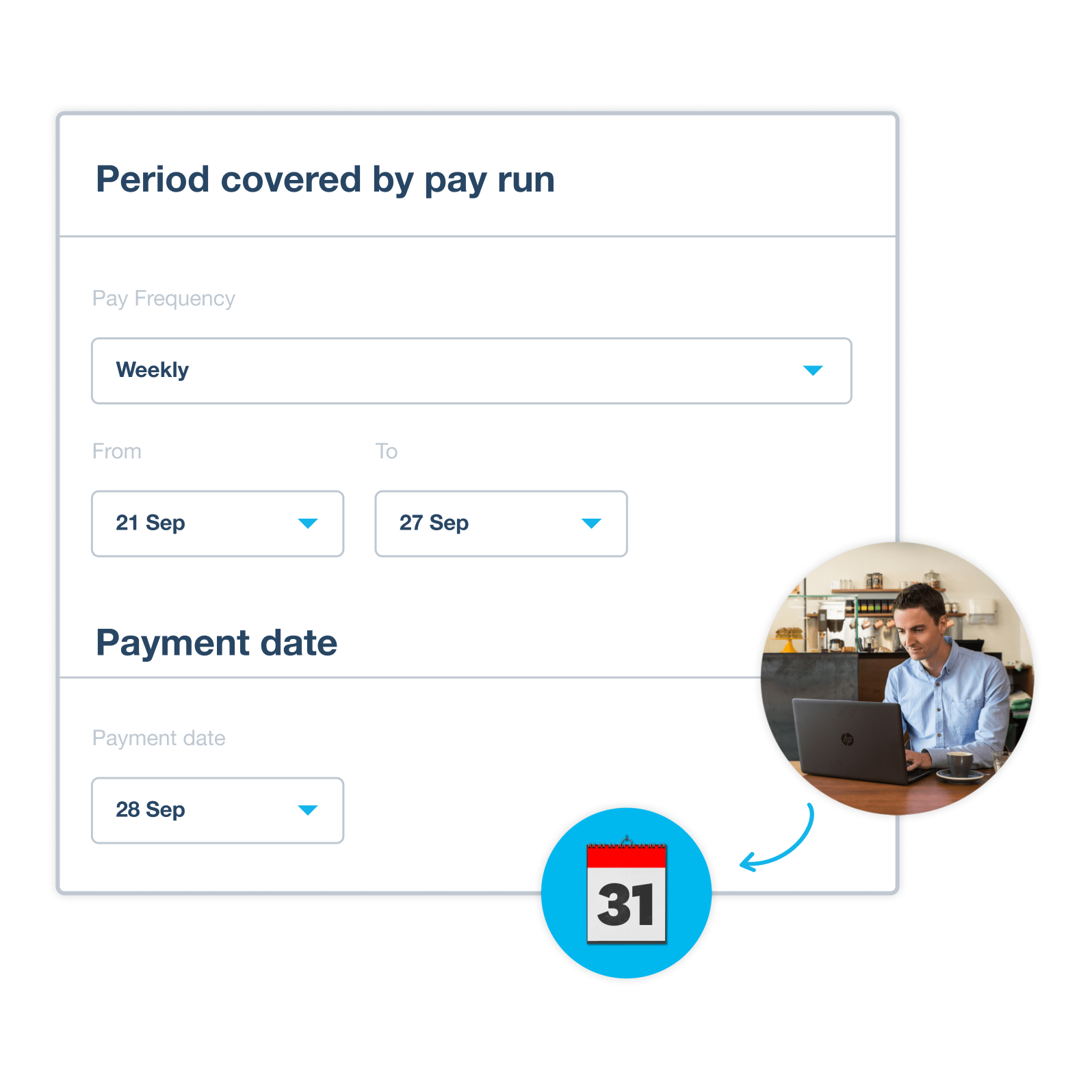

Use Xero accounting software for straight-forward recurring pay runs.

Organise your employee pay records

Store employee data, personal details and payroll records securely with Xero online accounting software.

Connect Xero to a payroll app

Use a third-party payroll app if you need a more advanced payroll solution.

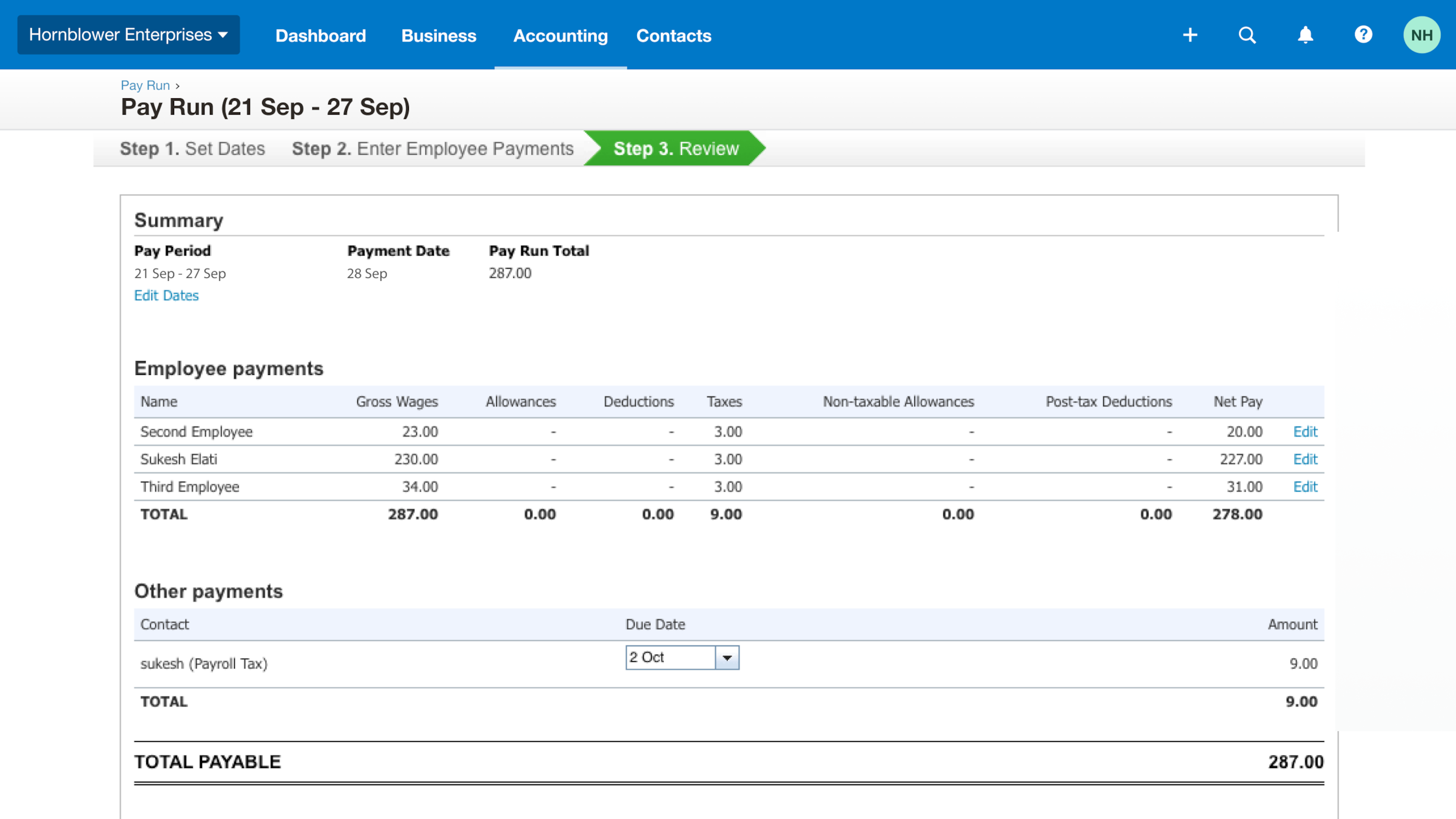

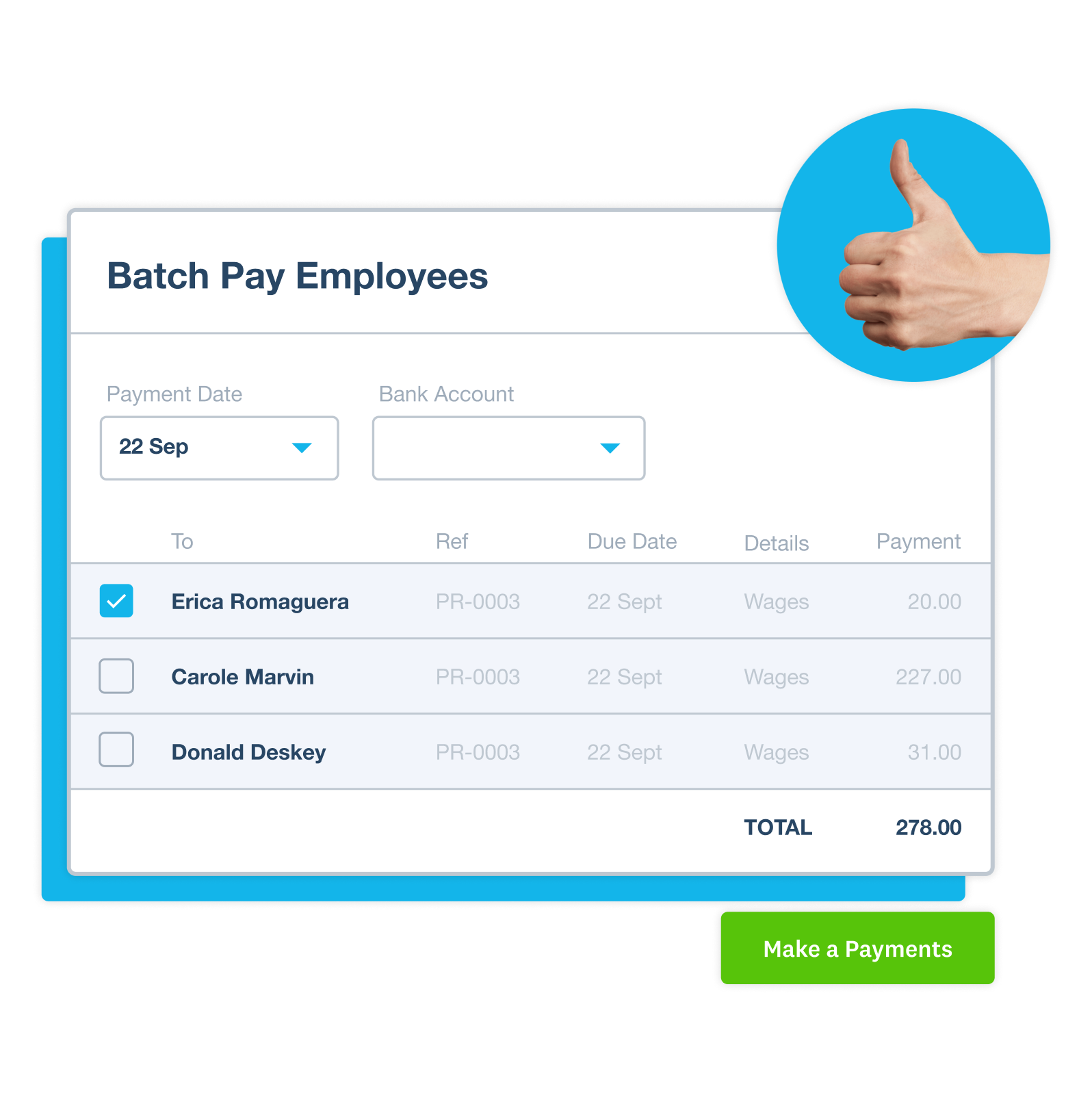

Streamline your online pay runs

Save time by paying a handful of employees with Xero online accounting software. Doing your pay runs online means automated calculations, fewer mistakes and instant, reliable delivery. And once you’re done, all your records are kept in the cloud. Perfect for small business owners and freelancers!

- Enter employee hours, hourly rates, and any taxes or deductions with Xero’s user-friendly design

- Quickly set up recurring payments by copying the previous pay run

- Give your team their pay info hassle-free way – just email or print professional payslips directly from Xero

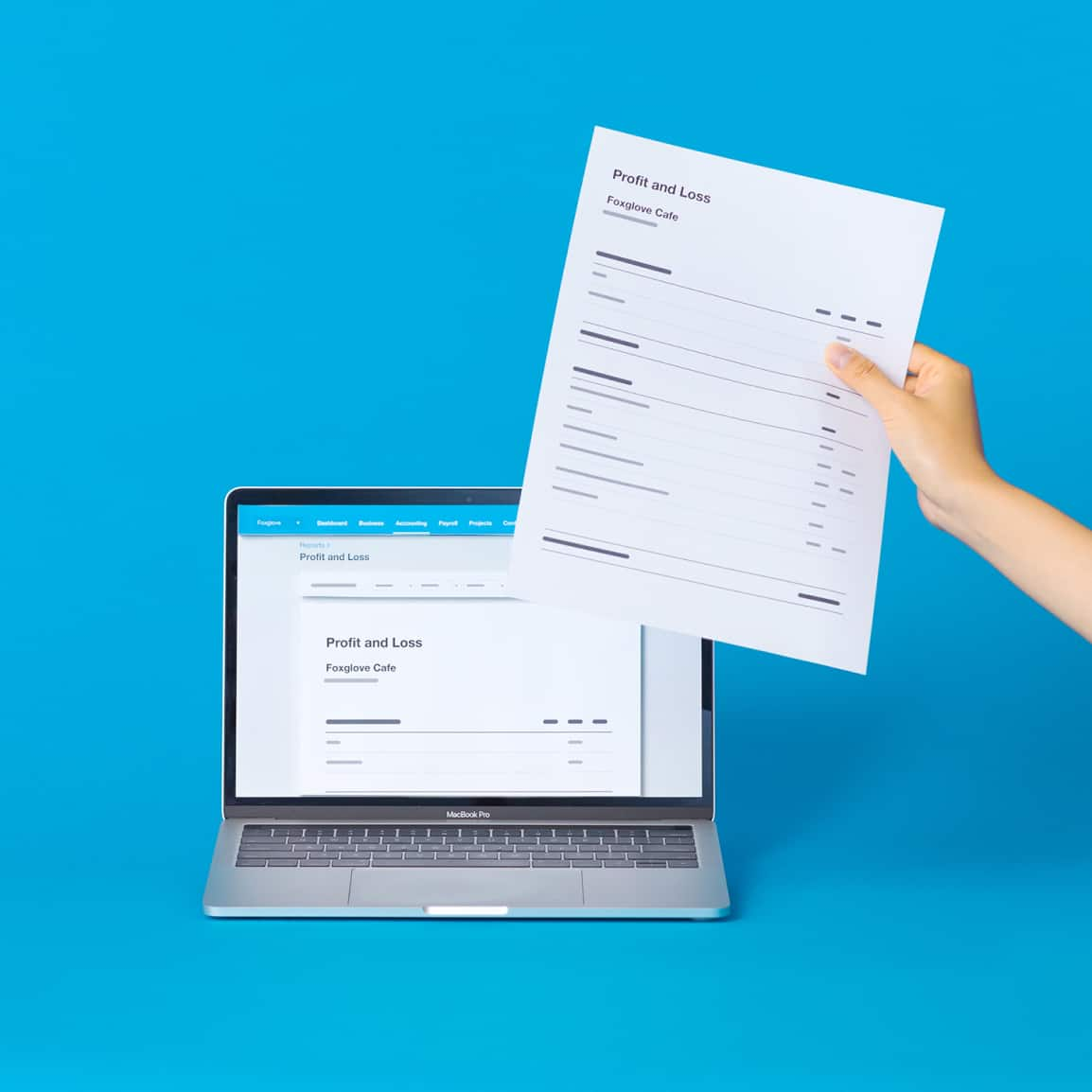

Organise your employee pay records

Xero is the secure, easily accessible place for all your payroll information. Need some banking details? Just pull up the digital record you need, wherever you are that day. Ready to report your finances? Have peace of mind your records are up to date, accurate, and fit for any audits.

- Keep your employee pay records, account details, and other sensitive info securely in the cloud

- Easily reconcile salary and wage payments within Xero for accurate and simple financial tracking

- Be sure you’re complying with government rules storing all your financial data together

Connect Xero to a payroll app

Do more complex pay runs for your small business by connecting a payroll app to your Xero software. Do you have an international payroll? Want to take on more employees or adapt to a new industry rule? Choose from a range of third-party apps that integrate with Xero to address your business needs.

- Filter third-party payroll app by industry, features, and user ratings to find the right app for your business

- Your data flows between your Xero organisation and the apps, so your employee records are accurate throughout the software

- A simple connection process means you don’t need any technical experience needed!

Simplify your entire Irish business with Xero

Xero doesn’t just simplify your payroll – it eases your financial admin, from online invoicing and receiving payments to managing cash flow and reporting on your finances. Lighten your workload with its clever tools and automations, so you can get back to what matters: running your small business.

See how Xero can help

I’ve gone from zero control to Xero control

Made by the Forge uses Xero to make quick decisions

FAQs on your pay runs with Xero

Pretty much instantly! Xero accounting software lets you create pay run reports with the click of a button, so it’s easy to check your pay run and payroll information whenever you have a moment. The reports include a breakdown of the amount paid to all, and individual, employees in your selected pay period. And you can customise your pay run reports by grouping or summarising the data by individual employees, for example.

Pretty much instantly! Xero accounting software lets you create pay run reports with the click of a button, so it’s easy to check your pay run and payroll information whenever you have a moment. The reports include a breakdown of the amount paid to all, and individual, employees in your selected pay period. And you can customise your pay run reports by grouping or summarising the data by individual employees, for example.

It’s simple. Just add your employees as contacts in Xero, then enter their key payroll information – like their wage rate, account details, tax number, and email and postal addresses. This way all this info is at hand whenever you run your payroll, streamlining your process. And don’t worry: Xero protects your personal information and employee pay details with multiple layers of security.

It’s simple. Just add your employees as contacts in Xero, then enter their key payroll information – like their wage rate, account details, tax number, and email and postal addresses. This way all this info is at hand whenever you run your payroll, streamlining your process. And don’t worry: Xero protects your personal information and employee pay details with multiple layers of security.

Xero makes it easy to create professional payslips. Xero online invoices show the employee’s earnings, any deductions, and total pay – plus any notes you choose to include. You can email the employee their digital payslip from within Xero or print them a copy. And Xero keeps all payslips for your records so you can review them whenever you want.

Xero makes it easy to create professional payslips. Xero online invoices show the employee’s earnings, any deductions, and total pay – plus any notes you choose to include. You can email the employee their digital payslip from within Xero or print them a copy. And Xero keeps all payslips for your records so you can review them whenever you want.

The Xero App Store: where your business grows

If you want to grow, to strengthen, to specialise – there’s an app to help. Discover what’s possible by visiting the Xero App Store and start planning your next steps.

Apps to smooth your everyday financial workflows

Discover payroll apps to speed up and simplify your admin, from your monthly pay runs to business expense reimbursements.

Apps for specialised needs

Dig into the details of how you want to manage your payroll and other admin, then find an app with the right features.

Ways to expand your business

Imagine more for your business – Xero connects seamlessly with a wealth of apps to help you extend your offerings.

Guides and other resources on payroll

Boost your understanding of payroll with these essential guides, written in plain English.

What is payroll?

Get an overview of the typical payroll process and definitions of common payroll terms from the Xero glossary.

Can payroll software save you money?

Learn how to decide if payroll software will save your small business money in the long run.

Invoice template

An invoice template creates a professional look, does the math, and makes it easy for customers to follow.

FAQs about Xero in Ireland

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App StoreYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App Store

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Already subscribed and need help with Xero Payroll?

Xero Central is filled with articles to get you started and answer your questions.

Payroll reports

Find technical information on how to run payroll reports, including the ‘Gross to net’ report.

Adding employee contacts for a pay run

Learn how to add your employees’ basic details while you’re processing a pay run, and more.

Payslips for pay runs

Find out how to generate payslips for your employees after you process a pay run.