Gross Profit Margin: What It Is and How to Calculate

Learn how gross profit margin helps you set prices, control costs, and grow profit.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 6 February 2026

Table of contents

Key takeaways

- Calculate your gross profit margin by subtracting cost of goods sold from revenue, then dividing by revenue and multiplying by 100 to get a percentage that shows how much you keep from each sale after direct costs.

- Track your gross profit margin monthly to spot trends early, as declining margins often signal rising supplier costs or pricing pressure before they significantly impact your business performance.

- Focus on improving margins by negotiating better supplier rates, reducing waste in production processes, and strategically raising prices with added value to justify increases to customers.

- Compare your margins against industry benchmarks to understand your performance, as healthy margins typically range from 25-50% for most small businesses but vary significantly by sector and business model.

What is gross profit margin?

Gross profit margin is the percentage of sales revenue remaining after you subtract the direct costs of producing your goods or services. It measures how efficiently your business turns sales into profit before accounting for operating expenses like rent and utilities.

A healthy gross profit margin means you keep more from each sale to cover overhead and generate net profit. Higher margins give you more flexibility to cover essential expenses and indicate healthy pricing and cost management.

Why gross profit margin matters for your business

Gross profit margin reveals whether your core business model is sustainable. It helps you make informed decisions about pricing, hiring, and growth by showing exactly how much profit each sale generates.

Here's what tracking your gross profit margin can tell you:

- Pricing effectiveness: whether your prices cover costs and leave room for profit

- Cost control: how efficiently you manage production or service delivery expenses

- Growth readiness: whether you can afford to hire, expand, or invest in new equipment

- Early warning signs: declining margins often signal rising costs or pricing pressure before they can affect your business

For example, a retail business noticing margins dropping from 45% to 38% over three months might discover a supplier price increase eating into profits, catching the issue early enough to renegotiate or find alternatives.

Gross profit margin vs gross profit

Gross profit is a dollar amount, the money left after subtracting direct costs from revenue. Gross profit margin expresses that same figure as a percentage of total revenue.

For example, if your business earns $100,000 in revenue with $60,000 in direct costs:

- Gross profit: $40,000

- Gross profit margin: 40%

The term 'gross margin' means the same thing as gross profit margin and is often used interchangeably.

How to calculate gross profit margin

Calculating gross profit margin

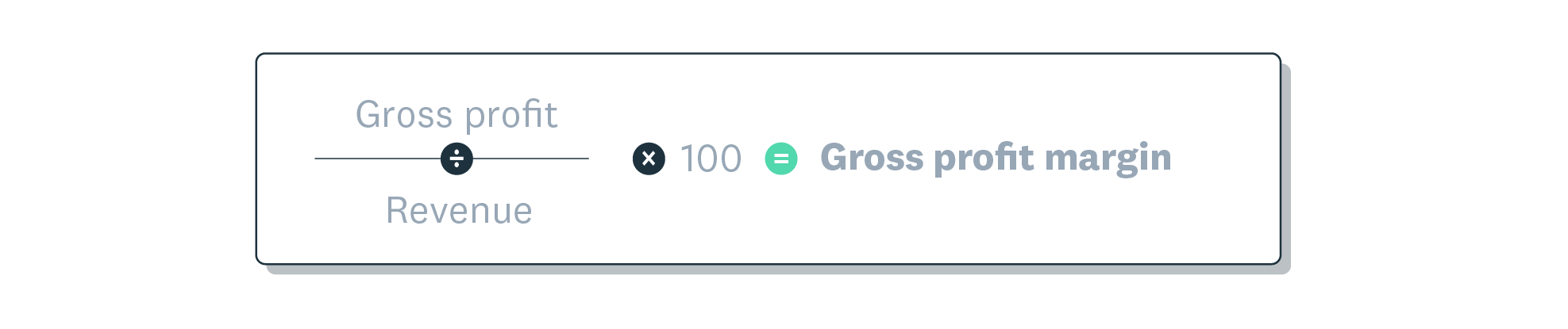

Gross profit margin formula:

Gross profit margin = (Gross profit ÷ Revenue) × 100

In plain terms: subtract your cost of goods sold from your total revenue to get gross profit, then divide by revenue and multiply by 100 to express it as a percentage.

Gross profit margin formula explained

Calculate your gross profit margin in two steps:

- Find your gross profit: Subtract your cost of goods sold (COGS) from your total revenue

- Calculate the percentage: Divide gross profit by revenue, then multiply by 100

Gross profit margin example calculation

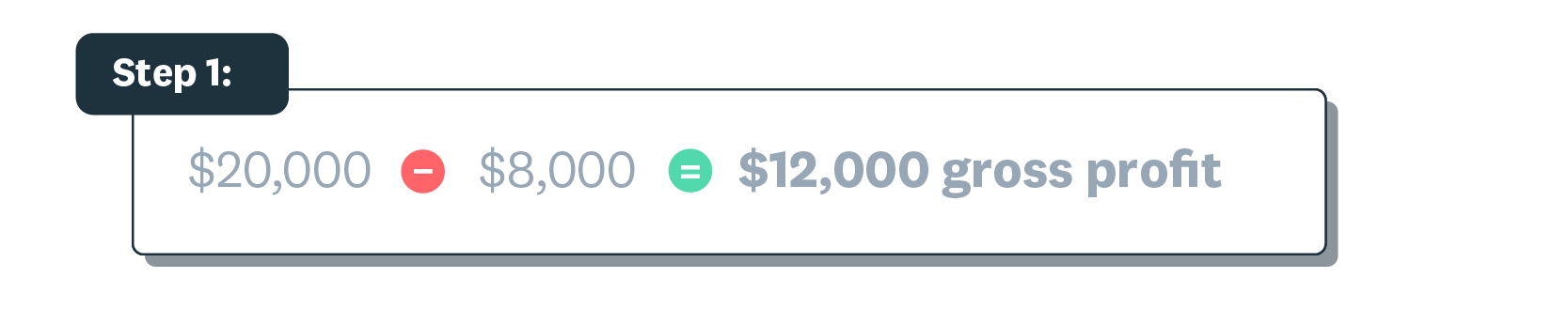

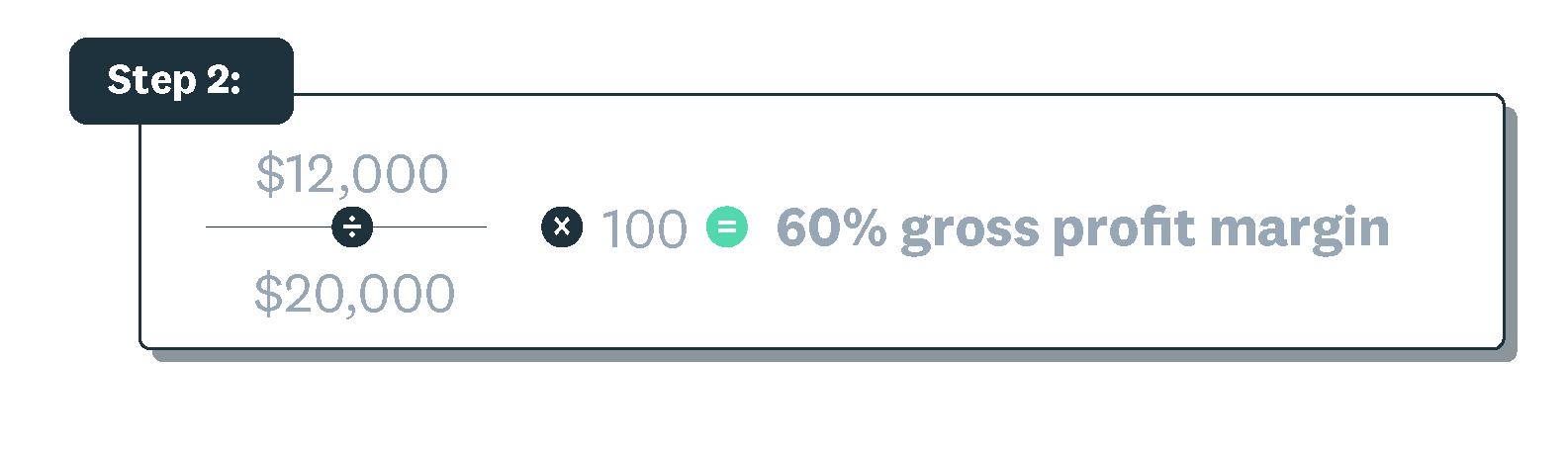

Example calculation:

A cleaning business earns $20,000 in revenue with $8,000 in service delivery costs.

- Revenue: $20,000

- Cost of goods sold: $8,000

- Gross profit: $20,000 − $8,000 = $12,000

- Gross profit margin: ($12,000 ÷ $20,000) × 100 = 60%

This means the business keeps 60 cents from every dollar of sales after covering direct costs.

Avoid common calculation mistakes

Accurate COGS figures are essential for meaningful margin calculations. Watch out for these common errors:

- Missing direct costs: Include all costs directly tied to production or service delivery, such as materials, direct labour, and shipping

- Including operating expenses: Don't add rent, utilities, or administrative salaries, these belong in operating profit calculations

- Using outdated figures: Update your COGS regularly, especially when supplier prices change

- Forgetting inventory adjustments: Account for beginning and ending inventory when calculating COGS for product-based businesses

Your accountant can help you identify which costs belong in your COGS calculation.

What is a good gross profit margin?

A good gross profit margin typically ranges from 25% to 50% for most small businesses, though this varies significantly by industry; for ecommerce stores, for example, analysis shows a 60–70% margin is often what makes profitable scaling possible. Service businesses often achieve 50% or higher, while retail and manufacturing typically operate between 20% and 40%.

Your target margin should cover:

- Operating expenses (rent, utilities, salaries)

- Taxes and loan repayments

- Profit for reinvestment or owner compensation

The right margin for your business depends on your industry, business model, and market conditions.

Factors affecting your margins

Several factors influence what counts as a healthy margin for your business:

Internal factors you can control:

- Pricing strategy: Higher prices increase margins but may reduce sales volume

- Supplier relationships: Negotiating better rates or finding alternative suppliers lowers COGS

- Operational efficiency: Streamlined processes reduce waste and direct labour costs

- Product mix: Focusing on higher-margin offerings improves overall profitability

External factors outside your control:

- Industry norms: Service businesses typically achieve higher margins than retail or manufacturing

- Regional costs: Labour, rent, and taxes vary significantly by location

- Market competition: Competitive pressure may force price reductions

- Economic conditions: Recessions reduce customer spending; inflation increases supplier costs

- Demand shifts: Changing customer preferences affect both pricing power and sales volume

Understanding which factors you can influence helps you focus improvement efforts where they'll have the most impact.

Benchmarking your gross profit margin

Compare your margins against similar businesses to understand how you're performing. For the most accurate comparison, benchmark against businesses that match your:

- Industry and business model

- Size (revenue or employee count)

- Geographic region

Your accountant or bookkeeper can help you find industry benchmarks. Trade associations, industry reports, and government business statistics also provide useful comparison data.

Industry benchmarks for gross profit margin

Typical gross profit margins vary widely by industry:

- Professional services (consulting, accounting): 50–80%

- Software and technology: 60–80%

- Jewellery and cosmetics: 55–65%

- Restaurants and food service: 25–40%

- Retail (general): 25–50%, with some sectors like the apparel industry boasting an impressive gross margin over 50%

- Manufacturing: 20–35%, though some sectors like auto manufacturing have significantly lower gross margins near 12.5%

- Grocery and supermarkets: 20–30%

- Electronics retail: 15–25%

When to reassess your gross profit margin

Review your margins more frequently during these situations:

- Supplier price changes: Rising material or labour costs directly impact margins

- New competitors entering your market: Competitive pressure may require pricing adjustments

- Missed revenue or profit targets: Declining margins often explain underperformance

- Business expansion: New products, services, or locations may have different margin profiles

- Economic shifts: Inflation, recessions, or changing customer behaviour affect both costs and pricing power

Monthly margin reviews help you stay ahead of changes, which is crucial in a dynamic environment where some finance teams report they alter their forecasts at least weekly. Quarterly deep-dives let you identify trends and make strategic adjustments.

Analysing gross profit margin for business insights

Gross profit margin analysis compares your margins across products, services, time periods, or business segments to identify what's working and what needs attention.

Regular analysis helps you:

- Spot profitable products: Identify which offerings generate the highest margins

- Stay ahead of costs: Identify expense changes early to protect your profits

- Make pricing decisions: Determine whether to raise prices or cut costs

- Track business health: Monitor trends over weeks, months, or years

Interpreting gross profit margin trends

Track your gross profit margin monthly or quarterly to spot patterns in business performance. Here's what different trends might indicate:

- Declining margins: Rising supplier costs, pricing pressure from competitors, or inefficient operations

- Seasonal dips: Normal fluctuations in industries with busy and slow periods

- Margins improving: Successful cost-cutting, price increases taking effect, or a shift toward higher-margin products

- Inconsistent margins: Possible issues with inventory management, pricing strategy, or cost tracking

Compare your trends against industry benchmarks to understand whether changes reflect your business specifically or broader market conditions.

Gross profit margin compared with other metrics

Gross profit margin measures profitability at the production level, but it's just one piece of the picture. Understanding how it relates to operating and net profit margins gives you a complete view of your business's financial health.

Gross profit margin vs operating profit margin

Operating profit margin measures profitability after deducting both COGS and operating expenses (rent, utilities, salaries, marketing). It shows how efficiently your business runs day-to-day.

Operating profit margin = (Operating profit ÷ Revenue) × 100

The key difference: gross profit margin only subtracts direct production costs, while operating profit margin also accounts for the overhead required to run your business.

Gross profit margin vs net profit margin

Net profit margin measures profitability after all expenses, including operating costs, interest, and taxes. It represents your true bottom-line profit as a percentage of revenue, and as a general rule of thumb, a 10% net profit margin is considered average.

How to use each metric

Each margin type serves a different purpose in financial analysis:

- Use gross profit margin to evaluate pricing strategy and production efficiency

- Use operating profit margin to assess operational efficiency and overhead management

- Use net profit margin to measure overall business health and long-term sustainability

Track all three metrics together for a complete profitability picture. Improving gross margins while operating and net margins decline may indicate rising overhead costs that need attention.

How to improve gross profit margin

Improving your gross profit margin directly increases the money available for operating expenses, growth investments, and profit. Here are proven strategies small businesses use to boost margins.

Adjust your prices

Strategic pricing directly impacts your gross profit margin. Consider these approaches:

- Raise prices gradually: Small, regular increases (2–5%) are often easier for customers to accept than large jumps.

- Add value to justify higher prices: Improved quality, faster delivery, or better service supports premium pricing.

- Segment your pricing: Offer basic and premium tiers to capture different customer segments.

- Review competitor pricing: Ensure your prices reflect your market position and value proposition.

Test price changes on a small scale before rolling out broadly to measure customer response.

Reduce your cost of goods sold

Lowering direct costs improves margins without requiring price increases. Focus on these areas:

- Negotiate with suppliers: Request volume discounts, longer payment terms, or price matching

- Find alternative suppliers: Compare quotes regularly to ensure competitive pricing

- Reduce waste: Track materials usage and minimise spoilage, errors, or overproduction

- Optimise inventory: Avoid overstocking (which ties up cash) and stockouts (which may require expensive rush orders)

- Review labour efficiency: Ensure direct labour hours align with production needs

Even small cost reductions compound over time. A 5% decrease in COGS can significantly improve your annual profit.

Streamline your operations

Operational efficiency reduces the time and resources required to deliver your products or services, directly improving margins.

- Automate repetitive tasks: Use software for invoicing, inventory tracking, and financial reporting to reduce labour costs

- Improve production processes: Identify bottlenecks and eliminate unnecessary steps

- Manage inventory effectively: Reduce carrying costs by maintaining optimal stock levels

- Train your team: Skilled employees work more efficiently and make fewer costly errors

- Track time and resources: Monitor where time and money go to identify improvement opportunities

Accounting software like Xero helps you track costs, monitor margins, and spot inefficiencies in real time.

Track your gross profit margin with confidence

Monitoring your gross profit margin can be simple and straightforward with the right tools. The right accounting software tracks your margins automatically and alerts you to changes that need attention.

With Xero, you can:

- See margins in real time: Access up-to-date profitability data from any device

- Track trends over time: Built-in reports show how your margins change month to month

- Compare by product or service: Identify your most and least profitable offerings

- Dashboard alerts highlight margin changes so you can respond quickly

Ready to take control of your business finances? Get one month free when you subscribe to Xero.

FAQs on gross profit margin

Here are answers to common questions about gross profit margin.

What does a 40% gross profit margin mean?

A 40% gross profit margin means your business keeps 40 cents from every dollar of sales after paying direct costs. The remaining 60 cents covers your cost of goods sold.

How often should I check my gross profit margin?

Review your gross profit margin monthly at minimum. Check more frequently during periods of price changes, supplier negotiations, or economic uncertainty.

Can gross profit margin be negative?

Yes, a negative gross profit margin means your direct costs exceed your sales revenue. You're losing money on every sale before even covering operating expenses. This requires immediate attention to pricing or cost structure.

What's the difference between gross margin and markup?

Gross margin is profit as a percentage of selling price. Markup is profit as a percentage of cost. A product costing $60 and selling for $100 has a 40% gross margin but a 67% markup.

Does gross profit margin include labour costs?

Gross profit margin includes direct labour, wages for employees directly involved in producing goods or delivering services. It excludes indirect labour like administrative staff, which falls under operating expenses.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.