How to calculate margin

October 2023 | Published by Xero

Margin (calculation)

The margin formula is profit divided by revenue, times 100. Margin is expressed as a percentage.

There are two main types of margin:

- Gross profit margin – the percentage of income left after paying for the goods and services you sell (COGS or COS)

- Net profit margin – the percentage of income left after paying all costs and taxes (or sometimes taxes are omitted and it can be net profit margin before tax)

Gross profit margin

Usually, when the term ‘margin’ is used, it’s referring to gross profit margin. If your gross profit margin is low you’ll find it harder to pay for other expenses like utilities and rent. And this then reduces your chances of making a net profit.

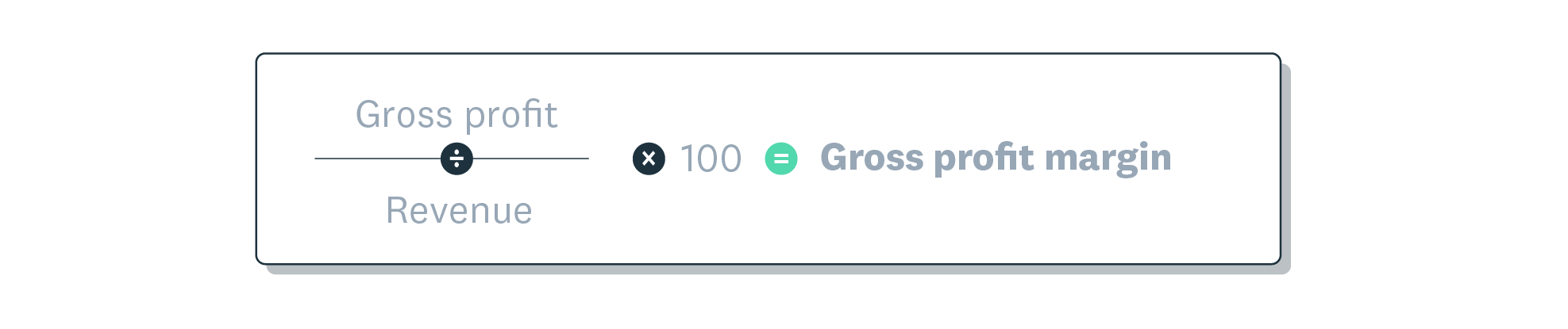

How to calculate gross profit margin

Gross profit is revenue minus the cost of goods sold.

Net profit margin

Your net profit margin shows what percentage of your revenue is actual profit after all expenses are deducted. This number shows how efficient your business is at turning income into profit.

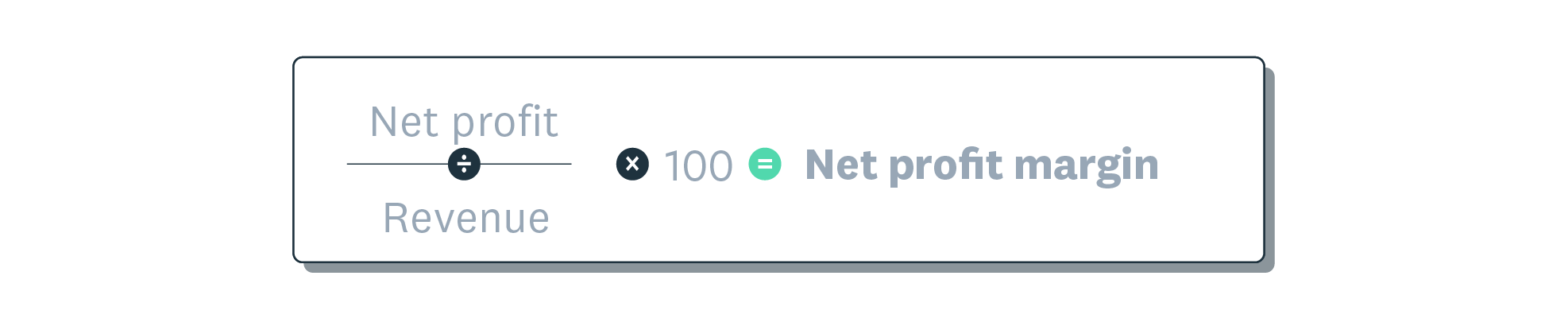

How to calculate net profit margin

Net profit is revenue minus all expenses and taxes. Or you can calculate net profit before tax, which is simply revenue minus expenses.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Explore our guides

Find guides with expert advice and tools to help manage and grow your business

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.