Bookkeeping vs accounting: What’s the difference for your small business?

Understanding bookkeeping vs accounting can confuse business owners. Learn the key differences and how each helps you.

Table of contents

Key takeaways

- Recognize that bookkeepers handle daily financial record-keeping and data entry, while accountants provide strategic analysis and business insights based on that financial data.

- Hire a bookkeeper when you spend more than 5 hours per week on financial tasks or need help with invoicing and monthly reports, but add an accountant when your annual revenue exceeds $500,000 or you need strategic financial planning.

- Understand that bookkeepers typically require certificate programs or associate degrees, while accountants need bachelor's degrees and often CPA certification, which affects both their service scope and fees.

- Implement a combined approach using both professionals—a bookkeeper for daily financial management and an accountant for tax compliance and strategic planning—to get comprehensive financial support without paying for unnecessary services.

Bookkeeping vs accounting

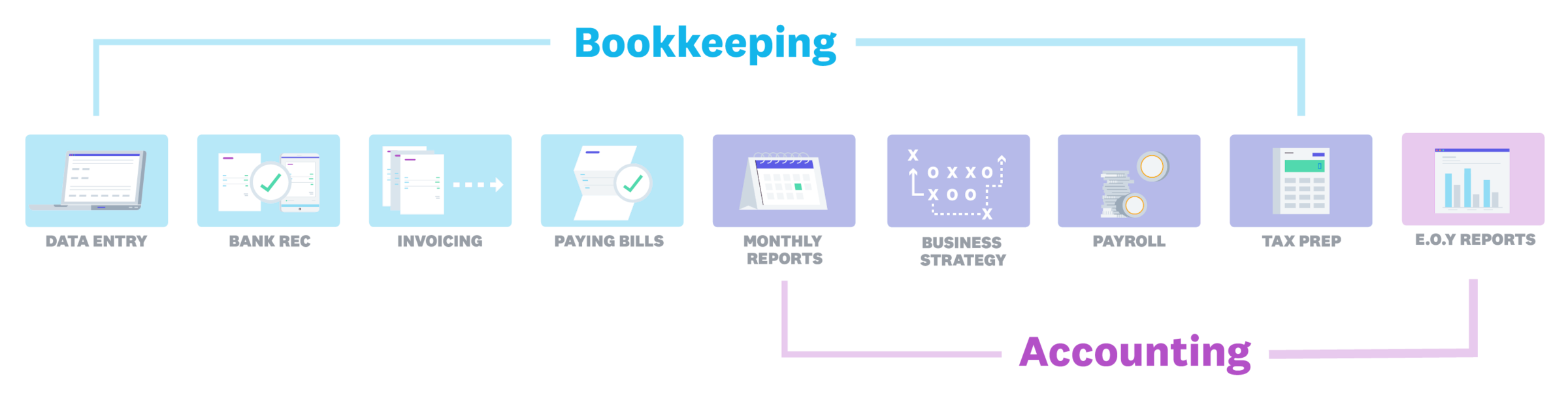

Bookkeeping is the day-to-day recording and organizing of financial transactions. Accounting involves analyzing, interpreting, and reporting on financial data to provide strategic business insights.

The key difference: bookkeepers handle data entry and basic financial tasks, while accountants provide analysis and strategic advice. Both roles are essential for managing business finances, but they serve different purposes at different stages of your financial management process.

Bookkeeping covers data entry to strategy. Accounting covers reporting, taxes and strategy.

What bookkeepers do

Bookkeepers handle the day-to-day financial record-keeping that keeps your business organized and compliant. Their core responsibilities include:

Daily tasks:

- Managing accounts payable and receivable

- Processing invoices and payments

Monthly activities:

- Generating financial reports for business owners

- Running payroll for employees

- Preparing preliminary tax documentation

Some bookkeepers also provide basic financial analysis and highlight trends in your business performance.

What accountants do

Accountants are trained financial analysts who interpret your business data to provide strategic insights and ensure compliance. They typically hold accounting degrees and professional certifications.

Core accounting services:

- Preparing official financial statements (income statements, balance sheets, cash flow statements)

- Filing tax returns and managing tax compliance

- Conducting financial analysis and forecasting

- Providing strategic business advice based on financial data

Strategic services:

- Business planning and budgeting

- Investment and growth strategy recommendations

- Risk assessment and financial planning

- Audit preparation and representation

Some accounting firms also offer bookkeeping services, so you can manage all your financial needs in one place.

Difference between accountants vs bookkeepers

The traditional division between bookkeeping and accounting has evolved, but key differences remain:

Education and qualifications:

- Bookkeepers: Certificate programs, on-the-job training, or associate degrees

- Accountants: Bachelor's degrees in accounting, often with CPA certification

Service scope:

- Bookkeepers: Focus on accurate record-keeping and basic reporting

- Accountants: Provide analysis, strategic advice, and complex tax services

Business impact:

You might use a bookkeeper for daily financial management and an accountant for strategic planning and tax compliance. This approach gives you full financial support without paying for services you do not need.

When to hire a bookkeeper vs accountant

Your business needs determine which professional to hire first. Here's how to decide:

Hire a bookkeeper when you:

- Have regular transactions that need organizing

- Spend more than 5 hours per week on financial record-keeping

- Need help with invoicing and bill payments

- Want monthly financial reports to track performance

Hire an accountant when you need to:

- Need strategic financial advice for business decisions

- Have complex tax situations or multiple revenue streams

- Are planning significant business changes (expansion, investment, loans)

- Require detailed financial analysis and forecasting

Hire both a bookkeeper and an accountant if you:

- Have annual revenue over $500,000

- Operate in multiple locations or jurisdictions

- Need both daily financial management and strategic planning

- Want to focus entirely on running your business, not managing finances

Most small businesses start with a bookkeeper and add an accountant as they grow and need more strategic financial guidance.

Education and qualifications required

Understanding professional qualifications helps you choose the right financial support for your business needs.

Bookkeeper qualifications:

- Entry level: High school diploma plus bookkeeping software training

- Professional: Certificate in bookkeeping or associate degree in accounting

- Experience: 1-3 years of practical bookkeeping experience

Accountant qualifications:

- Minimum: Bachelor's degree in accounting or related field

- Professional: CPA (Chartered Professional Accountant) designation

- Specialized: Additional certifications in tax, forensic accounting, or business valuation

- Experience: 2-5 years of professional accounting experience

What this means for your business:

Higher qualifications usually mean higher fees, but you also get more comprehensive services. Choose a professional whose qualifications match your business needs and budget.

Choose the right financial support for your business

The right financial professional depends on your business stage and needs. Start with a bookkeeper if you need organized records and basic reporting. Add an accountant when you need strategic advice and complex financial analysis.

You can use a bookkeeper for daily financial management and an accountant for strategic planning and tax compliance. This approach helps you keep accurate records and gives you the insights you need to grow your business.

Ready to make your financial management easier? Start a free trial of Xero accounting software and see how the right tools can support both your bookkeeping and accounting needs.

FAQs on bookkeeping vs accounting

Here are some common questions about bookkeeping and accounting.

Can a bookkeeper handle my accounting needs?

A bookkeeper can handle basic financial record keeping and simple reporting, but they usually can't provide strategic financial analysis, tax planning, or complex business advice that accountants offer.

Is accounting software like Xero considered bookkeeping or accounting?

Accounting software handles both bookkeeping tasks (recording transactions, generating reports) and some accounting functions (analysing finances, preparing taxes). The software doesn't replace professional expertise but helps both roles work more efficiently.

Which is more cost-effective for small businesses?

Bookkeepers usually cost less per hour than accountants. If you need basic financial management, a bookkeeper is more cost-effective. Add an accountant when you need strategic advice to help your business grow.

When should I upgrade from a bookkeeper to an accountant?

Add an accountant when your annual revenue exceeds $500,000, you are making major business decisions, you face complex tax situations, or you need strategic financial planning for growth or investment.

Handy resources

Advisor directory

You can search for experts in our advisor directory

When you should hire a bookkeeper

Find out all the things bookkeepers can do for your business

Xero dashboard

See your key information on the business dashboard

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.