How to calculate net profit

Net profit (calculation)

Net profit is gross profit minus operating expenses and taxes. You can also think of it as total income minus all expenses.

How to calculate net profit. When calculating net profit, your accountant also makes adjustments for depreciation

Example of a net profit calculation

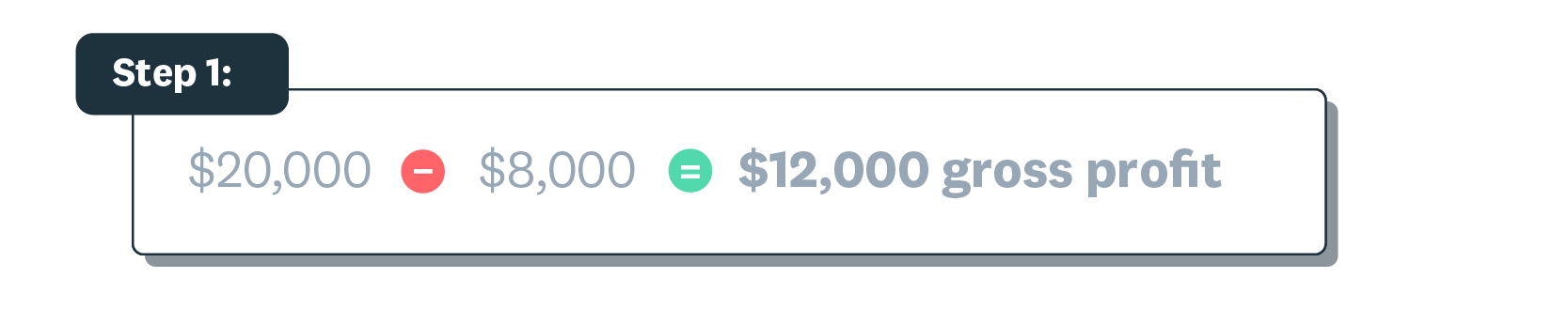

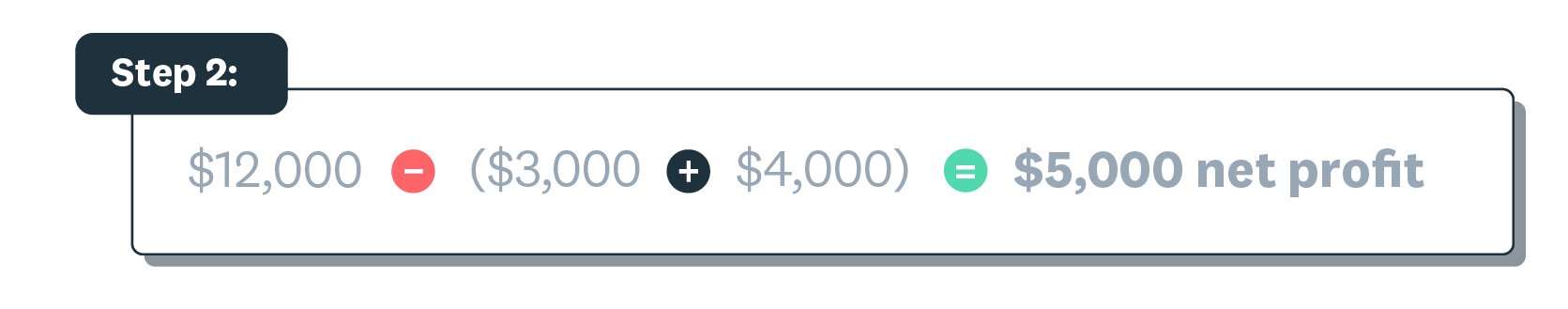

Let’s say your business sells $20,000 worth of products, and it cost you $8000 to make them. With additional operating expenses of $3000 and taxes of $4000, the calculation would go like this.

Net profit is the money you get to hold onto. The number comes last on the profit and loss statement, which is why it’s called the bottom line. The net profit can be paid out to owners or reinvested in the business.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

How to manage your finances and cash flow

Learn about money management for your small business

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.