Accounting software for your small business in the Philippines

Go paperless with Xero bookkeeping software for small business. Automate e-invoicing and bank reconciliation, simplify your workflows and get clear financial reports that meet BIR requirements – all in one secure, central place.

Reduce stressful admin

Xero’s online accounting software gives you hours back thanks to automated tools for all your financial admin.

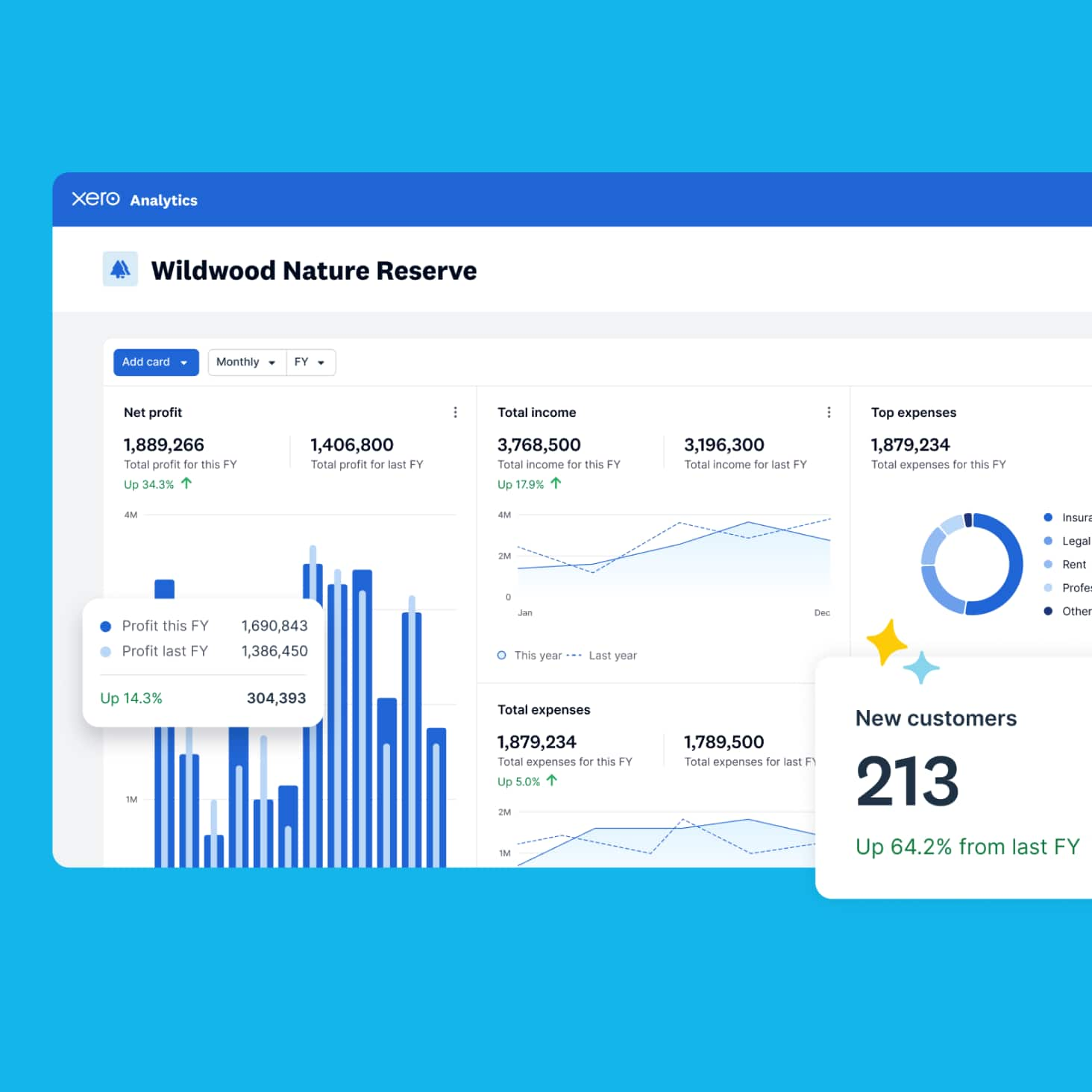

Insights on your finances

Make smart, data-led decisions with clear, insightful reports tailored to your Philippine business.

A better tax season with clearer reporting

Know you’re reporting the right numbers to the BIR with Xero’s cloud accounting software.

Run Xero your way with apps

Just plug in the extra features you need from the Xero App Store to supercharge your small business.

Join over 4.6 million subscribers using Xero

Awards and recognition for our work

Save yourself hours with Xero accounting software

Short on time? Xero’s smart tools automate admin, track finances, and provide insights—helping you stay organized and grow your business.

Paperless record-keeping

Keep all your financial records in one central place with Xero online accounting software. Never lose a receipt!

Automations that fast-track your admin

Save time on your jobs, from automating your invoice reminders to managing your business expenses.

Smart data and insights to grow your business

Make confident decisions with sophisticated trend analysis and clear, comprehensive reports tailored to your business.

Life before Xero was a nightmare. Using a spreadsheet took a ridiculous amount of time.

Ryan is no longer dogged by paperwork.

Streamline your billing

Do your invoicing online and get paid sooner.

Ace your inventory

Get your reorders right, and never run out of your big sellers.

Pay your team easily

Pay staff on time, every time and make BIR compliance easy.

Save hours with bank feeds

Pull your transactions into Xero daily and get automated reconciliation to update your books in a flash.

Get paid on time with online payment options

Make it simple and quick for customers to pay you.

Stay on top of projects

Handle your project planning, budgeting, time tracking, and analysis in one place.

Discover how Xero’s powerful features save you time and take the stress out of running your Philippine business. Here’s how Xero can help your business

All your small business accounting in one place

Xero is powerful online accounting software for Philippines small businesses, automating invoicing, bank reconciliations, and reporting. Get real-time financial insights, track expenses, and keep accurate records – all in one place – to simplify cash flow management and tax preparation.

- Automate tasks like invoicing, bank reconciliations, and reporting

- Get up-to-date financial data for a full picture of your business

- Keep accurate records in a single place for easier tax returns

Automations that fast-track everything

Save time on your financial admin jobs, Automate payment reminders, smooth your business expenses, and reorder big-selling items right on time with Xero’s powerful small business accounting software.

Clear insights to scale your business

Know your numbers inside out with Xero. Get clear, sophisticated trend analysis and reports so you’re up to date on your business position, cash flow and expenses.

Easy compliance for a smoother tax season

Xero puts everything where it belongs in time for tax season. Help your small business comply with the BIR’s e-invoicing mandate and nail your tax prep for VAT-registered businesses.

- Connect all your business bank accounts to Xero

- Get your bank transactions into Xero automatically

- Track your business’s current cash flow

Customise Xero to the way you do business

In a growth phase? Need extra features? Tailor Xero accounting software to the specific needs of your small business. Extra tools from the Xero App Store can further simplify your operations and power up your business.

Get even more out of Xero with third-party apps

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

See more of what Xero can do

FAQs on accounting software

Because Xero is based in the cloud, there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate with your accountant on your numbers in real time, and get automatic backups and world-class data protection – all in one secure platform.

See how Xero’s accounting software can help your small businessBecause Xero is based in the cloud, there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate with your accountant on your numbers in real time, and get automatic backups and world-class data protection – all in one secure platform.

See how Xero’s accounting software can help your small businessNo, but it’s very useful. The Xero Accounting app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The app is free with every subscription and works with iOS and Android.

See how to stay connected to your business on the goNo, but it’s very useful. The Xero Accounting app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The app is free with every subscription and works with iOS and Android.

See how to stay connected to your business on the goOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero, that has the features you need, like the ability to use e-invoicing and send foreign currency payments.

Here’s more on cash vs accrual accountingIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero, that has the features you need, like the ability to use e-invoicing and send foreign currency payments.

Here’s more on cash vs accrual accountingIt’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

Yes, but an accountant’s expertise can help your business perform. If you choose not to engage one, read online resources – like those by Xero – to help you manage cash flow, track payments, and create invoices. They also keep you up with regulatory changes around tax and record keeping, for example. And don’t forget accounting software like Xero – it keeps all your financial records in one secure place, and its automated calculations prevent mistakes, save you time, and make tax season easier.

Check out Xero’s directory of accountants and bookkeepersYes, but an accountant’s expertise can help your business perform. If you choose not to engage one, read online resources – like those by Xero – to help you manage cash flow, track payments, and create invoices. They also keep you up with regulatory changes around tax and record keeping, for example. And don’t forget accounting software like Xero – it keeps all your financial records in one secure place, and its automated calculations prevent mistakes, save you time, and make tax season easier.

Check out Xero’s directory of accountants and bookkeepersTechnically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Technically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Do more with Xero

Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.