Cash flow statement example

Check out this example of a cash flow statement to learn how they work. See what numbers go where, what maths takes place, and how to read the results.

Download the cash flow statement template

Fill in the form to get a cash flow statement template as an editable PDF. We’ll also link you to a guide on how to use it.

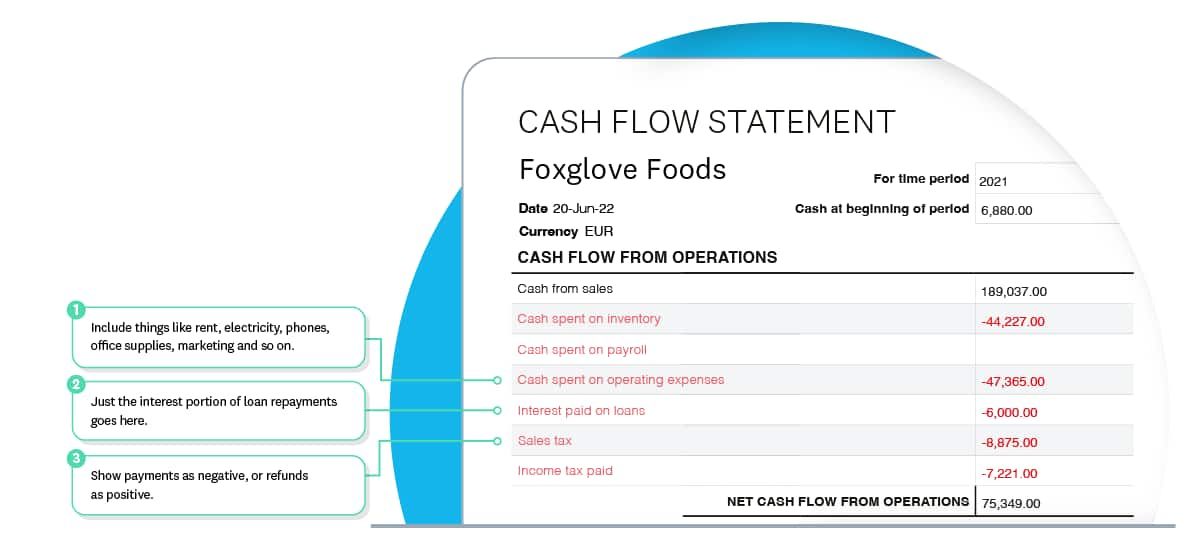

Example cash flow statement

A cash flow statement is divided into four sections. We'll explain each section in detail, but let's start with the overall layout.

Get more on each of the four sections below.

Cash flow from operations

Show the cash coming in from sales. And show the cash that you spent running the business. Total these amounts to show the overall effect of operations on cash flow.

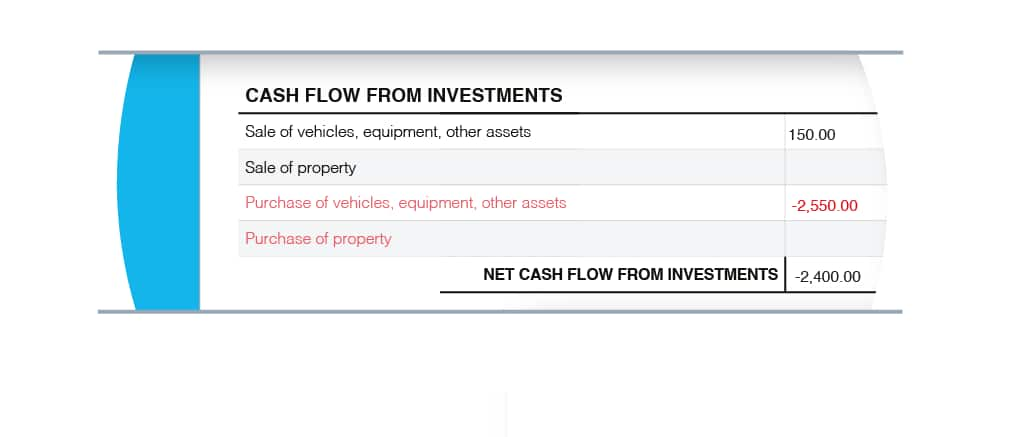

Cash flow from investments

Show cash spent on big items like real estate and equipment. Also show money received from selling those same types of things. Total these amounts to show the overall effect of investments on cash flow (it will often be a negative number).

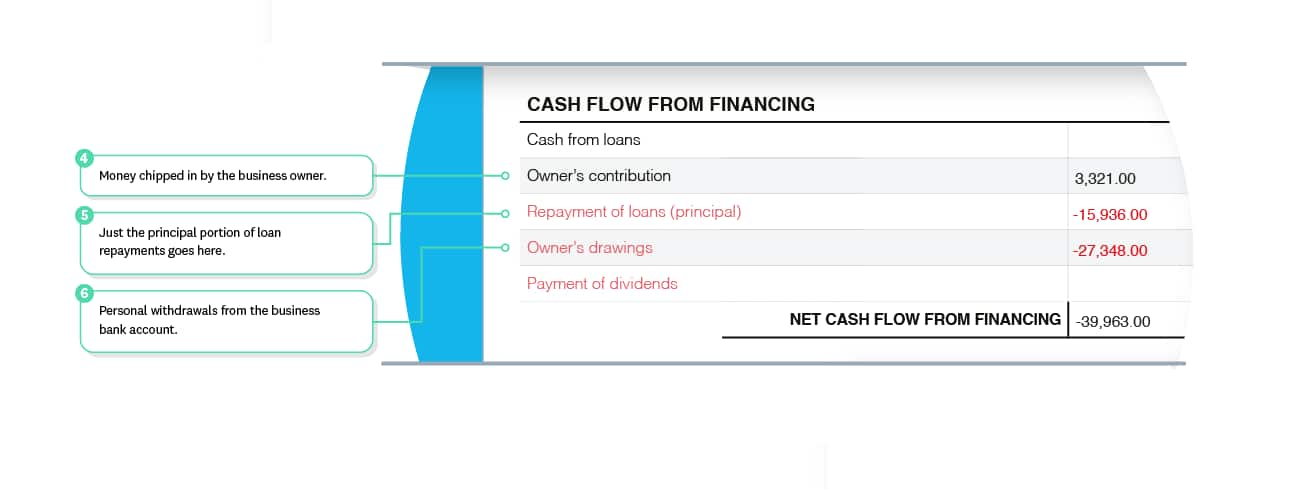

Cash flow from financing

Show cash received from lenders and investors, and amounts that were paid back to them. Also show cash put in, or taken out, by the owner. Total these amounts to figure out the overall effect of financing on cash flow.

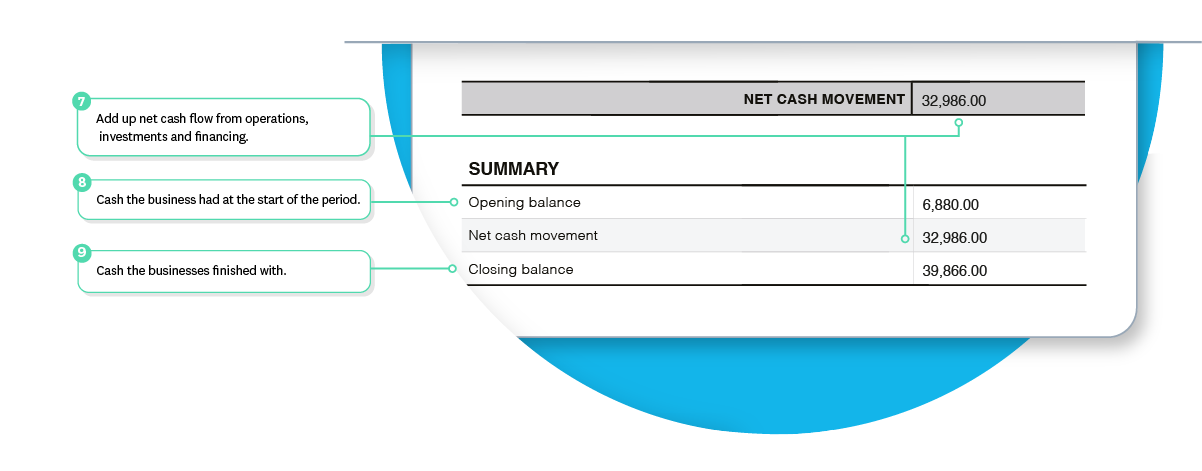

Net cash movement

Bring everything together to show the overall changes in your cash position.

Want to borrow this template?

If you like the format of the cash flow statement in this example – we can send it to you as a template.

Plan ahead

Make a more powerful statement

Create cash flow statements whenever you want with online accounting. No spreadsheets required.

What a cash flow statements tells you

A cash flow statement shows how much money you have to spend, and where that money comes from. And if there’s not much cash left, it can tell you where it went.

To do this, the cash flow statement combines information from your:

- profit and loss – including sales revenue and business expenses.

- balance sheet – including owner’s drawings and repayment of loan principal (your P&L only shows interest paid).

As you can see from our example cash flow statement, these reports also provide a handy summary of taxes and interest paid, which can be useful numbers to have on hand.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.