Australian small business jobs growth posts its lowest result since October 2020

Xero Small Business Index falls nine points in August as lockdowns impact four states

Melbourne — 30 September, 2021 — Xero, the global small business platform, today released new data on the health of Australia’s small business economy in August from the Xero Small Business Index. Based on aggregated and anonymised transactions from hundreds of thousands of small businesses, the Index is produced in partnership with Accenture and is part of the Xero Small Business Insights program.

Index continues to fall as restrictions are felt across Australia

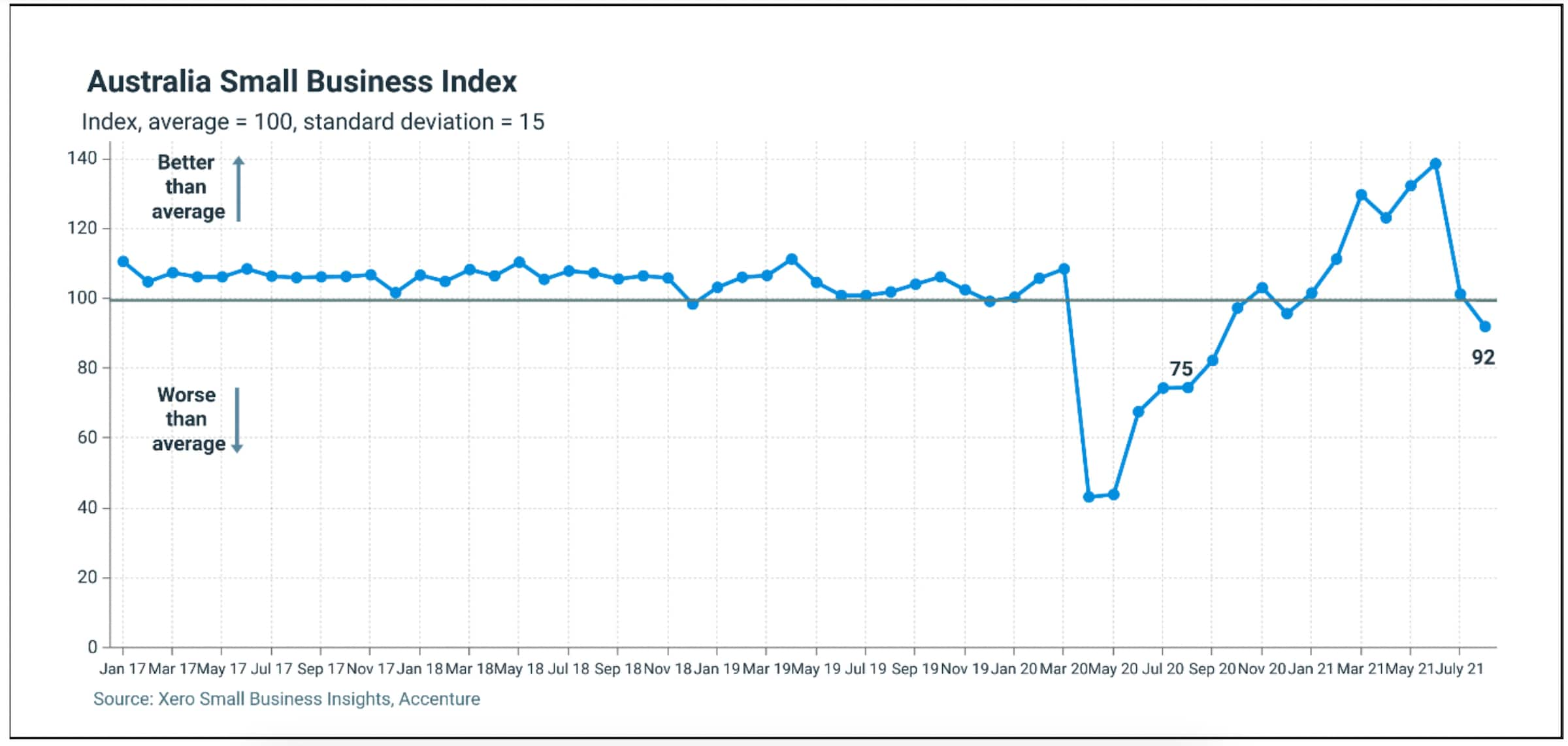

The Index fell by nine points to 92 points in August, continuing the downward trend from last month. With the Index now sitting slightly below 100, Australian small business performance in August was below average. Small business jobs rose just 1.3% year-on-year (y/y) in August, its slowest pace of growth since October 2020.

There was a pick-up in sales growth, however, that helped to prevent the Index from taking a harsher decline. By the end of August, around 60% of the Australian population was living under stay-at-home orders. Greater Sydney was under restrictions for the whole of August, while regional NSW (14-31 August), metropolitan Melbourne (5-31 August), regional Victoria (5-9 and 21-31 August), the ACT (12-31 August), South East Queensland/Greater Brisbane (1-8 August) and Cairns (9-11 August) all moved to stay-at-home orders during the month.

Joseph Lyons, Managing Director Australia and Asia, Xero said: “With more than half the Australian population under stay-at-home orders in August, it was yet another tough month for small businesses as jobs growth slowed to its lowest result since October last year. The Xero Small Business Insights data does provide some green shoots of hope, with an increase in sales offsetting the weakened jobs growth. Time and again, small businesses demonstrate their adaptability and resilience.”

“As Australians continue to roll up their sleeves for their vaccinations in record numbers, small businesses in NSW and Victoria are preparing for their own shot in the arm as reopening dates inch closer. Now’s the time for Australians to support the businesses springing back to life, to give them a much needed boost heading into Christmas and the summer holidays,” Lyons added.

Sales growth shows some resilience

Nationally, sales in small business – adjusted using annualised two-year growth – rose 6.4% year-on-year (y/y) in August. This is an increase from July’s sales growth of 4.2% y/y, despite the widespread lockdowns in August.

The national figures, however, masked significant state differences. NSW (3.1% y/y) and the ACT (3.3% y/y) recorded the weakest sales results, while Western Australia (12.8% y/y) and Queensland (10% y/y) delivered strong sales growth. Despite metropolitan Melbourne being in lockdown for most of August, sales in Victoria grew 6.7% y/y, up from 5.5% in July. South Australia bounced back from its short July lockdown, delivering sales growth of 9.3% y/y in August compared to 2.5% y/y adjusted in July.

The hardest hit sectors in August continued to be hospitality and arts and recreation, falling 11.4% and 6.5% y/y, with healthcare and real estate services as the strongest performing sectors in August with 14.8% and 11% y/y growth respectively. Sales growth in construction rebounded to 7.4% y/y in August, after just 3.4% in July, on the back of the two-week ban on activity in Greater Sydney.

Jobs growth weakens further

Small business jobs rose just 1.3% y/y in August 2021. This marks a continuing slowdown from July (2.4% y/y) and June (4.5% y/y) and is the slowest pace of growth since October 2020.

Jobs growth weakened across all states but NSW was the only state to record negative growth of -2.3% y/y. This follows a 0.1% y/y decline in July. Victoria recorded a modest +1.9% y/y while jobs in Western Australia rose a strong +6.9% y/y. Jobs growth in the ACT experienced the sharpest slowdown, falling from +6.1% y/y in July to +3.2% y/y in August.

Louise Southall, Xero Economist, said: “The slowdown in jobs growth is not uniform across Australia. Small businesses in hospitality and arts and recreation are once again being hit much harder than those that can revert to working from home, such as professional services. Similarly, there’s a stark contrast between states, as Western Australia continues to post jobs growth around 7% year-on-year, while in NSW jobs are now 2.3% below where they were in August 2020.”

Time to be paid ticks up

The time it took for small businesses to be paid by customers rose by 0.5 days to 23.7 days in August. While this is a slight rise, this metric is now at its highest since September 2020. Meanwhile, the late payments measure also rose, to 7.2 days, meaning businesses are, on average, being paid more than a week late.

Wages growth unchanged

Wages in small business, as measured by average employee hourly earnings, rose 2.5% y/y (adjusted). This is consistent with July’s 2.5% y/y rise and still down on the pre-pandemic pace of growth around 3%.

To download the full August results, including industry and regional breakdowns, go to the website here.

The impacts of the September lockdowns and the two-week ban on construction in Victoria will be assessed in the next monthly update to be released in late October.

To find out more about how the Xero Small Business Index is constructed, see the background information and methodology.

ENDS

Media Contact

Jessica Brophy | jess.brophy@xero.com | +61 431 268 549

About Xero

Xero is a cloud-based accounting software platform for small businesses with over 2.7 million subscribers globally. Through Xero, small business owners and their advisors have access to real-time financial data any time, anywhere and on any device. Xero offers an ecosystem of over 1,000 third-party apps and 300 plus connections to banks and other financial partners. In 2020 and 2021, Xero was included in the Bloomberg Gender-Equality Index and in 2020, Xero was recognised by IDC MarketScape as a leader in its worldwide SaaS and cloud-enabled small business finance and accounting applications vendor assessment.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialised skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders.

Note to editors:

The Xero Small Business Index is unweighted and comprised of the following four metrics:

- Sales - captures a core measure of small business health and a measure of the overall economic activity in the small business economy.

- Time to be paid - captures how long businesses are waiting to be paid, providing insight on the financial health of their customers and small business cash flo

- Jobs - captures if small businesses are growing and how small business is impacting on the broader economy and community.

- Wages - captures how benefits from small business performance are translating to employees-benefits flowing to the broader small business economy.

These four metrics were selected because they encompass the operating state of the small business (sales and time to be paid) and the contribution small businesses make to the community (jobs and wages).

Related media and enquiries

For all media enquiries, please contact the Xero media team.

- Media release

Xero customers around the world share realities of small business ownership in new social series

‘Good Days, Bad Days’ explores the stories of adaptability of seven different business owners from different countries

- Media release

New Xero data reveals Australian small business recorded strongest sales growth in 3 months in June

Xero Small business Index reached a new high in June 2021 ahead of latest COVID-19 restrictions

- Media release

New Xero data reveals Australian small business jobs and sales continue to rise

Small business jobs record second month of positive growth above 5%.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.