Manage VAT returns easily

Automatically calculate VAT on transactions, prepare VAT201 returns, and file them using the SARS e-Filing service.

eFile VAT returns to SARS

Auto-populate VAT201 returns ready for e-filing.

Flexible VAT rates

Commonly used VAT rates are already set up.

Automated calculations

VAT on transactions is recorded for you.

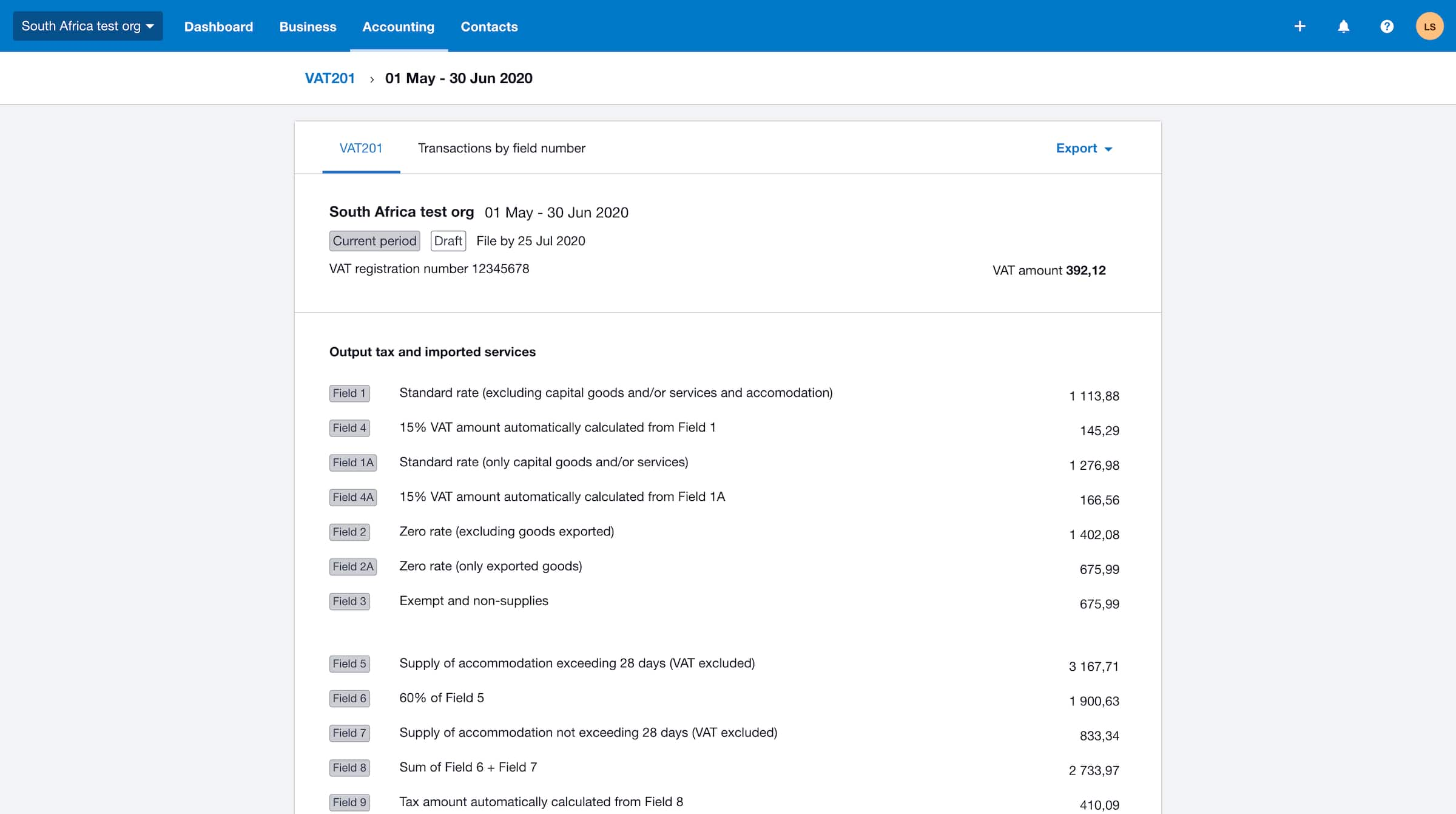

eFile VAT returns to SARS

Automatically populate VAT201 returns so they're ready for e-filing from Xero and generate VAT audit reports.

- Tax rates are mapped to the relevant fields in the VAT201 return

- Review the different tax lines on the return before submitting it

- Review the individual transactions that make up the return

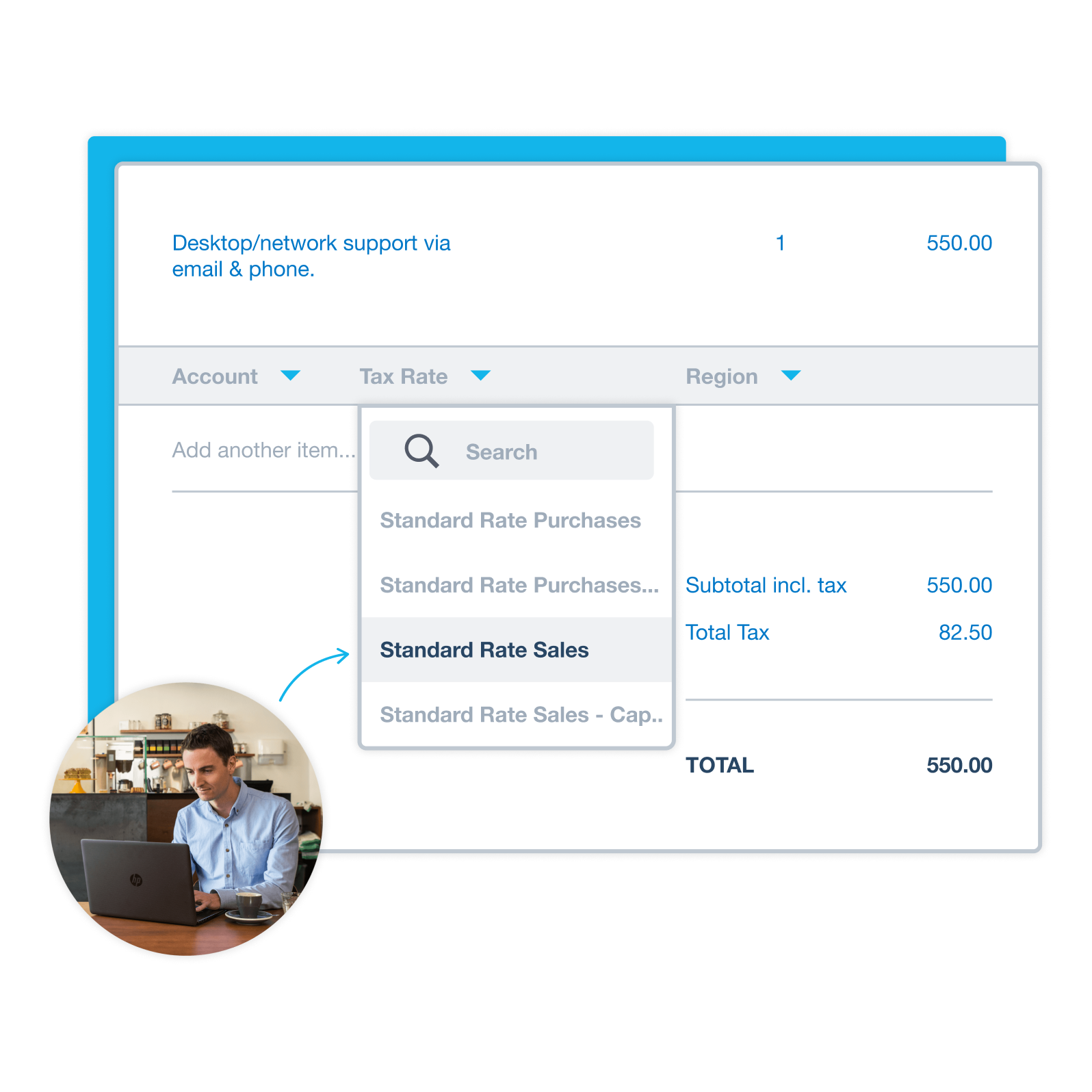

Flexible VAT rates

Default VAT rates for sales and services come set up in Xero and are updated automatically.

- Set a rate as the default for accounts, contacts or items

- Alter the VAT on any line item if needed

- Add or edit some default VAT rates if required

Automated calculations

Xero VAT software calculates each line item in your invoices, quotes, purchase orders and bills.

- The tax rate selected for each item is used to calculate VAT

- VAT on a transaction can be tax inclusive or exclusive, or have no tax

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Safe and secure

- Cancel any time

- 24/7 online support

It’s made a really big difference in keeping my finances organised

Nubian Skin use Xero to manage their business finances