United Kingdom Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, late payments and time to be paid.

A mixed end to the year for small businesses

Published: 26 February 2026

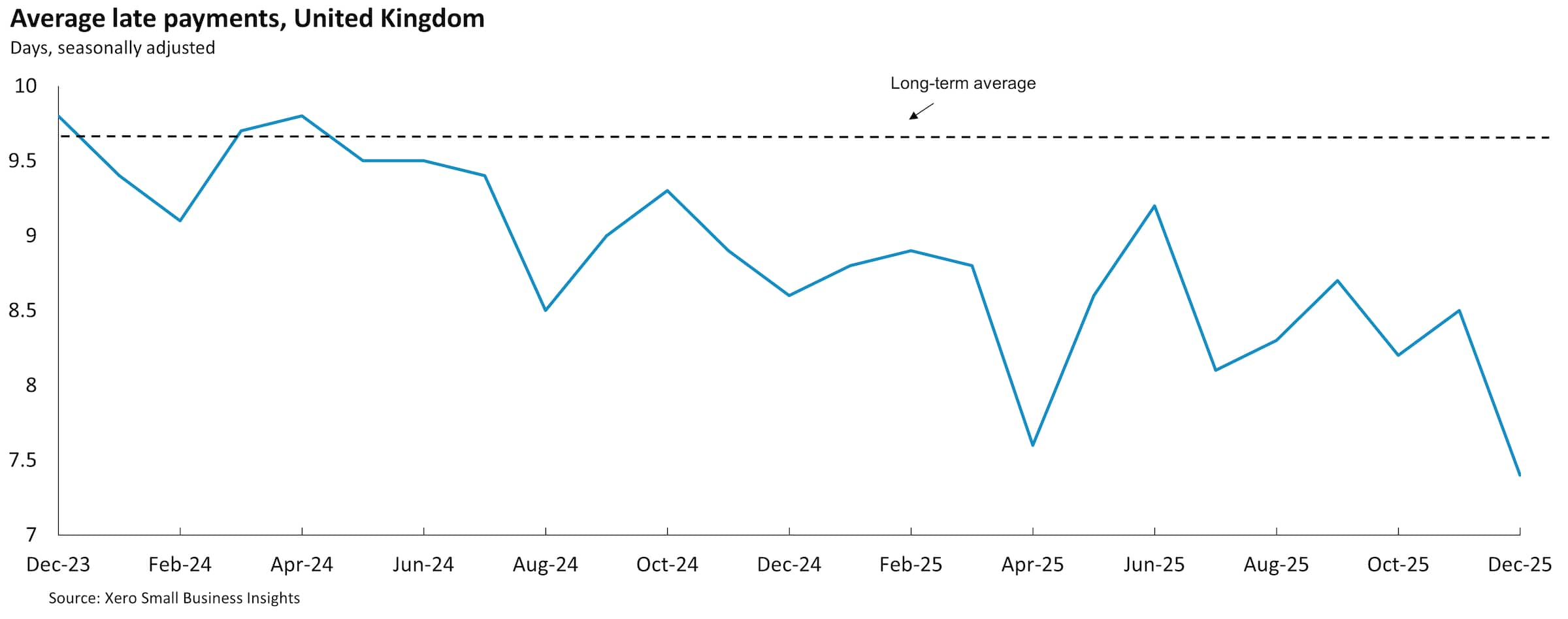

The latest Xero Small Business Insights (XSBI) data for the UK shows small business owners had a mixed December quarter. Sales grew 3.2% year-on-year (y/y), down from 5.0% y/y in the September quarter. Jobs grew 1.7% y/y, up from 1.3% y/y in the September quarter. The best news for the quarter was that small business owners are getting paid faster than at any time since this series began, at 29.0 days in the December quarter. Nevertheless, there is more work to do to improve payment practices, with small businesses still being paid an average of 8.0 days late. Overall, UK small business performance held up reasonably well in 2025, considering the significant national and international headwinds, but sales and jobs performance are still well below average. In early 2026, owners will be looking for evidence that last year's cuts in the official bank rate are starting to flow through to their sales.

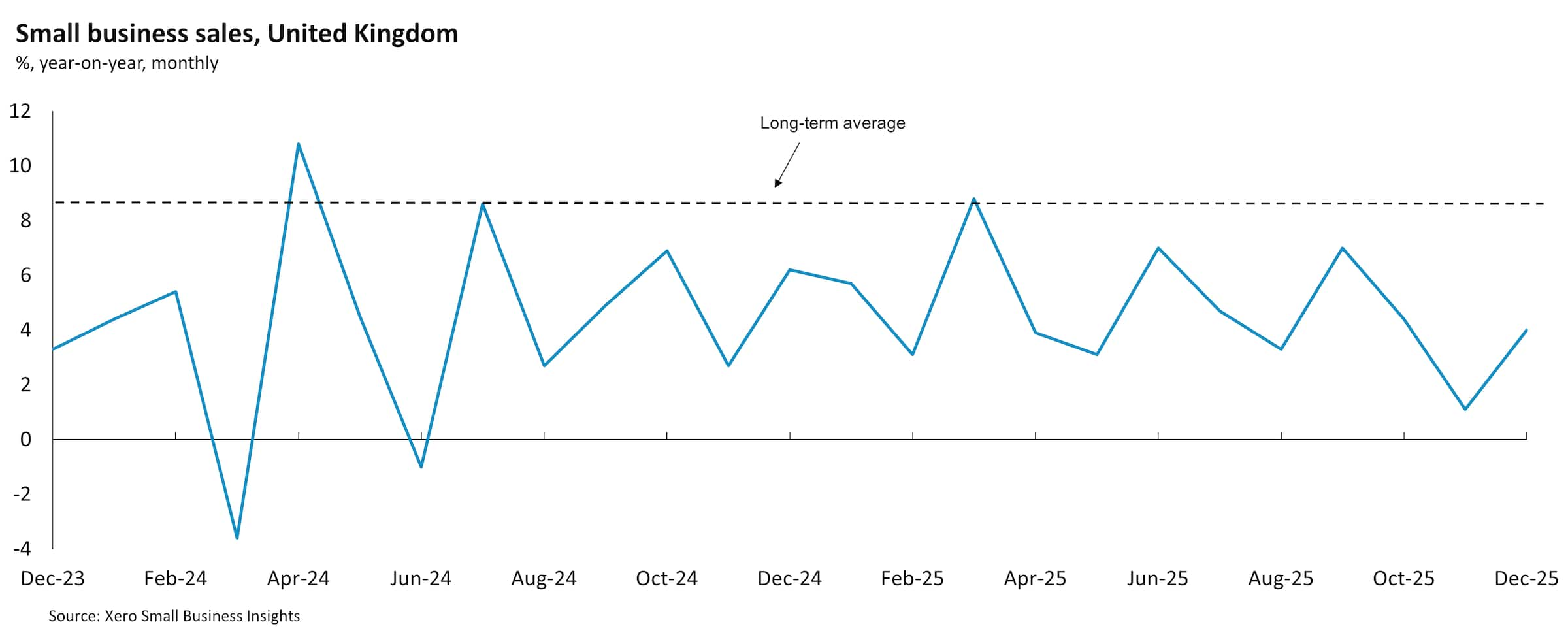

Sales in small businesses grew 3.2% year-on-year (y/y) in the December quarter, the smallest rise since the March quarter 2024. Despite the softer quarterly result, the overall sales picture improved a little from last quarter, with upward revisions to September quarter results - to 5.0% y/y, from 3.1% y/y initially reported. Most of the weakness in sales in the December quarter was in the month of November, when sales grew only 1.1% y/y. Both October (+4.4% y/y) and December (+4.0% y/y) had better outcomes. For all of 2025, sales grew 4.7% y/y, similar to the 4.4% y/y result for 2024 and below the long-term average of 8.6% y/y for this series.

Overall, the latest XSBI data shows that UK small businesses had a mixed December quarter.

XSBI UK October 2025 to December 2025 data

The sales performance wasn't uniform, with some industries and regions performing better than others. Health care (+5.3% y/y), professional services (+5.3% y/y) and construction (+4.8% y/y) were the best performing industries in the most recent quarter. The two industries where the December quarter is so critical - retail trade (-0.7% y/y) and hospitality (+0.7% y/y) - were the two worst performing industries. Both of these sectors had a solid September quarter, with sales growing more than 5%, but were unable to sustain this in the crucial final three months of the year. The regional quarterly sales results were more uniform, ranging from Yorkshire & the Humber (+4.1% y/y) and the South East (+3.9% y/y) down to Scotland (+2.5% y/y) and the North West (+2.5% y/y).

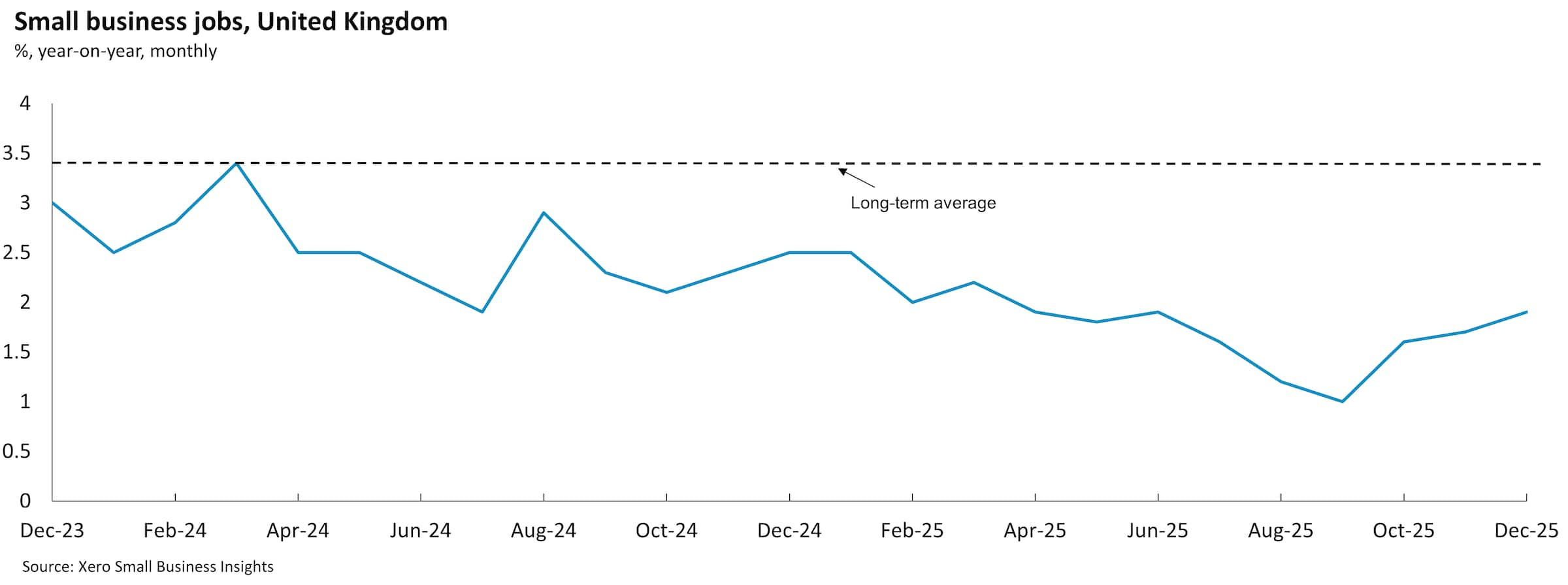

Labour market indicators were mixed in the December quarter - jobs growth picked up a little and wages growth slowed slightly. Jobs in small businesses grew 1.7% year-on-year (y/y) in the December quarter, after a 1.3% y/y rise in the September quarter. The monthly pattern shows that jobs growth gradually picked up across the quarter. Rising 1.6% y/y in October, 1.7% y/y in November and 1.9% y/y in December. Over the whole year jobs grew 1.8% y/y, slightly slower than the 2.5% y/y recorded in 2024 and below the long-term average of 3.4% y/y.

The largest jobs rises in the quarter were seen in retail trade (+3.8% y/y), possibly reflecting expectations that the Christmas trading period could be busy. There are still two sectors employing fewer people than a year ago - information media & telecommunications (-0.1% y/y) and administrative services (-1.4% y/y). The best region for jobs growth in the December quarter was the East Midlands (+3.6% y/y), followed by the North East (+2.7% y/y). West Midlands (-1.4% y/y) has fewer people working in small businesses than a year ago and Wales (+0.3% y/y) has only very slightly more.

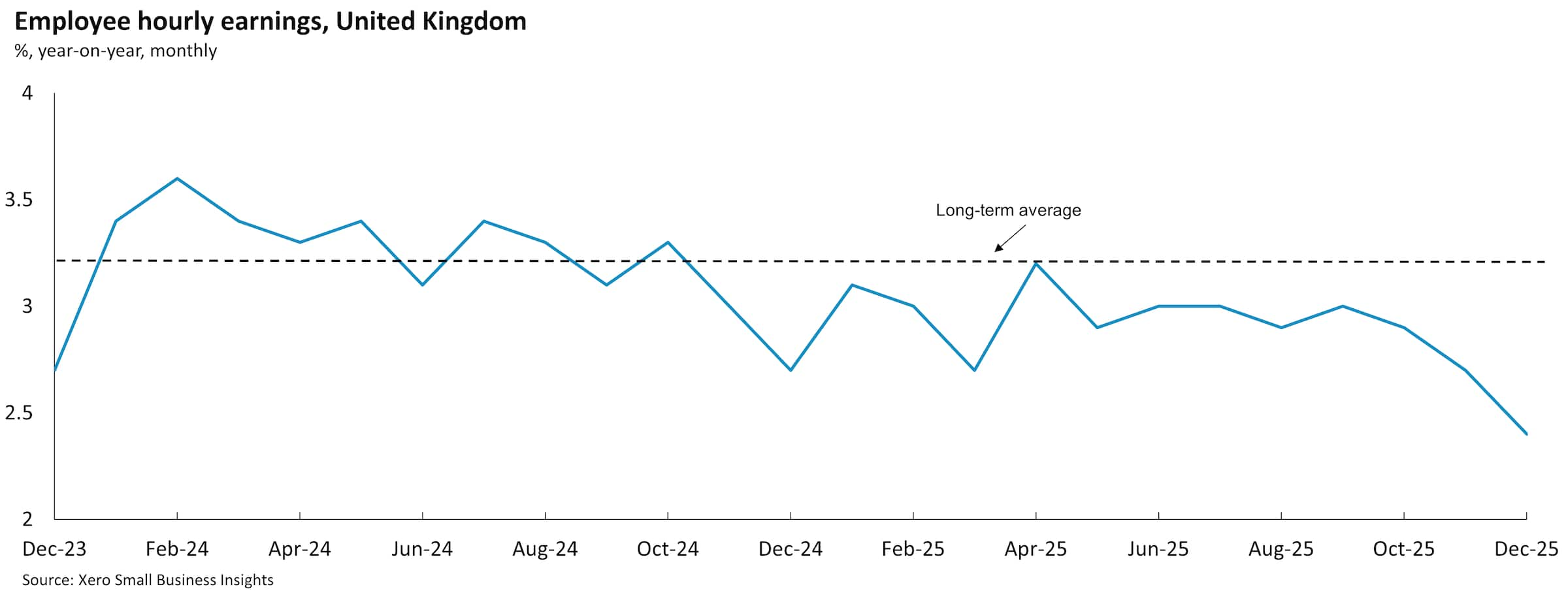

Wages in small businesses grew 2.7% year-on-year (y/y) in the December quarter, after a 3.0% y/y rise in the September quarter. The monthly pattern shows that wages growth gradually slowed during the quarter. Rising 2.9% y/y in October, 2.7% y/y in November and 2.4% y/y in December. Over the whole year wages grew 2.9% y/y, slightly slower than the 3.3% y/y recorded in 2024 and below the long-term average of 3.2% y/y.

Across industries, wage gains were reasonably uniform with most above 2.5% y/y in the December quarter. The largest rises were in hospitality (+3.6% y/y), other services (+3.3% y/y) and arts & recreation (+3.2% y/y). The smallest increases were in administrative services (+2.0% y/y) and real estate (+2.0% y/y).

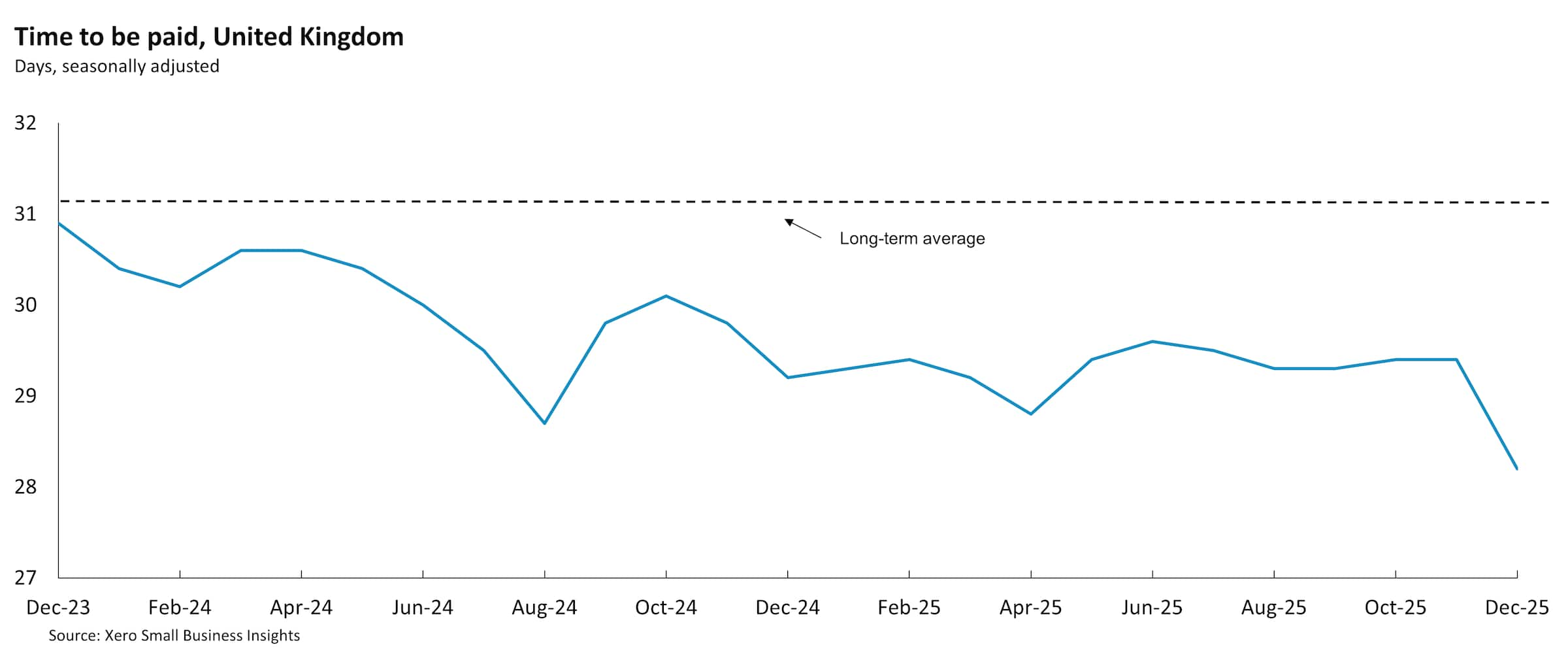

UK small business owners are getting paid in record quick time. The December quarter result, of 29.0 days, was the fastest average time a small business waited to be paid since this series began (in Jan 2017) and rounded out what has been a solid year of improvement in this area. The time to be paid metric has been under 30 days for the past 14 months. The month of December was even better at 28.2 days - a full 1.2 days quicker than November and October. For context, the average time to be paid in 2024 was 29.9 days and the long-term average for this series is 31.2 days.

Before getting too excited, it's worth remembering that on average small businesses are still being paid late - 8.0 days late in the December quarter and 8.4 days over the whole of 2025. This latest outcome is a near-record low result for this series, but it also highlights that there is still work to do to achieve on-time payments to small businesses and to get the average late payment measure down to 0.

The national improvement hides the fact that there is considerable variation in payment results across industries. The industry that is the closest to 'on time' is hospitality, where small businesses were paid on average 4.7 days late in the December quarter. This means small businesses in this industry need to plan their cash flow to allow for the fact that invoices will be paid about a working-week late. At the other end of the scale, arts & recreation (13.2 days), education & training (11.7 days), information media & telecommunications (11.2 days) and manufacturing (10.9 days) all have to plan for invoices being paid around two weeks late.

Overall, while sales, jobs and wages growth remain soft by historical standards it is pleasing to see some gains being made in small businesses getting paid quicker. Small business owners can continue to build on these improvements by taking steps to improve their own payment results. This includes simple steps such as setting up automatic invoice payment reminders, adding a 'pay now' button to invoices and offering as many payment options as possible to customers.

Looking ahead, 2026 is likely to be another mixed year for small business owners. The economy, and small business sales, are expected to keep growing but at a rate that is lower than historical averages. In its latest Monetary Policy Report, the Bank of England noted "Underlying GDP growth remains subdued, consistent with weak growth in potential supply and a small drag from past monetary tightening and uncertainty". While the Bank Rate was left unchanged at 3.75% at the February meeting, there is scope for further interest rate cuts later in the year if inflation continues to move back towards the central bank's target range.

In these circumstances it's important that small business owners stay focused on the elements of their business that they can control. This includes keeping on top of late payments, doing what you can to attract customers to your business (and not your competitors) and focusing on productivity enhancing investments, such as digital tools, to help you run your business more effectively.

For more information on the XSBI metrics, see our methodology page.

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Find out more about XSBI

If you have any questions about Xero Small Business Insights, reach out to us.