Prepare and track VAT returns easily with Xero and Parolla Plugins for free.

Automatically calculate VAT on transactions, prepare VAT3 returns, and easily upload to Irish Revenue.

.1677066821776.png)

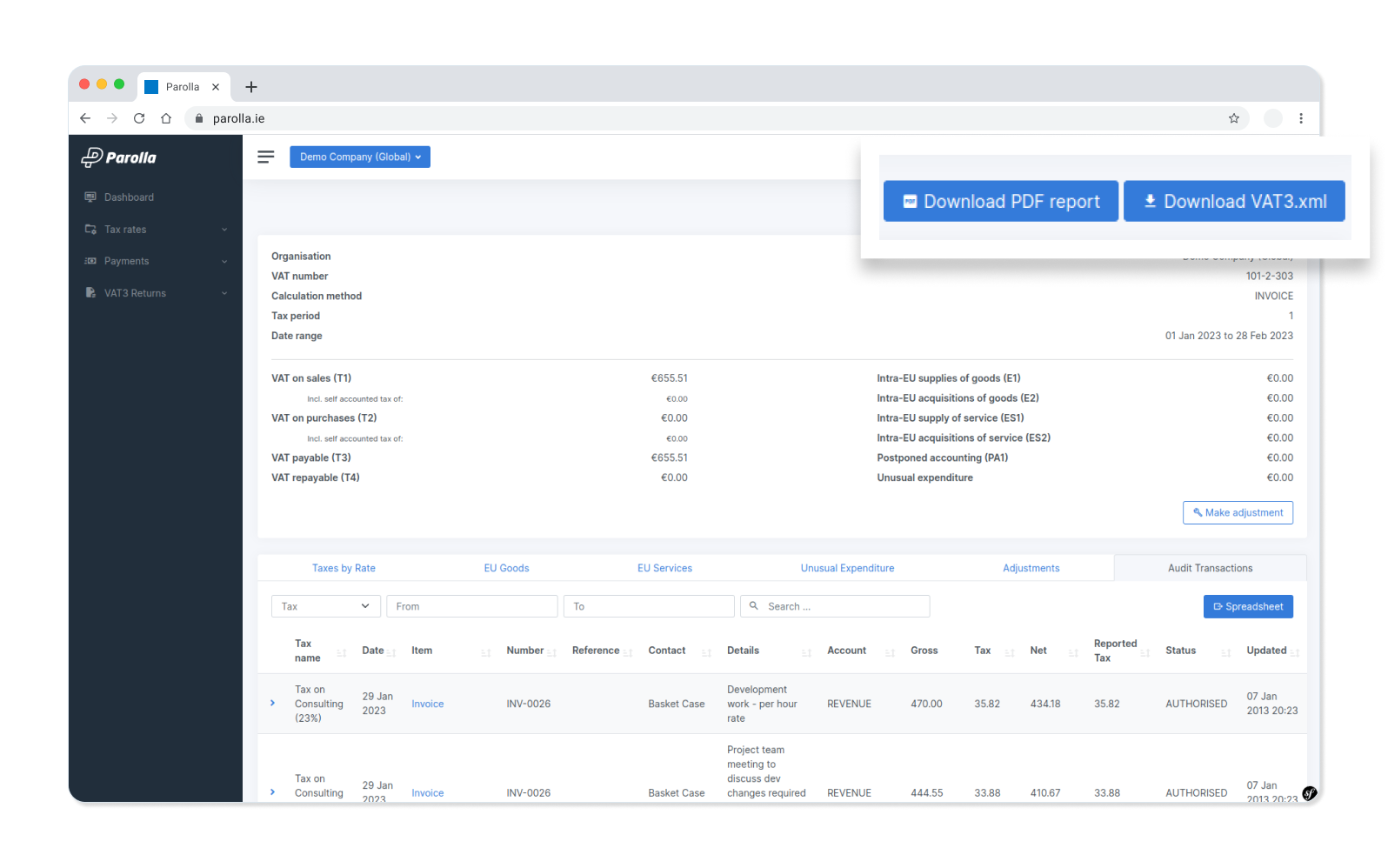

Create returns with ease

Designed for Irish VAT schemes, generate Revenue-compliant VAT3 returns for upload to Revenue Online Services.

Save time

VAT is automatically calculated to prepare your VAT return in a matter of minutes.

Review and record

Make as many changes to tax rates and instantly get accurate calculations, removing human-prone errors.

Know the details

Take out the guesswork and get an in depth picture of what VAT you owe or what's coming your way.

Watch our on demand webinar

For both partners and customers, see how quick and easy it is to file a return with Parolla Plugins and Xero.

Watch now

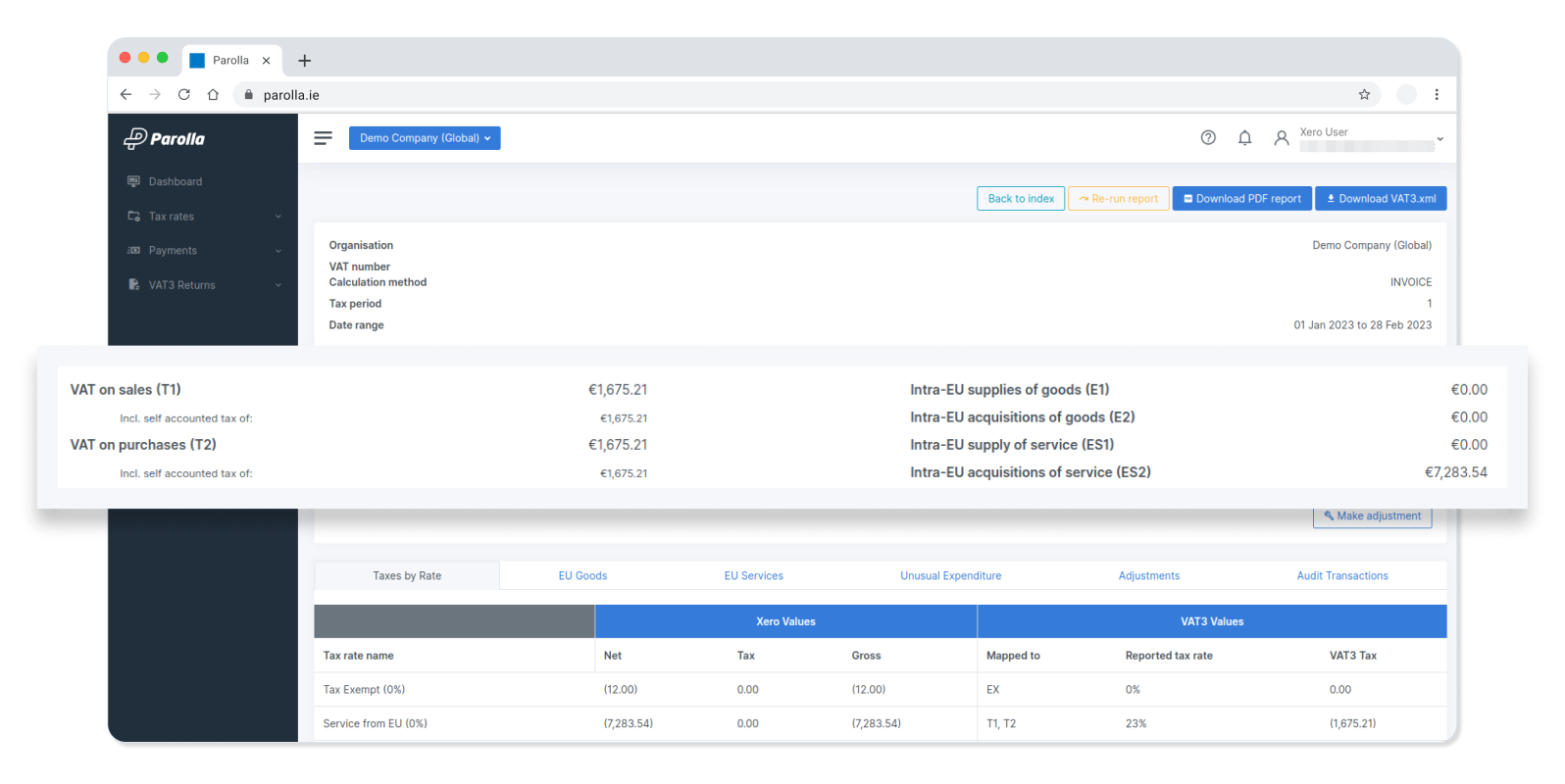

VAT calculated for you

Parolla Plugins is made for businesses that do work in Ireland, the EU and further afield, reporting on imports and exports to any country.

- Calculate Reverse Charge and Self Accounting methods of reporting VAT on Intra EU and Extra EU transactions, and modify the VAT3 submission accordingly

- Calculates each line item in your invoices, bills, spend items, bank transactions, credit notes, purchase orders, payments and manual journals

- The tax rate selected for each item is used to calculate VAT

- VAT on a transaction can be tax inclusive or exclusive, or have no tax

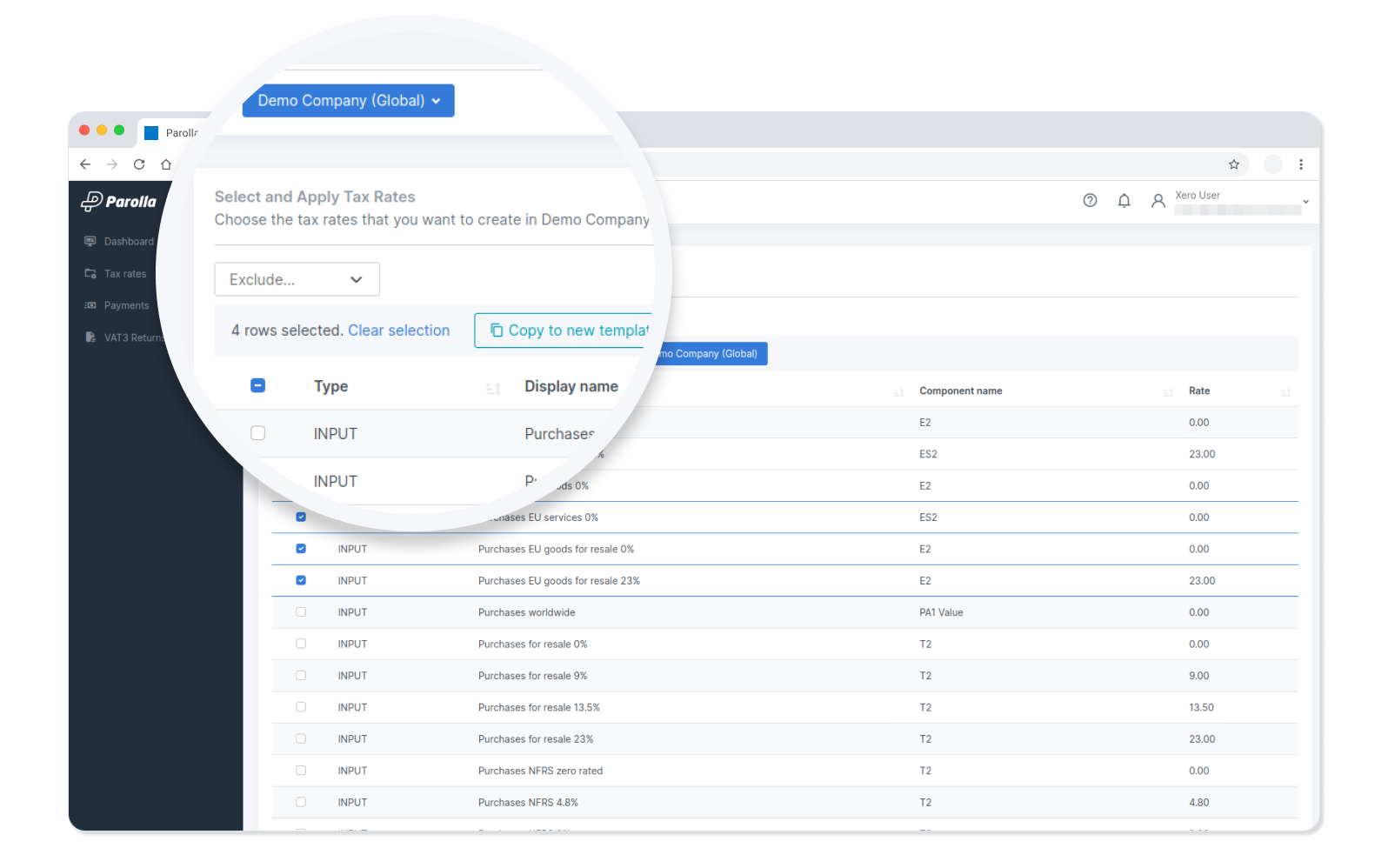

Customised VAT rates

Commonly used Irish VAT rates for sales and services come as standard with Parolla Plugins.

- Use default VAT rates or add and edit your own tax rates with the import tool

- Share your customised tax rate templates with colleagues and the wider business

- Alter the VAT on any line item if needed

Manage VAT transactions

Accurately track and manage VAT in Xero, and keep a digital audit trail.

- See details of the VAT report with itemised transactions which you can link to

- Review the fully annotated transaction audit schedule with each VAT return. Use the embedded links to jump directly to your Xero transaction related to each entry

- The VAT report has printable PDF, XLS spreadsheet, and XML file for upload to Revenue

- All VAT actions and activities are recorded digitally, that integrates with your wider banking and accounting

Frequently asked questions

Yes, absolutely. Parolla Plugins is now available to use for accountants, bookkeepers and small businesses subscribed to any Xero Business Edition plan and Xero Cashbook, included with no extra charge.

Try Parolla PluginsYes, absolutely. Parolla Plugins is now available to use for accountants, bookkeepers and small businesses subscribed to any Xero Business Edition plan and Xero Cashbook, included with no extra charge.

Try Parolla PluginsFounders Mark Ogilvie and Claire Brennan started Parolla in 2014. Based in Ireland, Tramore Co.Waterford, Parolla has a successful cloud-based product in the market which integrates with Xero.

Founders Mark Ogilvie and Claire Brennan started Parolla in 2014. Based in Ireland, Tramore Co.Waterford, Parolla has a successful cloud-based product in the market which integrates with Xero.

Using Parolla Plugins you can generate Single Euro Payments Area (SEPA) compliant payment files. Pay suppliers by batch payment directly from Xero or a CSV file, pay multiple bills in a single transaction using your preferred bank account and reconcile multiple payments in one go by matching them to a single statement line.

Try Parolla PluginsUsing Parolla Plugins you can generate Single Euro Payments Area (SEPA) compliant payment files. Pay suppliers by batch payment directly from Xero or a CSV file, pay multiple bills in a single transaction using your preferred bank account and reconcile multiple payments in one go by matching them to a single statement line.

Try Parolla PluginsParolla have created video tutorials, with step by step screen-shot instructions, to walk you through how to prepare a VAT3 report to upload to Irish Revenue.

Video tutorialsParolla have created video tutorials, with step by step screen-shot instructions, to walk you through how to prepare a VAT3 report to upload to Irish Revenue.

Video tutorialsParolla will provide you with the support you need. Head to their Frequently Asked Questions and if you cannot find your answer, use their live chat system. Don’t worry, it's not an automated chat bot — you’ll be put through to their support team.

Frequently Asked QuestionsParolla will provide you with the support you need. Head to their Frequently Asked Questions and if you cannot find your answer, use their live chat system. Don’t worry, it's not an automated chat bot — you’ll be put through to their support team.

Frequently Asked QuestionsNot at the moment but Statement converters, RTD returns, VIES returns are being considered.

Not at the moment but Statement converters, RTD returns, VIES returns are being considered.

No it will not. You can run the VAT reports as many times as you like in Parolla Plugins without changing anything in your Xero organisation. The only exception is the tax code import functionality that will create the tax codes you choose to import into Xero.

No it will not. You can run the VAT reports as many times as you like in Parolla Plugins without changing anything in your Xero organisation. The only exception is the tax code import functionality that will create the tax codes you choose to import into Xero.

Join the Xero community

Become a partner to access free tools, benefits and rewards for your practice. Access all Xero features for 30 days, then decide which plan