Income statement example

Learn how to read and prepare an income statement, with this simple tour of the world’s most-loved financial statement.

Download the free income statement template

Fill in the form to get an income statement template as an editable PDF. We’ll throw in a guide to help you use it.

Purpose of an income statement

An income statement shows sales revenue and expenses over a defined period, then brings those numbers together to show a profit or loss. For this reason, it’s sometimes called a profit-and-loss statement (P&L). The income statement also categorises types of income and expenses, allowing a business to see how certain activities impacted profitability.

Breaking down the income statement

An income statement has a header followed by 6 sections – two reporting income, two reporting expenses, and two reporting profit (gross and net). Let’s dive into an income statement example and see how it works.

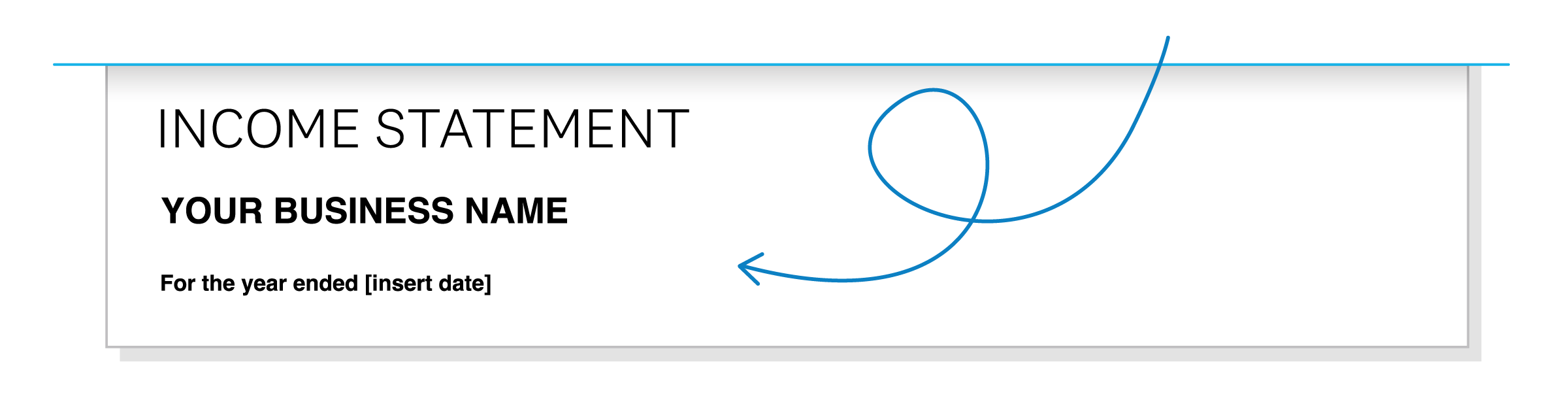

Header

Besides identifying the business, it’s important to show which time period you’re reporting on.

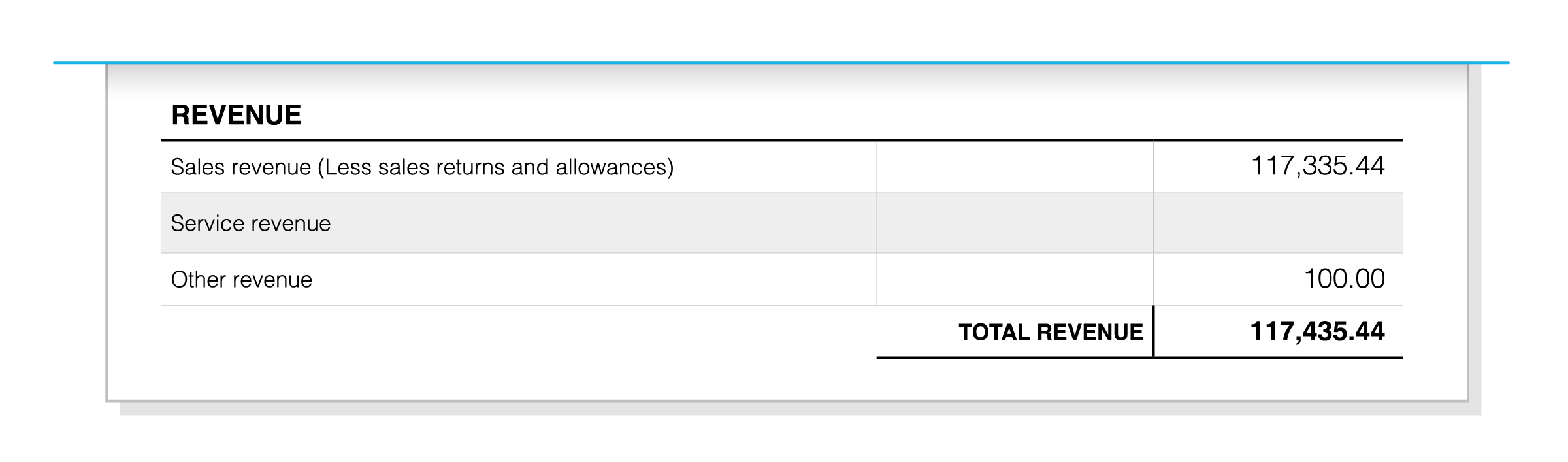

Revenue

How to read it

There are typically rows showing how much you made selling goods vs selling services, with a third row for other minor revenue streams, like if you leased out some equipment. You could have more rows if you have lots of revenue streams. It’s all totalled in the final row.

How to prepare it

You need to collect all sales data for the period and sort it by type. It helps to have a single place where all your sales are recorded. It may be in a business bank account, a sales log, an invoicing book, a POS system, or online accounting software.

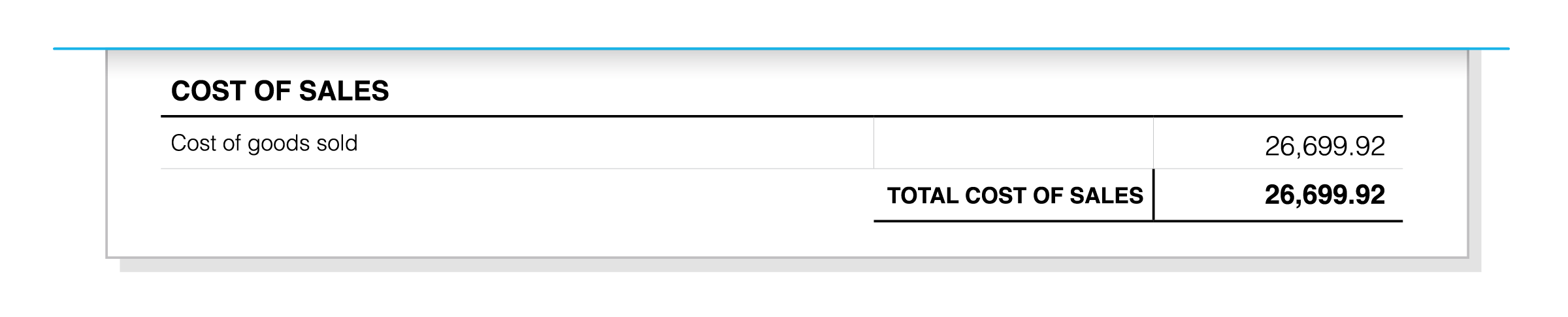

Cost of sales

How to read it

The cost of goods sold shows what you spent to provide products (or services) to your customers. You can learn how businesses typically categorise costs of sales, or cost of goods sold (they’re the same thing) in our glossary.

How to prepare it

Gather expenses directly related to the provision of goods or services to customers. This may include inventory or raw materials, freight costs, and some (but maybe not all) labour costs. An accountant or bookkeeper can help classify these expenses for you.

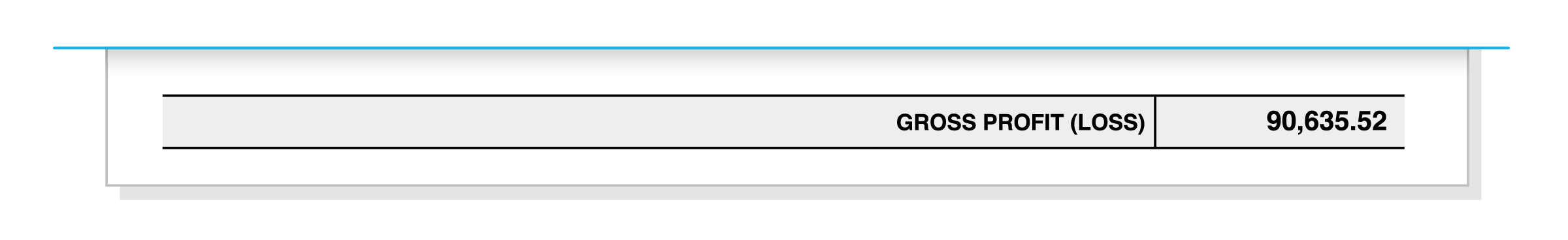

Gross profit

How to read it

A positive number – like on this income statement example – indicates a gross profit. That means you’ve met the cost of serving customers, with money to spare. You’ll still need to pay operating expenses before declaring a final (net) profit. A loss at this point tends to be shown in brackets or with a minus sign in front of it.

How to prepare it

Subtract cost of sales from revenue to get gross profit.

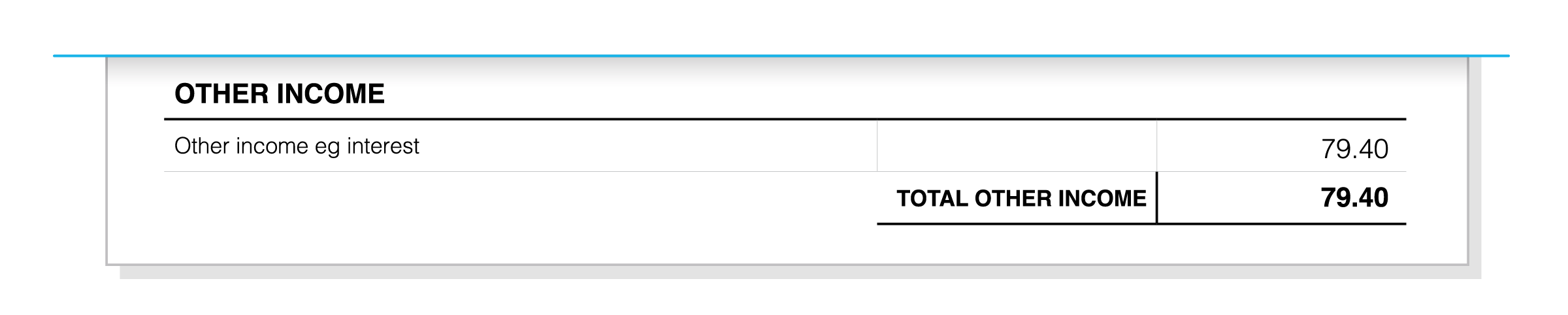

Other income

How to read it

This reflects income from outside of core business operations. Interest on savings or dividends on investments are often captured here. A business that sells an asset for 'more than it's worth' will report that income here, too.

How to prepare it

For many businesses, this is simply a matter of tracking interest received from savings accounts. Asset sales are more complicated. If you received more than book value for the asset, the extra cash will need to be counted here. Get help from a professional who understands depreciation and capital gains.

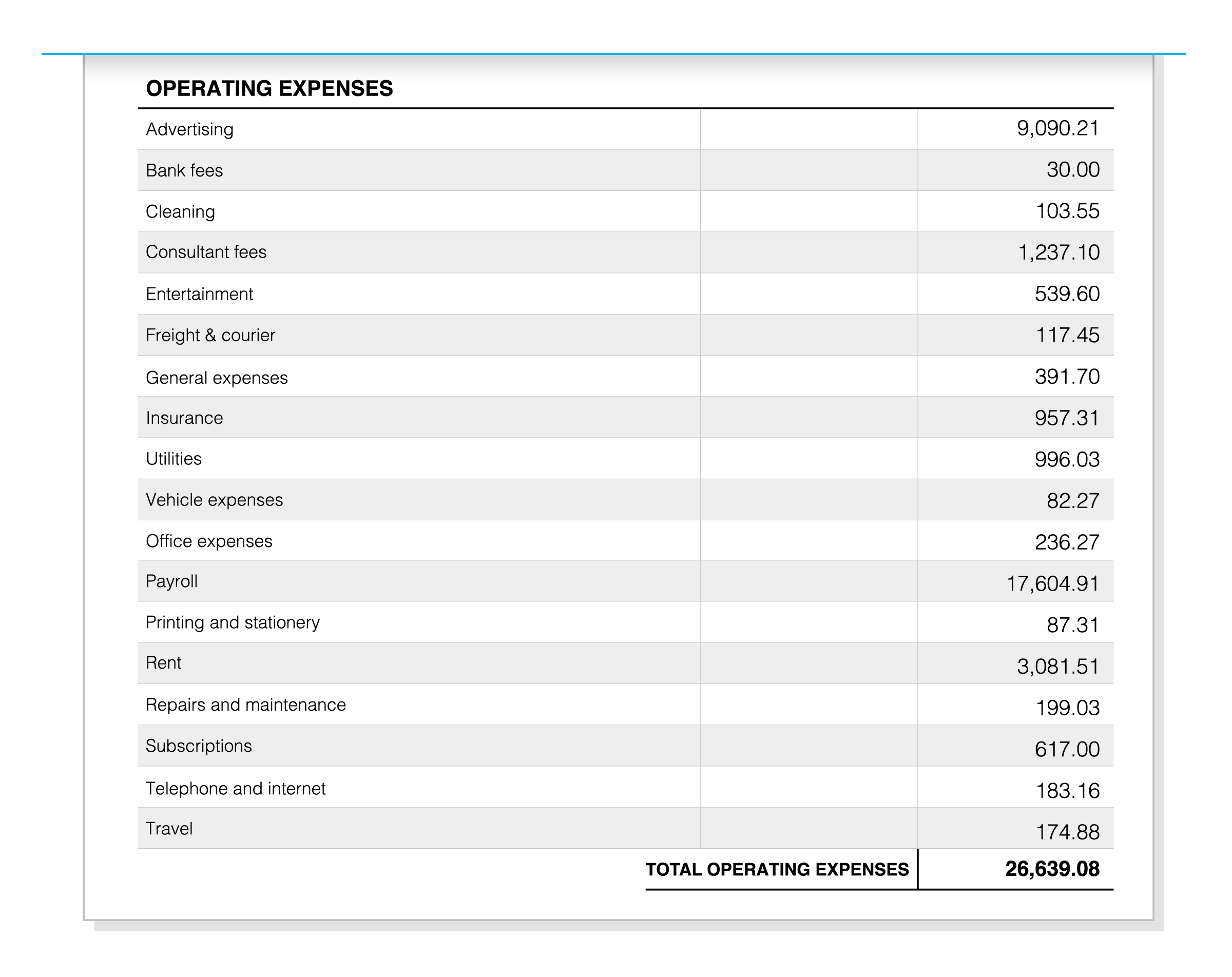

Operating expenses

How to read it

This section captures the costs of doing business that aren’t directly tied to providing goods or services to customers. This includes marketing, travel, utilities and a whole bunch of other general costs. Listing them out in this way can help you see where all your money goes.

How to prepare it

As you can see on this income statement example, there are traditionally lots of different operating costs. You need to capture the expense and categorise the type, which can be labour-intensive. Online accounting software can automate data capture (from bank accounts and paper documents) and speed up reconciliation.

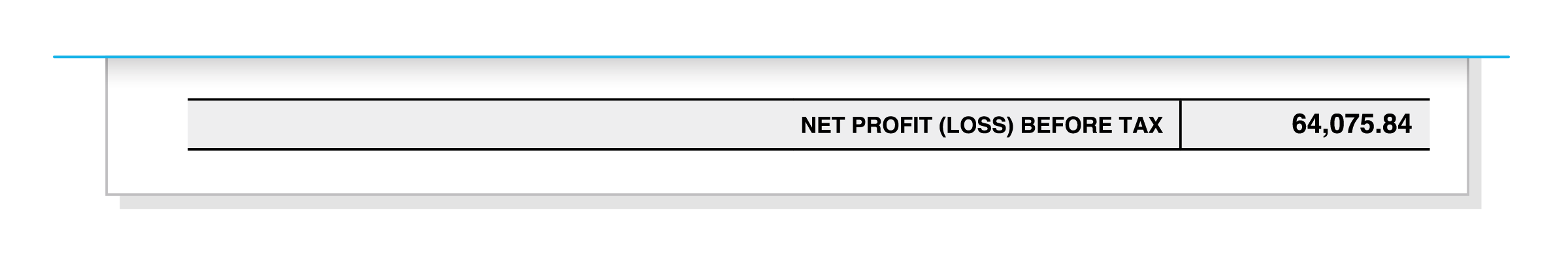

Profit or loss

How to read it

And now it’s time for the big reveal. A positive number here indicates a profit. Congratulations, you made more than you spent. A loss tends to be shown in brackets or with a minus sign in front of it.

How to prepare it

Outgoing money (cost of sales + operating expenses) are subtracted from incoming money (revenue + other income). This gives you net profit before tax.

Why you can trust this example income statement

Millions of businesses and thousands of accountants and bookkeepers use Xero software to create their income statements. These statements are our bread and butter. So while the look of an income statement may change from business to business, you can be sure the basics shown in this example are the same everywhere.

Income statement vs the other financial statements

The income statement and profit & loss (P&L) statement refer to the same document. The terms are interchangeable.

The income statement and profit & loss (P&L) statement refer to the same document. The terms are interchangeable.

While the income statement shows performance over a period, the balance sheet reports your financial position at a particular point in time. The balance sheet lists assets like cash, inventory, and property against liabilities to depict what the company owns vs what it owes.

While the income statement shows performance over a period, the balance sheet reports your financial position at a particular point in time. The balance sheet lists assets like cash, inventory, and property against liabilities to depict what the company owns vs what it owes.

Income statements show money earned vs money spent and may count money that hasn’t actually changed hands yet. Cash flow statements look at actual cash in and out, including cash exchanged between the business and its lenders, and investors.

Income statements show money earned vs money spent and may count money that hasn’t actually changed hands yet. Cash flow statements look at actual cash in and out, including cash exchanged between the business and its lenders, and investors.

Reporting tools from Xero

You can do all the work to manually capture data and prepare an income statement like the one in this example, or you can click a button on Xero:

- Transaction data captured automatically from your business bank account, POS, invoicing software, or ecommerce shop

- Simply click a button to create income statements, balance sheets, cash flow statements and more

- Quickly compare results against other time frames to see how the business is trending

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.