Manage and calculate sales tax

Automatically calculate sales tax on transactions, and use reports to prepare sales tax returns.

Customise VAT rates

Set up as many VAT rates as you need.

Automated calculations

The VAT on transactions is recorded for you.

Prepare VAT returns

Use the sales tax report to complete a return.

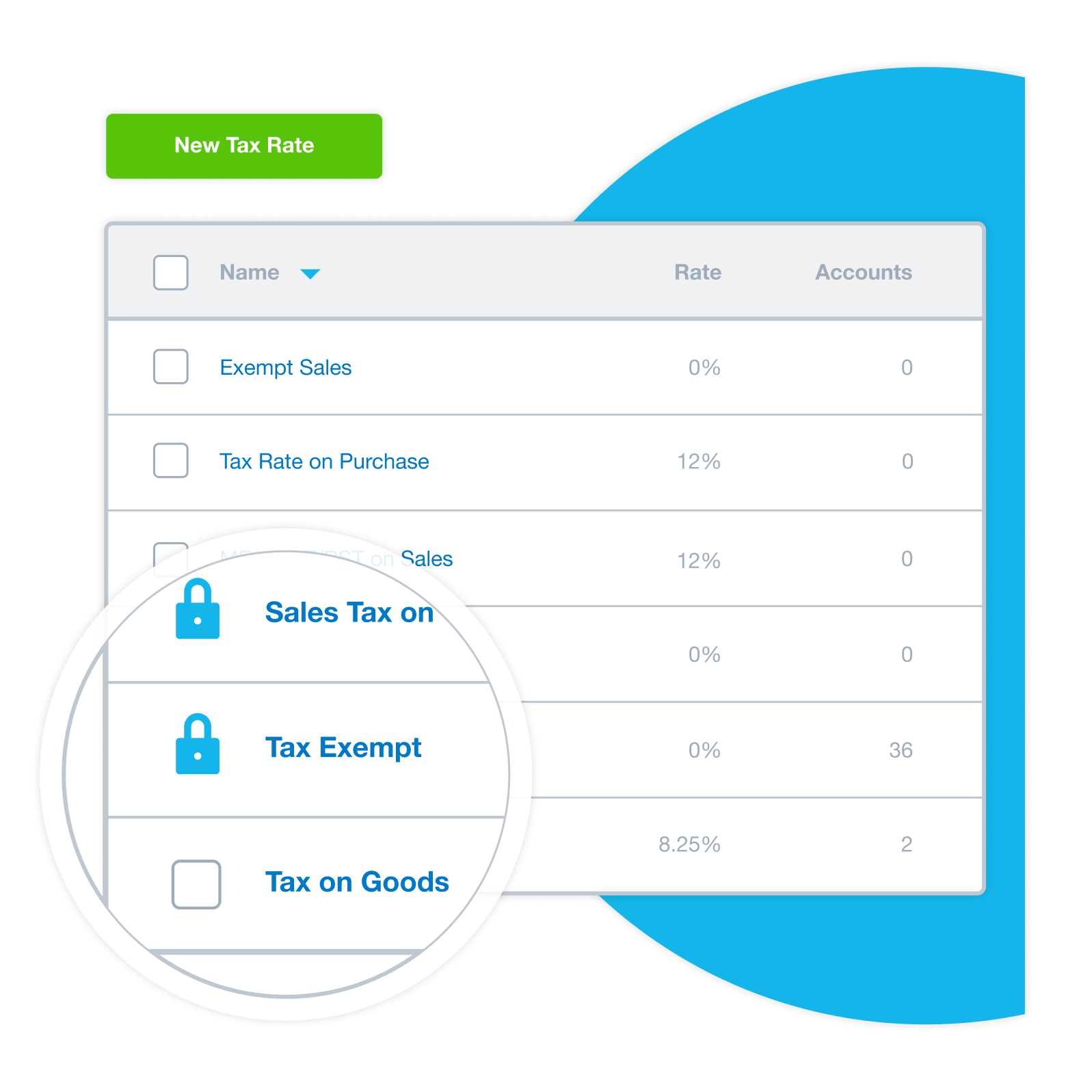

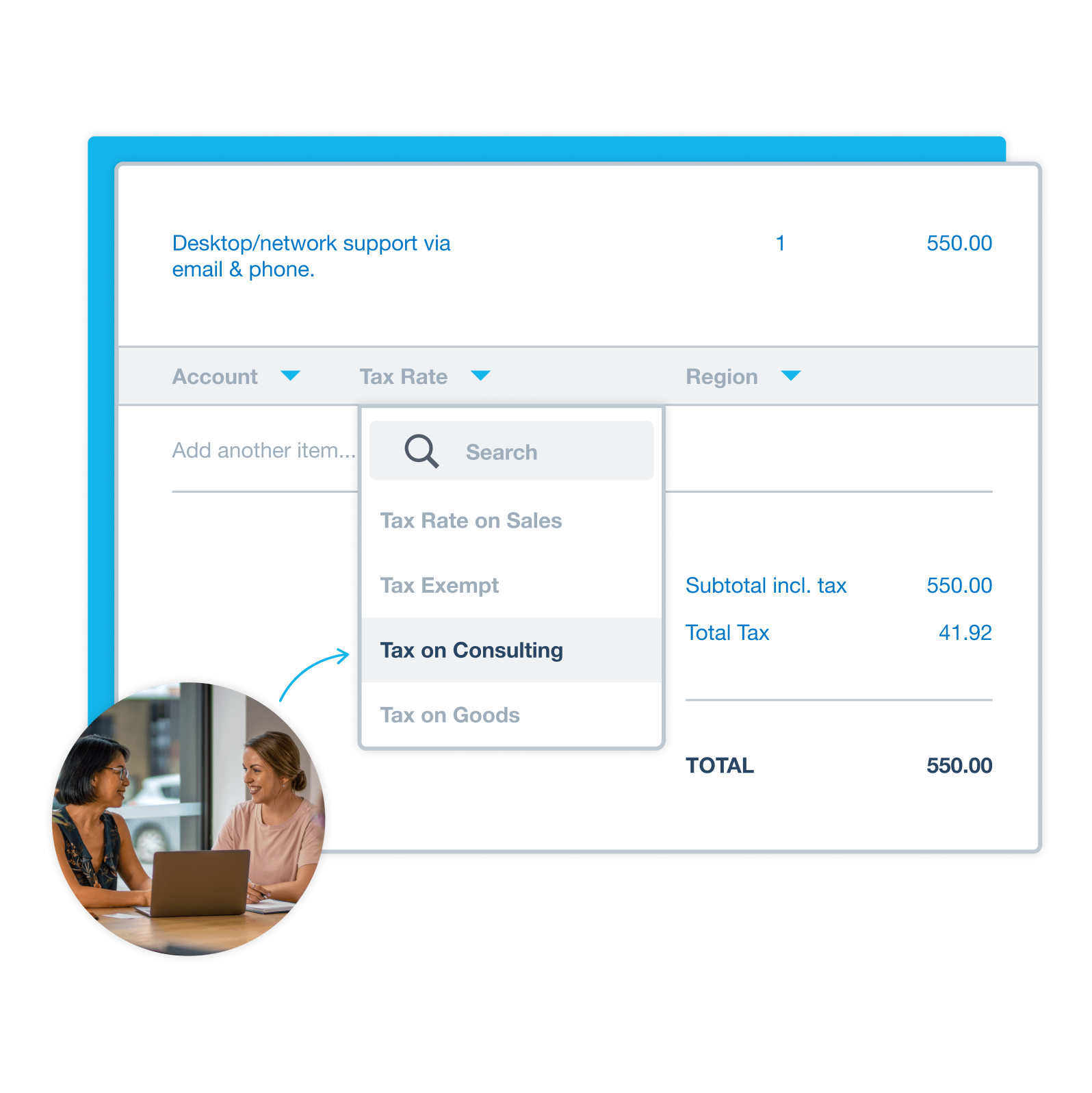

Customise VAT rates

Default VAT rates are set up, initially to 0%, for tax on purchases, sales, and imports, and tax exempt.

- Add or amend the default tax rates

- Set up as many tax rates and components as required

- Alter the tax rate on any line item if needed

Automated calculations

Calculate VAT on each line item in your invoices, quotes, purchase orders and bills.

- The tax rate selected for each item is used to calculate sales tax

- Sales tax on a transaction can be tax inclusive or exclusive, or no tax

- Set up default rates for contacts, inventory items, and accounts

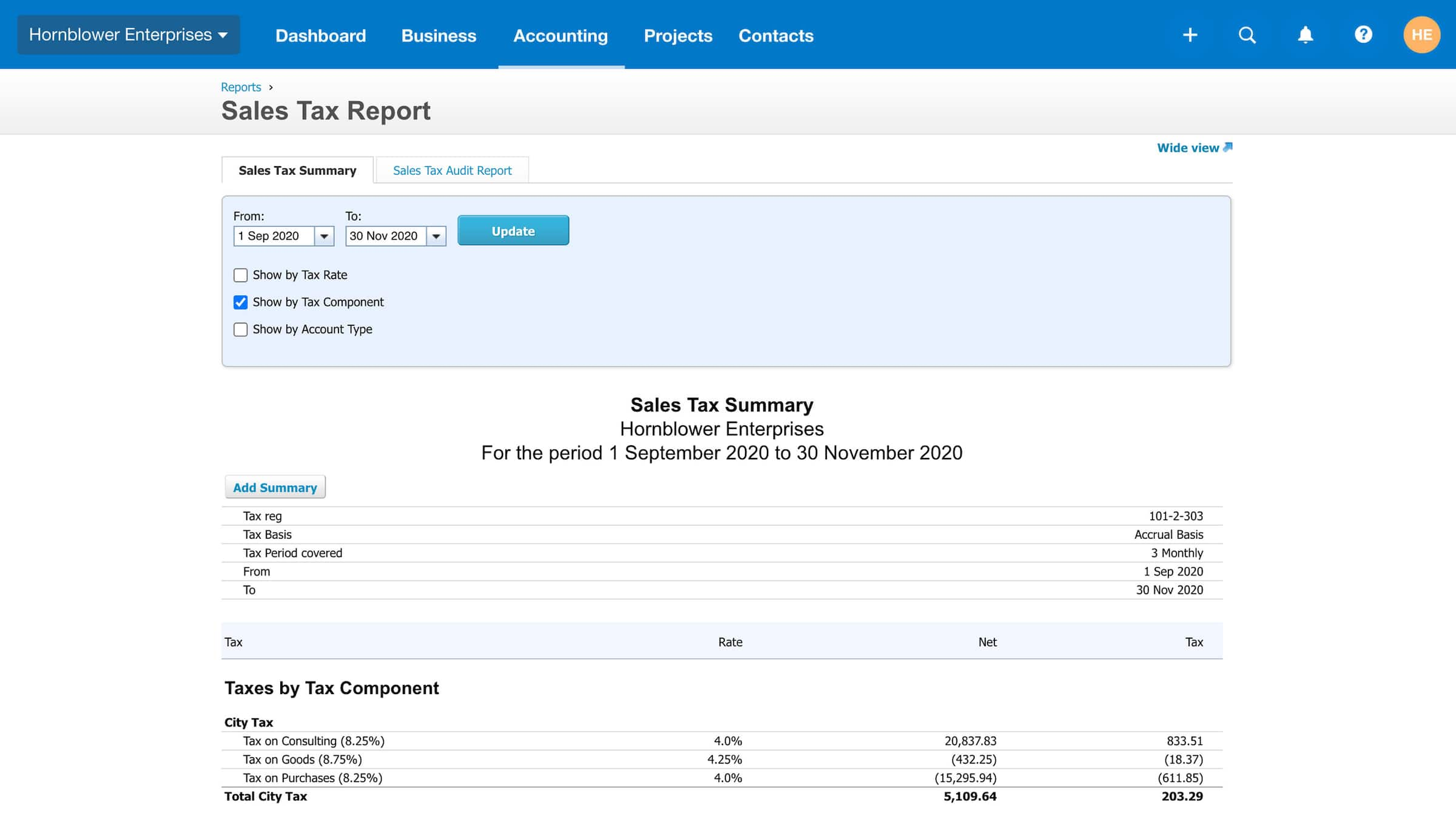

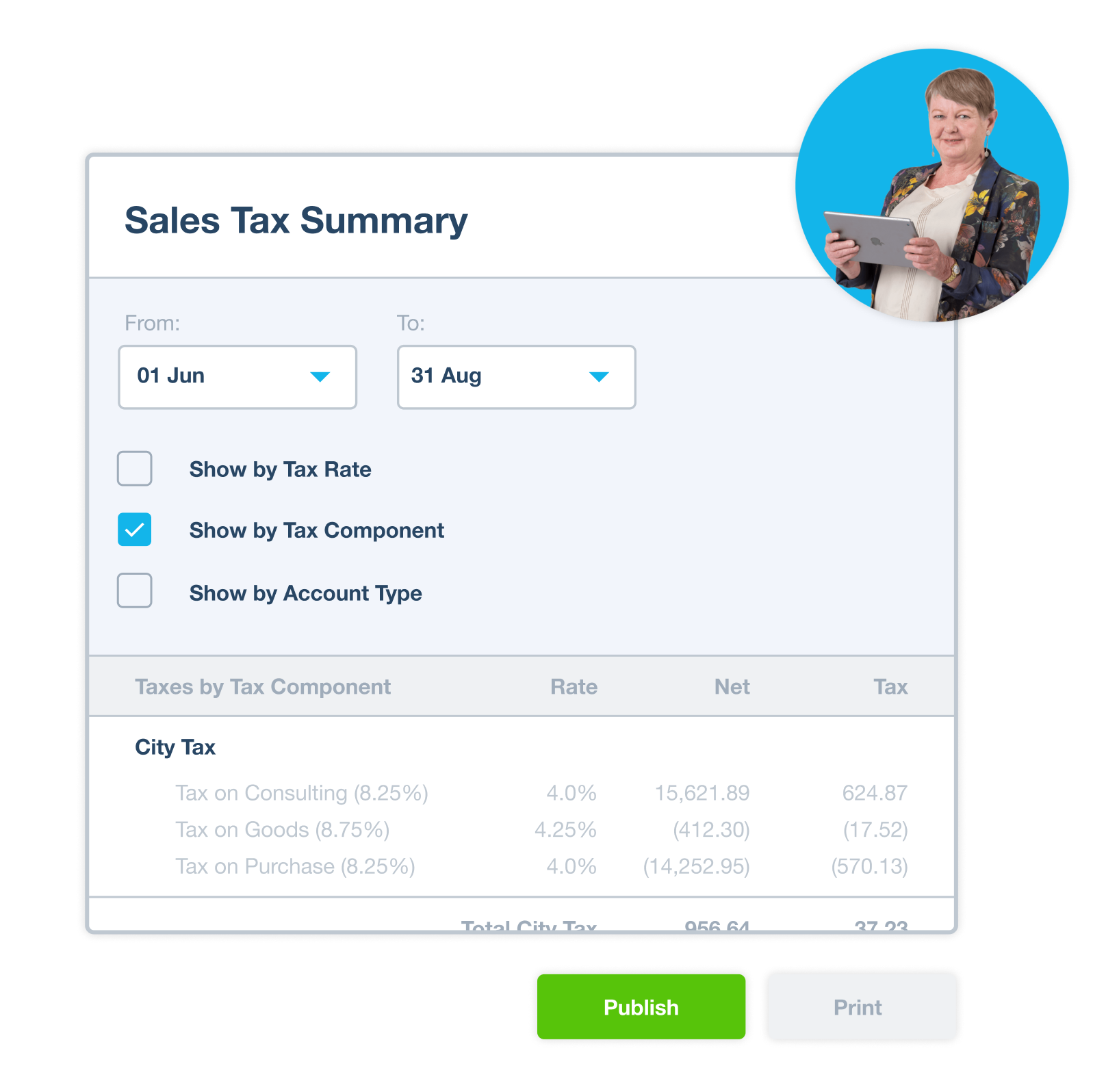

Prepare VAT returns

Run the sales tax report to gather information for completing VAT forms for a selected tax period.

- Get a summary of taxes by rate, component or account type

- View an audit report with sales tax software to see the individual transactions

- Sales tax figures can be generated using the cash or accrual basis

Accounting software for your small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

I find Xero’s interface really user friendly

Studio Banaa use Xero to look after their businesses finances